Ajanta Pharma: The small big dream

It took a second generation of Agrawals to change the future of Ajanta Pharma which, from being mired in debt, has seen a 65-fold growth in market value

To date, yesteryear bollywood superstar Jeetendra has appeared in only one television commercial to endorse a product. That was in the 1990s, for a popular over-the-counter (OTC) energiser capsule for men called ‘30-Plus’. Jeetendra was in his late 40s then, but looked much younger. Though 30-Plus sold like hot cakes, revenues from its sales didn’t justify the exorbitant marketing cost that its maker, a then little-known company called Ajanta Pharma, incurred. (It sold 30-Plus to Dabur for an undisclosed sum in 2011.)

But even before it sold its bestseller, the Mumbai-based listed company—set up in 1973 by three brothers, Mannalal, Purushottam and Madhusudan Agrawal—had been incurring huge losses for many years. In June 2000, it was trading at just Rs 24 per share on the Bombay Stock Exchange with negligible interest from investors. In 2001-2002, it reported a consolidated loss of Rs 1 crore and by the following year, it was reeling under a debt burden of Rs 130 crore. Ajanta Pharma needed a shot of its own medicine, an energiser like 30-Plus. It found its antidote in the new generation of Agrawals: Mannalal’s sons, Yogesh and Rajesh.“When I joined Ajanta (in 2000), and realised what was going on, I wanted to run away. I thought to myself, ‘Why did I return from the US? I could have had a job there,’” says Rajesh, 39, Ajanta’s joint managing director, who has a management degree from Bentley College, Massachusetts. “It was tough in the beginning, especially the situation with creditors and debtors.”

Together, Rajesh and his older brother Yogesh, 43, who is managing director, changed Ajanta’s trajectory by focusing on the ‘specialty’ generic drug market and putting an end to the company’s legacy businesses, which included OTC drug sales and supplying drugs to government health agencies in India and other countries.

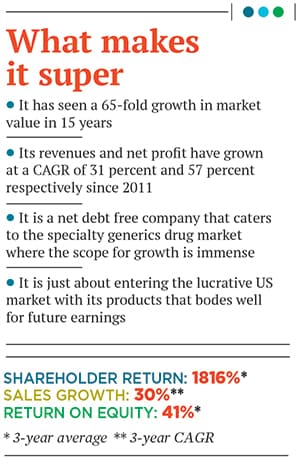

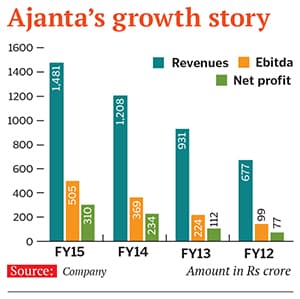

This was a risky move, but it has paid off. Ajanta Pharma closed FY15 with a consolidated net sales of Rs 1,481 crore and a net profit of Rs 310 crore (this is a compound annual growth rate, or CAGR, of 57 percent for four years since 2011). In terms of net sales, it recorded a CAGR of 31 percent for the same period. This growth has come on a low base, but the signs are encouraging. Its market value currently stands at around Rs 13,500 crore this is a 65-fold growth in 15 years.

Ajanta Pharma is a very small player in a market full of giants such as Sun Pharma, which reported a turnover of Rs 27,280 crore and net profits of Rs 4,780 crore in FY15. (These figures have been adjusted to reflect the earnings of Ranbaxy Laboratories, which Sun Pharma acquired in March 2015.) Yogesh and Rajesh knew they did not have the financial or operational muscle to compete with the ‘big boys’ in the $31 billion Indian pharmaceutical market, some of whom have single generic drug brands that are worth more than Ajanta’s entire operating profit. Instead, they focussed on launching first-of-its-kind generic drugs.

The way the brothers have channelled the company’s resources has caught the attention of analysts and investors. “The small size of the company presents an excellent opportunity for investment as they are poised for rapid growth,” says Raamdeo Agrawal, managing director and co-founder of Motilal Oswal Financial Services. His company, through investment products like mutual funds, invested in Ajanta Pharma around three years ago and, according to Agrawal, is sitting on at least a ten-fold return on investment. Motilal Oswal continues to invest in Ajanta which, as of June 30, was trading at Rs 1,554 on the Sensex.

By 2014-15, Ajanta’s return on equity stood at an impressive 43 percent, while return on capital employed was at 52 percent. It reported one of the highest earnings before interest, tax, depreciation and amortisation (EBITDA) margins among its listed peers in the pharmaceutical sector at 34 percent. The company has managed to achieve all this with a small presence in the US market, which is the golden goose. A third of its sales comes from India, and the rest from emerging countries in Asia and Africa. Its products are sold in 35 countries, including Iraq, Nigeria, Cameroon and the Philippines. The Agrawals brought about this turnaround by changing their strategy and focusing only on specialty generic drugs, identifying the right segments, products and markets, and taking a risk to borrow further so that they could invest in research and development (R&D).

“When I entered the business, we were all over the place in the domestic market. We had a generalised product portfolio and were trying to cater to the GP (general physicians) market, which was and even now is a big boys’ game [with companies like Sun Pharma and Cipla in the fray],” says Rajesh. “There is constant onslaught in terms of price competition in the daily prescription-based market. Very early on, I realised that this is not the way to make any progress. We had to differentiate ourselves and focus on specialties.” Rajesh chalked out a new business model: Ajanta would make generic drugs that were unique in their formulation and dosages, and create specialty brands (medicines that can only be prescribed by specialist doctors and not general physicians) in four areas—ophthalmology, dermatology, cardiovascular and pain management—where the competition was less intense.

It was Yogesh who convinced the company’s lenders in 2003 to open their wallets. After all, Ajanta needed funds to invest in new R&D and manufacturing facilities. Initially, bankers were apprehensive. In early 2003, Ajanta’s lenders, including officials from the State Bank of India and Exim Bank, gathered at a room in the Taj Mahal Palace in south Mumbai to hear Yogesh out. “I made a presentation for an hour-and-a-half about where we were earlier and how we planned to transition,” says Yogesh. “The investors asked us to step out so that they could discuss the plan. About 45 minutes later, they said they believed in our strategy and were willing to extend the loan facility we needed.”

With a strategy and funds in place, Ajanta has built a Rs 418 crore-business in India and is ranked 36 out of the top 300 companies in the Indian pharmaceutical market. Today, it stands net debt-free, with a cash reserve of around Rs 100 crore, according to its chief financial officer Arvind Agrawal. (Though he shares the same surname, he is not related to the founders.) Today, around 70 percent of Ajanta’s portfolio comprises products that it has made available for the first time in India, either in the way they were formulated or in terms of their delivery mechanism. Some examples of the first-to-market products that Ajanta has produced include Gatifloxacin, an eye solution that was available only as an oral dosage till Ajanta launched it in the form of eye drops and Met XL, a cardiovascular drug that was available in dosages of two to three capsules a day till Ajanta launched a version of the drug that needed to be taken only once a day.

Since 2004, it has gradually been expanding to more emerging markets in Africa and Asia (which Yogesh oversees) with products that include antibiotics and anti-malarial and orthopaedic drugs. It is the first Indian generic drug-maker to secure pre-qualification from the World Health Organization for its anti-malarial drug, which means that international agencies like Unicef can procure such drugs from Ajanta as part of their global health care initiatives. In the international markets, it has registered 1,445 brands, and is in the process of registering another 1,609.

All this wouldn’t have been possible without investing in R&D and manufacturing capacity. “After we convinced our lenders about the strategy, the next step was to build a team that was aligned to the new vision,” says Yogesh. “We knew we had the required talent in-house and decided to build the new team from our existing employee base. So some people were given leadership positions, others left the company and, yes, some were asked to go.” At present, Ajanta, which has its main R&D centre in Mumbai, employs around 5,000 people in India and abroad.

Its workforce has evolved to keep up with the times. Before it changed its business model, Ajanta had some 600 medical representatives in its domestic pharmaceutical business team. The Agrawals transformed the unit into a specialty marketing division that would only visit specialist doctors and educate them on the benefits of Ajanta’s first-to-market drugs. Today, it has around 3,000 medical representatives in India, each doing an average business of Rs 15-20 lakh per year.

The company also took a conscious decision to build its own marketing team in countries where it had a presence, and not rely on third-party distributors to promote its products. As a result, it has a field force of 572 people across 35 countries. “Many pharmaceutical companies have tie-ups with distributors who take care of product marketing. But they charge their own margins and deal with multiple products. In contrast, my medical representatives are single-mindedly responsible for ensuring my product moves,” says Arvind.

In terms of manufacturing capacity, Ajanta has four plants, three in Aurangabad (Maharashtra) and one in Mauritius. One of the three Aurangabad units is approved by the United States Food and Drug Administration (USFDA) and The UK Medicines & Healthcare Products Regulatory Agency. (This means that drugs produced from this unit can be exported to the UK and US.) It has recently commissioned a facility in Dahej, Gujarat. According to Arvind, this unit will start commercial operations by FY17. Another plant in Savli, Gujarat, is also in the pipeline. To date, Ajanta has invested around Rs 300 crore towards capital expenditure and R&D, and plans to invest another Rs 400 crore over the next two to three years which, according to Yogesh, should be enough to take care of its aspirations in the US and emerging markets.

Promoters and analysts tracking the company agree that the next big thing for Ajanta will be scaling up its presence in North America. The drug maker has filed 25 Abbreviated New Drug Applications (ANDAs), which is an application to the USFDA, requesting approvals to market new formulations of existing drugs. The expected market size that it will cater to based on the applications already filed is $1.5 billion. Its latest investor presentation states that it intends to file at least six ANDAs per year. According to Yogesh, Ajanta will eventually aim for a 20-25 percent share of this market. A March 2015 report by Anand Rathi Research states that Ajanta’s US business could grow exponentially to be worth $8 million (around Rs 50 crore) by FY17.So far, the company has secured approvals for two drugs, including Risperidone (for schizophrenia and bipolar disorder), which it started selling in the US last year. Its second product, another anti-psychotic drug, will be sold in the US later this year. Apart from mental health disorders and diseases, the new segments that it will cater to in the US include ophthalmology, dermatology and oncology. “The US is the biggest market for generic drugs. Any ambitious pharmaceutical company cannot ignore it, and we are an ambitious company,” says Yogesh. “Over the last 12 years, we have developed strong competency in R&D and want to cater to the US market with complex, difficult-to-make products.” The Agrawals want to replicate their India strategy in the US. They will make products utilising complex technologies like extended release (a mechanism used in pills or capsules to dissolve a drug over time in order to be released slower and steadier into the bloodstream) and delayed release drugs.

But with the prospects of strong growth come certain challenges, the most important being consistently meeting USFDA standards. The brothers will try and avoid the pitfalls that have caught bigger players like Wockhardt and Ranbaxy Laboratories that have in the past faced regulatory heat from the FDA and restrictions on the entry of drugs. “We know that data integrity is an important issue for the US pharmaceutical market, which is uncompromising and unforgiving if lapses are found,” Yogesh says. “We have installed a Laboratory Information Management System at our units so that all the data is processed by a software, thereby eradicating the scope for [human] error and manipulation.”

Ajanta cannot afford to make even the slightest slip, given that it is a late entrant in the US market. “My message to workers at our units has always been that we should make quality products that are fit for our parents and children to consume,” says Yogesh. “Nevertheless, if any company gets a warning letter from the USFDA, we look at it seriously and map it with our own facilities to check for any gaps and take corrective action.”

Another challenge lies in the nature of the drugs it is manufacturing. Around 12 percent of Ajanta’s portfolio comprises cardiovascular drugs, which come under the National List of Essential Medicines (NLEM) of India, and their prices are regulated by the government. The possibility of more of its products coming under NLEM, especially as and when Ajanta expands its cardiovascular portfolio, remains a red herring for its India business.

That said, analysts believe in the Ajanta growth story. A May 11 research report by ICICI Direct reads: “With focus on niche therapies in domestic formulations and a calculated approach in the exports market, Ajanta remains an interesting candidate from the midcap pharmaceutical space with high growth rates, strong margins, commendable return ratios and lighter balance sheet.” The report highlights Ajanta’s differentiated strategy of beginning its international expansion by targeting semi-regulated, emerging markets with its generic products to begin with, “defying the normal trend of targeting developed markets... initially”. ICICI Direct projects Ajanta’s revenues to grow at a CAGR of 19 percent between FY15 and FY17 and to touch Rs 2,072 crore. Exports are expected to grow at an annual growth rate of 17.3 percent in the same period to Rs 1,309 crore, around 63 percent of the estimated turnover. In a conference call with analysts, Ajanta’s management has indicated that its EBITDA margin should sustain at 32-34 percent in FY16 with a 16-18 percent revenue growth.

It is little wonder, then, that Ajanta Pharma finds itself in that phase of its lifecycle where it is a ripe target for a takeover.

When asked if the promoters would consider selling out, Yogesh and Rajesh laugh the suggestion off. “People are especially interested in our domestic business, which is profitable and has a unique product portfolio,” says Yogesh. “But we are definitely not looking to sell out. It’s too early to retire.”

First Published: Jul 17, 2015, 07:11

Subscribe Now