India's craft beer Bira 91 is frothing over

In less than two years, Ankur Jain has given India a craft beer, Bira 91, to talk about

Ashish Kothare, head of the Bengaluru chapter of the National Restaurant Association of India and owner of the bar and restaurant Roadhouse, is not much of a beer drinker, and therefore a bit of an oddity in Bengaluru, the so-called pub capital of India. And yet, he remembers Bira 91. “It had a very interesting taste,” says the 60-year-old veteran restaurateur, who sampled the new brand that entered Bengaluru late last year, after being launched in Delhi and Mumbai in April.

Since direct advertising of alcohol is against the law in India, there had been no mass publicity of the new kid on the beer block, and yet consumers were becoming rapidly aware of it through word of mouth. “Suddenly, there was a buzz, and everybody at my restaurant started asking for Bira 91,” adds Kothare.

Sales have been brisk across the city. “Stocks vanish in one or two days,” says Manoj Venkatswamy, managing director, Drops Total Spirits, a Bengaluru-based liquor retail chain. However, this has also left fans high and dry because the supply of Bira 91 continues to be erratic most so for the 330 ml bottles.

The issue with supply has to do with the fact that Bira 91—available in two variants, White Ale and Blonde Lager—is produced in Belgium and imported into India.

Bira 91—Bira does not really mean anything, while 91 is India’s international telephone code—is the brainchild of first generation, New Delhi-based entrepreneur Ankur Jain (36). Not happy with the standard of breweries he came across in India, Jain decided to lease one in the Flanders region of Belgium, and import the brew into India, till he found a suitable brewery in this country. The beer is available in Delhi, Mumbai, Bengaluru, Pune, Goa and Kolkata, and was launched in New York this summer, where Jain has set up an office with a small team.

In India, nearly 70 percent of Bira 91’s sales come from restaurants, pubs and bars, where it is available on-tap—Jain claims it is available at “1,000-plus bars on-tap”, largely in the National Capital Region and Mumbai—while 30 percent of sales come from the retail of 330 ml bottles. (In Bengaluru and Kolkata, due to state excise policy regulations, it is sold only in bottles.) Jain expects the sales split to touch 50:50 next year, with the introduction of 500 ml cans over the next three months.

“There have been patchy supplies of Bira 91 in July and August in most of the larger markets,” admits Jain, mainly because the company was outselling its existing production capacity from Belgium. But the company has now leased a brewery in Indore, beer from which is expected to reach the market by mid-September and thus ease supply and enhance sales.

The Belgium brewery will, however, continue to supply to the US market where the beer is sold on-tap, and in bottles and cans. “If we gain critical mass in the US we will start manufacturing there,” adds Jain.

The success of Bira 91, however, has outweighed its supply-side issues. In January this year, US venture capital firm Sequoia Capital, which has invested heavily in India, led a Series A round of funding of $6 million into B9 Beverages Pvt Ltd, the company that owns and manufacturers Bira 91. On a global level, the investment marked Sequoia’s debut in alcoholic beverages. “It is unusual to find the kind of customer love Bira 91 has seen in its early days,” says Abhay Pandey, managing director, Sequoia Capital India Advisors. “This customer pull in a large emerging category of craft beer gave us the conviction of this potentially being a large and valuable company.”

Jain, the CEO of B9 Beverages, says he is in talks to raise an additional round of growth capital to grow the tap network, expand domestic production capacity, and launch newer products. Another production facility in Mysuru, expected to go live next year, is a step in that direction. “It’s a $20 million [around Rs 133 crore] project. We do not own the brewery it is owned by a partner and is being built for Bira 91 solely,” says Jain.

But the industry is not rattled. “Very small volumes, with little or no impact in real terms,” is what Samar Singh Sheikhawat, senior vice president of marketing at United Breweries, has to say about it United Breweries, makers of Kingfisher, has a market share of 51.5 percent.

And although Jain wants Bira 91 to be known as a craft beer—“Anything that moves people away from swimsuit calendars [a dig at Kingfisher’s annual feature] and focusses on taste”—he does not believe that craft beer should always have a small scale of production. “Craft is not just tiny breweries. It is any beer where taste is central to the product—beers created with natural ingredients, traditional processes and recipes that reflect human creativity.” Bira 91’s ingredients include malts from Belgium and France, and hops from the Himalayas and select Bavarian farms. Taste-wise, the White Ale is a low-bitterness, wheat beer, while the Blonde Lager is an extra hoppy lager.Although the definition of craft beer can be broad, it usually implies beer that is produced at a small scale (in microbreweries), using traditional methods and innovative ingredients often they are sold at the brewery itself. When asked if a beer produced at a large scale can still qualify as craft, Jain cites the success of The Boston Beer Company, one of the largest craft brewers in the US. According to the company’s annual report, in 2015, it sold about 4.2 million barrels of its proprietary products.

TJ Venkateshwaran, MD of Rian Hospitalities Pvt Ltd, which owns and operates the microbrewery TJ’s BrewWorks in Pune, says that although microbreweries had first emerged in India sporadically as early as 2005-06, it is only in the past three years that the concept of craft beer has proliferated in India. “Lots of cities have opened up to it and a lot of state governments have opened up to having a policy [on microbreweries and craft beer],” he says.

The genesis of Bira 91, however, lies in the US craft beer movement that Jain witnessed while working there. (The Boston Beer Company’s report says that the US, at present, has more than 4,000 independent breweries, with 700 new craft breweries opening in 2015.) Born and brought up in New Delhi, Jain moved to Chicago in 1998 to study computer science at the Illinois Institute of Technology. After getting his degree, he moved to New York in 2002 to work with Motorola. He left Motorola after a year to co-found a health care management startup, Reliant MD, which he sold in 2007.

“My Reliant MD office was down the street from Brooklyn Brewery, one of the icons of craft beer in the US,” recalls Jain, who visited the brewery every Saturday afternoon. His liking for craft beer grew so much, that he was soon converted from an avid vodka drinker to a beer enthusiast. “Converts are the worst fanatics,” he announces.

When Jain moved back to India in 2007, the first thing that struck him was that “there was no beer worth drinking” in the country. That is when he got thinking about a craft beer brand for the Indian market. Bira 91, though, would only become a reality eight years later. On his return, Jain found a job with Reliance Retail in Gurgaon (now Gurugram), where he worked for around 18 months. He was part of a team that looked at the supply chain side of the business.

It was in 2009-10 that Jain founded Cerana Beverages, a company that imported and distributed craft beer brands from Belgium, Germany and the US. The beer was available in 330 ml bottles and sold in Delhi, Mumbai, and Bengaluru most of them were priced between Rs 300 and Rs 600. The attempt, says Jain, was to figure out what the Indian consumer really liked.

In 2013, he started making one of these imported beers available on-tap across 10 bars and restaurants in Delhi. “We noticed a jump of 25 times in sales volumes,” says Jain. The higher demand for beer on-tap, Jain says, was because consumers at bars and restaurants perceived it to be a fresher, and a more authentic way to drink beer. Also, since restaurants mark up prices on bottles, on-tap beer turns out to be cheaper for the consumer.

There was another key takeaway: “We were in front of the bar, visible 24x7 as compared to when we were in bottles, where we were either under the bar or behind the bar in a refrigerator.” Consumers are also more open to experimenting while in a bar or restaurant than at a retail store.

By May 2014, Jain transformed from being an importer and distributor to a manufacturer. He, however, chose to import his brew from Belgium, a country well-known for its craft beers. By October that year, Akhil Dhawan (portfolio manager at Locus Investment Group) and his brother Ashish Dhawan (founder of private equity firm ChrysCapital) made an angel investment of an undisclosed amount in their personal capacities in Jain’s beer business.

“We were a little biased here, because we are beer drinkers ourselves and, selfishly, we liked the product,” says Akhil (40). The Dhawan bothers have invested an additional undisclosed amount of capital into B9 Beverages (by now rechristened from Cerana Beverages), during its Series A funding.

“When we looked at the landscape of existing players [of commercial beer]…. they were all serving the same product, which is fairly generic,” says Akhil. With Bira 91, he felt that something uniquely different was being offered to the consumer. “And at a price point that was quite favourable. You have all the domestic beers priced at about Rs 60 a bottle and all the imported ones at Rs 200 plus for 330 ml bottles,” says Akhil, whereas Bira 91’s Blonde Lager is priced at Rs 80, and White Ale at Rs 100 at retail stores in New Delhi (different states impose varying taxes on the sale of alcohol).

Across restaurants and bars, the price for a mug of Bira 91 varies from Rs 150 to Rs 300 (depending on the mark-ups in price by restaurants). Bira 91’s new 500 ml cans will be priced between Rs 125 and Rs 140. “We believe that Bira 91’s product and pricing fit has been superb so far and has a large potential,” says Pandey of Sequoia Capital India.

In India, craft beer is associated with the indigenous beers produced at various microbreweries that have mushroomed in metros across the country in the last five to six years. Taste apart, the other difference between Bira 91 and an indigenous microbrewery brewed beer, says Jain, is in the scale of production. “Most of their businesses are in the restaurant space and not in the consumer packaged goods space.”

Venkateshwaran of Rian Hospitalities says that while several states, such as Goa, Maharastra, West Bengal, Punjab, Haryana, Karnataka, and Telangana have a microbrewery policy, only Maharashtra, West Bengal and Goa permit microbreweries to sell their beer outside of their own premises, although not at liquor retail stores, but in restaurants and bars.

Bira 91 has been able to sell at retail stores since they do not own any microbrewery, and hence the laws that apply to microbreweries selling their own brew do not apply to them. “Bira 91 is the first mover to sell at liquor retail stores,” says Venkateshwaran, adding that he would consider beer from microbreweries alone to be craft beer.

Having started off as a brand accessible primarily in restaurants, pubs and bars, it is the retail arena that Jain is now betting big on. “The brand is already built and consumers are now seeking the product at retail shops,” he says.

But, how much of a disruptor can Bira 91 be?

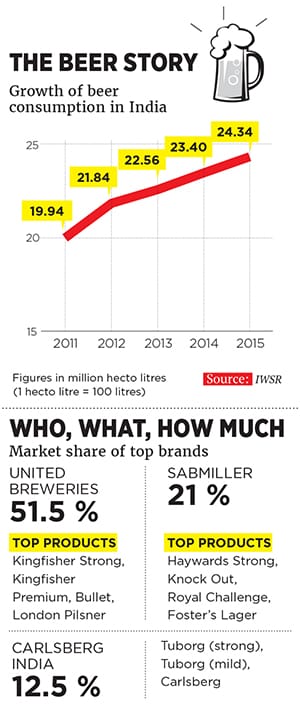

According to IWSR, a global research entity that collects data on the alcoholic beverages market, in 2015, total beer consumption in India was 24.34 million hecto litres (1 hecto litre is 100 litres), registering a volume growth of 4 percent over the previous year.

United Breweries, maker of Kingfisher beer, dominates the market with a 51.5 percent share, followed by global giants SABMiller (21 percent) and Carlsberg (12.5 percent). From a brand perspective, Kingfisher Strong alone accounted for 34 percent of overall consumption, while Carlsberg’s Tuborg strong variant reported a volume growth of over 120 percent over the previous year.

The preference for beer in India is clearly skewed towards a stronger brew that has about 8 percent alcohol strength. In contrast, Bira 91 has an alcohol strength of about 5 percent, equivalent to that of mild beers such as Kingfisher Ultra.

“The question of scalability of the business model remains, but craft beers are definitely disrupting the beer marketplace,” says Sanjay Jain, director at Taj Capital, a boutique investment advisory firm based in New Delhi. According to him, some of the bigger established players, who are “constrained with their traditional business models”, may eventually acquire a craft beer brand. This, he adds, “is a bet [that] many ‘craft’ investors may be making.”

According to Ankur Jain, Bira 91 has been “effectively doubling its volumes every quarter”, since its debut in 2015, and believes the Indian market is ripe for disruption. Bira 91’s success is indicative of the acceptance among consumers for non-traditional beer variants.

Sheikhawat of United Breweries, however, adds that the interest in these variations is “not beyond some curiosity to try wheat beer, rice beer, lime beer, ciders, etc.” And, he adds, that the “curiosity” is restricted only to “affluent” urban consumers. He also cautions that Bira 91 could face challenges with respect to “funding, scale, product integrity, etc,” going forward.

For now, even as Bira 91 transitions itself from being brewed in Belgium to being brewed in India, which comes with its own risks, Jain is chasing two goals: By 2020 he wants Bira 91 to emerge as a leading brand in the premium beer category as well as an established Indian consumer beer brand with a global footprint.

Clearly, there is a lot brewing.

First Published: Sep 23, 2016, 08:08

Subscribe Now