Seven Indian companies with king-sized growth and returns

For our seventh anniversary, Forbes India has chosen to celebrate seven companies that have shown significant growth over the last five years while maintaining high returns on equity

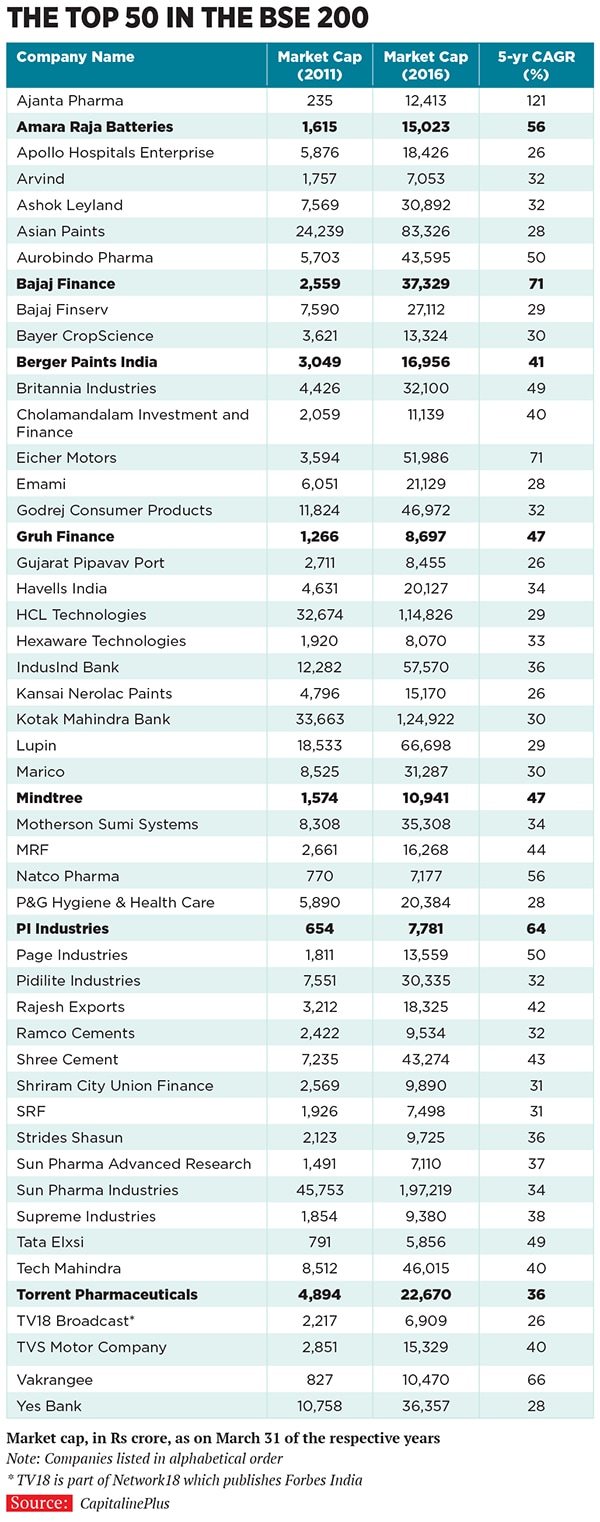

For our seventh anniversary, Forbes India has chosen to celebrate value creators. These companies have shown significant growth over the last five years while maintaining high returns on equity. To ascertain this, we considered the five-year compounded annual growth rate in market capitalisation of the BSE 200 companies (see the top 50 on page 35). Of the top 50, we selected seven companies to profile—our choice was based on diversity in industries and management styles and not on any quantitative criteria.

At the root of it, all seven of them — like others who feature in this table — are on a consistent growth path. They are also scrappy, having emerged out of the 2008 global financial crisis in record time, and with few scars to show for it. For instance, in March 2009, by which time the crisis had taken a complete toll on the markets, these seven companies were trading at low P/E multiples compared to their competitors: Take, as examples, Bajaj Finance, which had a P/E of 8, and Amara Raja Batteries 4, way below the leaders in their sectors in terms of valuation.

Things have changed dramatically in the last seven years. Today, Bajaj Finance trades at a P/E of 41 and Amara Raja Batteries at 30.

In nearly all cases, the promoters have proved critical in the improvement of fortunes, constantly thinking of different ways to stay ahead of the competition. Read their stories in the pages that follow to appreciate the value leadership brought to these companies.

These stories are broadly structured such that the role of decision-making in propelling the companies on the growth path becomes clear. Think seven smart decisions/tenets of highly successful companies.

You will find that one of the key takeaways has been the importance of bringing in the right talent, at the right time. To understand this better, let’s consider this framework created by Neil C Churchill and Virginia Lewis, which appeared in a Harvard Business Review (HBR) article (May-June, 1983) called ‘The Five Stages of Small Business’, through which they describe the transformation of small- or mid-sized businesses into mature companies. These stages are existence, survival, success, take-off and maturity (see chart).

Continued on Next Page...

Most of the companies that we have featured in this issue are at a success-growth stage where the owners disengage themselves to “ensure that the basic business stays profitable so that it will not outrun its source of cash and develop managers to meet the needs of the growing business. The second task requires hiring managers with an eye on the company’s future than its current condition”.

This doesn’t mean that the owners detach themselves, but that they invite active participation from professional management, and that is making all the difference in reading the market clearly and taking the tough calls. Consider that Berger Paints has had professionals in operational roles since the Dhingras acquired the company—they only involve themselves in strategic calls—and others like Bajaj Finance have long been run by CEOs with significant industry experience.

An indicator of quality management is also its ability to allocate capital. And these companies all know how to get more bang for the bucks they deploy in their business. In fact, what distinguishes them is their ability to earn a higher return on capital employed (RoCE). Amara Raja Batteries, within a short span of seven years, is vying for market leadership with profitable growth. In 2009, its RoCE was 21 percent and Exide Industries, the market leader, was at 40 percent. In 2015, the roles have reversed with Amara Raja at 36 percent and Exide at 8 percent.

This point resonates across the other companies that we have featured too. All of them may not yet be market leaders, but they show the way on value creation and smart capital allocation.

First Published: May 23, 2016, 06:52

Subscribe Now