Letter from the Editor: It's Open Season at Unilever

While many experts see it as an inevitable sign of power shifting from developed markets to emerging markets, the moot point is really this: How should Indian investors plot their investing strategy?

Tucked away deep inside the steel almirah were a set of share certificates of blue-chip Indian firms. Prized among them were shares of India’s best known multinational, Hindustan Lever. Most Indian families treated these shares like a family heirloom that was rarely touched, except when there was a family exigency like a wedding or a son’s education.

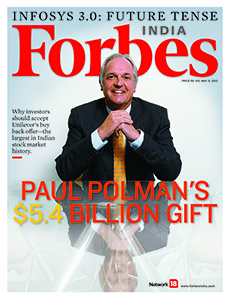

It’s a story that is likely to find resonance across many upper middle class households. And today, many of them will need to decide what to do with their family treasure. Starting June 21, Unilever, the world’s second largest consumer packaged goods firm and HUL’s parent company, will be offering Rs 600 for every HUL share that you own. Unilever’s global boss Paul Polman’s decision to plonk an eye-popping $5.4 billion—the biggest open offer till date in Indian markets—is a pointer to the value that is ascribed to the India growth story. At the end of its buy back operation, Unilever hopes to own a maximum of 75 percent of HUL’s stock.

Mind you, this Unilever open offer may not be the last one. In fact, a clutch of listed multinationals are expected to announce buy back schemes to control a larger part of their Indian subsidiaries. While many experts see it as an inevitable sign of power shifting from developed markets to emerging markets, the moot point is really this: How should Indian investors plot their investing strategy?

As you would have already discovered on the cover, we haven’t pulled our punches. We’ve decided to stick our necks out and advised you to tender in your HUL shares. Samar’s analytical story on page 32 will tell you exactly why.

Once you’ve read the story, comments and feedback are most welcome. As always, I’d be delighted to hear from you.

Best,

Indrajit Gupta

Editor, Forbes India

Email: indrajit.gupta@network18online.com

Twitter id: @indrajitgupta

(This story appears in the 31 May, 2013 issue of Forbes India. To visit our Archives, click here.)

Post Your Comment

Comments 1

-

Chandresh Jain

Chandresh JainFirstly they earn from Royalty and now by increasing stake they will be earning by paying dividend to themselves .... Good way to get money out from india to their parent organisation ...

on May 24, 2013