Why the land and gold obsession of rural Indians may be entirely rational

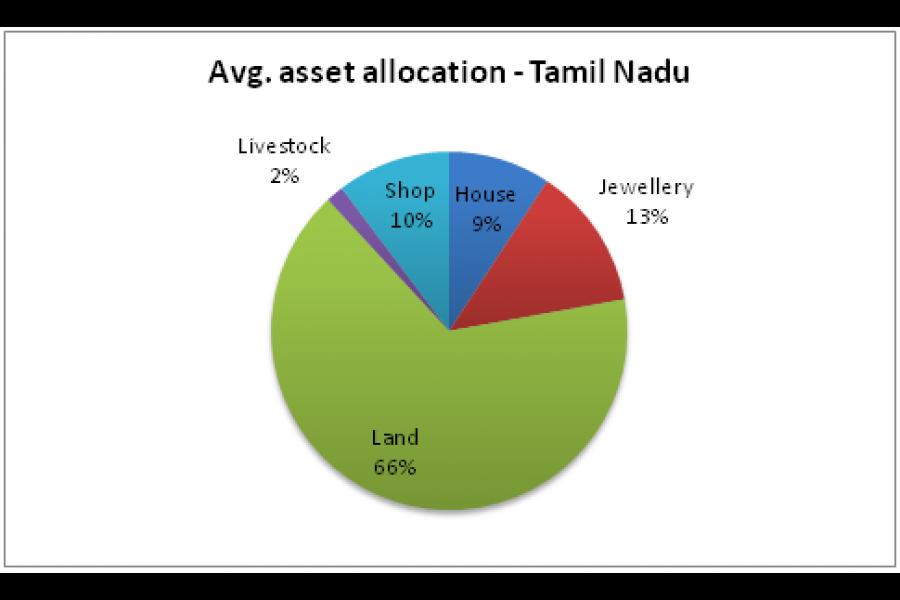

What does the asset allocation look like for people living in remote rural India (villages with less than 5000 population)? My colleague Sowmya Vedula and I looked at the data from some of our investee companies and this is what the picture looks like across 250,000 individuals in rural Tamil Nadu, Uttarakhand and Orissa.

While there has been much discussion about demand for gold in recent times, the data reveals that land holdings are a much bigger issue from a concentration perspective. So, why are rural households hoarding these assets instead of financial assets?

In the absence of financial assets like fixed deposits, stocks and pension plans at these locations, rural households are forced to look at physical assets that will give them old age security and inflation protection, among other objectives. Land as an asset has many dimensions. Several of our labourer customers tell us that it is difficult to find wage labour opportunities beyond the age of 45 or so and then owning a piece of land becomes an important strategy to earn in the later years because you can always “hire yourself”. Similarly, in light of the heavy dependence on the local economy, gold is often the only “national asset” available to hedge against local economic downturns.

There is no quick-fix to alter asset allocations of rural households away from gold and land, despite their obvious shortcomings. We have to complete the task of making access to high-quality financial services available and create trust in these instruments and the institutions that provide them.

The thoughts and opinions shared here are of the author.

Check out our end of season subscription discounts with a Moneycontrol pro subscription absolutely free. Use code EOSO2021. Click here for details.