GST: Measures you can take in the next 10 days

Now that GST is at our doorstep, it is time to ensure that we are aware of its repercussions and be prepared before it is implemented

Image: Amit Dave / Reuters

The uncertainty over July 1 will now be quelled – it is now absolutely clear that GST will be rolled out on 1 July 2017.

Returns deferred

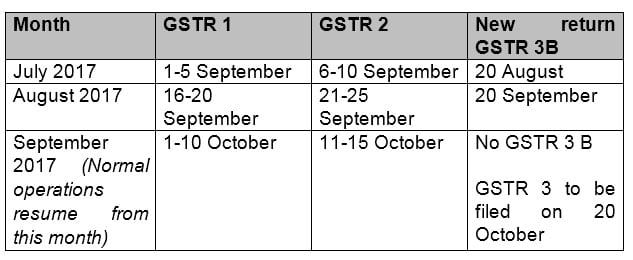

The biggest worry dogging us all was that the IT systems of trade and industry were not ready for the implementation of GST, due to the frequent tinkering of rules. But the GST Council has come out with a solution by deferring the returns. This means that two of the major statements/returns called GSTR-1 and GSTR-2 for July and August will now be deferred. This will now give companies one more month to get the requisite IT systems in place for uploading invoice level data and matching the data with vendors’ data.

This begs another question. How will tax be computed in the meanwhile? The Council has put into use a simple return form called GSTR 3B, as this can provide a summary of outward supplies (or crudely put, sales) and inward supplies (Purchases) for the purpose of working out the tax liability as is done in current times. This means that the cross matching with vendors’ details will not happen till September.

The revised dates are as follows:

Besides the above, a few more changes were announced by the Council:

For one, the composition limit for Northeastern states has been changed. Also, the E-Way bills implementation has been left to the states, thereby allowing them to continue with existing rules as required

Thirdly, changes in rates were announced on lotteries and hotel stay and anti-profiteering and other rules were cleared.

While these changes are already flashing in the media and social media alike, let us now see what it really means for the industry:

1. Those who are on course for implementing GST will now have to continue with the preparations, perhaps stepping on the pedal a little harder. Those who are still contemplating on the preparations for GST and had delayed these preparations expecting a last-minute deferment by the end of June, will have only 12 days left for the preparation.

2. The to-do list could be as below (You may ignore the steps if you’ve already completed them).

a. Know the tax rates for your products and services: The rate schedule is already available. This may be a little complex in some cases though. For example, depending on tax positions, activities like warrantee services (whether these should be treated as services/ goods/ or both) or job work with use of material, etc, the rates could differ.

b. List all activities: All activities that are performed by the organisation (we call it a transaction matrix) must be listed. This should include all types of procurements, supplies, transactions with employees, transactions flowing out of various contracts, etc.

c. Prioritise activities: One must prioritise or conduct an ABC analysis to understand which of these activities are important and will have a larger implication for your organisation. For example, issue on whether GST should be paid on reimbursement to an interview candidate is insignificant or determining the place of supply for a Rs 100 crore contract.

d. Identify the tax position you would take: Determine the place of supply and which tax (CGST/ SGST/ IGST) would be levied.

e. Restructure some of the transactions: It is necessary to restructure some transactions to make them GST compatible. It is, however, not necessary that what we do today should be replicated in the GST days, GST can be used to refine the processes. Let us see some examples:

 Quite often, the HQ will place an order on a vendor for supply to the branch office/depot in another state. Under GST, this may be treated as a ‘bill-to ship-to’ transaction which will have its own complexities. The question here is can the transaction be restructured in a way that the PO (Purchase Order) mentions that payment will be made by the branch/depot to whom the supply has been made. Further the invoice would also be raised on the same branch/depot. Here one of course has to look at practicalities.

 Sometimes it may make sense to pay tax at a higher rate to avoid disputes in the future, especially when most of the taxes would be available to the recipient as credit. For example, where two products A & B are sold together, tax may be paid basis the product attracting a higher rate of tax, treating it as a mixed supply instead of evaluating if the same would be a composite supply.

f. The supplier may often find himself in a situation where his/her own state would question the place of supply especially when the tax is IGST. This is because, his/her state would lose the revenue to the other state. It may be necessary to evaluate all IGST situations carefully and build a strong documentary trail, so as to reply to inquiries and notices in the future. A stitch in time will save nine in the future.

g. Get your ERP ready: To be able to issue various documents like invoices, payment vouchers, delivery challans and so on, ensure all fields required for filing returns are generated from your ERP.

h. Decide on the ASP and GSP solution: If not yet decided, getting the ASP solution to work with your ERP may take two to four weeks or even more. Though there is a little breather here due to the deferment of returns as explained above, it is better to get the ASP running so that the details can be captured as transactions happen. Also GSTN will allow the upload of outward transactions from 15 July.

i. Go through the anti-profiteering provisions which will be released soon and decide on the pricing that adheres to the legal provisions.

j. Act on changed regulations of other allied departments such as customs, DGFT, etc. For example, customs recently notified that declaration of GSTIN in customs documents is mandatory from July 1. DGFT too have announced that PAN will be now be used in place of IEC with the implementation of GST.

k. Any other activity you think is important.

3. It is extremely essential to keep communicating to all the stakeholders at all times: Be it oral communication (one-on-one like a telephone call or one-to-many like trainings, webex meetings) or written communication (emails/ circulars/ screen saver messages within the organisation). Stakeholders could be top management, departments other than finance, suppliers and customers, consumers at large (especially in consumer product or services companies), government agencies, peers in the industry, etc. Repeated and crisp communication is the key if the changes in GST need to be implemented properly. Preparing a list of ‘dos and dont’s‘ could be one way of making the communication crisp and practical.

Lastly, GST is a big change and it is at our doorstep. One should meet this change with a big smile - a thorough preparation in the next 10 days can add certainty to that smile.

– By Dr. Waman Parkhi, Partner, Indirect Tax, KPMG in India

The views and opinions expressed herein are those of the author and do not reflect the views and opinions of KPMG in India.

First Published: Jun 21, 2017, 07:50

Subscribe Now