Days after Walmart announced its $16 billion buyout of a 77 percent stake in Flipkart, the rather grim prognosis was the candid view of the founder of one of India’s largest internet companies that’s a leader in the industry it operates in. The founder who spoke to Forbes India on the condition of anonymity then went on to point out a truism that none of his tribe will say on the record: That for most ecommerce entrepreneurs chasing valuations remains the prime objective.

There’s little gainsaying that initial reactions to Walmart’s buyout of Flipkart, in early May, bordered on the euphoric. As congratulatory messages to the founders Sachin and Binny Bansal poured in, the most commonly heard phrase was ‘watershed moment’. Homegrown entrepreneurs celebrated one of their own hitting pay dirt. Clearly this was the coming out party Indian ecommerce had been waiting a long time for.

But scarcely had the dust settled on the Flipkart deal when those same homegrown entrepreneurs, and the investors backing them, began to ponder the inevitable question. What is the road ahead for their businesses and how long before a viable model emerges for Indian ecommerce?![g_105965_nevillenoronha_280x210.jpg g_105965_nevillenoronha_280x210.jpg]()

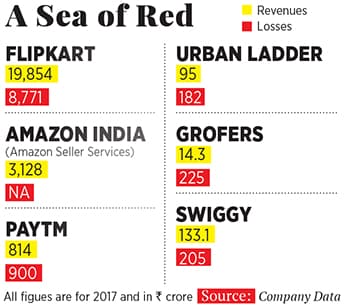

Image: Mexy XavierFor clues, turn to the very acquisition that the Indian startup ecosystem is celebrating. In 2017, Flipkart registered an impressive 29 percent increase in its sales, or gross merchandise value (GMV), to ₹19,854 crore while losing ₹8,771 crore. In an investor presentation its new parent Walmart all but admitted that they expect losses to mount further to ₹11,500 crore in 2020 as the company battles it out with arch-rival Amazon and Alibaba-owned Paytm. On the day the deal was announced nervous investors in the United States shaved $10 billion off Walmart’s market cap.

And herein lies the dichotomy at the heart of many ecommerce ventures. India with its 200 million plus addressable internet consumers is among the largest markets in the world after the US and China. It’s enough for the three main actors Amazon, Walmart and Alibaba, with its 55 percent stake in Paytm Mall, to dig in for the long haul.

Still, for now at least, getting to those consumers is an expensive proposition—order sizes are low and delivering and collecting cash involves expensive logistics. Add returned orders (26 percent of total), and the reverse logistics are equally challenging. Online companies believe that what they lose with touch and feel, they can make up with discounts leading to high levels of cash burn for the foreseeable future. That number (losses) is estimated at ₹27,000 crore.

What’s clear is that the rules of the game are bound to change with the battle being fought entirely with foreign capital. Kashyap Deorah, author of The Golden Tap, a book on Indian ecommerce, believes unlike China and the US, India will not be a winner-takes-all market. Instead he argues that growth will be slower than projected and “the Indian market will remain far more fragmented”. It’s also the only market in the world where the world’s three biggest retailers Amazon, Alibaba (through Paytm) and Walmart compete head on and fight for a pie of the estimated $200 billion ecommerce market by 2027.![g_105963_kishorebiyani_280x210.jpg g_105963_kishorebiyani_280x210.jpg]()

Image: Mexy XavierIndian ecomm: A special child

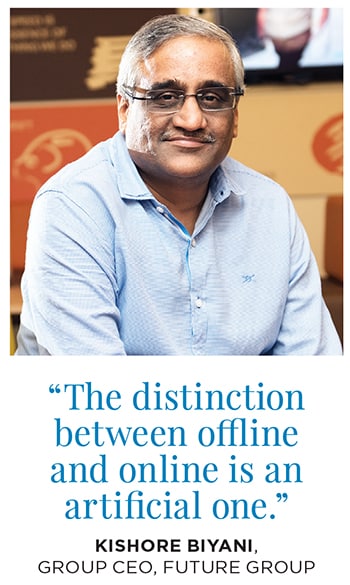

Indian retailers don’t tire repeating that this market is unlike any other. They’re not only referring to the size of the opportunity but also to the inordinately high cost of doing business. This renders online sales of most categories unviable. Kishore Biyani—who founded the Future Group, which runs the supermarket chain Big Bazaar, among other brands—should know best. “The distinction between offline and online is an artificial one,” he says. His over two decades experience in this business has seen him pivot four times and make a loss of ₹400 crore with various online ventures. Each closure of online operations was related to the cost of doing business.

Take for instance the furniture category, which at 45 percent has the highest margins. In 2016, the Future Group acquired Rocket Internet’s FabFurnish with the view that they could make it work due to the high margins. A year later, it was merged with HomeTown. At 20 percent customer acquisition cost and 20 percent delivery cost there was very little scope to make money.

It is a story that repeats itself across categories, in some of which the battle becomes even more cut throat. Apparel operates at 35 percent margins, groceries at about 5-15 percent and mobile phones, which account for almost half of Flipkart’s GMV, operate at about 7 percent. On the cost front, Google and Facebook act as gatekeepers and take 4-5 percent as advertising costs. Payment and cash on delivery account for 2 percent of costs. (“In China it is just 0.2 percent,” laments Biyani.) Delivery costs account for 20 percent. Add to that discounts and very soon the business operates at a negative margin, with discounts being the only moat.

For now large offline players—the Future Group, DMart and Reliance Retail—are busy protecting their turfs. They’ve built a large and robust offline presence and are confident this can withstand an onslaught from pure-play online companies which, they argue, will not want to lose money indefinitely.

![g_105969_asishgoel_280x210.jpg g_105969_asishgoel_280x210.jpg]()

Image: Nilotpal Baruah

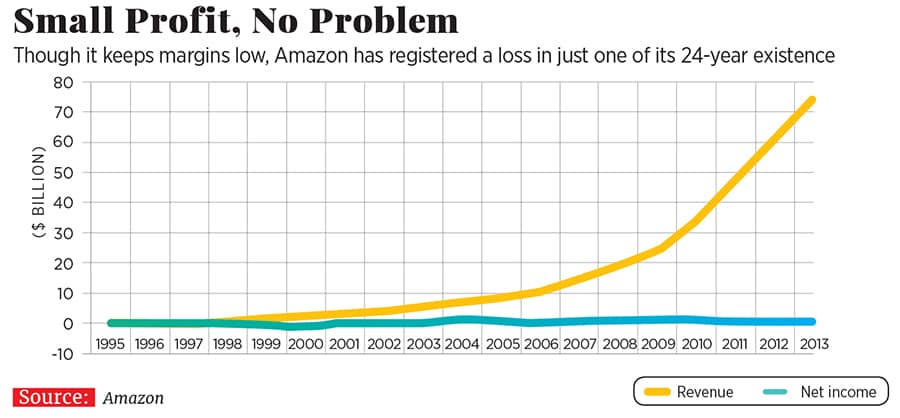

Except, the online universe, and Amazon in particular, operates with a very different model—the zero percent net margin model. Here’s how it works. Across categories, on a blended basis, Amazon ensures that it makes a very tiny margin. The additional money is ploughed back into developing new categories —it could be anything, from an entry into e-publishing to shoes. As market share is built up, the number of categories keeps on increasing. This in turn attracts more sellers and more customers to the site. At Amazon this is known as the Flywheel. (Note: There have been minor deviations from this strategy with Amazon’s 2017 acquisition of Whole Food Markets, a supermarket chain, being a case in point.)So, while grocery worldwide operates on wafer thin margins there is nothing stopping Amazon from using the money it makes in, say, gardening equipment to sell groceries at a zero percent margin. In time, its lead in the grocery business expands. What’s important to note is that zero percent margin does not mean negative margins and Amazon has only registered a loss in one year of its 24-year existence.The rapid expansion of businesses across categories ensures that online retailers are able to take market share away from offline retailers and play with what is loosely termed as float—payments are made by customers instantly, while suppliers are paid after a gap.

If done correctly, in time, a combination of the zero percent margin and float makes online players far more competitive than offline retailers. In Amazon and Alibaba’s case the markets have in the last five years begun to price what they believe is an infinite growth opportunity.

Deorah points out that while the Flipkart founders did a great job with the website and with customer service (later CEO Kalyan Krishnamurthy brought in financial control) they failed to understand that in competing with Amazon they are up against a very different beast. Not only does Amazon (and Alibaba) have access to unlimited capital for the Indian market they play the game with zero percent margin and continuously expand their market share and float.

Unlike Amazon founder Jeff Bezos, Flipkart’s founders were unable to issue shares with differential voting rights and lost control of their company very early. It has since then been run by Tiger Global and later Softbank, who have a clear exit strategy. As an owner, Walmart would in all likelihood run the company with a long-term lens i.e. it would be willing to invest more.

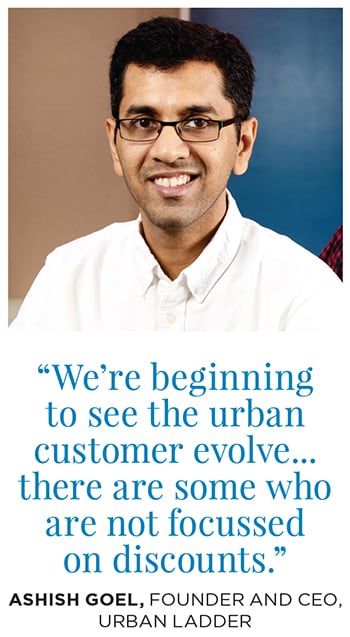

![g_105971_indianecommerce2_280x210.jpg g_105971_indianecommerce2_280x210.jpg]() For now, Indian retailers are steeling themselves for the battle with pure play online players—a battle that will be fought with very different rules. The next decade will see an additional 100 million customers shopping online, according to Morgan Stanley as people from tier 2 towns take to ecommerce. In time, it is hoped that order sizes will improve, returns reduce and the cost of delivery halve. “We’re beginning to see the urban customer who has shopped online for say five years evolve. While this is still a tiny portion of total customers, there are some who are not always focussed on deals and discounts,” says Ashish Goel, chief executive of Urban Ladder, an online furniture store.

For now, Indian retailers are steeling themselves for the battle with pure play online players—a battle that will be fought with very different rules. The next decade will see an additional 100 million customers shopping online, according to Morgan Stanley as people from tier 2 towns take to ecommerce. In time, it is hoped that order sizes will improve, returns reduce and the cost of delivery halve. “We’re beginning to see the urban customer who has shopped online for say five years evolve. While this is still a tiny portion of total customers, there are some who are not always focussed on deals and discounts,” says Ashish Goel, chief executive of Urban Ladder, an online furniture store. ![g_105967_indianecommerce_280x210.jpg g_105967_indianecommerce_280x210.jpg]() Walmart: last among equals

Walmart: last among equals

As ecommerce companies continue to broaden, a considerable amount of sales will move online. What remains to be seen is what portion of the online sales consolidate around the Amazon, Walmart, Alibaba (Paytm) triumvirate and where smaller niche players like Urban Ladder, Snapdeal, Zomato and ShopClues fit in. Will they have the deep pockets and customer loyalty to compete with a zero- or low-margin regime?

To be sure, Walmart could find itself at a disadvantage in competing with Amazon and Alibaba in India. Walmart is valued as an offline retailer and the difference in market cap between the three—Walmart: $254 billion, Amazon: $783 billion, Alibaba: $512 billion as on May 16—could leave it with less firepower to invest in India. Also, investors are likely to be less kind to sub-par performance from Flipkart, whose financials will be consolidated in Walmart international. That could give it less time than it needs to build a viable long-term business in India even as it competes with Amazon and Alibaba.

For the time being, offline players are focussed on guarding their moats, which they believe their extensive network of offline stores and understanding of the Indian customer gives them. As the ecommerce pie increases they could find some of these moats under threat. Jabong and Myntra have already given Flipkart a lead in the online apparel category. There’s nothing stopping Amazon and Paytm from muscling in there.

The eventual big battle will be fought over grocery and, in private conversations, offline players believe they have an advantage with their understanding of regional tastes and preferences. Globally this is the holy grail for ecommerce as it accounts for the largest share of the retail pie. At the same time, even in the US, online grocery sales account for just 3 percent of total grocery sales.

![g_105973_indianecommerce3_280x210.jpg g_105973_indianecommerce3_280x210.jpg]()

DMart, the country’s most valuable retailer, believes that home delivering groceries is the fastest road to bankruptcy. “They are bulky to transport and the margins are very thin,” says Neville Noronha, MD, Avenue Supermarts, which runs DMart. Instead they’re experimenting with pick up points where customers order online, receive the same discounts as they would in a DMart store and come to collect their groceries.

Noronha concedes that they’re using this as a learning factory and says it is too early to comment on the success or failure of their 61 pick up points in Mumbai. Pureplay online grocery players like BigBasket have yet to come up with a viable business model. Big Basket lost ₹191 crore in 2017. Again it remains to be seen if it can compete with a zero-margin player that serves several categories.

While the online-offline skirmishes play out, it’s fairly certain that it will be at least five years till they start feeling the pinch and cutting back on expansion. It’s too soon to predict Circuit City-like closures in India. The more interesting battle will be the one between Amazon, Flipkart and Alibaba (Paytm) with neither conceding an inch.

With 100 million new customers entering the market in the next decade all major categories—apparel, mobile phones, furniture—will be up for grabs with a grocery push coming in some pockets of the country over the next decade. With a zero percent model, the companies have every chance to grow at anywhere between 20 and 35 percent a year over the next decade.

While there is as yet no answer to the billion-dollar question on whether ecommerce in India can make money, it’s fair to expect several more billion-dollar sale days.

(Additional reporting by Rajiv Singh)

For now, Indian retailers are steeling themselves for the battle with pure play online players—a battle that will be fought with very different rules. The next decade will see an additional 100 million customers shopping online, according to Morgan Stanley as people from tier 2 towns take to ecommerce. In time, it is hoped that order sizes will improve, returns reduce and the cost of delivery halve. “We’re beginning to see the urban customer who has shopped online for say five years evolve. While this is still a tiny portion of total customers, there are some who are not always focussed on deals and discounts,” says Ashish Goel, chief executive of Urban Ladder, an online furniture store.

For now, Indian retailers are steeling themselves for the battle with pure play online players—a battle that will be fought with very different rules. The next decade will see an additional 100 million customers shopping online, according to Morgan Stanley as people from tier 2 towns take to ecommerce. In time, it is hoped that order sizes will improve, returns reduce and the cost of delivery halve. “We’re beginning to see the urban customer who has shopped online for say five years evolve. While this is still a tiny portion of total customers, there are some who are not always focussed on deals and discounts,” says Ashish Goel, chief executive of Urban Ladder, an online furniture store.  Walmart: last among equals

Walmart: last among equals