Tailor-made SaaS will emerge from India for the world: Blume Ventures' Anirvan C

The time has come for vertical SaaS, with custom-made software that has marketplaces and fintech built in, the vice president of Blume Ventures writes

We have all heard how “software is eating the world" and I think it is time for us to recognise that vertical software is capable of, and is already eating up, chunks of horizontal software.

At Blume Ventures, we have been investing in vertical software for the past 10 years, and in the past few years we have doubled down on the space through multiple investments in vertical SaaS companies across the beauty, education, shipping, mobility, and entertainment industries.

Software has come a long way from the client-server model, to ASPs, to cloud-hosted software-as-a-service (SaaS). And, in more recent years, cloud-hosted SaaS tailor-made to the needs of particular industries have emerged. We strongly believe that with wider adoption of SaaS, the new breed of vertical-focussed SaaS companies that started around a decade back are not just here to stay, but could very well be the future of SaaS.

This opportunity is not restricted to vertical SaaS companies building for India like Classplus, but we believe there are going to be multiple plays such as Innovaccer in health care, and Zenoti (salon and spa management) out of India building world class vertical software for global markets.

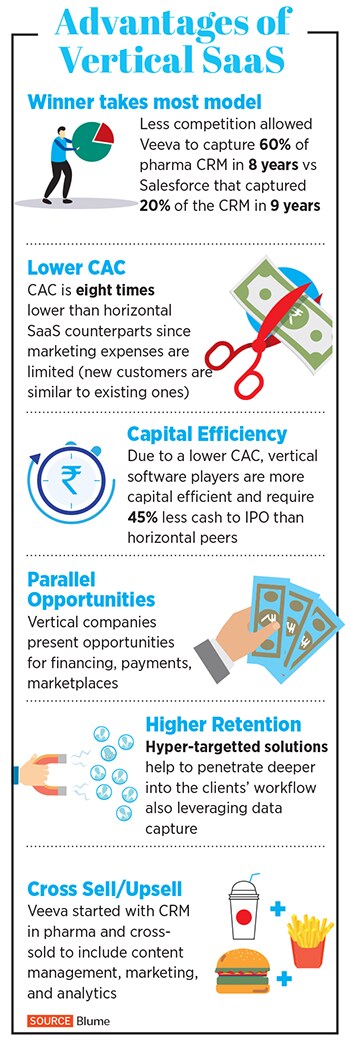

Most investors, including us, have sometimes shied away from vertical SaaS companies with very strong business fundamentals due to a relatively smaller total addressable market (TAM) compared with horizontal software. However, with a lot of the cold-start problems around embedding fintech and building a marketplace being solved over the past decade, we believe embedding marketplaces and fintech (payments, lending, and so on) into the SaaS offering provides avenues to expand the TAM significantly.

Most investors, including us, have sometimes shied away from vertical SaaS companies with very strong business fundamentals due to a relatively smaller total addressable market (TAM) compared with horizontal software. However, with a lot of the cold-start problems around embedding fintech and building a marketplace being solved over the past decade, we believe embedding marketplaces and fintech (payments, lending, and so on) into the SaaS offering provides avenues to expand the TAM significantly.

Vertical SaaS companies also tend to be more capital efficient due to a significantly lower cost of acquisition of customers (CAC) and higher sales efficiency. In addition, due to the inherent sticky nature of tailor-made software, most vertical software companies have a net dollar retention (NDR) rate that is higher than 100 percent.

As many of you know, NDR is a key SaaS metric, as it shows how much a company’s annual recurring revenue or monthly recurring revenue has grown or shrunk over time, factoring in customer expansion, churn and downgrades. The difference between a company with 99 percent NDR and a company with 101 percent NDR, is essentially a 3x revenue impact!

Software solutions tailor-made for an industry tend to be deeply embedded in the workflows of that industry and have the opportunity to be the system of record, system of process/workflows and system of engagement for their customers, and with a critical mass of customers for the industry as well.

This, in our opinion, shifts the narrative from being a software provider to that industry, to actually becoming a key participant in trillion-dollar industries through B2B marketplaces and fintech deeply embedded into the SaaS solution.

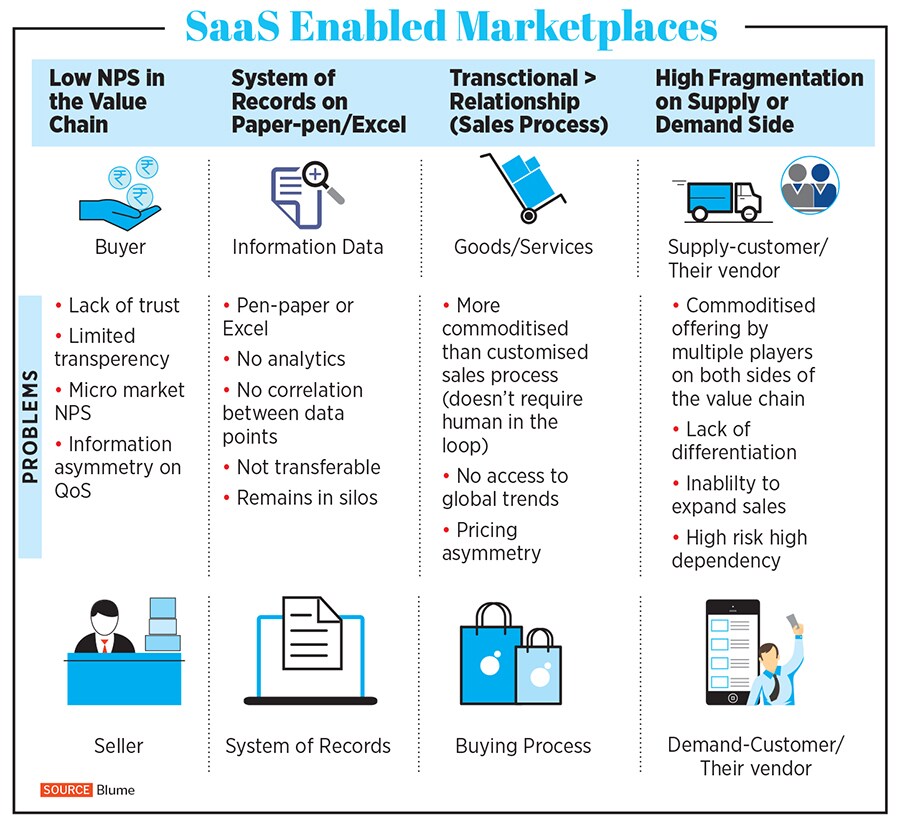

For a SaaS-enabled marketplace to work, it is important for a SaaS solution to fit into one function in the value chain and focus on moving from a system of record to system of process/workflow and a system of engagement at that node of the value chain. By being a system of records and eventually embedding workflows to become a system of engagement between both sides of the node, the SaaS offering has an opportunity to open up transactions between stakeholders at that node, making itself even more valuable.

In SaaS-enabled marketplaces, we have observed that there tends to be:

• A lack of system of records on both sides with spreadsheets used for capturing information, if at all.

• High level of fragmentation on either side.

• A commoditised sales process for the goods or services.

• A high level of asymmetric information with limited transparency.

When transactions are opened up, there is the opportunity to have embedded finance offerings within the product, thanks to more accurate underwriting capabilities with being a system of record, system of process and a system of engagement.

In the US, this virtuous cycle has played out well for Toast, Procore, Mindbody, and a bunch of others, while in India we are seeing this playing out for Classplus, and we believe this opportunity exists in all industries with similar characteristics.

When we are assessing vertical SaaS plays, we generally like to look at companies through the lens of:

• Overall GDP of the industry

• Software spends as a percentage of revenue in that industry

• Market concentration (incumbents and fragmentation of vendors)

• Scope of parallel opportunities

• The extent of regulatory and compliance requirements in the industry

While this framework helps distill industries, there are a few broader themes that we believe will continue playing out in vertical SaaS:

• Mobile-first vertical SaaS (eg PlanGrid, Khatabook, Procore, Guidewire)

• Verticalisation of the API economy (Estated, HumanAPI, BetterDoctor, Checkout.com, Plaid)

• Hardware-enabled vertical SaaS (Pixxel, Tricog)

• Generating proprietary data (Flatiron, THB)

• Vertical SaaS for SMBs (Zenoti, Glamplus, Squire, Classplus, Khatabook)

As these themes play out, the industries that can be most impacted by vertical SaaS companies built out of India are construction, manufacturing, health care, banking, financial services and insurance (BFSI), and transportation.

We foresee vertical SaaS companies built out of India having some inherent advantages:

• A lower cost-to-serve with respect to support, which tends to be an imperative for tailor-made software.

• Depth and cost arbitrage of inside sales and customer success talent that would enhance cross-sell opportunities and further drive sales efficiency and retention.

• Large beach-head market in India to test product features and B2B marketplace opportunities in industries where there are similar market dynamics globally.

• With rapid digital adoption, there is a large SaaS-enabled marketplace opportunity in India itself due to the sheer size of the B2B marketplace opportunity in India.

Over the next five years, we are hopeful that there will be more founders out of India building tailor-made SaaS solutions embedded with B2B marketplaces and fintech for large underserved industries in India. However, we are confident that we would see more Indian founders targeting industries globally where there are sleeping incumbents and custom made solutions to displace.

The time for vertical SaaS solutions made from India for the globe is here and it would be no surprise if the next Veeva gets built out of India.

The writer is a vice president at Blume Ventures, specialising in investments in SaaS and deep-tech startups

First Published: May 20, 2022, 09:00

Subscribe Now