In 1984, when Anil Rai Gupta was given his first business assignment by father Qimat Rai, he was all of 15. The founder of Havells India Limited had decided to host a meeting of the 70-odd dealers of his company and had tasked his son with scouting for a five-star hotel.

Though Havells—which manufactured industrial electrical products such as rewirable and changeover switches, HBC fuses and energy metres at the time—was a relatively small business, clocking annual revenues below Rs 50 lakh, Qimat Rai Gupta had the disposition of the big leaguers. “QRG [as he was fondly known in industry lore] told me, ‘Larsen & Toubro hosts its dealers’ meets at five-star hotels, so we should do the same’,” recalls Anil, who took over as the chairman and managing director of the company following his father’s death in November 2014.

Eager to earn his stripes, Anil negotiated a deal with the Taj Palace Hotel in New Delhi’s diplomatic enclave—a transaction he recalls with pride, even today. “I still remember the person at the hotel… I told him, ‘Look, I might be young, but I want to make sure I get the best rate’, to which he replied, ‘You are doing a very good job at that’.”

Three decades since that meet, the company is no longer the minnow that it was. Havells today has a 6,500-strong dealer distribution network. Its product basket has also diversified to include cables and wires, motors, fans, power capacitors, lighting (CFL and LED), water heaters and domestic consumer appliances such as iron, mixer grinders and air coolers.

Financially, Havells is within touching distance of becoming a billion-dollar entity. Its standalone revenue in FY16 stood at Rs 5,436.88 crore, a 4 percent increase from the previous fiscal, while its net profit in the same period was Rs 715.35 crore, a year-on-year increase of 54 percent (includes exceptional item). Also, the company has a market capitalisation of over Rs 22,000 crore and its shares have delivered returns in excess of 800 percent since it got listed in 1993.

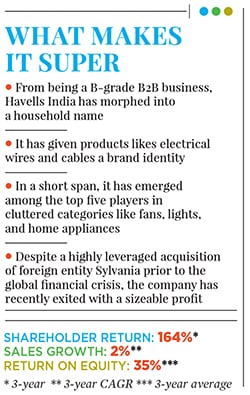

What’s more, Havells has become a global player. In 2007, it acquired the European lighting company Sylvania, which was at the time one-and-a-half times its size, for a total consideration of Rs 981 crore. The leveraged buyout catapulted Havells to among the top five lighting manufacturers in the world. In the same year, global private equity major Warburg Pincus invested $110 million in the company for an 11.2 percent equity stake. (Warburg Pincus has since exited and, earlier this year, Havells divested 80 percent of its stake in Sylvania to Shanghai Feilo Acoustics for a profit of Rs 202 crore.)

“The most satisfying part of this journey is the transformation from a B-grade manufacturer, which was one of the smallest in the space, to the largest electrical company in the country. And, to be considered as the most premium for the consumer,” says Anil, who worked alongside his father for 22 years since he joined the company in 1992 as a non-executive director.

Simply put, Havells was a brand known only to a specific target audience such as electricians and architects, but now it has become a household name thanks to the vision of the late Qimat Rai Gupta.

And his legacy lives on. As Anil, 47, says, “Every day, I recollect many of my father’s old adages to find out what he would have done in a particular situation.” As a tribute to his father, Anil authored Havells–The Untold Story, which was published earlier this year.

Havells India’s non-executive, non-independent board member TV Mohandas Pai says what stands out in the company is its “culture of excellence” and “openness”. “QRG set up a culture based on curiosity, great products, customer satisfaction and aggressive marketing. It [Havells] is an extraordinary company, one-of-its-type.”

Qimat Rai Gupta’s entrepreneurial journey began in 1958, when he set up shop in Delhi’s famous electrical market Bhagirath Palace as a dealer of electrical products. The next 20 years saw Gupta’s rise from a dealer to a manufacturer of electrical products, having set up three plants in Delhi. In 1971, he acquired the brand Havells from businessman Haveli Ram Gandhi.

Until 2003, Havells focussed largely on cables and switchgears, which were not consumer-facing products. Then, it switched gears and entered the lighting and fans segments. “It was the biggest change the company saw, a shift from an industrial company to a consumer company,” says Rajesh Gupta, whole-time director (finance) and group CFO, who has been working with the company for 37 years. (Rajesh is not related to the founder-family of Havells.) The company then entered the domestic appliances market and launched water heaters in 2010-11, and has since expanded its product portfolio.

![mg_88069_havells_india_280x210.jpg mg_88069_havells_india_280x210.jpg]()

As of FY16, cables and wires garnered the highest share, or 40 percent, of the company’s revenues, whereas 24 percent came from switchgear, 21 percent from electrical consumer durables and 15 percent from lighting and fixtures. In actual terms, cables and wires—a business that was started two decades ago—has become a Rs 2,200-crore category. The fans business, which was started a decade ago, has become an almost Rs 1,000-crore category. Lighting, also a decade old, is at Rs 800 crore.

“The vision of the organisation, for which I would give credit to my father, was to become one of the leaders in the electrical industry. We realised that if we were to just remain in that space [switchgears], we would be constrained by our size,” says Anil, an alumnus of Shri Ram College of Commerce, New Delhi, and an MBA (marketing and finance) from Wake Forest University in North Carolina, USA.

Qimat Rai Gupta’s “vision” was also about creating a profitable entity. Over the last 15 years, the company has seen its profit margins increase by 0.5 percent to 1 percent annually, with the focus being on diversification and offering premium products. For instance, when the company entered the fans business (which is now a Rs 6,200-crore market), it knew that profitability was next to nothing as big brands had to compete with local manufacturers in the unorganised sector.

So, the bulk of the products in the market were in the economy segment. Unlike competitors—Crompton, Bajaj, Usha and Orient—Havells did not enter this space. Even today, the company’s cheapest fan is priced at Rs 1,550—a Rs 200 premium over rivals. Anil explains the business rationale: “If a consumer is paying Rs 50 lakh for an apartment, he or she is not going to try and save Rs 200 on a fan.” And that bet has paid off. Despite catering to a niche space, Havells has already captured a 15 percent share of the Indian fan market.

Focusing on the premium end of the market has been the company’s strategy across all its product categories, including switchgears and cables and wires. In October 2012, Havells launched a mass-market switch brand called Reo. It was priced 20 percent higher than competition and the company offered a lifetime warranty on it—a first such initiative in the category.

An analyst at equity broking firm Motilal Oswal, who requested anonymity, assesses that Havells is the market leader in many of the product segments it operates in, “so the overall growth of the company as compared to its peers or competitors is much better”. Adds Anil, “Our PBT [profit before tax] was 5 percent of our net sales today we are inching towards 15 percent. And it has taken us 10 years to reach that.”

Product diversification and premiumisation apart, a key behind-the-scenes growth driver for the company, according to the analyst at Motilal Oswal, has been Havells India’s relationship with its dealer network, which is “much stronger compared to other players”. And this has been a big asset for the company from the beginning, which explains Qimat Rai Gupta’s decision to organise the first dealers’ meet at a five-star hotel.

For a decade now, the company has been running a novel programme wherein a small percentage of the dealers’ profit is invested in a mutual fund every year. The dealers can redeem their money along with the interest accrued only after three years. “It’s their profit and savings, which they can use for their children’s education or to get their daughters married,” says Anil. As of today, the mutual fund investment is about Rs 200 crore in size.

Also, all its 6,500 dealers are covered under a medical insurance plan, the premium for which is paid by the company. The company also has a special scheme called Grihalakshmi to involve dealers’ spouses in various initiatives of the company.

Creating a brand image is also top priority for Havells. The company spends a considerable sum every year on advertising and marketing. In FY16, this was roughly Rs 200 crore or about 4 percent of its net sales. This is significant, considering the nature of the business, where the average industry norm is to spend not more than 1 percent of net sales on marketing.

“In the past, there have been brands that have done well, but Havells has adopted a different stance altogether,” says brand expert Harish Bijoor, who is founder, Harish Bijoor Consults Inc. For one, the company has made even electrical wires a household name with its popular advertisement of a mother and son, depicting Havells India’s wires as fire-resistant.

“Nobody thought that switchgears or wires could be advertised. Frankly, these are products which consumers do not buy [directly],” says Rajiv Goel, executive president, Havells India Limited.

Due to its heavy advertising spends, Havells has been able to stand out in completely cluttered categories like fans and consumer appliances, despite being a late entrant in all of them. “You buy Havells fans and the message is ‘Hava badlegi’, right? You buy other brands and what is the message you get? I can’t remember,” quips the company’s board member Pai. “It’s a young, yuppie, active and exciting brand that sells.”

To many an Indian consumer, the Havells brand comes across as being foreign. “Though we don’t want to play on that perception, because ‘Make in India’ is sexy these days,” says Anil.

Having grown up in a self-made, first-generation entrepreneur family, Anil got a bird’s eye view of business early in life. “I recall seeing, when I was three or four, the first switchgears being assembled in my house,” he says. The ground floor of their home was converted into an assembly shop, with around seven or eight workers. “Once you start seeing this from a very young age, you suddenly start becoming aware, if not interested, in what is happening.” His summer holidays were spent at his father’s office, a habit he carried into his college years. “I used to sit with my dad—it was not very interesting initially. But, he insisted that I don’t while away my time.”

The professional camaraderie between father and son began when Anil joined the company. “Anil was the true advisor to the founder chairman [Qimat Rai Gupta],” says Rajesh Gupta. He credits the junior Gupta for pushing the idea of diversifying into the consumer business. That said, the biggest benefit for the company has been that Qimat Rai Gupta sufficiently groomed his son over the last two decades. “Most family business leaders do not prepare the ground so well while continuing to be at the helm,” says Professor Kavil Ramachandran, executive director, Thomas Schmidheiny Centre for Family Enterprise at the Indian School of Business.

But what really sets Havells apart from other family-run enterprises in the country? Says Professor Ramachandran: “The family has been very entrepreneurial even after reaching a certain size unlike many mid-sized family businesses. They have not diversified into unrelated products.”

Anil is talking about the next phase of “fast growth” across all product categories. Given the government’s push on the real estate sector and the setting up of smart cities, Havells sees a robust pipeline ahead, be it with cables and switchgears or consumer appliances. Likewise, category expansion is also on the cards.

Havells has already taken to solar. It recently picked up a 51 percent stake in Bengaluru-based Promptec Renewable, an industry leader in LED and solar lighting. Anil says water heaters as a category could be expanded to include solar water heaters and might also include water purification. “Anything related with the consumer on the electrical side is what we will look at,” he says, but quickly clarifies, “We are not getting into electronics right now.”

While he does not wish to share internal target numbers, he says the company has the potential to grow 2-3 times its current size in five years. “All you need to double the turnover is a 15 percent [compounded annual] growth in revenues over the next five years, plus a couple of acquisitions.”