Earlier this year, seven members of the management team of the Rs 18,000 crore- plus (revenues) Bajaj Finserv Ltd (BFS), the financial services mothership of the Bajaj Group, were in Silicon Valley, meeting some of the world’s best-known corporations and venture capitalists. This not only included Microsoft, Amazon and Salesforce, but also 15 fintech startups which were doing new and different things in the finance space.

“The kind of things they are doing there just blew our minds completely. We thought tapping into the India opportunity was good enough but it was fascinating to see how they are using technology and ideas to change small aspects of the business,” says Sanjiv Bajaj, 46, the second son of 77-year-old group patriarch Rahul Bajaj. Sanjiv Bajaj took over as BFS’s managing director in 2008, after a widely publicised group demerger which saw two-wheeler giant Bajaj Auto Ltd (BAL), the then flagship, go to older brother Rajiv while Sanjiv focussed on financial services. (The Bajaj family was ranked 19th on the 2015 Forbes India Rich List with a total net worth of $4.4 billion, as of September 2015.)

Today, BFS operates as the financial services holding company of the group, and holds stakes in three key businesses: Bajaj Finance Ltd (BFL), the non-banking finance company, Bajaj Allianz General Insurance (Bagic) and Bajaj Allianz Life Insurance (Balic). BFS holds 57.5 percent in BFL and 74 percent each in the insurance firms which are joint ventures with Allianz of Germany.

The fact that a financial services firm was scouting the landscape in Silicon Valley to understand the ecosystem and also explore opportunities to partner with some fintech companies is evidence of BFS’s approach. Bajaj says innovation is at the heart of how the group thinks. Together with innovation, a single-minded focus on sustainable profitability is what differentiates BFS and its companies from the rest of the pack.

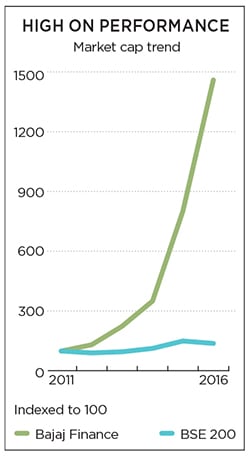

Investors are clearly happy with this strategy. BFS’s market capitalisation has grown sharply to Rs 27,112 crore as of March 31, 2016, from Rs 7,590 crore on March 31, 2011, a compound annual growth rate (CAGR) of 29 percent over five years. In fact, the NBFC, BFL, is an even bigger star performer, clocking a staggering 71 percent five-year CAGR over the same period, its market cap growing to a jaw-dropping Rs 37,329 crore from Rs 2,559 crore in 2011.

These figures should bring a smile to Sanjiv Bajaj’s face. Having worked on the BAL shopfloor in the early nineties as a management trainee, he went on to complete his MSc in Manufacturing Systems Engineering from the University of Warwick, UK, before returning to BAL. After an MBA from Harvard Business School in 1997, he did ten straight years at BAL, involving himself in various functions from finance to exports until the demerger in 2008.

BFS apart, Bajaj is also managing director of Bajaj Holdings and Investments, the group’s holding company which holds 31.49 percent in BAL and 39.17 percent in BFS. His role there includes building strategy and team, and guiding this company which has approximately $1 billion in cash and investments.

“The insurance companies and auto finance were existing businesses, but BAL was the only listed entity. We had a lot of institutional investors telling us that with multiple businesses under BAL, it was becoming difficult to derive a fair valuation,” explains Bajaj on the context of the demerger. “Why not find a way so that people could own both auto and finance separately? When my father and I spoke about spinning off financial services, I was happy to take that on and build it up because I’d spent a good deal of time at BAL which was being led by my brother Rajiv,” he adds, during the course of two lengthy meetings with Forbes India at the BFS headquarters in Pune.

Enter Nanoo Pamnani

A masterstroke by the Bajajs was to get veteran banker Nanoo Pamnani (Pamnani’s wife and Rahul Bajaj’s late wife are sisters) on board in 2007 to guide the financial services business. Pamnani—who was director of Citibank’s Asia Pacific Group based in Singapore and also CEO of Citi in India—was the perfect mentor and guide for Sanjiv Bajaj. Pamnani, now 71, serves as vice chairman of BFS and is still deeply involved in the business. He also chairs BFS’s risk management committee. “Without him [Pamnani], we’d not be anywhere near where we are. Not just me, the team will tell you that,” says Bajaj, who is also the vice chairman of BFL, fondly.

“Bajaj Finance had been around but it was largely captive doing two-wheeler financing [for Bajaj Auto]. Sanjiv, when still working with Bajaj Auto, had called me when I was with Citi and asked me to spend a couple of hours daily to guide us. He made a presentation. I called him back and told him it is interesting but really a lot more can be done. I knew what an NBFC could do. The challenges were enormous but so were the opportunities,” recalls Pamnani.

When Bajaj took charge of financial services, the NBFC was primarily into auto finance, while the non-life and life businesses were relatively smaller. What followed was a brick-by-brick approach to building all the three business lines into major players. Today, BFL is a diversified NBFC present in consumer finance, lending to small and medium enterprises (SMEs), and in commercial and rural lending with a book size of over Rs 41,760 crore as of December 2015, a 41 percent jump over the same quarter the previous year. Bagic is the country’s second largest private non-life insurer and one of the most profitable in the private sector, with among the best combined ratios (the sum of incurred losses and operating expenses as a percentage of earned premium). Balic, on the other hand, is one of the most profitable life insurers in the country and the fourth largest player in the private sector.

In a highly commoditised financial services industry, where a number of players are aiming to offer pretty much the same suite of products and services, how does BFS differentiate itself from the rest? By thinking beyond size, Bajaj stresses. The group has a single-minded focus on excellence, innovation and, most important, profits. Share of profit, not size alone

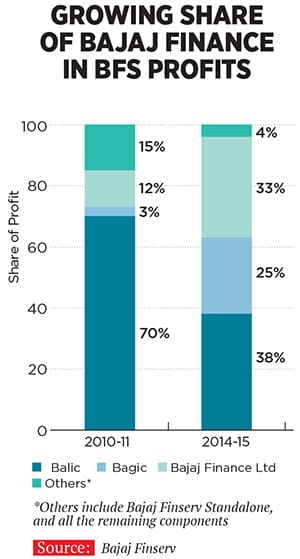

“Our focus is on profit share, not market share. It really doesn’t matter what the topline is. Our aim is to be a large part of the bottomline in the segments we are in,” says Bajaj. The evidence: From a negative of Rs 33 crore in FY08, BFS ended FY15 with a consolidated profit after tax of Rs 1,690 crore. From FY11 to FY15, the company clocked an 11 percent CAGR in profits. BFL is clearly the star among group companies—from Rs 20.58 crore in FY08, its FY15 profit stood at Rs 898 crore, translating into a CAGR of 71.49 percent.

“We are always looking for long-term profit growth. In the life- and non-life businesses, the net worth has also grown sharply, multiple times of what it used to be. If you see how well we have used capital and compare us with the top 10, you will find how this has worked for us in terms of long-term profit growth,” says Bajaj. “If you respect capital and leverage it properly, the business will always deliver high returns.”

However, Bajaj adds that his idea of long-term profit is also linked in a way to a certain size, though the latter is not the objective. “We don’t want to be a Ferrari. We want to be the equivalent of a Mercedes. [You need to] deliver outstanding profits but also be of a reasonably large size. If you chase only size, there are enough examples across the world to show you that you end up making mistakes.”

The focus on profitability also played out when BFL took the decision to move out of infrastructure lending in 2011, an area which many felt was lucrative when the group entered the business. Bajaj says while infra lending is a good way to build the book, the number of lenders makes margins very thin, even in good times. “In the bad times, you’re in trouble anyway. So we got into it for a year or so [in 2010] and then pulled out,” he explains.

The profitability mantra drives all businesses across the group. “When I joined BFL [in 2007], I wanted to be the most profitable business among the three Bajaj Finserv businesses. This has now been achieved with a higher pre-tax profit than the insurance businesses. My next goal is to make more profit than both of them put together,” says Rajeev Jain, 45, the managing director of BFL, who joined the group after stints at GE Capital and AIG, and is a member of the core brains trust of BFS.

Away from the clutter

The innovation intent at BFS is critical for its growth and all businesses are oriented towards it. In BFL, the biggest example is how loans get approved in 30 seconds flat.

“Earlier, if you wanted a consumer durables loan, the retailer would ask for a set of documents, start processing the loan and send the product. Now the retailer only requires a cancelled cheque from the customer, who would fill in an application, select the product and the approval comes on your mobile instantly,” says Jain, adding that last Diwali, BFL took this a step further with the launch of Experia, the country’s first EMI-finance app which approves a loan of up to Rs 3 lakh in 30 seconds. The company provides documentation-free approval, on submission of the customer’s PAN and Aadhaar card details. The customer can provide his deal ID at the store which, once verified, allows him to shop, without having to wait for loan approval. Thanks to the company’s robust back-end and focus on analytics, the good and bad customers are already separated. “I agree that all of this is replicable but we have to keep raising the bar,” says Jain.

“Put very simply, the 30-second approval move is the biggest innovation. Banks do it only for existing customers. What about new customers?” says Bajaj. Today, BFL has a total customer base of about 15 million, with all the BFS firms together accounting for 80 million customers. In the spirit of constant innovation, BFL moved from consumer electronics to furniture to mobile phones and now to apparel, shoes and accessories, increasing the market size it addresses from Rs 50,000 crore eight years ago to Rs 3 lakh crore now, by adding new business lines. It now has 5.5 million EMI cards and has also entered the ecommerce financing space recently by going live on the Flipkart platform. It has also just received approvals from the Reserve Bank of India to launch a co-branded credit card with RBL Bank. With this, the company will have its arms around the overall payments piece. “Our strategy is to get to 10 million EMI cards by 2019. That should position us as the largest cards-in-force issuer in India with our own merchant network,” says Jain, emphasising that BFL’s competition is no longer the other NBFCs but large private banks. The strategy has translated into a return on equity (RoE) of 20.4 percent for BFL as of March 2015.

“We think the overall discretionary pool of the mass affluent will expand significantly. With differentiation, we can make it,” he says. “We are not happy with our current state. We are finding better customer experiences and growing the share of wallet. We are adding depth and width.”

This model draws praise from peers and competitors as well. Says Ajay Srinivasan, chief executive of the Aditya Birla Financial Services Group: “They [BFS and BFL] have grown well and built a good franchise. They got into areas like consumer durables financing where others have not been that successful and built a good track record. They run a good shop and there aren’t too many I’d say this for.”

Bagic has also been an innovator in its field, as an early adopter of cashless claims in the industry. It was also the first to have an in-house health administration team to handle health insurance claims.

Tech-savvy, analytics-driven

Bajaj agrees that the focus on technology has allowed the group to be very customer efficient and add new products seamlessly. Added to that is the focus on analytics. Of the 15 million customers BFL serves, as many as nine million have Bureau best scores, meaning they have scores of 750 and above with Credit Information Bureau (India) Ltd (Cibil). “That is really the power of the franchise,” says Jain.

This has come on the back of hard analytics which the group works on, together with the likes of firms like Equifax and now Bridge i2i Analytics, which pore over customer data and sift the good from the bad, identifying cross-selling opportunities. “Our customer base is all mapped, data cleaned, segmented, put into analytics and credit stamped,” Bajaj adds. “Knowing Basel-III norms will come, we have also built with Crisil an SME rating product for customers where 300-400 SMEs get rated every month.” Not surprising, then, that BFL’s net non-performing assets (NPA) as on December 31, 2015 stood at 0.26 percent. (Rival Shriram City Union, for instance, has a 0.66 percent net NPA level.)

The technology thrust is not just applicable to BFL but to the two insurers as well. “We have opened 300-400 virtual offices through the app on mobile/tablet, where you can also swipe your card and receive the receipt on phone,” says Tapan Singhel, Bagic’s MD and CEO.

“For customers, we have an app-like assist where they can buy a policy, service it or ask any question. For agents, in June 2015, we created an offline app so that documentation can be completed fast,” says Anuj Agarwal, Balic’s MD and CEO. ![mg_86909_bajaj_three_280x210.jpg mg_86909_bajaj_three_280x210.jpg]() Own your business

Own your business

Whether it is BFL or the insurance firms, the BFS approach is to ensure each manager is trained to take ownership of businesses as if they were running them totally as entrepreneurs. This is at the heart of the manner in which BFS’s 26,000 employees and their companies operate and Bajaj is keen to ensure this startup-ish and disruptive attitude continues even as the group grows rapidly.

“We want to create an environment where somebody who wants to be an entrepreneur but may not have the opportunity comes and does so here. Our 34 P&Ls [in BFL] run like individual businesses. The business head looks at everything like it is his money and his business,” says Bajaj. Not surprising then that people like Singhel have risen to CEO from branch manager.

Checks and balances

While Bajaj says the entrepreneurial DNA at the group has helped create high quality leaders because they understand business, risk and expenses, robust processes and reviews also ensure a single-minded focus on sustainable profitability. For instance, Bajaj says he is personally involved in HR and looks at mid- and end-year appraisals for middle and senior management. “We hold them [top managers] responsible by way of detailed monthly reviews and they are very happy to be responsible,” says Bajaj, adding that Pamnani’s background as a top-notch foreign bank professional brought in this element into the system.

“The risk review meetings in BFL go on for a full day. We now have over 450 slides, over 2,000 variables. Doing it month after month, you know what to hone in on, but the information is all there. More important, this information is available to people so that they can take action whenever needed,” he adds. There’s so much documentation and detail in the papers that Bajaj jokes it’s enough to immediately start another NBFC from scratch. “There’s enormous intellectual property in there. We need to guard it all carefully.”

The Bajaj way

Technology, innovation, disruption, differentiation: These growth drivers are meaningless for the Bajaj group “unless it’s done the Bajaj way”, says Bajaj, with the focus on values, ethics and transparency. So whether it is disclosing the internal rate of return on EMI loans of zero percent, declaring net asset values when renewing Unit Linked Insurance Plans or giving a longer free-look period while selling insurance policies, he says the idea is to ensure a high degree of transparency and fairness. “The market may go up or down but we need to be transparent and explain things to customers,” he says. “The goal of all the 26,000 employees of the group is to build the best financial services company in India. Period.”

It has been eight years since Sanjiv Bajaj took charge of the financial services business—and father Rahul can now give him a pat on the back. Consider how far he has come. As of March 31, 2016, BFS and BFL had a combined market cap of Rs 64,441.14 crore BAL’s was Rs 69,625.32 crore. What better validation could investors have asked for?

“In 2007, the media universally thought that the Bajaj group demerger was done to create independent businesses for my two sons. That was not the case. The objective of the demerger was to unlock and create shareholder value. That the boys were getting different businesses was a very welcome by-product,” says Rahul Bajaj. “And, from 2007 to now, Sanjiv has really flourished.”

For his younger son, these words would mean much more than the profits his companies are bringing home.

Own your business

Own your business