The quest for the Amazon of healthcare

We're going to see all sorts of new entrants playing a role in promoting wellness, says Vaughn Kauffman, Health Industry Practice Leader, PwC

You believe that within 10 years, the ‘health business’ will look very much like other consumer-oriented, tech-enabled industries. Describe how you see this unfolding.

My colleagues and I characterize this movement as the New Health Economy, and there are several aspects to it. The first is a mindset shift among providers, from a volume-based approach to one that is based on creating value for people. Patients will be treated more like customers, with more personalized, convenient and on-demand care. Our data shows that one third of people would change their healthcare provider based on the promise of a better experience—so there is a strong basis for this shift.

A second aspect of this movement will be a shift from ‘episodic’ treatment to care that is more continuous. Obviously, the treatment of acute and chronic illness will always be a big part of healthcare, but there will be a much greater focus on the wellness side: keeping healthy people healthy. We’re going to see all sorts of new entrants playing a role in promoting wellness.

A third aspect is the idea of ‘prescriptive analytics’, which will use predictive data to drive better patient outcomes. Most doctors will tell you that they don’t want to weed through reams of data what they want is access to the right information to inform a particular treatment at any given time—and this is on the horizon. However, this means that some significant cultural shifts will have to happen along the way: when we surveyed clinicians, only about 17 per cent felt that prescriptive analytics was important right now and 37 per cent agreed that it will become more important in the next five years. That’s a fairly big gap for a tool that promises such great value.

Talk a bit about ‘the democratization of care’, and what it will look like.

We are entering an age in which healthcare customers will no longer be entirely dependent upon their family doctors or local hospitals for medical expertise—or treatment. Do-It-Yourself healthcare will continue to grow, as complex conditions become easier to manage at home. Over-the-counter pregnancy tests have been around for some time, but now there are HIV tests and proton-pump inhibitor tests—and Streptococcus infections are on the brink of being diagnosable at home. Such DIY tests and treatments could divert millions of patients away from doctor’s offices and emergency rooms.

As a result, we predict that we’ll see the decentralization of the healthcare model to include a combination of offerings from traditional players, new entrants and non-traditional players. In addition to giving consumers more choices—like retail clinics and virtual visits—pharmacists will also play an expanded role in treating certain conditions. Importantly, this emerging ecosystem will share information much more than the current one does. We have found that more than 70 per cent of physicians are not currently sharing their information with caregivers outside of their practice—which has major implications for learning and innovation.  Describe how startups are going after the healthcare consumer’s ‘discretionary dollar’.

Describe how startups are going after the healthcare consumer’s ‘discretionary dollar’.

In the U.S.—which is becoming dominated by high-deductible plans offered through employers and marketplaces known as ‘exchanges’—we have found that millions of adults incur less than $1,000 in medical expenses in a year. With higher deductibles, many never hit their plan’s limit, so they pay for virtually all of their care out of pocket. That opens up a huge opportunity for new entrants to say, ‘Hey, rather than putting that money towards your deductible, why not pay us instead, for a convenient video consult with a physician?’ For example, as we detailed in our recent report on payment and billing, Alii Healthcare offers a $100 consult with an emergency room physician to anyone willing to pay for it—and they are not just targeting affluent Americans: this is also intended for the hourly-wage employee who can’t afford to miss a half day of work, and who finds that the convenience factor is worth $100.

As consumers bear more of the cost of care, new business models are unfolding. Of course, this is much like what we’re used to seeing in every other industry—where companies have long battled it out for customers. In healthcare, until now, that has not been necessary: in Canada, you have universal care provided by each province, and in the U.S., employers are the ‘customers’ for healthcare companies. In both places, we’re seeing this begin to shift to more of a business-to-consumer (B2C) model and as healthcare’s incumbents inch towards this new value-driven world, their customers are signaling that they may not wait for them.

You have called the wellness and fitness arenas ‘the paths of least resistance’ for businesses that want to branch into healthcare. Please explain.

The money people spend on non-medical products and services to get—and stay—healthy offers the most flexible entry point for a business, because it doesn’t have to rub up against government or traditional providers.

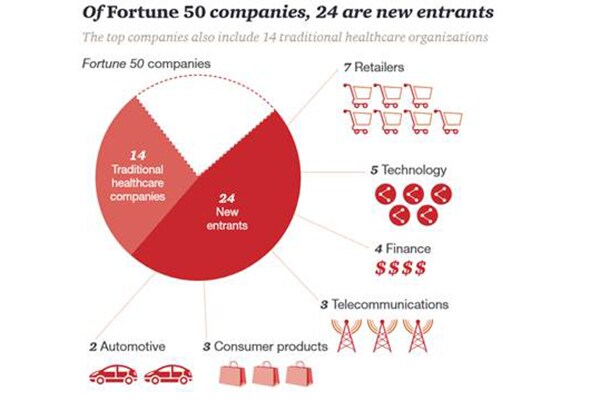

These opportunities have not been lost on the smartest companies: new entrants from the retail, technology, telecom, consumer products and automotive sectors are nibbling at the edges of the traditional healthcare ecosystem. For example, according to our report on global new entrants, Nestlé Health Science has made acquisitions in several companies specializing in gastrointestinal conditions, clinical nutritional products and cancer diagnostics to reinforce its position in the growing segment of ‘specialized nutrition’. And Nintendo recently outlined its plan to expand into health. Founded 125 years ago, it launched its first video game console in 1983 but with its last big success coming in 2006, the company needed a new direction. As we outlined in our report on global new entrants, CEO Satoru Iwata said that, with its new health products and services geared towards improving quality of life, Nintendo wants to “create an environment in which more people are conscious about their health and in turn, expand Nintendo’s overall user base.”

We also studied Virgin Care, which has started bidding for (and has won) some National Health Service contracts in the UK. Since 2006, it has provided health and social care services across the country, treating more than four million people with, according to its mantra, ‘care good enough for our families’. As one of the early private corporations to win work under the NHS, Virgin now runs 230 services throughout the country, spanning primary care, intermediate care and community services. Sir Richard Branson has said that “There is plenty of room for healthcare innovators to disrupt the industry by offering products and services that are palpably better and by delivering superior customer experiences.”

Elsewhere, early glimmers of healthcare’s versions of OpenTable and Hotwire can already be seen in upstarts such as ZocDoc and iTriage, while others are pitching 24/7, flat-fee online evaluations and treatment. Incumbents face critical decisions about whether to compete with these emerging players, or align with them.  Retail is one industry that has been quick to embrace health. Please discuss.

Retail is one industry that has been quick to embrace health. Please discuss.

Many retailers already had pharmacies in their stores, but walk-in clinics are now becoming more prevalent. Having debuted its $4 generic drug program in 2006, Walmart is now exploring providing basic medical care for $40 a visit. Other retailers are focusing more on wellness, which makes a lot of sense, because most of them already sell food, gym equipment and exercise apparel. Now, they are taking it to the next level—for example, by bringing in dieticians to provide individualized consults for customers who are looking to improve the way they eat.

You have noted there are opportunities in the public sector, too.

Definitely. As nations become more affluent, the growth in chronic diseases—which represents a whopping 75 per cent of healthcare costs, globally—is compelling governments around the world to invest in preventative medicine. New entrants can offer innovative strategies and products to meet national goals, but it is important to observe what consumers are willing to pay for to remain healthy. Healthy eating is a great place to start: the global nutrition market is now US$391 billion weight loss is US$595 billion and sporting goods and apparel is at US$236.5 billion.

Developing countries such as India are also witnessing a paradigm shift. With the eradication of polio and better control over other infectious diseases, the country is growing its fitness and wellness market: the market was poised to reach its trillion rupee potential by the end of 2015. New players are educating and improving consumer awareness of the benefits of wellness products and services. Innovative new products that can encourage consumers to make healthier choices offer value that cuts across both healthcare and lifestyle. Most important, they reach younger consumers, and encouraging youth to eat better and exercise more will reduce chronic conditions in later years.

What role do consumer ‘wearables’ play in all of this?

We have found that consumers are very price-sensitive when it comes to wearable devices: their interest level drops dramatically after a device costs more than $100. But their interest jumps dramatically if the device is subsidized by an insurance company or employer. We’ve seen employers give these devices to employees and have them sign up for a wellness program that offers perks if they reach certain health targets. Life insurance companies are also looking at the use of wearable devices. Imagine having a product that doesn’t pay a death benefit, but instead pays a health benefit? Some of this is still theoretical in nature, but the idea is, if you can use a wearable device to track how healthy someone is, it might be worth it in the long run to provide them with some sort of credit or reward. The fact is, popular wearables aren’t regulated yet, so it’s a great time to experiment.

A growing number of existing tech and consumer electronics companies are also getting involved. In the medical device space, for instance, it’s very difficult to get a new product to market: the life cycle is long, the cost of the research is high, and at the end of the day, the cost of the devices is high. Usually, these firms target their products—whether it be a new CT scanner or an MRI machine—to large providers or hospital systems. But these companies are starting to realize that care is increasingly being provided outside of a hospital setting. Dr. Ed Brown, CEO of the Ontario Telemedicine Network has said that within the next five years, more than 50 per cent of healthcare will be virtual. Clearly, the virtualization of care creates big challenges for medical-device companies that currently target providers.

What is your advice for companies that want to embrace the New Health Economy?

The best innovations we are seeing are happening around technology, but also, around the application of technology. We always talk about how cool new technology is but what’s even cooler is all of these new business models that are forming.

I would tell any new entrant that not all innovation is created equal. They should be aiming for disruptive leaps, because customers will reward truly transformative services and products. We recommend embracing the 3Fs: a fast, frugal, frequent-failure model that enables the quick development and testing of ideas. I would also tell would-be innovators that it is critical to engage risk management early in the game. The traditional rules of healthcare still apply, so they should involve regulatory, legal and compliance counsel early on. Last but not least, they should collaborate with other organizations, blending the best of emerging ventures and incumbents to fill skill and asset gaps.

Even with so many varied opinions about healthcare, most people agree on one thing: the current system is antiquated in terms of meeting the needs of consumers. The good news is, we are on the cusp of some fairly dramatic changes to the business models for delivering care.

- Vaughn Kauffman is a Global Practice Leader and Principal in PwC's Health Industries Advisory, based in Cleveland, Ohio.

First Published: Aug 29, 2016, 09:31

Subscribe Now