Siddharth Banerji, managing director, Kyndal Group, acquired his business philosophy from a veteran Chettiar businessman over a meal of curd rice at a five-star hotel in Chennai. “I was all suited up, waiting for my guest at the hotel porch. And then emerges an old gentleman from a Fiat, in kurta and dhoti,” recounts Banerji of the time when he was the executive assistant to a top executive at ICI (Imperial Chemical Industries) in the early 1980s.

The veteran and “super rich” industrialist, whom Banerji doesn’t want to name, talked about the business legacy of the Chettiar community who travelled across the world but came back home to invest their money. “The philosophy was to do business, but with caution,” he had said.

It is a mantra that Banerji has drawn from through a career spanning three decades in the Indian spirits sector. The philosophy might sound counterintuitive at a time when risk-taking and aggression are seen as prerequisites for success. But, “I am not a risk-taker,” says Banerji.

The 53-year-old has only taken a handful of risks over the years, but that hasn’t taken away anything from his long entrepreneurial journey.

In 2009, Kyndal India introduced Bols super premium brandy in Bangalore in a joint venture with Dutch company Lucas BOLS Distillers NV. Brandy was an unlikely first product for a liquor company. Though the third largest consumed spirit in India, it constitutes only 20 percent of the market as against whiskey which has a share of over 50 percent. Brandy is also a very ‘regional’ spirit, more preferred by drinkers in the four southern states that make up for over 90 percent of its consumption. As far as building scale went, there were fundamental limitations.

If these hurdles were not enough, at over Rs 550 per bottle, Bols was sold at double the price of popular brands such as United Spirits’ McDowell No.1 and Honey Bee. Traditionally, drinkers of brandy would shift to whiskey when they searched for a more premium drink. Would they take to this super premium offering?

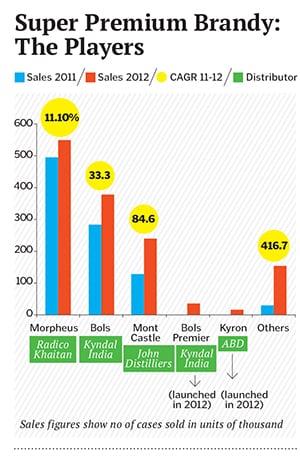

The proof, in this case, lay in the peg. “Bols debuted spectacularly in Bangalore and was selling 200 to 300 cases within a month in no time,” says Pushpanjali, Siddharth’s daughter, who heads marketing at Kyndal India. The brand has maintained its growth and, according to the last published figures by International Wine and Spirit Research, sold 380,000 cases in 2012 with over 30 percent of the market share in its price segment. Radico Khaitan’s Morpheus has since taken the lead in the segment but Banerji insists that his product is better and growing faster.

“Siddharth has a great knowledge of the Indian market and saw the opportunity in the premium brandy segment,” says Andrew McDonald, former managing director, Asia Pacific, for V&S Spirits, then the owner of Absolut Vodka, which was later bought by Pernod Ricard in 2008. Banerji had launched the iconic vodka brand in India through Kyndal which was, at the time, focussed on distribution.

The success of Bols marked Kyndal’s transition from a distribution company to a manufacturer of premium brands. The brown spirit brand is bottled in distilleries across the four southern states through partnerships with small, regional manufacturers. Banerji subsequently introduced Bols Premier in the super premium segment and Bootz in the deluxe segment in 2012. In total, Kyndal sold 500,000 cases of spirit in FY2013. Its revenue stood at Rs 300 crore, a sharp jump from Rs 30 crore in 2009, with a net margin of 18 percent. “We have been profitable from day one,” says Banerji.

EARLY SUCCESS

Banerji was an early achiever. After ICI, he joined Shaw Wallace and, at 25, he became part of the team that launched Officer’s Choice whiskey in the country. By the time he turned 32, Banerji had become country manager for Jim Beam, one of the largest selling whiskey brands in the world. “I was scared that I would become redundant at 45!” says Banerji. So when opportunity knocked, he turned entrepreneur.

When Whyte and Mackay formed its trading subsidiary Kyndal India in 1998, Banerji was roped in to head it. And, in 2006, even as Vijay Mallya was completing the buyout of Whyte and Mackay, Banerji led a management buyout of Kyndal India.

Around that time, Lucas BOLS’ managing director Huub Van Doorne was looking to expand the reach for its 500-year-old heritage. The Dutch company is the oldest distillery brand in the world and is known for its premium brands as opposed to chasing volumes. “India had a growing young population that is open to trying out new products. Also, with rising prosperity and opening up of the economy, people tend to drink less but better,” says Doorne on the India entry. In Banerji, Doorne found someone who had experience in handling premium brands. “He understood them.”

That is an invaluable attribute in the Indian spirits sector dominated by United Spirits which in its “Vijay Mallya days” had mastered the art of selling more at cut-throat prices. Mallya’s singular focus on volumes had made United Spirits (USL) the largest in the world with annual sales of 125 million cases in FY 2013.

![mg_75040_kyndal_india_280x210.jpg mg_75040_kyndal_india_280x210.jpg]()

There has been a change in approach since with companies in the sector more concerned about margins. Pernod Ricard’s India unit was among the first to go for ‘premiumisation’ and dislodged United Spirits as the most profitable Indian spirit company in 2010.

Banerji perfected the art with Absolut, which was competing with Smirnoff, though the latter was priced almost half its price. But Banerji didn’t have pockets that were as deep as Diageo’s, Smirnoff parent, who was spending big in campaigns on print and television. “We focussed on educating the consumers through innovative events and promotions,” says Pushpanjali, whose internship at Kyndal involved marketing for Absolut. Initiatives included giving away premium leather gloves as promotional gifts, instead of the usual glasses, and partnering with high-end restaurants and top designers. By the time Pernod Ricard took over, Absolut was selling nearly 50,000 cases a year, the most in its price segment.

THE SAB ROUTE

Helped by his travel across the globe, Banerji was quick to learn from his peers. For instance, leading brewer SABMiller’s success in Africa, where it had joined hands with regional players to penetrate the market. Banerji is now trying the same in India, where the complex web of local taxes make each state a unique market. Late last year, he roped in JP Sudhakar, managing director of the Bangalore-based JP Corp, to form a joint venture called Terra Inc. JP Corp is one of the oldest distillers in the region and is known for its economy brands.

The JV will be a “truck”, as Banerji puts it, to distribute Kyndal’s premium brands as well as those being developed by the JP Group in the economy segment. The intention is to create a basket of products at several price points. “We will benefit from Kyndal’s knowledge of creating brands,” says Sudhakar. Banerji, who emphasises that the JV won’t impact the premium value of Kyndal brands, will benefit from JP’s distribution reach in smaller cities and towns these also have customers that can afford a Bols bottle.

Another advantage is the local muscle of regional players like JP Corp that will come handy given the regulatory environment. “Ninety percent of the trade in Tamil Nadu and Andhra Pradesh is controlled by the state governments. We need to adapt quickly to the frequent changes in tax structure,” says A Jayakrishnan, general manager (south), Kyndal India.

Banerji is looking for more such tie-ups. However, his bigger challenge—one that will test his patience—will be his investment in Scotland. Last year, the entrepreneur formed a JV with local distiller John Fergus & Co to set up a new malt distillery and warehouse. “We want to create a brand, or buy an existing one, that will target consumers in emerging markets,” says Banerji. No one from India has done this so far. The new distillery will start operations by 2015 and will become a source for premium blended Scotch whisky.

Financially, this is a big bet for Banerji who is investing about Rs 60 crore in the first phase and will cough up about Rs 80 crore, as per present plans, for the second part of the project, which will see it increasing the capacity. Fortunately, the debt leverage of Kyndal, at 1:2, is not high right now.

The tougher challenge would be to make a mark in this ultra-competitive segment. In India itself, Scotch whisky makes up for just about 2 percent of the market. And the segment already has heavyweights such as Teacher’s and Johnnie Walker. What will work for Banerji, as Pradeep Khedkar, director, technical, Kyndal India, points out is his “patience”. “He understands that brands can’t be built overnight,” says Khedkar.

In that sense, Banerji goes back to his approach of conducting business with caution. “Otherwise, I wouldn’t have waited for so long to introduce Bols in Delhi,” he says. The brand entered the capital in late 2013. He is also not flamboyant, a quality that has characterised the industry that has been led by Vijay Mallya’s example. Hopefully, that will stand him in good stead as will the patience he imbibed early in his career.