Indian luxury cars: JLR takes on the Germans

Jaguar Land Rover may be a late entrant into the country's fiercely competitive luxury automobile market but it has a plan to break the German stranglehold over India. And it is already driving Tata M

Two years ago, auto enthusiast Mahesh Chauhan decided to buy a vehicle “with personality”. The co-founder of the Mumbai-based ad agency Salt Brand Solutions is an avid driver, having undertaken road trips on challenging and remote tracks in Rajasthan and Ladakh. He was looking for a rugged, four-wheel drive that could withstand rocky terrains. After much thought, he splurged on a Freelander 2, a sports utility vehicle (SUV) from marquee British brand Land Rover.

Along with Jaguar, Land Rover had been acquired by India’s Tata Motors (from Detroit-automaker Ford Motor Company) in a $2.3 billion deal in 2008. A year later, the Tatas brought both luxury brands into the country for the first time.

It was Freelander 2 that gave Jaguar Land Rover (JLR) a toehold into India’s fiercely competitive luxury car market. It was the first vehicle (a few parts for which are imported from JLR’s plant in Halewood, UK) that JLR assembled and rolled out of its factory at Pimpri, Pune district, in May 2011.

Chauhan couldn’t be happier with his choice of car. “It is a cult SUV. It is raw and macho, and can take me anywhere,” he says of his Rs 50 lakh ‘Loire Blue’ Freelander 2. He’s already broken it in with two road trips, one to Kutch in Gujarat and the other to Bangalore in Karnataka. “It has amazing road manners.”

This affirmation is significant for JLR India because, as a late entrant in an already crowded market, the company is making up for lost time. And, since 2009, it has captured nearly 10 percent of the luxury car market. Apart from the Freelander, the Indian arm of the UK-based Jaguar Land Rover Automotive Plc (a Tata Motors subsidiary) assembles the Jaguar XF and XJ from the Pune factory. Industry analysts predict that JLR’s Range Rover Evoque may be the next luxury vehicle to be assembled in India.

In the initial months, JLR imported only six cars—three each from Jaguar and Land Rover. This was a time when India’s luxury car market was, and still is, dominated by the big three German brands: Audi, Mercedes-Benz (from Daimler) and BMW. Reason: All three have at least a five-year headstart in India, either through well-established distribution networks or assembly units.

Notwithstanding that, it was a heady start for JLR. Rohit Suri, who heads operations as vice-president (premier car division) of JLR India, says that customers were lining up to place orders even as the company was setting up its first showroom at Ceejay House in Worli, Mumbai. “This was our first statement to the Indian market,” says Suri. “We were here that was the message. As our cars were being readied for display, a customer literally threw a handkerchief on one of the Range Rovers, indicating that he wanted to ensure that no one else got the car when the showroom opened.”

By the time the showroom opened, all six imported cars had been booked and sold despite the fact that a luxury car import is accompanied by a hefty tax. (According to analysts, global automakers face import duties from anywhere between 60 and 200 percent depending on the price of the car.)

However, to be taken seriously by its competition and potential consumers, JLR had to assemble its cars locally. And it started doing that in 2011.

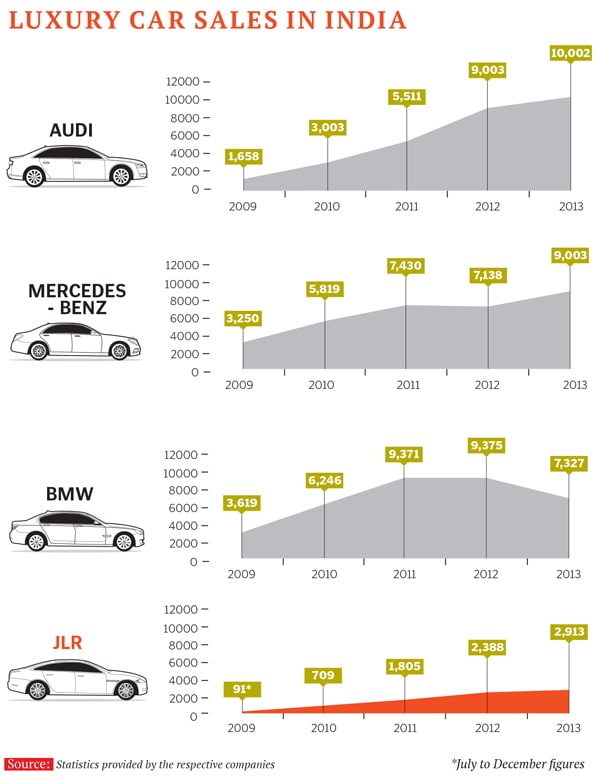

With the advantage of starting from a small base, it recorded a 3,100 percent jump in sales in India over a four-year period, from 2009 to 2013: In the first year (from July to December), JLR sold 91 units. In 2013, the company sold 2,913 cars. Market leader Audi, which sold 10,002 cars in the same year, recorded a 500 percent growth between 2009 and 2013, followed by Mercedes (177 percent) and BMW (100 percent). The base effect was in full play for JLR—as was the brand appeal.

Mahantesh Sabarad, deputy head of research at SBICAP Securities, points to a string of factors that ensured JLR’s success in India. “It did not need to create brand awareness it was already well known,” he says. “The Tata Group was also cost-conscious, and the fully integrated auto manufacturing plant at Pune with its body and paint shops was a huge plus for JLR. It helped the company push the brand in terms of ease of service, post-sales related activities and sourcing of auto parts.”Then, there is the clear and present opportunity. At 17 cars per 1,000 people, India has the lowest car density of all the Bric (Brazil, Russia, India and China) emerging markets. The luxury auto industry, though rapidly expanding, occupies a minuscule space—for now. India sold near 25 lakh cars in 2013, of which only 30,000 belonged to the luxury sector, or just 1.3 percent. “But the potential is huge. In China, for instance, this segment constitutes five to seven percent of the total market,” says Sabarad. “If India doubles its (annual) car sales to nearly 50 lakh, and the luxury market increases to even three percent, we would see sales in this niche segment go up nearly five times.” And it is this potential that Suri is betting on. “JLR was not present at all in India until 2009 but, since then, the journey has been exciting. All we’ve seen is growth,” Suri tells Forbes India.

Competitors and industry experts are keeping a close watch on the newest automobile player. In the early years, sceptics, which included the media, questioned Tata Motors’s ability to sell a high-end car to Indian consumers, who were accustomed to brands such as Audi, BMW and Mercedes-Benz. What does an Indian firm—one that has made its name manufacturing trucks and buses—know about high-technology premium cars, they asked. There was also fear that Jaguar would lose some of its luxurious sheen after the acquisition. It didn’t help that the buyout took place just months after the global financial meltdown of 2008.

But in this maelstrom of debate, there was one reassuring voice, that of Ratan Tata, who was then the Tata Group’s chairman and the mastermind behind the JLR acquisition. “Our plan is to retain the image, the touch, and the feel of Jaguar and Land Rover,” Tata had said at the Geneva Motor Show in 2008, weeks before the official acquisition announcement was made. “We will not tinker with the brands in any way… They are special global brands, and whoever acquires them has a responsibility to nurture them and enable them to prosper.” By staying true to this sentiment, the marquee brand grew in strength. JLR and Tata Motors surprised its critics and surpassed even the most optimistic predictions.

Not that it should have been a surprise. The Tata Group is no stranger to European brands. At the time of the JLR acquisition, it owned 12 businesses in the UK, including tea brand Tetley, and had taken over Anglo-Dutch steel giant Corus in 2007. From past experience, the management decided to retain the essence of JLR as a company.

And that helped. Over the years, JLR has been consistently boosting Tata Motors’s earnings: For the July to September 2014 quarter, the luxury brand constituted 90 percent of Tata Motors’s revenues. (Tata Motors officials refused to speak on ownership and strategies for the future growth of Jaguar Land Rover.)

In FY2009, Tata Motors reported a consolidated loss of around $520 million, but its fortunes started looking up soon after. For FY2011, it posted a consolidated profit of Rs 9,274 crore (approximately $1.72 billion), a 260 percent jump over the Rs 2,571 crore profit it had recorded during the corresponding period the previous year. The recovery was led by JLR, which reported a net profit of $1.61 billion (approximately Rs 8,300 crore) for FY2011. In the same year, JLR’s global sales increased by 26 percent, selling over 2.43 lakh cars.

JLR’s revival can be attributed to a combination of Indian funding, functional autonomy and the hiring of talent, particularly of German management. “Tata Motors has provided vision and leadership. It clearly recognised the difference between brands and their markets. I am not sure if any other corporate house would have been able to do that,” says Suri, who had previously worked with General Motors in India.

For instance, Ratan Tata hired people who had mastered the European market. In 2010, Tata Motors appointed Carl-Peter Forster, former head of General Motors Europe, as group chief executive of Tata Motors. And though he quit in a year, he helped map JLR’s global plans. Ralf Speth, formerly with BMW and Ford, is JLR’s chief executive officer.

British journalist Ray Hutton explores the global turnaround in JLR’s fortunes in his book, Jewels in the Crown: How Tata of India transformed Britain’s Jaguar and Land Rover (2013). “It (Tata Motors) negotiated a good purchase price, committed the right investment and applied good management,” writes Hutton, former editor-in-chief, Autocar magazine. Auto analysts explain this further. “What JLR got was operational and financial autonomy towards expenditure and marketing goals,” points out Piyush Jain of Morningstar, Inc, a global investment research firm.

“Over the last five years, there has been a continuous infusion of funds into JLR, amounting to $12.28 billion,” says Sabarad. (This injection of capital was initially from Tata Motors, followed by debt, and, now, through internal funding. JLR has partly repaid Tata Motors the initial capital, he adds.) By March 2014, JLR was selling more than 100,000 cars in China, now its largest single market. It opened a new factory in China in October 2014, in a joint venture with Chery Automobile. It will be setting up a manufacturing facility in Brazil next year.

Over the past five years, JLR’s global revenues have grown at a compounded annual rate of 40 percent, according to Jain. In the fiscal year 2013-14, JLR sold more than 4.3 lakh vehicles worldwide, up 16 percent from the previous year. It set new records in 38 markets, including India and China. Jain is confident that JLR will be able to repeat its China success in India, but he predicts that it will take a decade to do so.

This slower pace of growth is a challenge that even JLR’s competitors acknowledge. BMW India’s president Philipp von Sahr tells Forbes India, “In absolute terms, India cannot compete with other high-volume single markets, yet. But the future belongs to India. If you want to benefit from the dynamics of the Indian market later, you need to act today.”

To that end, JLR has crafted an ambitious India growth strategy to battle the ‘German Big Three’ in the coming months. It is betting heavily on the Jaguar XE—popularly called ‘Baby Jag’—which will help it enter the lower end of the luxury market. The XE, whose launch was announced first in London in September 2014, is slated to hit Indian roads by December 2015-January 2016.

Why this matters? Because about 40 to 50 percent of India’s luxury car market comprises compact executive cars, including the BMW 3 Series and Mercedes C class, which start at about Rs 30 lakh. These ‘affordable luxury’ cars drive the volume of sales in India. The Baby Jag may just be a game-changer.

“Audi has about 5.5 lakh vehicle sales in the Chinese market, of which about 60 percent comes from the lower end of the luxury market where JLR has zero presence. The XE will help the company gain more brand recognition, increasing volumes and its market share,” says Jain from Morningstar. He predicts that JLR will introduce 20 products in India by 2020. It currently has 12 different cars in its existing portfolio.

Another product set to be launched by mid-2015 will be the Land Rover Discovery Sport, an SUV aimed at replacing its own Freelander. This could place car enthusiast Chauhan in a fix. “I am already getting tempted by the Discovery!” he says.

As promising as the momentum is, JLR in India will still have to overcome a few bumps. For one, JLR has to strengthen its dealership arm, which currently stands at 21 networks across India. Compare this to its rivals: BMW has 37 dealer networks, Audi 40 and Mercedes-Benz leads with 68.

Competition will be fierce this year with several new launches in the offing: The Indian consumer will be spoilt for choice. Audi has plans to flood the market with 10 models in 2015. “It will be an exciting period for us,” says Audi India head Joe King. “Inquiries are up 20 percent (from the same period the previous year).” Mercedes-Benz, the fastest growing in the luxury space, will begin the new year with the launch of its highly anticipated CLA-Class, a sedan aimed to take on Audi A3. Eberhard Kern, managing director and CEO, Mercedes-Benz India, says, “We will continue with our product offensive all through the year.” His confidence stems from the growth spurt for Mercedes-Benz which could end 2014 with sales of over 10,000 cars in India it has already shown a 16 percent increase in Q3 (July-September) with sales of 7,529 cars. Meanwhile, BMW India, which had launched the all-new M3 sedan and M4 Coupe this year, will introduce the low-emission, petrol-electric hybrid BMW i8 in 2015.

All signs point to a fierce fight for the dominion of India’s roads. Suri, however, is going into top gear: He wants to break the hold that the German automakers have on India and his foot is on the accelerator. But it is also a matter of patience and determination. For JLR India, the race has only just begun.

First Published: Jan 14, 2015, 07:44

Subscribe Now