How Prime Focus Broke into Hollywood

Prime Focus started out as a teenager's garage operation in Mumbai and is now a global force in the post-production of films

The 2011 Academy Awards saw 10 nominations in the VFX (visual effects) category. Of these, five films (including X-Men: First Class, Transformers: Dark of the Moon and The Tree of Life) had engaged an Indian company for 2D-to-3D conversion and post-production work. Prime Focus Limited (PFL), a global visual entertainment services company, has been instrumental in altering the Hollywood perception that only US-based studios excelled in visual effects, 3D and animation. Today, 40 percent of Hollywood’s VFX and 3D work gets done in Asian countries like India, Malaysia, South Korea, Thailand and the Philippines, says a 2013 KPMG report.

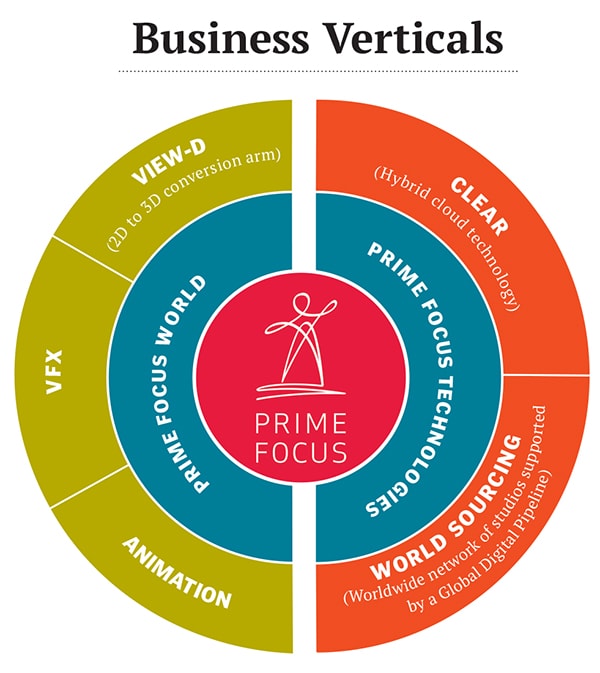

According to PFL’s 2011-12 annual report, its creative services division Prime Focus World (PFW) had a 38 percent share in the global market for 3D conversion. Since the launch of View-D, its proprietary 2D-to-3D conversion arm, in 2009, it has worked on projects including Avatar, Harry Potter and the Deathly Hallows Part 2, The Chronicles of Narnia: The Voyage of the Dawn Treader, Clash of the Titans, Star Wars: Episode One—The Phantom Menace, The Twilight Saga: New Moon and World War Z.

In 2D-to-3D conversion, PFL competes with Hollywood’s Legend 3D (Alice in Wonderland and Transformers), Stereo D (Titanic and Avengers) and Rocket Science 3D (Immortals and Gulliver’s Travels). In India, though, it is the only company making inroads into the nascent 3D market. In VFX, PFL faces stiff competition from Shah Rukh Khan-owned Red Chillies Entertainment, which is warming up to Hollywood projects after Ra.One.

From a tiny studio in Mumbai, the company has more than doubled its revenues from Rs 354 crore in March 2009 to Rs 762 crore in March 2013. It has a 4,500-strong workforce in 16 offices across the world. As a media expert at a global consulting firm puts it, “It has broken international barriers in the film industry.” And its journey has been fascinating.

Humble Beginnings

PFL was founded by 18-year-old Namit Malhotra in 1995. He had dreams of becoming a filmmaker—inevitably so. His father Naresh Malhotra was a film producer his grandfather was a cinematographer who had worked with BR Chopra.

But paucity of funds put Malhotra’s ambitions on the backburner instead, he took a course in computer graphics. Thereafter, along with three others (Merzin Tavaria, Prakash Kurup and Huzefa Lokhandwala, who were his instructors), he set up a small editing studio in a garage next to his apartment in Khar, Mumbai. “I’m the third generation in the entertainment business,” he says.

As satellite television was taking off in India in the mid-’90s, they moved to the services side when his father initiated an equipment rental business, Video Works. For about two years, the studio was being run as a traditional proprietorship, almost like a “small shop”, and was called Video Workshop. “We did some low-budget pilot TV programmes which caught on very well,” says Malhotra. They did everything from visual effects to digital art to colour correction. “I was not always able to sell the technology but I could sell the solution,” he says. “I told my dad that I can’t be running a godown and a workshop. I wanted to leverage the creative aspects of my own business.”

And thus, at 19, he had a big business plan—and he was willing to pitch hard. Rupert Murdoch-owned Star was setting up operations in India, and Malhotra wanted to build the backend for them. “We will provide cameras and create content as well—that was my pitch to Star. I went to Hong Kong and presented the business plan. They loved it,” says Malhotra. But that partnership didn’t take off due to lack of funds.

It was in 1997 that Video Workshop gave way to Prime Focus Private Limited. “We had a Rs 2 crore debt on a Rs 75 lakh turnover at the time. We had to consolidate,” says Malhotra. The business expanded: From small-time TV shows, they started working on ads and music videos.

“We worked with MTV. We became Channel V’s in-house design team. We did advertising by day and television by night. My facility would run 24 hours and I had to buy low-cost machines because I didn’t have funds,” he says.

Dearth of money meant coming up with innovative and cost-efficient ways of work. “I was nobody in the business. But that changed very quickly. We had no real experience but our work was really edgy,” says Malhotra.

SHARP RISE

Between 1997 and 2005, PFL grew rapidly. Though completely debt-funded and servicing a steep interest cost, it increased revenues from Rs 35 lakh to Rs 30 crore with profits of Rs 15 crore. The same year, Reliance Capital invested Rs 25 crore in the company for a 14.53 percent stake. (In 2010, RCap sold its stake to Centrum Capital for about Rs 30 crore.)

In 2006, an IPO followed with a 19 percent equity dilution. The company raised Rs 100 crore and spent it on properties, building facilities and expanding global operations.

It entered the UK with the acquisition of VTR Plc, an AIM-listed company (AIM is the London Stock Exchange’s international market for smaller growing companies). “I didn’t want to enter a mature market as a startup,” says Malhotra. In 2007, it entered the US market through the acquisition of Post Logic and Frantic Films. As it went international, it gained visibility and credibility. It introduced new technologies for international vendors who came to India. Says Malhotra, “We became more confident about the trends in technology, the transitions, how much money to invest, what price to buy at.”

But there were obstacles.  SLIPPERY SLOPE

SLIPPERY SLOPE

Malhotra admits that his biggest business mistake was to opt for FCCBs (foreign currency convertible bonds) in December 2007 to fund an international acquisition. “We were immature to not understand that FCCBs were convertible equity,” he says.

When the company entered the US in 2007, the film industry there was severely hit by the monumental Writer’s Strike. Nearly 12,000 writers were a part of it, affecting about 400 film and television producers. This was followed by the actors’ strike. “It was a no-business period for six to seven months,” says Malhotra.

Then came the Lehman crisis in September 2008 the industry went through a severe downturn and a number of projects sank. Malhotra recalls, “I had bought loss-making companies with debt. We had a 60,000 sq ft facility in LA and wanted that to be our flagship. But with the crisis, there was complete destruction of value. Since 70 percent of our business came from these markets, the investors said this company is lost. The stock price just fell.”

Around the same time, PFL was restructuring its businesses in the international markets and aligning them more closely to India where talent was in plenty. “It took 12-18 months to get back on track. We rebranded our global operations in 2009. We were working on the VFX of Avatar then,” Malhotra says.

BACK WITH A BANG

After the release of Avatar in 2009, the number of 3D screens exploded worldwide from 3,800 in 2008 to 43,000 in 2012. It was in January 2010 that PFW secured its first 3D conversion contract which reversed its fortunes.

Inspired by Avatar’s success, Warner Bros wanted to convert Clash of the Titans to 3D. They approached multiple vendors. “While most vendors said they needed eight months for the conversion, Namit said we could do it in eight weeks,” says co-founder Tavaria, who is now chief creative director of Prime Focus. “He took up the challenge we hired 300 people in 10 days and finished the project in eight weeks flat.” This propelled them further into the Hollywood big league.

“Clash of the Titans really brought us back. That [2D-to-3D] is now the biggest part of the business. Star Wars, Transformers, Harry Potter… we are competing for front-of-the-line projects,” says Malhotra. And now, taking up seemingly impossible tasks and pulling them off with élan “is in the company DNA”, says Tavaria.

In February 2012, Malhotra’s teenage dream of working with Star was finally fulfilled when India’s largest television network struck a deal with Prime Focus Technologies (PFT)—the cloud-based technology arm of PFL—to digitise its operations and enable tapeless end-to-end workflow. This was a first in the country’s broadcasting history and a triumph for Malhotra.

PFT is the brainchild of Ramki Sankaranarayanan who is also the India CEO of the parent company PFL. Ramki is the former chief of Subex and has worked with Tata Elxsi prior to that. His rich experience in the field of media technology enabled him to spot the gaps in India and develop CLEAR—the company’s hybrid cloud technology for the digital archival of content. “We have grown rapidly from Rs 9 crore in 2008-09 to Rs 92 crore in 2012-13, and are likely to end 2013-14 with Rs 140 crore in revenues from India alone,” says Sankaranarayanan. With clients like Star, Associated Press, BCCI and Sony Music, PFT’s future looks promising.

With PFT’s CLEAR technology, “Star TV has eliminated tape completely. Everything is networked across one platform. There’s not a single DVD going back and forth,”says Malhotra.

According to industry sources, the network has seen a 30 percent reduction in its operating costs after the deal. Going tapeless has helped them eliminate logistical inefficiencies and attract contextual advertisers to their channels. “There’s a team at Prime Focus which tags each scene of each show with ‘emotions’. Advertisers target spots depending on these tags,” says an industry insider.

“For the Star deal, clearances had to come from Rupert Murdoch himself. That is a huge vote of confidence for their technology,” says a fund manager from a leading asset management company.

Consequently, other clients came on board. “Most of India’s leading broadcasters today have gone digital. This domestic technology platform built by Prime Focus will aid their growth in the next few years,” says the media consultant.

INVESTOR SUPPORT

In March, Hong Kong-based private equity fund AID Capital Partners invested $10 million in PFW, valuing it at $250 million (approximately Rs 1,637 crore). Later in June, PFW received another Rs 313 crore in investment from Macquarie Capital, which valued it at Rs 1,770 crore.

For a company whose market

cap is a mere Rs 514 crore, the valuations are sky-high. How did the PEs arrive at such figures? “Many small caps are cheap today due to lack of investor interest,” says the fund manager. “And the industry is growing.”

What also helped PFW is the equity partnership it struck with the producers of Sin City 2, thus making them eligible for profit-sharing. “If it can get more deals like Sin City, its valuation will only go up,” says the fund manager.

The capital raised from PEs will be used for PFW’s global expansion and in deleveraging the debt (Rs 707 crore) in its parent company, PFL. Despite the leverage on its books, investors are happy.

“Prime Focus is one of the few companies from this part of the world that has been able to credibly break through into Hollywood. It has a strong front end in LA, the cost advantages of a backend in India, and tax-efficient locations in Canada and the UK. Few companies have this combination of competitive advantages,” says Nainesh Jaisingh, global co-head, private equity, Standard Chartered Bank.

In October last year, Standard Chartered PE had invested $70 million in PFL for a 19.71 percent stake, making them the second largest shareholder in the company after the promoters. (Billionaire investor Rakesh Jhunjhunwala owns 6.14 percent of PFL, while ICICI Prudential and Citigroup have 3.81 percent and 1.02 percent respectively.) With the fund infusion, PFL successfully redeemed its convertible bonds in December.

OPPORTUNITIES AND RISKS

“PFT’s potential is unbelievable. It is far more risk-free than PFW which is a project-based business and if you don’t utilise your manpower, fixed costs reduce profit,” says the fund manager.

The VFX and 3D industry is still nascent in India. But FICCI-KPMG’s 2013 report on the Indian media and entertainment industry estimates that the market will grow at a CAGR of 20 percent to reach Rs 19 billion by 2017.

Reducing the debt should be the company’s priority now. But Malhotra seems unfazed, “Most of our debt was in real estate or in working capital. It will get pared down now,” he says.

His investors don’t seem too jittery either. Standard Chartered PE’s Jaisingh says, “A substantial portion of the $48 million of equity capital raised this year will also be used to retire debt. The company’s balance sheet is strong and the profile of debt that remains is appropriate.” Further, the devaluation of the rupee is likely to benefit companies that are concentrated in Western markets.

Malhotra is often touted as a flamboyant entrepreneur. “But he had the aspiration to grow big and break barriers,” says the fund manager. In Malhotra’s words, “the game is not limited” and he could possibly look at a Nasdaq listing in the future. “The real power of our platform is still not visible. We’ve been through the hard times. Now let’s start having some fun,” he says.

First Published: Oct 02, 2013, 06:08

Subscribe Now