In late 2012, Blackstone Capital Partners invested Rs 520 crore in the relatively unknown International Tractors Ltd (ITL), valuing the makers of the Sonalika brand of tractors at Rs 4,200 crore. Industry may have taken note with interest, perhaps even surprise, at the time, but today, the private equity (PE) firm will get congratulated on a smart investment.

From all accounts, it also deserves to be applauded for perseverance.

An 18-month pursuit to convince the promoters of a company to accept their money was, simply put, an unusual experience for one of the world’s largest PE players. In most cases, promoters are only too glad to invite the marquee investor, with $68 billion under its management, into their companies. But ITL’s promoters, headed by Chairman LD Mittal, were not as easily persuaded.

When Blackstone India approached ITL, they got a surprisingly cold response. While Vice Chairman AS Mittal and Managing Director Deepak Mittal, sons of the family patriarch LD Mittal, were happy to meet the Blackstone team and talk business, “they said they don’t need the money”, recalls a top Blackstone executive who did not want to be named.

But the PE firm was not giving up. Its interest in ITL which, despite its success, was not as high-profile as domestic peers Mahindra Tractors and TAFE (Tractors and Farm Equipment), had a solid foundation.

The company, based in Hoshiarpur, Punjab, was a comparatively young player in the Indian tractor industry—it sold its first machine in 1996. But despite its ‘youth’, Blackstone’s own research had shown that ITL’s 20 percent Ebitda margin was the best among its peers. A study conducted for Blackstone by consulting firm Boston Consulting Group and marketing research company Francis Kanoi showed that “Sonalika has a very good product, [needed] low maintenance, [had] good power [essentially torque] and good fuel efficiency”. The survey sample included 15,000 farmers from different parts of India.

Blackstone was interested in India’s rural story and had already invested in Nuziveedu Seeds, India’s largest hybrid cotton seed company. “ITL is intrinsic to India’s efforts in enhancing agricultural productivity and enriching its farmers. Favourable macro economic trends such as rising minimum support prices and rising labour costs are leading to increased adoption of mechanisation by farmers,” said Akhil Gupta, then senior managing director and chairman of Blackstone India, during the announcement of the deal. He is now non-executive chairman of Blackstone India.

The investors finally got the green signal after the senior Mittal convinced his sons to agree to the Blackstone deal. He offers a simple rationale for his change of mind. “We have pan-India and global ambitions and given Blackstone’s experience, it [the deal] will help us scale up,” he told Forbes India in a meeting at his Delhi office in late 2013.

Dividends And Growth

And it has been so far, so good for the partnership that is less than two years old. ITL has already given two rounds of dividend payments to Blackstone. It stands to reason then that the company has done well: It sold nearly 60,000 Sonalika tractors in FY2013, the number up 23 percent from the previous year. This is a remarkable performance given that the industry grew by a miniscule 3 percent. ITL’s revenues rose by nearly 30 percent to Rs 2,911 crore, again beating the industry average growth which was about half of that.

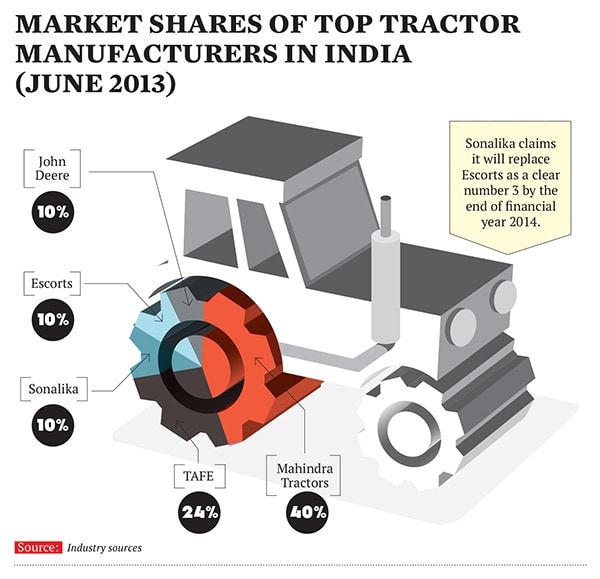

It has quickly emerged as the fourth largest company in the sector, behind Escorts but ahead of multinational biggies like John Deere and New Holland—this is as per 2013 figures. The company has also increased its market share over the last two years, from 7.8 percent (in 2011) to 9.9 percent in 2013. “This year, we will become the third largest tractor company in the country,” says Raman Mittal, son of Deepak Mittal and an executive director at ITL who handles the company’s marketing vertical. He estimates that ITL’s share in the nearly 6 lakh-unit per year market will increase to 10.3 percent in 2014, while Escorts’ share will drop to 10.1 percent.

After including exports, ITL is expected to sell 80,000 tractors in 2014 and touch the one lakh mark in 2015. “We have increased our share across the states and across the HP [horse power] range,” says AS Mittal.

But what appears to be an up-up-and-away story has a catch. While Sonalika is virtually a household name in its traditional markets, including Punjab and Haryana, its market share in these states is reaching saturation. And it is yet to have a significant hold in other parts of the country, including South India where it has a 5 percent market share. While the company has been able to achieve faster growth than the industry largely due to its lower base, a pan-India presence is now imperative. The gap is obvious as market leader Mahindra Tractors sells about 2.5 lakh units a year, about four times the volume of ITL. And in the tractor business, which isn’t a high-technology area, scale becomes the competitive strategy.

“Each region in the country has its own climatic and soil pattern and is a different market. One needs to have a presence in all the markets to hedge against a possible slowdown in one market,” says JM Sahni, former deputy CEO of M&M Swaraj division and now an advisor for TAFE. “Product requirement also differs so it is important to have the right portfolio.”

Experts also point out that ITL has so far specialised in tractors with sub-30 HP. Raman points out that the company’s market share in sub-30 and 30-40 HP segments have consistently increased. At the same time, however, in the above-40 HP category, ITL’s performance has not been as impressive. “While the average HP of tractors in India is still about 36, farmers in developed markets like Punjab are increasingly going for tractors that have 50 HP and more. The trend will soon get replicated in the south,” says Sahni.

While the promoters are positive—“We are now selling in Europe. We can do it in south India too,” says Deepak Mittal—much will depend on the company’s R&D strategy as well as its understanding of customer need.

Neither should be tough to get right—they only have to look to the patriarch of the group for inspiration. After all, LD Mittal had perfected both aspects when he first started out making farm implements.

FARMER FINDINGS

Scouting the rural market of Punjab as an LIC agent during the 1960s, LD Mittal had realised that crops were vulnerable to the vagaries of weather as harvesting was a slow process and farmers didn’t have a proper place to store their produce. He set up a storage shed and started experimenting in farm implements that could shorten the harvest time. Though the first “48 of the 50 threshers were sent back” by farmers, Mittal improvised till he created the right product. He then incorporated the company in 1969 and, within 10 years, it was among the top manufacturers of farm implements in the region.

This success with farmers helped when, pushed by its farm implement customers and dealers, the company diversified into tractors in 1996.

Dealers helped the company raise the money to set up its first tractor manufacturing facility in Hoshiarpur. Incredibly, Mittal and his sons didn’t blink an eye when they were asked to bring it down three years later by its new partner, French major Renault. “We didn’t have the resources to avail of the best technology. But with Renault we could. We realised it was best to build a new facility, rather than improve upon the earlier one,” says Mittal.

While the technology from its French partner helped, ITL was also the beneficiary of a good run for the tractor industry that began at the turn of the century. The increase in farm mechanisation helped as did the “commercial use”, or non-farm use, of tractors that accounts for 30 percent of demand.

![mg_73747_sonalika_280x210.jpg mg_73747_sonalika_280x210.jpg]()

Apart from a blip of a year or two in the interim, the sector has grown in double digits over the past decade. In recent years, it has been helped by farm labour becoming more expensive after the implementation of the MGNREGA scheme that assures employment to the rural poor. This gave farmers a further push towards using tractors as opposed to manual labour.

The market conditions were helpful but ITL’s knowledge of the local needs were crucial in warding off the challenge from MNCs like New Holland and John Deere, which also entered the Indian market around the same time as ITL (in 1996 and 1997 respectively). They struggled to customise their products to suit Indian conditions where, unlike in the Western markets, tractors with lower HP are more popular because of smaller land holdings.

ITL, thanks to its farm implements business, had its ears to the ground and understood farmer needs. Its aggressive pricing (lower than its larger competitors) and tailored packaging with farm implements, where it had a natural edge, helped in cementing its place in the markets in North India.

Interestingly, even the selection of the brand name, Sonalika, the same as a popular rice breed, had been made such that it would strike a chord with the farmers.

“It is true that the farm implement business helped us initially when we forayed into tractors. But now as we try to get into other markets in the country, it is not a significant factor,” says Deepak Mittal.

ORGANIC PUSH

To that end, the company is banking on a multi-pronged strategy. It has bought land adjacent to its existing facility in Hoshiarpur as part of a plan to increase its production capacity to over one lakh units a year. “Right now we are creating records every month by crossing our monthly targets,” says Raman Mittal. The Rs 300-crore investment will make the facility the largest integrated tractor manufacturing unit in the country.

Backed by Blackstone, the company has also invested in creating systems and processes. “Earlier, records of enquiries and after-sales service were done manually. Now the company has a management system. Spare parts are also available readily,” says M Nataraja, owner of Nataraja Tractors, an ITL dealer in Karnataka’s Davangere region.

Nataraja sold 1,200 tractors in the region last year and claims that it is getting closer to market leader Mahindra Tractors. “The company has shown more intent in recent years to penetrate the market in the region. Marketing has become more aggressive,” he points out. Raman Mittal says that his media campaigns and product brochures are now in nine languages. He is also making presentations to prospective dealers, emphasising the company’s product portfolio in the above-50 HP segment. “We want to increase our dealer network to 1,000 from the present 700,” says Mittal.

But the products would hold the key. The Mittals reiterate that Sonalika tractors factor in local needs, have speed (important in the South as the local soil is harder), and “can take more load without slowing down” compared to its peers. The company is holding demonstrations to increase awareness among its prospective customers. Also, at its R&D centre in Hoshiarpur, the emphasis is to develop the portfolio further in the higher HP category as the company looks to target the export market. “We have a 14 percent market share in the export market and sell our tractors in 65 countries,” says Deepak Mittal who looks after the international business.

The push beyond the home market is also taking the otherwise reserved Mittals out of their comfort zone, literally.

A close-knit family, the promoters have been fairly “conservative” till now and are proud of their zero-debt status. But ambition will dictate a change in approach. For one, they will now need to push themselves to use their Rs 1,100 crore cash (accumulated through years of profitability in a high margin business) in the smartest way possible.