Redbus Has The Hot Ticket

Phanindra Sama and Charan Padmaraju built India’s biggest online bus ticketing service. Now that service is helping boost demand for bus travel

As 2010 was drawing to a close, Kadamba Transport Corporation, Goa’s state owned and perennially loss-making bus operator, saw itself in the doldrums.

Thanks to factors that infect most state-run transport corporations—decrepit buses, many unprofitable routes, low occupancy and a snowballing salary bill—it was losing anywhere from Rs 2-3 crore every month. This was on top of a cumulative financial liability of over Rs 100 crore.

Faced with very few options, Venancio Furtado, Kadamba’s managing director, decided to try his luck with online ticketing for his interstate buses. In March 2011, Kadamba went live with its own Internet ticketing portal, powered by ‘BOSS’, a software reservation system made by Redbus, a Bangalore-based company.

What happened over the next few months was a miracle, at least for Kadamba. Travellers increased, drawn by the easy and quick online experience. Occupancy rates increased across most interstate routes from Goa like Sholapur, Bangalore, Hampi, Shirdi and Mumbai. On those routes it started seeing a concept that was almost alien—profits.

In 2006, when the cherub-faced Phanindra Sama and laconic introvert Charan Padmaraju started Redbus, they were just two 25-year-olds with an “idea” to offer bus tickets online.

Instead, what they were wading into was a cesspool of unpredictable occupancy, rickety buses and stagnant routes, all leading to dissatisfied customers and resigned bus operators.

After five years of slogging away at those problems, the picture today is quite different.

“Most of Redbus’ competitors don’t realise the power of the bus travel market,” says Parag Dhol, a director with Inventus Capital Partners and one of the investors in the company. “There’s $3 billion of inventory among just private bus operators, growing at 25 percent annually.”

Thanks to good and ever improving roads, an expanding range of modern luxury coaches, and the hassle-free booking enabled by Redbus and many of its peers like Via, TicketGoose and MakeMyTrip, demand for bus travel is growing rapidly. And as customers vote for greater comfort and speed with their wallets, operators too are upgrading—buying expensive multi-axle buses, hiring ‘customer service managers’ and investing in technology.

Inspired by the turnaround story of Goa’s Kadamba, various state-run corporations too are now approaching Redbus to sell tickets online.

Maharashtra, one of the states that is currently implementing Redbus’ reservation system, has over 19,000 daily ‘schedules’ or trips.

That’s a single state running as many schedules as all 700 private operators currently on Redbus! Another large state, Rajasthan, is also set to adopt Redbus.

The bullishness is evident on the supply side too. “Including the 800 that it sold last year, Volvo has sold a total of 5,000 coaches in India from its inception 10 years ago. But they are ramping up manufacturing capacity to produce 5,000 coaches every year from 2015!” says Phanindra Sama, 30, CEO and co-founder of Redbus.

Buoyed by Volvo’s success, a rash of international coach makers are set to launch in India this year, including Toyota, Scania, MAN and Hyundai.

Spurred by this, Redbus’ business is booming. With a self-estimated market share of over 65 percent, it did over Rs 100 crore in sales during the last quarter of 2011. Despite the fact that most of the tickets it sold were worth just a few hundred rupees, it generated a cash profit of Rs 50 lakh, its first ever.

“Redbus has done a pretty phenomenal job and I have nothing but admiration for them. They focussed on a market that was extremely underserved and fragmented,” says Hrush Bhatt, co-founder and head of products and strategy at Cleartrip.com, one of the leading travel portals in India.

The secret to that is an unrelenting focus on keeping costs low. It claims to have never run an advertising campaign, preferring to rely on word-of-mouth through its largely loyal customer base. Its offices are housed in non-descript buildings, often close to bus terminals. Most senior management, including the founders, are frequent bus travellers themselves.

Therefore most of its growth has been self-funded, unlike the typical e-commerce startup that burns venture funding to buy growth. “Almost all the funding they’ve raised (Rs 42 crore) is still in the bank,” says Sanjay Anandaram, an early investor in the company and a board member.

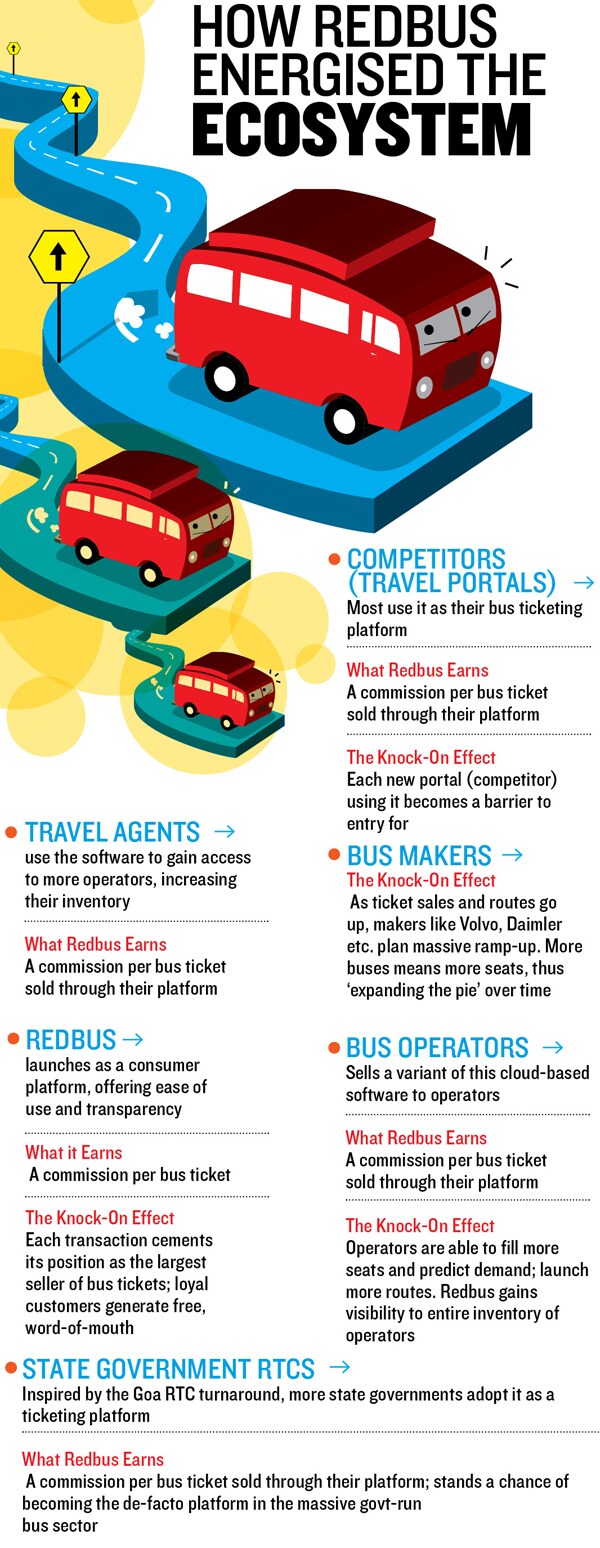

Using its significant transaction volume and loyalty among bus travellers, Redbus has gradually expanded its role with bus operators and travel agents. Through BOSS and Seat Seller, two cloud-based software services it developed and now sells to bus operators (for managing their operations), and travel agents (to aggregate and sell tickets across multiple operators), Redbus is slowly trying to establish itself as the industry’s reservation platform, like Amadeus or Sabre in airline travel.

There are other competing platforms, like Mantis (TravelYaari), AbhiBus and SimplyBus, but none with the comprehensiveness of Redbus’ offerings that combine consumers, operators and travel agents.

In the case of BOSS, Redbus charges 1 percent of every ticket sold by an operator, while for Seat Seller it charges anywhere from 1-5 percent from travel agents. Seat Seller has even been adopted by many of the travel websites who compete with Redbus on bus ticketing, like Yatra.com and Expedia.co.in.

With 600 operators on BOSS and over 10,000 travel agents on Seat Seller, the two already bring in between 10-15 percent of Redbus’ revenue and have the potential to become 20-30 percent over the next two years, says Sama.

But a subtler benefit will be access to the inventory of any bus operator or travel agent who uses BOSS or Seat Seller. “Take for instance routes like Rajahmundry-Kadapa in Andhra Pradesh which would never come into our inventory any time in the near future because they are too small for us to deliver. But through BOSS and Seat Seller, we will immediately see such inventory too,” says Sama.

That visibility could be the key to expanding in tier 2 and tier 3 towns, where an overwhelming majority of tickets are still sold manually. Consider this: Redbus, by far the largest bus ticket seller in India, offers around 18,000-20,000 tickets every day, out of an estimated total of nearly 300,000 across India.

“Through BOSS and Seat Seller, Redbus is co-opting the market. Then on, it becomes a virtuous cycle,” says Anandaram.

In 18 months we want to be Rs 1,000 crore in revenue and by 2015, Rs 3,000 crore, of which our profit should be around Rs 100 crore,” says Sama.

Considering Redbus is currently at an annualised revenue of Rs 400 crore, isn’t that a tall order?

Not really, say Redbus and its venture backers. Thanks to its no-nonsense and behind-the-scenes work over the last couple of years, it is now set to benefit from multiple cycles of adoption.

The first is its expansion into the state government-owned bus sector. Considering that Maharashtra alone runs more daily buses than all private operators on Redbus put together, the growth in volumes could be in multiples.

The rising adoption of BOSS and Seat Seller among operators and travel agents will bring on board revenue and seat inventory that will allow it to plot its future expansion.

There is its large and loyal customer base which allows it to grow organically sans expensive marketing expenses. In an era where most travel portals have to literally ‘buy’ transactions through search engine advertising (because users compare prices across sites, then choose the lowest), that is a huge advantage for Redbus. “Redbus’ organic customer base, combined with the efficiencies that come from scale, are already leading to falling costs per sale. So, while MakeMyTrip’s margins from airline tickets are coming down, Redbus’ from (much cheaper) bus tickets is going up,” says Anandaram.

And even if Redbus’ competitors were to realise the potential of this market, making money from it will be very difficult.

That’s because unlike airline ticketing where the ‘suppliers’, i.e. the airlines, are just a handful, there are over 2,000 bus operators across the country. Most of its larger competitors are also used to an operating model that works with high transaction costs and therefore, high absolute margins. “The economics of bus tickets are challenging, given you only make Rs 10-20 per transaction,” says Cleartrip’s Bhatt.

Vinay Gupta, founder and CEO of Via.com, one of the earliest bus ticketing portals in India, says there is quite simply no money because of the razor thin margins. “We entered this space in 2005, invested in creating the best of software and infrastructure, before realising by 2006 itself there wasn’t enough money in the sector to justify all those.”

But Sama, by now the battle-hardened fighter, is unperturbed. “Bangalore-Chennai used to be a loss-making route five years back with just three-four buses that ran on it. We built this route, and today there are over 150 buses on the same route,” he says.

Says Anandaram, “What are Redbus’ assets? A large customer base, a technology platform, offline networks and partnerships with a lot of backend operators. If I have these, what else can I do? Pretty much anything.”

First Published: Mar 05, 2012, 06:30

Subscribe Now