Farmers first for Tafe

Mallika Srinivasan, by betting on farm mechanisation, is linking tractor maker Tafe's future to farmer prosperity and India's food security

The year was 1986. A proud Mallika Srinivasan had just returned to India with a business management degree from The Wharton School to join her family’s Amalgamations Group. The enthusiastic 26-year-old was asked by her father A Sivasailam, then chairman of the group, to join the flagship Tractors and Farm Equipment Ltd (Tafe), which was engaged in manufacturing tractors. (The family, ranked 37th on the 2015 Forbes India Rich List, has 47 companies and 50 manufacturing plants, making Amalgamations Group one of India’s largest light-engineering conglomerates with a presence in manufacturing, agriculture, trading and services.)

She was unprepared for what she was getting into: A fluid job description—she was asked to carve out a role for herself by working with stalwarts—and a salary far lower than what her classmates from Wharton were getting. Rankled, she took these issues up with her father. However, all he said was: “Sit down, young lady, you might be a Wharton graduate, but I do not need one to run my business.”

Sivasailam had no intention of undermining her prestigious Wharton qualification. Instead, he was trying to get his daughter to understand the values on which the group was built—ethical business practices, nurturing partnerships, respect for stakeholders and the need for a larger purpose.

He need not have been overly concerned. Srinivasan is proving to be her father’s daughter, not just in terms of business acumen but also as far as social responsibility is concerned. After all, Srinivasan had grown up with a ringside view to her father’s passion for a larger purpose—both in life and in business. And he had set quite the standard.

In 1960, when his father S Anantharamakrishnan, founder of the group, set up Tafe, Sivasailam had bought a 200-acre farm at Kelambakkam on the southern outskirts of Chennai. Reason: He was appalled by the poor farming practices which were leading to low yields and inadequate income, sending the average farmer into a debt spiral. Sivasailam, then 30, wanted to bring about a change. “He wanted to make farming, especially for small farmers, profitable as he realised it was the only way to improve their livelihood and help India become self-sufficient in foodgrains,” Srinivasan, who went on to become the chairman and CEO of Tafe in 2011, told Forbes India during an interview at her office in Chennai.

Hundreds of farmers visit J Farm every month to learn modern agricultural practices and benefit from the knowledge assimilated over 50-plus years. “It is a big testing ground for our products. We capture the voice of the farmers, engage with them to understand their needs and work with them to solve their problems by offering the right products,” says Mallika Srinivasan. “No other tractor manufacturer in the world has a farm of this nature.”

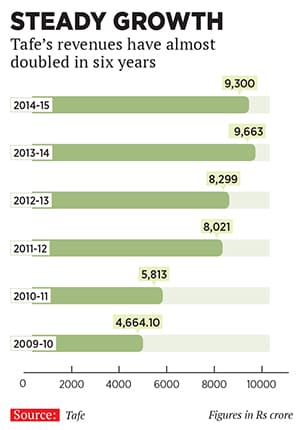

It is now almost 30 years since she returned from Wharton. Tafe’s revenues have since grown from Rs 85 crore in 1985 to Rs 9,300 crore in 2014-15. Today, this closely-held unlisted company is the second-largest tractor maker in the country, selling 1.5 lakh units (including exports of 15,583 units to 75 countries) with a market share of 24 percent. Mahindra & Mahindra is the market leader with a 42 percent share. Tafe is also the third-largest tractor maker in the world in volume terms after Mahindra & Mahindra and John Deere.

Tafe has three brands: Massey Ferguson, Eicher (acquired from Eicher Motors in 2005 and positioned as a value-for-money brand) and the eponymous Tafe, which is used only for exports. The company’s manufacturing facilities span across India—Chennai and Madurai (Tamil Nadu), Bengaluru (Karnataka), Bhopal (Madhya Pradesh), Alwar (Rajasthan) for engines and Parwanoo (Himachal Pradesh) for gear and transmission. Overseas, Tafe has a tractor assembly unit in Turkey and a component aggregating unit in China.

A higher purpose

Tafe has made considerable progress under Mallika Srinivasan’s leadership and her father, who passed away in January 2011 at the age of 77, would have been impressed. Having established Tafe’s strength, she, like her father, has found her own larger purpose. Mallika Srinivasan wants to contribute to the long overdue farm mechanisation in India. Her vision is that revenues from farm equipment should equal those of tractors in 10 years (an ambitious plan, since currently, the share of farm equipment in Tafe’s revenue is negligible).

“The world population is set to increase from the current 7 billion to 9 billion by 2050, and foodgrain requirement will jump from 3 billion tonnes to 4.5 billion tonnes. This addition has to come from either increasing the land under cultivation or raising the productivity of the land that is already under farming,” she says. “Considering that there are very few places in the world where fresh land is available for cultivation, increasing yield is paramount and for that, farm mechanisation is critical.” This is particularly relevant in India where land availability is low (given that agricultural land is being converted for industrial and other uses) and foodgrain production needs to increase from the current 247 million tonnes to 494 million tonnes by 2050 if India has to ensure its food security. Yields for almost all crops grown in India are far lower than those in other countries and also below the global average.

The Applications Business Unit was set up within Tafe in 2014 with the intention of helping the farming community improve productivity through mechanisation. “In the next three to five years, we want to provide the full range of farm equipment across various crops and the entire farming value chain. The equipment will meet the farmer’s needs with relevant technology and an ideal cost-benefit ratio,” says Mallika Srinivasan.

Currently, Tafe has products for land/seed preparation (across crops like rice, wheat, sugarcane, soya, maize, cotton and vegetables) and for harvesting (rice, wheat, maize and some horticultural crops). There is a product gap for farming activities such as planting, de-weeding and fertiliser application. “It is this gap that the Applications Business Unit will plug,” says TR Kesavan, chief operating officer, product strategy & corporate relations. R&D investment for the farm equipment segment has been significantly ramped up, Mallika Srinivasan says, without revealing the absolute value of the investment or the percentage increase.

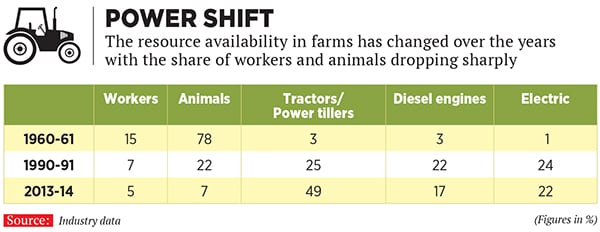

But while India’s farm equipment sector poses a huge challenge, there is also massive growth potential, which is why companies like Tafe, Mahindra & Mahindra, Murugappa Group and John Deere are making their moves. The opportunity is, simply, in the current low levels of adoption in Indian farms. According to a paper presented last year by Kanchan K Singh, assistant director-general (engineering), Indian Council of Agricultural Research, at the 2nd Regional Forum on Sustainable Agricultural Mechanisation in Indonesia, the level of mechanisation varies across farming activity. It is 40 percent for tilling/seed bed preparation, 29 percent for sowing, 34 percent for fertiliser application, 37 percent for irrigation and less than five percent for harvesting (though it goes up to 60 percent for wheat and rice).Surendra Singh, advisor to the Agricultural Machinery Manufacturers Association, puts the size of the farm equipment sector at Rs 12,000 crore. It is dominated by 1,500 tiny units, 2,500 small-scale units and 250 medium-sized companies. Only in the last few years have big players such as Mahindra & Mahindra, Tafe and Murugappa Group ventured into this space. “In India, farm mechanisation meant a tractor and a plough. All other aspects were ignored. That is beginning to change slowly,” says P Soman, chief agronomist, Jain Irrigation Systems Ltd.

What is driving the transformation is the situation on the ground. “Till a decade ago, labour availability was high. Because of rapid urbanisation and with youngsters choosing to escape the drudgery and unviable nature of farming, shortage of labour has risen sharply. This has substantially pushed up labour costs as well,” says Vijayakumar Browning, chief–corporate relations, Tafe. “Farming is a time-bound activity. For instance, planting starts with the rains. Similarly, harvesting takes place after a fixed period of time. It leads to chaos when all the farmers in an area look for labour at the same time. Their unavailability leads to lower yield,” says J Farm’s K Srinivasan.

This apart, the need for certified seeds, higher usage of chemical fertilisers and pesticides, and rising labour costs have increased a farmer’s cost of cultivation while the price he gets for his produce has not kept pace. Mechanisation will help him control this imbalance. And the cost savings, according to Singh’s paper, are significant. He estimates savings in seeds to be about 20 percent, fertiliser (20 percent), time (30 percent) and labour (30 percent). Mechanisation, he says, will increase crop intensity by 5-20 percent, thereby resulting in a 15 percent increase in yield.

Unique India

While these factors underscore the broader opportunity, the push towards mechanisation cannot ignore the uniqueness of India’s farm sector. Here, Mallika Srinivasan feels companies like hers have an inherent home advantage. “The Indian farm holding is fragmented and small. It is not possible to bring equipment from elsewhere in the world and use them here. There is a clear need to invest in R&D and innovation to develop relevant products,” she says. Indian companies are better positioned to leverage this demand, so global players such as John Deere have, for now, restricted themselves to the top end of the farm equipment spectrum with products such as harvesters.

The challenges of small land holdings are significant. Their size has meant that farmers do not see any merit in owning farm equipment. They can neither afford them nor use them effectively. This, experts say, is the main reason for farm mechanisation not taking off in India. Tafe has been working with various governments to devise an innovative solution to this problem. One such innovation is the ‘pay per use’ concept. The farmer does not have to buy farm equipment but can rent them. The Karnataka government has employed measures that seem to be seeing early success. The state, in 2014, issued an e-tender asking for applications from NGOs and trusts to set custom hiring centres for farm equipment across 30 districts. It offered subsidies to the applicants to buy the equipment. A District Steering Committee was established to ensure that the machinery purchased was in line with the need of the farmers. The committee also fixed the rate at which the equipment would be rented.

“Farmers are happy as they do not have to wait for labourers to work in their fields. They are seeing an increase in productivity,” says Ganesha Kudva, director (Custom Hiring and Service Centre), Sri Kshetra Dharmasthala Rural Development Project, which operates 164 centres across 25 districts of Karnataka. Profitability of these centres is critical for mechanisation to take off. “For most farm equipment, the payback is around two years,” says Tafe’s Browning.

The other big challenge is the diversity in the agro-climatic and soil conditions. Each soil type needs different performance from the equipment—this entails a fair amount of fine-tuning. Tafe faced this dilemma when it began selling tractors. “We manufacture and sell 180 variants of tractors between 35 to 50 horsepower,” says Kesavan.

Also, to be closer to the farmers and tackle diverse agro-climatic conditions, Mallika Srinivasan is expanding the J Farm to many states across India.

She has also ensured that Tafe works closely with the central government to ensure a favourable policy that will accelerate the adoption of farm mechanisation. The government, in the 1990s, took the first big step when it reversed its earlier stand of reserving farm equipment for the small-scale sector and opened it up for all. “This was a big step as it enabled players like us to foray into the segment and bring in top-of-the-line technology,” says Kesavan.

Tafe’s focus now is propagating the custom hiring centres model and devising a better working subsidy scheme. Reams of paper work, delays and the presence of middlemen are proving disruptive, and the industry is pushing for subsidy transfers through the direct benefits transfer scheme.Another view gaining ground among the farmers is to scrap the subsidy altogether and, instead, support farm equipment purchase through an interest subvention scheme (where the government pays a part of the interest—on the loan taken by the farmer to purchase the equipment—directly to the banks). “The government has been very proactive and some of the recent measures give us confidence that ideal conditions for the adoption of farm mechanisation are being created,” says Kesavan.

Still, is Mallika Srinivasan biting off a lot more than she can chew? In 10 years, Tafe’s tractor revenues will rise to Rs 18,000 crore (assuming the 7 percent compounded annual growth rate projected by the Draft Automotive Mission Plan for the tractor sector between now and 2026). That could mean a massive leap for its farm equipment revenues from its current miniscule levels. “Adoption of tractors was slow initially but in the mid-1990s, backed by very supportive government policies, its demand took off sharply. The same thing will happen in the farm equipment space as well,” says Kesavan.

Today, India has 20 tractors per 1,000 hectares, which is higher than China (15) but far lower than Western Europe which has 101. Surendra Singh expects the industry to grow exponentially in the next 10 years as demand is very strong. “The key is how we build products and systems to service this demand,” he adds.

Even as she focuses on farm equipment, Srinivasan has not lost sight of her tractor business. Her mandate to her top management is: Double exports to 30,000 units in three years and increase Tafe’s market share to 35 percent in five years. “If you look back over five decades, only now have all the elements of policy related to farming started converging, like how all pieces in a kaleidoscope fall together to form a perfect mosaic,” she says. Should her plans work, the penetration of farm mechanisation will nearly double in the next 10 years. In other words, if she succeeds, so will India.

First Published: Nov 24, 2015, 07:34

Subscribe Now