PE deals fall by 46% in H1 2016; angels drive deal momentum

Energy sector was the worst hit with not a single deal in the first half of 2016

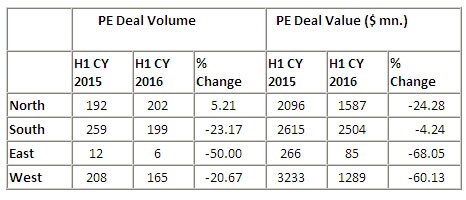

Private equity (PE) deals fell by 46 percent in the first half of this year on the back of a steep fall in deal values and a weak exit market. Only 643 PE deals worth $5.8 billion were recorded in the first six months of this year the worst hit is the energy sector that saw no deal in the period under consideration, according to News Corp VCCEdge, the financial research platform of News Corp VCCircle.

On a quarterly basis, deal value is down by 62 percent from $6.1 billion to $2.2 billion between Q2 CY15 and Q2 CY16 the lowest investment received in the second quarter since 2013.

In the last six months, the deal volume fell by 13 percent compared to 737 deals in the corresponding period last year. The energy sector saw four deals worth over $0.5 billion in the first half of last year, which came down to zero this year. In Information Technology, while the number of deals actually increased, the total value slipped slightly compared to a year ago period. Health care saw a 14 percent drop in the number of deals.

The year, however, saw a stark increase in angel investments, though institutional funding across venture and late stage slowed down considerably. Angel and seed investments grew by 16 percent to 368 deals in the January-June period this year from 317 deals a year ago, while deal value slipped by 25 percent to $100 million from $134 million, suggesting a drop in average ticket-size. Median deal value too was down to $1 million from $1.58 million during the same period.Venture and late stage capital declined significantly, down by 64 percent and 55 percent, respectively, between H1 CY2015 and H1 CY2016. In terms of deal volume, the dip across the two stages was recorded at 33 percent and 42 percent, respectively.

PE exits continued to be difficult and were down to a five-year low on a sequential basis. PE investors unlocked $1.4 billion worth of investments across 97 exits this year. Deal volume dipped by 37 percent and deal value dropped by 63 percent compared to the same period last year.

M&A was the preferred mode of exit in the first six months of 2016 with 45 deals, followed by 28 open market deals. The first-half of the year saw 479 M&A deals being struck, worth $14.5 billion. Compared to a year ago period, deal value is up by 76 percent while deal volume remains unchanged. Domestic M&A deals saw an uptick in deal value and volume, growing at 86 percent and 10 percent, respectively. Inbound deals declined by 17 percent and outbound ones slipped by 3 percent. In terms of deal value, inbound deals dropped by 14 percent.

Karnataka, with 144 deals worth $2318.76 million, was the most attractive state for investors followed by Maharashtra with 141 deals worth $1141.91 million.

First Published: Jul 04, 2016, 17:51

Subscribe Now