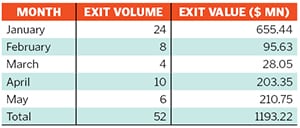

PE exits through public markets hit $1.2 billion in 2015

Of the 52 full and partial exits so far this year, KKR's sale of 1.31 percent in Bharti Infratel, for $142.3 million, was the biggest

Private equity investors in India have made exits worth $1.2 billion (around Rs 7,636 crore) through the bourses in the year till date, in a sign that the public markets have opened up and investors are beginning to cash out on their investments. There were 52 full and partial exits in all, with the top seven mopping up nearly $666 million, according to VCCEdge’s estimates.

While a majority of them were part exits, a few full exits included the likes of Tiger Global, an international investment firm, monetising its stake in Just Dial and India Value Fund exiting from Mahindra CIE Automotive through the open market. Both investors made handsome returns on these exits, with Tiger Global raking in gross returns of over 18 times its capital invested.

Experts say exits through public markets must be seen in the context of the time period of an investment by a private equity investor as well as opportunities that companies are beginning to see in the market for further fund raising. In the current year, there have been 20 initial public offerings (IPOs) in India so far.“Some of these companies raised funds a long time ago and PE money needs an exit. PE investors have a finite time to stay invested, it’s not a function of the stock market peaking. None of this is an immediate gratification situation,” says Sanjeev Krishnan, transaction services and private equity leader, PwC India.

PE firms typically stay invested for four to six years but they tend to be flexible with this time horizon if market conditions are adverse or if they cannot find a buyer for their stake or if a public offer is in the offing.

Krishnan says the IPO pipeline is bullish this year with several interesting consumer-focused firms working on their issue plans.The biggest exit so far this year has been KKR & Co’s sale of 1.31 percent stake in Bharti Infratel for $142.3 million.

First Published: May 25, 2015, 14:57

Subscribe Now