Look for opportunities instead of focusing on the negatives: RBI governor

Das highlighted that monitoring NBFCs is on to prevent any collapse, gross NPAs position of banks is improving

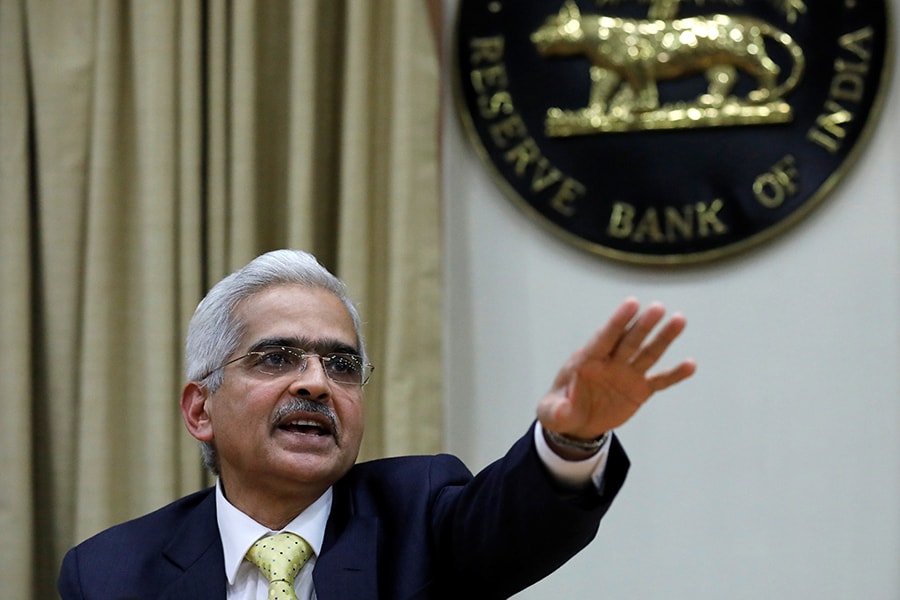

Image: Danish Siddiqui/Reuters[br]The Reserve Bank of India (RBI) governor Shaktikanta Das on Monday attempted to ease corporate India’s concerns and investors’ mood of gloom and doom, stating that there were “opportunities” that lie ahead and are not being capitalised upon at the moment.

Image: Danish Siddiqui/Reuters[br]The Reserve Bank of India (RBI) governor Shaktikanta Das on Monday attempted to ease corporate India’s concerns and investors’ mood of gloom and doom, stating that there were “opportunities” that lie ahead and are not being capitalised upon at the moment.

“When I read the papers and watch the television channels, the mood does not appear to be sufficiently positive and optimistic. I understand that there are global challenges and difficulties coming from external and domestic sources,” he said. “But I think one has to look at the opportunities, one has to maintain a positive sentiment…because the mood of doom and gloom is not going to help anyone. Its neither going to help the banks, nor the business, nor the real economy,” Das told a gathering of bankers and financial heads at an annual banking summit in the city.

India is witnessing its slowest growth in the past five years—with GDP growth of 5.8 percent in the fourth quarter of FY19, from 6.6 percent in the previous quarter. The RBI has—in a move to spur demand—cut interest rates by lowering the repo rate by 110 basis points in four successive monetary policy meetings.

But economists say that the RBI’s move is unlikely to revive growth, as there are deeper concerns surrounding investment, manufacturing and consumer spending.

India’s stock markets, hurt by fears of slowing growth and weak corporate earnings, have seen the markets slide 7 percent from their early June levels, when the benchmark 30-share Sensex crossed the 40,000 points level.

Foreign portfolio investors were net sellers in July for Rs 12,419 crore in equities—their highest level since October 2018—according to data from the National Securities Depository Ltd (NSDL).

In this scenario, Das is urging banks not to be influenced by the negative sentiment and start to look at opportunities surrounding lending.

He also urged public sector banks (PSBs) to be a little proactive in raising capital at this stage. “The real test of performance, efficiency, internal stability and governance improvement in PSBs would be their ability to access capital markets rather than looking at the government as a recapitaliser of first and last resort,” Das said.

Das spoke extensively on the steps taken in recent months to improve financial stability in the banking system in India. “The macro tests for credit risk done by the RBI indicate that gross non-performing asset levels will decline by March 2020,” Das said. The RBI is also keeping a close watch on the interconnectedness of banks and non-banks through the working group on Core Investment Companies (CICs).

He highlighted the point that they were carefully monitoring the performance of non-banking financial companies (NBFCs). In May this year, NBFCs with asset size of Rs 5,000 crore have been mandated by the RBI to appoint fully independent chief risk officers to create a resilient financial system.

“We will aim to ensure that there is no collapse of a large or systematically important NBFC,” Das told the banking gathering.

The liquidity crisis that had affected NBFCs since the IL&FS crisis is yet to improve particularly segments such as housing finance companies continue to face headwinds.

Last week, India’s Finance Minister Nirmala Sitharaman met the heads of public and private sector banks, representatives of the automobile, small and medium enterprises and real-estate sectors, to find solutions to their challenges. But there is still no clarity whether the government will announce a stimulus packages for certain sectors or tax rebates in some cases.

First Published: Aug 19, 2019, 15:38

Subscribe Now