Rural artisans stand to benefit from Fabindia's aggressive growth plan

Synonymous with ethnic wear in the country, Fabindia has found the formula that balances social impact with scale

William Nanda Bissell, MD, Fabindia, is keen on going aggressive on omni-channel retail and plans to expand its international operations

William Nanda Bissell, MD, Fabindia, is keen on going aggressive on omni-channel retail and plans to expand its international operations

Image: Amit Verma

On March 1, 2017, Fabindia will start a new chapter in its already significant retail story: A different store format in South Delhi, spread across 10,000 sq ft as opposed to its average 2,500 sq ft.

William Nanda Bissell, managing director, Fabindia Overseas Pvt Ltd, doesn’t even call it a store. “This will be our first retail experience centre,” he says. “It will have lots of things for every member of the family.” A wellness centre, cafe, alteration unit, and a kids’ zone will be part of this experience centre. And if this proves to be a success, Bissell has plans to roll out 40 such experience centres across the country in 18 months. “We are now looking at a new face of retail where we are transitioning from retail as being a product transaction to retail as an experience.”

Over the last decade-and-a-half, Bissell—and Fabindia—has built the right foundation to make such transformatory moves.

Take just the last financial year.

Seated in his corner office, in Okhla Industrial Area, Phase-2, New Delhi, 50-year-old Bissell looks back at FY16—when the company undertook its largest retail store rollout in the country—with satisfaction. “The store rollout was 29. This year [FY17] we have projected for 32 new stores,” he says and then arches his eyebrows to add, “In the next financial year [FY18], we are planning on opening between 60 and 80 stores.” If all goes according to plan, FY18 could well be a watershed year in the company’s 67-year-old history.

A large part of the rollout will be through the franchise model that Fabindia has only started to embrace in the last two years. Another shift in strategy is the scorching pace of growth in itself. Consider that Fabindia took 40 years to establish 232 retail stores across 88 cities in India and make its presence felt in Singapore, Dubai, Italy, Nepal, Malaysia, Mauritius and Dallas, US.

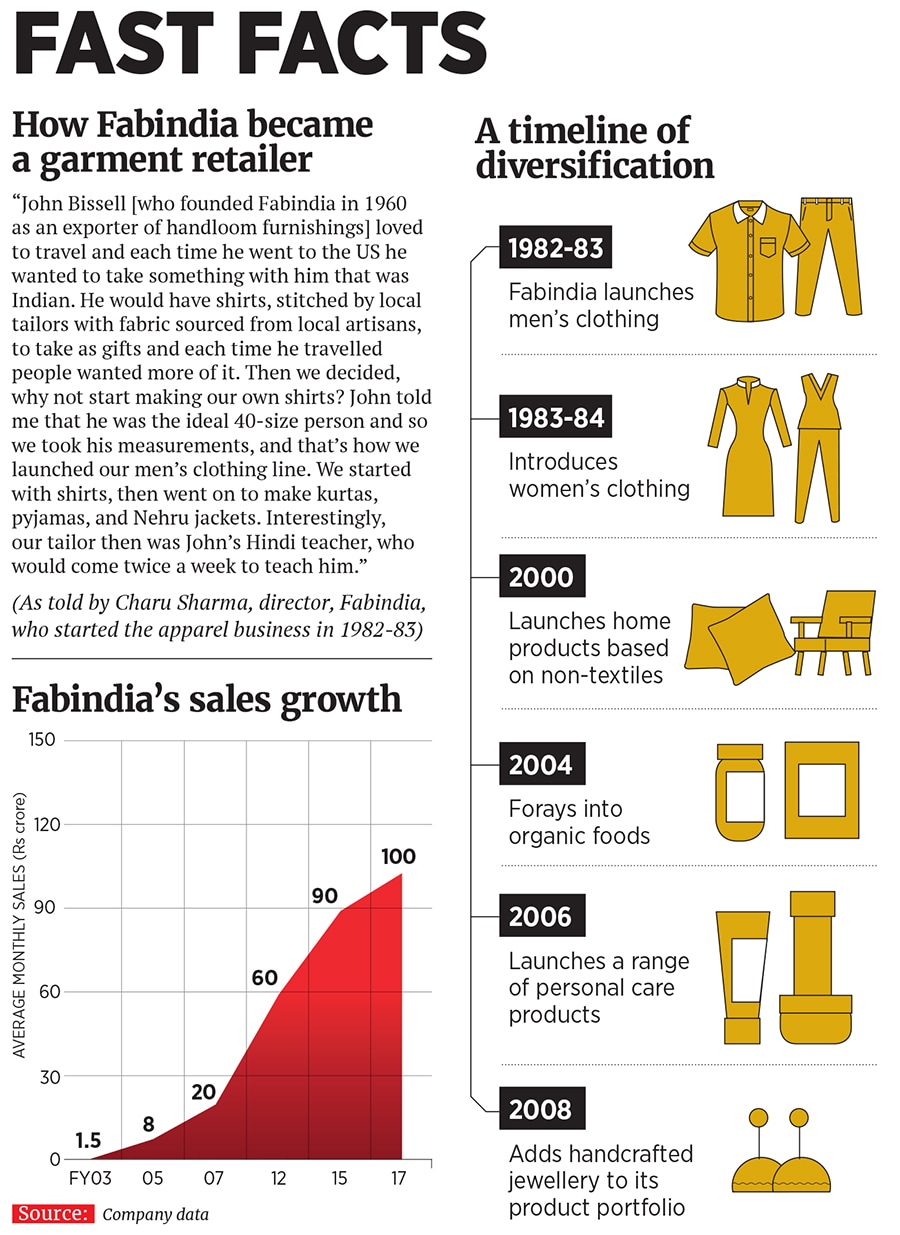

But the new approach and expansion plans are in line with the company’s bold Vision Plan 5, which came into effect from April 1, 2015. According to this, says Bissell, Fabindia will grow its revenues from Rs 90 crore a month to Rs 250 crore a month over a period of four to five years—a 178 percent revenue growth. “We will exit this year (FY16-17) with a revenue run rate of Rs 100 crore a month,” says Bissell.

For FY16, he says Fabindia reported consolidated revenues of Rs 1,150 crore, which includes the revenue of Organic India, a company in which Fabindia holds a majority stake. Since it’s a privately held entity, Bissell did not divulge the company’s profit numbers. However, according to Fabindia’s annual report on corporate social responsibility activities for FY16, its average net profit before tax for the last three financial years was Rs 92.98 crore.

That is a fair indicator of the financial strength of the Indian retailer, which links 55,000 rural artisans to modern retail stores through its signature hand-printed and hand-woven fabrics.

“In the semantic of social enterprise that we use today, Fabindia must be counted as a social enterprise because it provides livelihood to a large number of artisans,” says Narayan Ramachandran, 54, managing director (India) at L Catterton Asia, a consumer-focussed private equity firm, which was formerly known as L Capital. “In doing so, Fabindia has other elements that many social enterprises don’t have, such as the revival of Indian weaving techniques, fabric, colour dyeing and so on.” L Capital had invested in Fabindia Overseas Pvt Ltd in 2012 and exited in early 2016.  Charu Sharma (left), director, Fabindia, joined the company in 1979

Charu Sharma (left), director, Fabindia, joined the company in 1979

Image: Amit Verma

What is of “particular importance” to Ramachandran is the fact that Fabindia provides formal sector employment to women, especially since they account for a disproportionate number of rural artisans. “In our country, the female participation in the workforce is pathetically low, closer to Saudi Arabia than it is to any modern developing country,” he says.

Though Ramachandran is unwilling to disclose investment figures, he says L Capital had an approximately 15 percent stake in Fabindia. He adds that the fund had “a successful exit” not only in rupee terms but also in dollar terms. “Businesses that are well run can deliver a good return on capital. Be it in microfinance, affordable housing, low-cost health care or whether it is retailing of the type that we are speaking about.”

Presently, PremjiInvest, the family office of Wipro founder and billionaire Azim Premji, is a significant minority shareholder in Fabindia, having first invested in 2012 (picking up a 7 percent stake) and then buying out L Capital’s stake in early 2016. Bengaluru-based billionaire Nandan Nilekani is also an investor in Fabindia. Recently, investment fund India 2020 Fund II, Limited, which is advised by Lighthouse Advisors India, picked up a stake as well. Details of the transaction were not disclosed.

“High social impact, but fully self-sustaining enterprises—such as Fabindia—are the need of society today. We are impressed with how Fabindia delights the customer with product and experience, all while nurturing a highly complex but socially transformational supply chain,” says Sean Sovak, partner at Lighthouse Advisors India.

The Transition Period

Born and educated in America, Fabindia founder John Bissell began his career as a buyer with departmental store chain Macy’s where he developed a keen fondness for hand-woven fabrics. He found his way to India in 1958 after he was awarded a two-year grant from the Ford Foundation. His work was to guide and advise Indian villagers [who worked for the government-run Central Cottage Industries] to make products for exports. The work captured his imagination and, after his two-year stint, Bissell decided to stay back in India. Using the $20,000 inheritance from his grandmother, he started Fabindia in 1960 and set up roots in New Delhi.

After he was impaired by a stroke in 1993, his son William Bissell got involved in the business. John passed away in 1998, leaving Bissell to take over the operations of the company, which then had less than seven stores. Bissell became managing director in 1999.

Till about 1992, Fabindia was largely an exporter of handloom furnishings to markets such as the US, Europe, Australia, New Zealand, and the Middle East. The company had just the one retail store it had opened in 1976 in Vasant Kunj in New Delhi till about 1994, when it opened its second store in the city.

“John was a content and simple person. He loved to work, eat, and travel with the weavers. His attire was Kolhapuri chappals, pyjama with a kurta or shirt,” recalls Charu Sharma, director, Fabindia, who joined the company in 1979. “There were so many people in the ’80s and ’90s who got into exports because of him. If anybody had potential, he would introduce them to buyers. He would say, ‘I have enough to handle and I don’t need more’.”  Retail veteran Viney Singh took over as its CEO in August 2016

Retail veteran Viney Singh took over as its CEO in August 2016

Image: Amit Verma

With his son, however, the gears shifted. William Bissell had realised that in the long run, Fabindia could not rely on exports—it needed to focus on the domestic market, in particular on retail. “We were not manufacturers. The landscape was also changing—a lot of our buyers wanted to deal directly with our suppliers. At the same time, a number of export houses had sprung up,” says Sharma, who is credited with setting up Fabindia’s garment business in 1982-83. “The change that came with William was that he was taking Fabindia to the next level.”

In 1988, after completing his BA from Wesleyan University in the US, Bissell returned to India and set up the Bhadrajun Artisans Trust (BAT), an artisans’ cooperative for leather workers and weavers in Rajasthan. The trust went on to become a supplier to Fabindia (BAT now focuses on education and runs The Fabindia School, which was set up in 1992 in Bali, in the Pali district of Rajasthan). “He wanted to prove himself. He didn’t like the idea of being parachuted into the business,” says Sharma.

Fabindia’s retail growth took off in the early 2000s, around the time Bissell started diversifying the product portfolio. For instance, in 2000, the company launched its home products range, which today comprises furniture, lighting, stationery, tableware, cane baskets and handcrafted utility items. In 2004, Fabindia started retailing organic food products and, two years later, followed that up with the introduction of personal care products. The handcrafted jewellery business was launched in 2008.

Adding heft to its organic food range, in 2013, Fabindia bought a 40 percent stake in Lucknow-based Organic India, a retailer of organic foods and supplements. Since then, Fabindia has increased its shareholding in Organic India to 53 percent.

This was planned growth, driven by vision documents being laid out by Bissell. The company’s first vision plan came into effect in 2003. It was to run its course till 2007, but the targets were achieved by 2005. “When we started Vision Plan 1, our sales were about Rs 1.5 crore a month, a run rate of Rs 18 crore a year. However, we exited Vision Plan 1 with a monthly sales run rate of Rs 8 crore, taking us to a Rs 100-crore company,” says Bissell.

Vision Plan 2 too envisioned sales growth, from Rs 8 crore a month in 2005 to Rs 20 crore a month by 2009. These goals were also met two years ahead of time. And so in 2007, the company moved on to its third vision plan, which set the target of monthly sales at Rs 60 crore by 2012, in effect tripling its sales over a five-year period. More importantly, Vision Plan 3 had a social impact component which formulated the creation of joint stock holding companies or Community Owned Companies (COCs), in which the company’s supplier base of artisans would be shareholders.

Social Goals

Sixteen COCs were set up by the end of the FY07-08, with Fabindia holding between 25 percent and 45 percent in each through its microfinance unit AMFPL (Artisans Micro Finance Private Limited). The rest of the shareholding was held by the artisans. The intention was to streamline the supply chain. The company had to deal directly with small groups of artisans in remote villages of the country. The COC model created a middle tier between the artisans and the company procurement hubs and field offices were also set up to further streamline the process. However, the model did not work. “In terms of social impact, it was a huge success and something we should be proud of,” says Bissell. “[However], it led to quite a few problems in terms of implementation, in terms of interests being divergent because they (COCs) were trying to maximise their profits and we were trying to buy at the best price. So it had certain design flaws.”

The intention was to streamline the supply chain. The company had to deal directly with small groups of artisans in remote villages of the country. The COC model created a middle tier between the artisans and the company procurement hubs and field offices were also set up to further streamline the process. However, the model did not work. “In terms of social impact, it was a huge success and something we should be proud of,” says Bissell. “[However], it led to quite a few problems in terms of implementation, in terms of interests being divergent because they (COCs) were trying to maximise their profits and we were trying to buy at the best price. So it had certain design flaws.”

The model had to be disbanded and at the end of Vision Plan 3, Fabindia went back to the drawing board. At that point, initially, Bissell worked on the idea of integrating all the 16 COCs with Fabindia Overseas Pvt Ltd, thereby making 35,000 artisans direct shareholders of the company. But that was no easy task. “It was an honest experiment. But the mechanics of such a distributed ownership turned out to be problematic,” says Ramachandran of L Catterton Asia. Eventually, AMFPL, through a buy-back of shares between 2013 and 2014, wound up 14 COCs, spending approximately Rs 90 crore. Two COCs—one based in Odisha and the other in Rajasthan—continue to operate.

At the same time, Bissell points out that between 2007 and 2012, the share price of the worst performing COC had grown by 1.5 times, while that of the best performing one had gone up by 11 times. “What happened was that we left the choice [whether to integrate or not] to the boards of these companies and what they saw was an average upside of 5x in returns,” adds Bissell. Most of the COC artisans have gone on to set up micro-enterprises and Fabindia continues to engage with them. “In hindsight, I would have merged the COCs with Fabindia,” he says.

Fabindia’s association with artisans has been a constant, and with some artisan families, it has sustained for four generations. Taking forward from the COC model, the relationship has now shifted to a Craft Cluster Development and Livelihood Impact programme. Clusters are typically a group of artisans in a particular village and, sometimes, even include handloom weaver cooperatives.

In Vision Plan 5, Fabindia’s Craft Cluster Development and Livelihood Impact programme has been given an outlay of Rs 50 crore. This programme entails skill development as well as helping local artisans achieve scale and size. Says Bissell: “As a commercial entity, we can only work with producers who are at a certain level.” The programme is intended to help the artisans scale up. The proof of concept is a similar initiative, in Chanderi in Madhya Pradesh, which proved to be a success.

In 2005, Fabindia set up a field office in Chanderi and started working with artisans who were earlier part of defunct cooperatives and NGOs. From this pool they identified artisans who had an entrepreneurial bent and began working closely with them. Currently, the cluster comprises 27 producers operating over 200 handlooms. When Fabindia entered the Chanderi cluster, the artisans were primarily working on sarees and some home furnishing products. After Fabindia’s intervention, the craft cluster’s product basket has grown to include curtains, cushions, table mats, napkins and accessories such as dupattas and stoles as well as creating yardage for garments. “Our vision is to nurture and sustain craft clusters and impact the lives of the artisans. And also to broaden our sourcing base using a focussed approach,” says Anuradha Kumar, head-creative and social mission at Fabindia. At present, Fabindia is developing 10 such craft clusters spread across Maharashtra, Chhattisgarh, Madhya Pradesh and Uttar Pradesh.

Similarly, says Kumar, Fabindia impacted the lives of artisans in the village of Khurrampur in Uttar Pradesh. The company taught the women artisans there, who typically work from their homes, how to stitch pyjamas. This project started in 2012. Currently, 25 percent of men’s pyjamas retailed at Fabindia are sourced from this Khurrampur cluster.

Road Ahead

For urban consumers, Fabindia has come to be an iconic Indian ethnic brand. However, its senior management views it as a value-for-money, everyday wear brand. In fact, Fabindia has been less about fashion and more about the fabric and craft. That said, the brand has evolved from its humble offerings of kurtas. Today, you can shop for sarees that are worth Rs 25,000 a piece and jewellery worth Rs 30,000 a piece. The company even retails pashmina shawls at Rs 20,000.

Bengaluru-based impact investor Nagaraja Prakasam believes that the most defining facet of Fabindia’s success has been its “cult-like customers” that proudly wear the brand to “celebrate India”. He adds, “My children go to The Valley School [founded by philosopher Jiddu Krishnamurti and located on the outskirts of Bengaluru] where there is no uniform, but Fabindia is the unofficial uniform most of the days.”

As an angel investor in GoCoop, which is a marketplace for handloom cooperatives, Prakasam has tracked and studied the sector closely. “As it happens in any sector, the person at the top of the food chain tends to squeeze the person below. While ‘celebrating India’ has been achieved, whether artisans are celebrating is doubtful. Also, I don’t see much of handloom [mark on their products], which excludes around 8 million weavers in its story,” he says.

This points to the age-old question: How do you measure social impact and ensure that profitability is not the focus? L Catterton Asia’s Narayanan believes that the question itself is a false dichotomy. “I can make anything look horrific by saying you are pillaging from the artisans or you’re taking away from what is truly theirs,” he says. “More people are invited into the fold of artisanship because Fabindia has scaled as an enterprise. For every Rs 500 crore more that Fabindia gets in revenue, many more artisans get work.”

Retail veteran Viney Singh joined Fabindia as its CEO in August 2016. Singh was formerly with Max Hypermarkets and was responsible for building the Spar hypermarket brand in the country. “The social dimension of the company where you have a strong social link to the business, I have to confess, has a tremendous feel-good factor,” says Singh. He has the task of taking Fabindia to the level of growth laid out in the company’s Vision Plan 5. The challenge in that is, he says, “How do you grow this equity that has been built over all these years, strengthen the craft connect, and scale the business?”

Consider also that the retail landscape has changed dramatically. Competition is not only from brick-and-mortar retailers, who offer machine-stitched garments that are cheaper than craft-based products, but from online retailers as well.

Bissell admits that there is no level-playing field, as etailers have huge amounts of investor money to offer discounts and buy market share. But that’s not giving him sleepless nights. Not least of which because Fabindia has its own website and is looking to further grow that business. Also, Fabindia is going aggressive on omni-channel retail. It also plans to expand its international operations.

Product lines too could see a lot of diversification, with plans afoot for the launch of newer categories like yoga, spa and maternity wear. “Often people who run social enterprises tend to be very ambitious with their vision. But translating that vision into an actual business, a scalable enterprise, is very tough,” admits Bissell. Organisations—social or otherwise—have to think long term, continually learn, innovate and most importantly, not rest on their successes. And this mindset seems to be woven into the fabric of Fabindia.

First Published: Jan 17, 2017, 06:28

Subscribe Now