Behind Netflix India's audacious plans

From Sacred Games to Little Things, a deep dive into why Netflix is betting big on India, with a bold original content play

Team Netflix India (from left): Abhishek Nag, director for business development and partnerships Monika Shergill, director (international originals) Srishti Arya, director (films) Aashish Singh, director (films)

Team Netflix India (from left): Abhishek Nag, director for business development and partnerships Monika Shergill, director (international originals) Srishti Arya, director (films) Aashish Singh, director (films)

Image: Mexy Xavier[br]October 2019 Los Gatos, California

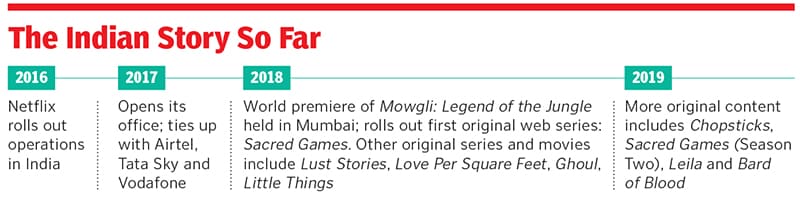

The proclamation was ‘mighty’. “We don’t shy away from taking bold swings if we think the business impact will also be amazing.” Netflix made this daring declaration in its latest quarterly letter to shareholders in October. The world’s biggest online streaming player was alluding to the ever rising cost of generating premium content—it flaunted its content budget of around $15 billion in cash for the year—and how the impending launch of online video platforms by rivals such as Disney and Apple would make the scramble for content even costlier. In the bargain, the American giant would inadvertently go on to offer a glimpse into one of its ‘bold swings’ and ‘amazing’ impact in one of the Asian countries it had debuted three years ago.

Cut to Mumbai, India. December 2016

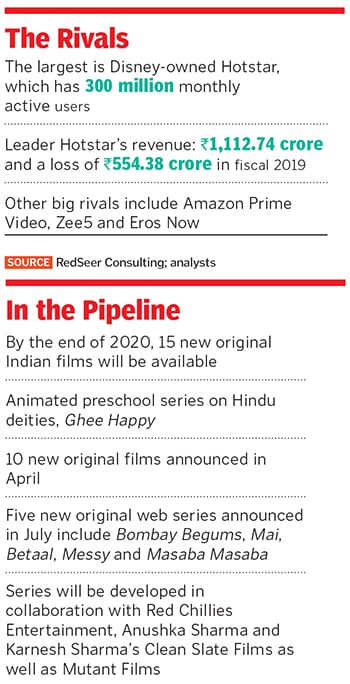

Despite having an 11-month head-start over rival Amazon Prime Video—which entered India in December—and the popularity of American crime drama web series Narcos, Netflix was still a niche concept, confined largely to salaried corporate honchos in Mumbai and Delhi. The reason was not hard to fathom. Netflix was prohibitively expensive. While Amazon offered an ad-free, on-demand service at a monthly rate of ₹41, Netflix was available at ₹500 for a month. Even Hotstar, another big competitor, now owned by Disney, had a tempting tag: ₹199 per month.

A year down the line, Netflix CEO Reed Hastings, though “pleased with the progress made in India”, acknowledged the reality. “YouTube gets the most streaming in India, but Hotstar gets the second most,” he said in an investor earnings call in 2017. Undeterred, the CEO went on to wager a mighty bet on India in 2018. “The next 100 million (subscribers) for us are coming from India,” Hastings said at a business summit in India in August 2018.

The reality, though, was still playing on Reed’s mind. “We’re way behind YouTube and Hotstar (in India),” he admitted in another earnings call. However, he was quick to look at the brighter side. The advantages, he continued, are tremendous in India for internet viewing. “We just have a lot of work and a lot of opportunity ahead,” he remarked.

Back in California. October 2019

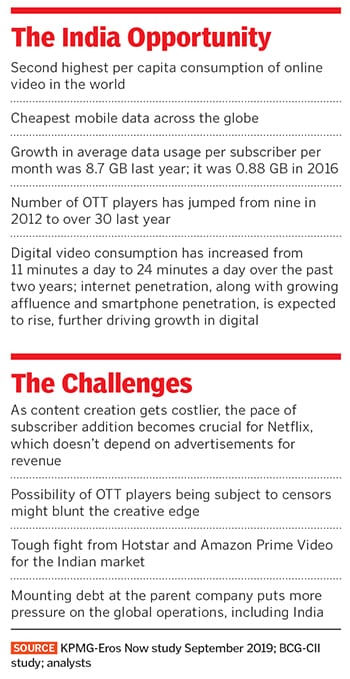

There is a ‘beam’ of optimism. “We’re pleased with the results,” Netflix let on in its letter to shareholders. In July, it had rolled out its lower-priced mobile plan—₹199 per month.

The bold swing—India is the first country where Netflix has dropped to such a price point—had an impact. Our approach, the US giant added in the newsletter, with pricing is to grow revenue and so far, uptake and retention on the mobile plan in India has been better than initial testing suggested. “This will allow us to invest more in Indian content to further satisfy our members,” the company said, adding that it is continuing to test mobile-only plans in other markets as well. Gregory K Peters, chief product officer, was elated. “We’ve been very, very happy with the mobile plan.”

India, one of the 190 countries where Netflix gets streamed, is fast turning out to be a crucial market for the media-services provider in its global scheme of things. This is at a time when growth in the home country is moderating and competition gets cut-throat as Apple and Disney roll out streaming services of their own. “India is a priority for us,” says Todd Yellin, vice president (product), at Netflix in an exclusive email interview with Forbes India. Since making its India debut in 2016 and launching the first original series last year, Netflix has announced 40 original series and films.

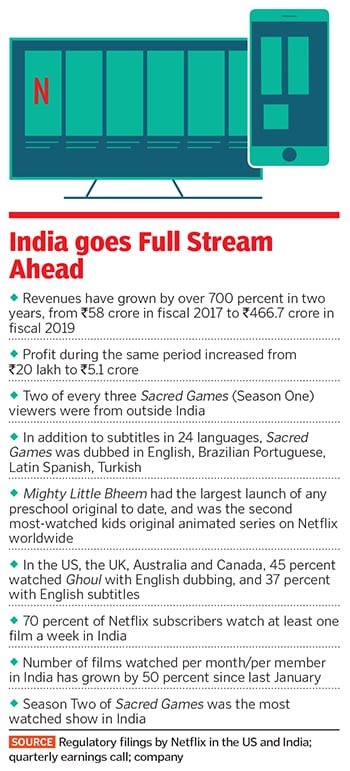

Netflix’s optimism is backed by India’s promising performance so far. In 2017, Indian viewers devoured a web series at a faster pace than global counterparts: Three days as against the global average of four. A series viewed more than two hours per day was labelled as ‘devoured’ by Netflix. The financials picked up accordingly. From a paltry ₹58 crore in fiscal 2018, revenue leapfrogged eight times to ₹466.7 crore a year later. Profit jumped 25 times to ₹5.15 crore from ₹20 lakh. Though Netflix doesn’t disclose its global breakup of users, its subscriber base in India is estimated to be between 12 million and 14 million.

The success of the ₹199 mobile plan for Netflix also means a massive opportunity to tap into the fastest growing smartphone market in the world. Its subscribers in India—the second biggest base globally after China—watch more on mobile than anywhere else. As a percentage of overall time spent on Netflix, film viewing in India is the highest for any country worldwide. The number of films watched per month per member in India has grown by 50 percent since last January.There is another first. Since its entry, Netflix claims India has seen the fastest-growing content investment than any country outside the US (the company did not share the numbers). And India is likely to have over 500 million online video subscribers by 2023, which will make it the second largest base in the world after China, where Netflix doesn’t have a presence.

The American major has already pressed on the gas pedal in India where two broad trends have had a predominant play in the online video space over the last few years. One, a large chunk of the population has shown an appetite for global content as they move away from linear TV to online streaming. “Netflix has an edge here,” says Manav Sethi, group chief marketing officer of Eros Now, an Indian subscription-based OTT, video-on-demand Indian and South Asian entertainment platform (Reliance Industries, which owns the Forbes India franchise, has a 5 percent stake in Eros Now’s parent company, Eros International, a film production and distribution company). This global slate, adds Sethi, is diverse, has variety and quality that grows member engagement, which impacts revenue positively.

The second, and bigger, trend is first-time video users (200 million TV households versus 1.2 billion mobile connections) consuming local stories on their mobile. “They aren’t yet exposed to global content yet,” Sethi says. The mobile-only plan of ₹199, he argues, will take care of the second trend.

What is more, locally-produced content is finding takers outside India. Two of every three viewers of Sacred Games (Season One), Netflix’s first original web series in India streamed last year, were from outside India. In addition to subtitles in 24 languages, Sacred Games was dubbed in English, Brazilian Portuguese, Latin Spanish and Turkish. In the US, the UK, Australia and Canada, 45 percent watched Ghoul—another Indian original—with English dubbing, and 37 percent with English subtitles. The icing on the cake, though, was Mighty Little Bheem, which was the second most-watched kids original animated series on Netflix worldwide.

India offers a serious business opportunity for SVOD (subscription video on demand) players, reckon experts. “India is one of the most important markets outside the US for Netflix,” says Anil Kumar, chief executive officer of RedSeer Consulting. With 10 GB data consumption per smartphone per month, Indians are the biggest data guzzlers in the world. India also boasts of the second highest per capita consumption of online video and the cheapest mobile data in the world.

“For the time being, things are working out for Netflix,” says Kumar, adding that it has cracked the pricing puzzle with its affordable mobile-only plan. “Netflix seems to be winning the first battle on the price and volume.”

Enchanted by the potential of the Indian market, new players are making a beeline. The latest to enter India is Mubi, the London-headquartered on-demand movie streaming and rental service. Taking a leaf out of the books of the incumbents, the 12-year-old is offering its service at a competitive price: A three-month subscription comes at ₹199.

Meanwhile, at the India headquarters at the Bandra-Kurla Complex in Mumbai, Monika Shergill, director (international originals) at Netflix India, has been experiencing ‘sleepless’ nights. Just a little over four months into her role, Shergill reckons the journey so far has been intense, an eye-opener and full of insane possibilities. “The potential of what Netflix can do for good story-starved people in India is something that excites me,” says Shergill, who has had stints at Zee, Sony, Star and Viacom.

Meanwhile, at the India headquarters at the Bandra-Kurla Complex in Mumbai, Monika Shergill, director (international originals) at Netflix India, has been experiencing ‘sleepless’ nights. Just a little over four months into her role, Shergill reckons the journey so far has been intense, an eye-opener and full of insane possibilities. “The potential of what Netflix can do for good story-starved people in India is something that excites me,” says Shergill, who has had stints at Zee, Sony, Star and Viacom.

To be sure, Netflix has been betting big on original content. And one of the ways is by stitching partnerships. These include tie-ups with Dharmatic Entertainment, the digital content arm of filmmaker Karan Johar’s company Dharma Productions, and Shah Rukh Khan’s Red Chillies Entertainment. “What is most exciting for me is the unique creative freedom to tell a story in the best way possible, and finding audiences all over the world,” says Johar, who worked with Netflix for Lust Stories.

In a cluttered OTT market—the number of players has jumped from nine in 2012 to over 30 now—the ones having a distinct edge will be those with original content. Ted Sarandos, chief content officer of Netflix, has a reason for the success that the early originals have had in India. The investment in local language content in India, Sarandos said in a recent earnings call, is paying back in the form of excitement and member growth and hours growth. “That’s encouraging us to keep going.”

Back in Mumbai, Srishti Arya, director (films) at Netflix India, tries to define a ‘Netflix person’: Somebody who is open-minded, can hear another point of view and is willing to empower others. Lust Stories, which created a buzz in India for Netflix and recently got nominated for the 47th International Emmy Awards, did its bit to empower the female protagonist. An anthology of four short films directed by Dibakar Banerjee, Johar, Anurag Kashyap and Zoya Akhtar, Lust Stories grabbed eyeballs across the country. “This is the golden age of content. Netflix is empowering a lot of creators,” says Arya. Agrees Aashish Singh, director (films) at Netflix India: “There is no box office pressure on the actors and creators.” One can just tell the story one wants to, and in a manner one wants to, he adds.

Rivals like Amazon Prime Video India, which started 2019 with the aim to launch 6-8 Indian Amazon original series, are also planning similar strategies. “We are thrilled that we will exceed our goal, closing the year with nine launches, points out Vijay Subramaniam, director and head, content, Amazon Prime Video India. “Today, a big hit can come from anywhere and some of these incredible shows coming out of India can be our next big global hit.” While Indian Amazon original shows Inside Edge and The Remix got nominated for the International Emmy Awards, The Family Man was first premiered at The Television Critics Association in the US.

It’s been almost three years for Amazon as a streaming service in India. Subramaniam explains that in the last 12 months, India has added more Prime members than in the previous years. “Our service is now watched by customers in over 4,000 cities and towns across India.”

Amazon Prime Video, which has an estimated 13 million monthly active users, is pushing the envelope in terms of innovative shows. Take, for instance, One Mic Stand, an unscripted comedy original. The five-episode show, where celebrities will perform along with professional comics, has already roped in Shashi Tharoor, India’s first politician to feature in a streaming original. Other celebrities on the show are YouTube star Bhuvan Bam, singer and music composer Vishal Dadlani and actors Richa Chadha and Taapsee Pannu.

Then there’s Zee5, which claims to have the largest bouquet of originals. “We have at least one original web series coming out in six regional languages each month,” says Tarun Katial, CEO of ZEE5, the OTT arm of the Zee group. “We have released over 100 originals since 2018,” he claims.

The biggest Indian OTT player, Hotstar, which has advertising as its dominant source of revenue, lords over the online video streaming space with 300 million monthly active users. This base has been built on the back of live sports programming, including cricket. Hotstar, which is lining up aggressive plans to beef up its original content, did not reply to an email sent by Forbes India.

Netflix is aware of the challengers, but it prefers to play to its strengths. “While the competitors have some great titles (especially catalogue ones), none has the variety, diversity and quality of new original programming that we are producing around the world,” it boasted in its latest letter to shareholders. “We’re ready to compete to earn consumers’ attention and viewing.”

Clearly, the way Netflix sees it is that it wants to be India’s ‘Bard of Binge’.

First Published: Dec 09, 2019, 11:37

Subscribe Now