India's tax, regulatory environment challenging: Foreign investors in PwC survey

Cost of trading in Indian markets still high

Over 200 foreign portfolio investors (FPIs), who have exposure to India’s financial markets, say that the cost of trading is high compared to other emerging markets, in a latest PwC India report. A significant majority of the FPIs also view India’s current regulatory and tax environment still challenging, compared to other markets, according to the report titled, ‘Foreign Portfolio Investor Survey 2016-17 – India Moving in the right direction’.

These findings came from a PwC report, after they interviewed 203 FPIs from across the United States, UK and Asia Pacific regions in the April to June 2016 quarter. India, in a still uncertain global economic environment, remains one of the more attractive destinations for investments, due to its favourable trade and settlement cycles, moderate tax rates and adequate investment limits.

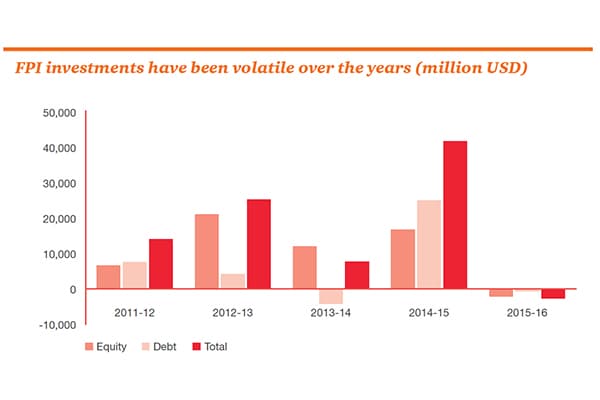

In 2015, FPIs invested a net Rs 63,663 crore through equity and debt. In 2016, between January and August, FPI investments stood at a net Rs 31, 885 crore. The benchmark 30 share Sensex index closed at 28,005.37 points, now edging close to a 52-week high.

Nearly a third (27 percent) of the FPIs surveyed by PwC also indicated a preference of tapping the Indian markets through P-notes (participatory notes). The majority (73 percent) still prefer to invest directly in the Indian markets.

India’s market regulator, the Securities and Exchange Board of India (Sebi) has in recent years tried to clamp down on indirect “India access products” like P-notes and offshore derivative instruments.

Image source: PwC

P-notes is a route used by foreign investors to tap the Indian markets without the burden of complying with mandatory tax and regulatory rules. In recent years, investments through P-notes as a percentage of FPI inflows, has declined from 55.7 percent in June 2007 to 8.8 percent in June 2016, the report shows.

A significant minority (45 percent) of those surveyed also said that the cost of trading is still high. Investments into India’s markets attract a range of costs, including securities transaction tax, fees and statutory compliances.

“A lot more can be done to bring down the cost of trading. Interoperability between clearing corporations (CCs), allowing offset of positions across exchanges and taxing dollar gains as against rupee gains are some of the potential solutions,” Suresh Swamy, partner, PwC said in the report.

On the overall regulatory and tax environment, 77 percent and 81 percent of the respondents respectively, found them to be challenging.

Around 64 percent of the respondents said they were worried about the introduction of anti-tax evasion GAAR regulations, which had dampened investor sentiment between 2011 and 2013. At a granular level, tax managers (78 percent) were more concerned about GAAR than portfolio managers (42 percent).

First Published: Aug 17, 2016, 18:04

Subscribe Now