Retail banks must embrace digital technology to remain competitive: BCG

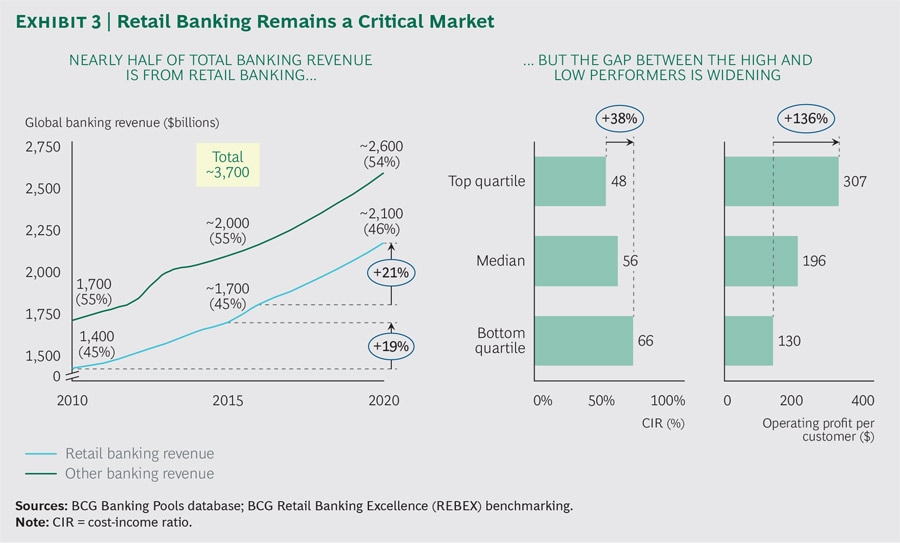

Despite overall revenue growth, disparity between best- and worst-performing banks is increasing

Image: Shutterstock

Image: Shutterstock

Retail banks must effectively integrate the latest technology with personalised human interaction to improve service levels, profitability, and competitiveness, according to a recent report titled Accelerating Bionic Transformation by the Boston Consulting Group (BCG).

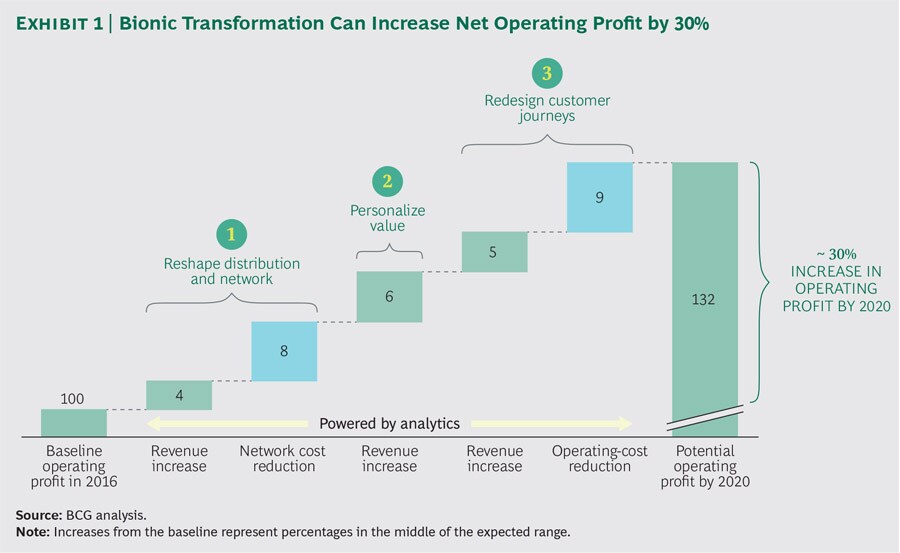

A ‘bionic transformation’ has the potential to generate a 30 percent increase in net operating profits for retail banks by 2020, according to the report. “A bionic transformation essentially consists of three interrelated elements,” says Ian Walsh, a BCG senior partner, the leader of the firm’s global retail banking segment, and a co-author of the report. “First is the blending of digital and personal interactions to create a more responsive and cost-effective distribution model second is the articulation of a value proposition that combines human judgement with data power and third is the adoption of a customer journey mindset, with end-to-end processes that are supported by robotics and machine learning. Banks must combine all three in order to blaze a positive path forward.”

The report also noted customers’ increased appetite for digital banking solutions—among customers surveyed worldwide, 43 percent indicated they want completely digital experiences while the same percentage indicated they want a mix of physical and virtual interactions. Only 14 percent indicated they want to do almost all of their banking face-to-face.

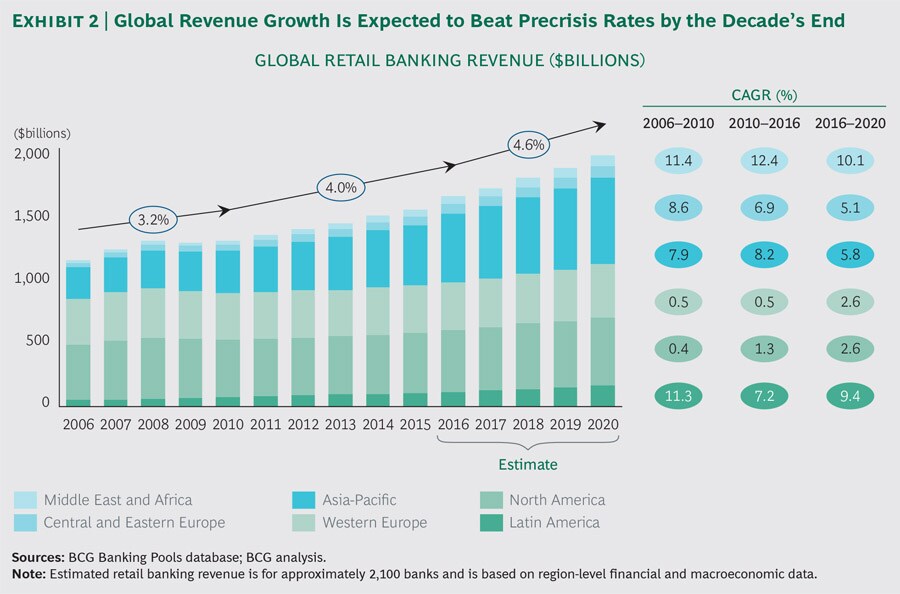

Revenue growth at retail banks is expected to pick up pace between 2016 and 2020, with a projected global compounded annual growth rate (CAGR) of 4.6 percent. The Middle East, Africa, and Latin America are expected to have the fastest growth, with significantly slower growth projected in North America and Western Europe. Revenue growth in Asia-Pacific is expected to lie in between.

Savings are expected to account for 30 percent of global revenue growth over the next few years, compared to 20 percent between 2010 and 2015. New savings will play a particularly important role in growth in India, with the report noting that “government efforts to bring more people into the formal banking system have proved enormously successful”.

Most of the difference between the best- and worst-performing banks can be attributed to traditional cost-saving moves, such as cutting personnel and closing branches. The top-quartile banks serve about 800 customers per full-time employee, while that number is about 600 customers per full-time employee at the median.

This results in significantly higher operating profit for the top banks—top-quartile banks make $695 per customer, compared with $441 for bottom-quartile banks. At the same time, top-quartile banks spend $231 per customer, compared with $400 for bottom-quartile banks.

The report notes that banks in every quartile have the opportunity to leverage technology to improve customer service and overall efficiency. “The starting point for each institution will vary depending on its specific business strategy, market position and capabilities,” says Walsh. “But taking a wait-and-see approach is no longer an option. Retail banks need to act now.”"‹

First Published: Jul 19, 2017, 19:14

Subscribe Now