Forbes Global 2000: Powerful Companies, Compelling Stories

What's interesting about Novartis is not just the breakthroughs it is making in discovering new cancer cures, but how it is going about it

The Forbes Global 2000 list of the world’s most powerful companies makes for sad reading from the Indian viewpoint. The number of Indian companies on the list has been dwindling over the last three years—from 61 in 2012 to 54 this year—while the Chinese contingent is growing in numbers and clout. The Top 3 in the Global 2000 are all Chinese companies, even though the US dominates the overall list with 564 members. China has 150.

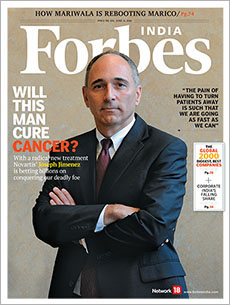

But the reason why we put the Forbes Global 2000 on our cover is not to tell you the story of India’s decline and fall. Far from it. Rather, it is to bring you inspiring stories from the world’s most innovative and exciting companies—and what they are doing now. A case in point is the story of Novartis and how it may be close to revolutionising the fight against cancer.

What’s interesting about Novartis is not just the breakthroughs it is making in discovering new cancer cures, but how it is going about it. The company is innovating even in the way it is pursuing M&As. While the normal route for M&A is to target a company with an interesting product or market position, Novartis is doing “precision M&As”: It is buying out specific businesses from rivals so that it can bulk up on strengths in its chosen areas of research and new drug development. For example, earlier this year, Novartis CEO Joseph Jimenez sold his vaccine and consumers businesses in return for GSK’s cancer drugs business. Reason: Novartis wants to dominate the cancer cure space.

The Forbes Global 2000 has many such interesting stories on companies that are making waves, including Jeff Bezos’ disruptive foray into B2B distribution. We invite you to feast on these and other stories in this issue.

Best,

R Jagannathan

Editor-in-Chief, Forbes India

Email: r.jagannathan@network18online.com

Twitter id: @TheJaggi

(This story appears in the 13 June, 2014 issue of Forbes India. To visit our Archives, click here.)

Post Your Comment