The investment roadmap: Why stability matters

Nothing pleases an investor more than a sense of stability, a feeling that he can put his money into assets where things won't suddenly change

Last year, when we published our annual Investment Guide, uncertainty and volatility were the key themes. No one was willing to hazard a guess about how the year would unfold, and geopolitical and economic uncertainties loomed large. Now, as we bring you the 2015 Investment Guide, things have changed quite dramatically. India has a stable political formation at the Centre, there is an overriding sense of optimism in the business community, and the markets have been buoyant despite occasional blips in between. Nothing pleases an investor more than a sense of stability, a feeling that he can put his money into assets where things won’t suddenly change or head in a direction opposite to the position he has taken.

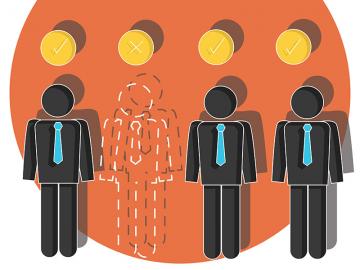

While on the subject of investing, this issue also introduces you to a lineup of India’s most successful and prolific angel investors who are powering the country’s fast-growing entrepreneurship ecosystem by funding startups with great ideas and passionate teams. You will meet them on page 80. These are the people who have been able to spot ideas early and have had the courage and conviction to back them, creating excellent businesses in many cases. India, as most of us will agree, needs many more like them.

Best,

Sourav Majumdar

Editor, Forbes India

Email:sourav.majumdar@network18publishing.com

Twitter id:@TheSouravM

(This story appears in the 06 February, 2015 issue of Forbes India. To visit our Archives, click here.)