Given the sky-high valuations, should you still invest in mid-caps?

The recent mid-cap rally has led to sky-high valuations for these companies. Is it sustainable?

The past three years have been encouraging for Indian equity investors. Falling inflation (CPI-based average inflation currently stands at six percent, compared with 10.92 percent in 2013), near-zero interest rates in the developed world and a change in the central government in May 2014 have come together to shake the stock market out of its comatose state, attracting higher investments from domestic and foreign investors.

The benchmark NSE Nifty 50 index has risen by 20 percent between May 2014 and September 2016. And, in the period since the turnaround began, the markets have found a sweet spot in mid-caps, or stocks of mid-sized companies by market capitalisation. (While there is no clear definition of large- and mid-cap stocks, the top 100 in terms of market capitalisation are considered to be large-caps and the next roughly 500 stocks are treated as mid-caps.) Companies in this segment have shown the sharpest acceleration in stock prices in the past three years. Since July 2013, the NSE Free Float Midcap 100 index—comprising the medium capitalised segment of the market—is up 100 percent, more than double than that of the Nifty, which comprises the top large-cap stocks.

Much of the long-term gains in the mid-cap segment were accumulated in the last three years, after a long period of lull. “[The shares of] mid-cap companies have gone up recently because they cater to the domestic market. In the case of large-caps, almost 40 percent of revenues are associated with the global economy, which is not in good health. So, growth has been subdued in that [large-cap] part of the market,” says Taher Badshah, co-head, equities at Motilal Oswal Asset Management Company. According to research firm Capitaline Databases, over the last three years, the quarterly sales figures for mid-cap companies have shown a 30 percent rise, compared with 11 percent for large-caps.

The recent outperformance has led to a huge demand for mutual funds that buy into mid-cap stocks. Investments in mid-cap funds touched a record high of Rs 74,618 crore in August 2016, a 45 percent increase from 2013, according to research firm Morningstar India. In comparison, investments in large-cap funds saw an increase of just 20 percent in the same period (to touch Rs 1,32,203 crore).

Fund managers are also attracted to the segment because of the diverse pool of around 500 mid-caps listed on the bourses, giving them more investment ideas to choose from. “There are new sectors that are coming up. Over the last one year, the new companies that have been listed have brought in new ideas to this [mid-cap] space,” adds Badshah.

Is this growth sustainable? Going by analysts, it is. “India has become a nation of startups. There are young people promoting companies that belong to new sectors. All these companies will come up for listing. This space is attractive,” says Sunil Singhania, CIO, equity investments at Reliance Mutual Fund.

Singhania’s is one of the most credible voices when it comes to investing in mid-caps. He and Madhu Kela, an equity strategist and fund manager, created the mid-cap funds segment with the Reliance Growth Fund. Singhania’s idea of identifying companies that grow at a fast rate has stood the test of time. His Reliance Mid & Small Cap Fund is one of the best in this category and has delivered growth of 22 percent annually, against 16 percent for the BSE Midcap Index over the last five years.

The long periods of flat growth in the segment, he says, have nothing to do with any mismanagement by the promoters of these companies. Despite their businesses being relatively immune to global headwinds, their stock prices are not. Volatility in the flow of global investments can batter the prices of mid-cap stocks. “As finance has become global and money flows across international borders, a troubled global economy affects the fortunes of all countries. This was not the case earlier,” Singhania explains.

And in it lies a note of caution.

When the global financial crisis hit the Indian markets in 2008, the mid-cap segment was affected and Singhania realised that those funds were equally vulnerable. Since then, Singhania’s team has been watching global macro issues seriously.

As the rally in mid-caps has far outpaced the growth in sales and profits of the companies, fund managers are becoming cautious. Mid-cap stocks have become expensive and returns in this segment are far more volatile than in the large-cap space. “There will be issues related to valuation and one needs to be cautious,” warns Singhania.

The price-to-earnings (P/E) ratio—a measure of whether a stock or index is undervalued or overvalued—of the NSE Free Float Midcap index is around 33, compared with 23 for the Nifty (as of September). Stocks of mid-cap companies like Shree Cement, ABB and Siemens currently have P/E multiples close to 100. “The valuations of some of these companies, across sectors, are rich. It is best to lie low right now as far as equities are concerned,” says Rajeev Thakkar, chief investment officer, PPFAS Mutual Fund.

Because of high mid-cap valuations, some analysts are recommending large-caps for safety. “I think, from here on, the large-cap index looks more attractive,” says Mrinal Singh, deputy CIO of ICICI Prudential Mutual Fund.

Other strategists see a rationalisation in mid-cap stocks soon. “The earnings growth [of mid-cap companies] has been weak, but there are expectations of a pick-up that should cool down valuations as the markets have already factored in a turnaround,” says John Praveen, chief investment strategist, Pramerica International Investments Advisers. “Things have been moving in the right direction.”

Mid-cap companies have low liquidity and are high beta stocks (higher the beta of a stock, the higher will be its volatility). Moreover, they are totally dependent on the decisions of promoters. Large caps, on the other hand, are managed by professionals. “If key people leave a large-cap company, it is very easy to replace them. But that may not be the case with small- and mid-cap companies. In the mid-cap space, one needs to be very careful,” says Anup Maheshwari, vice-president and equity strategist at DSP BlackRock Mutual Fund.

Aswath Damodaran, professor of finance at Stern School of Business, New York University, sees companies as ‘stories’ and ‘numbers’. Story stocks normally have people at the centre. It is their passion that drives the decisions of the business. For example, Tesla Motors and Amazon became story stocks because these companies are totally entrenched in the personalities of Elon Musk and Jeff Bezos, their respective founders. But number stocks are not people-centric. There, the business environment and economics are at the centre.

Mid-cap companies in general are story stocks where the fund managers try to do a best fit by marrying the economic environment with the personalities behind the businesses. “We like entrepreneurs who understand efficient capital allocation. If an entrepreneur is a scientist but doesn’t know capital allocation, then it can become a problem,” says Vinit Sambre who manages the DSP BlackRock Micro Cap fund.

Great stocks are a combination of stories and numbers. They are risky at the initial level but once they are on the growth path, they start to deliver. Large-cap stocks, meanwhile, are predictable and pay dividends. “These stocks are also important because they give inflation-beating returns and have relatively lower risk,” says Abhimanyu Sofat, vice president, IIFL.

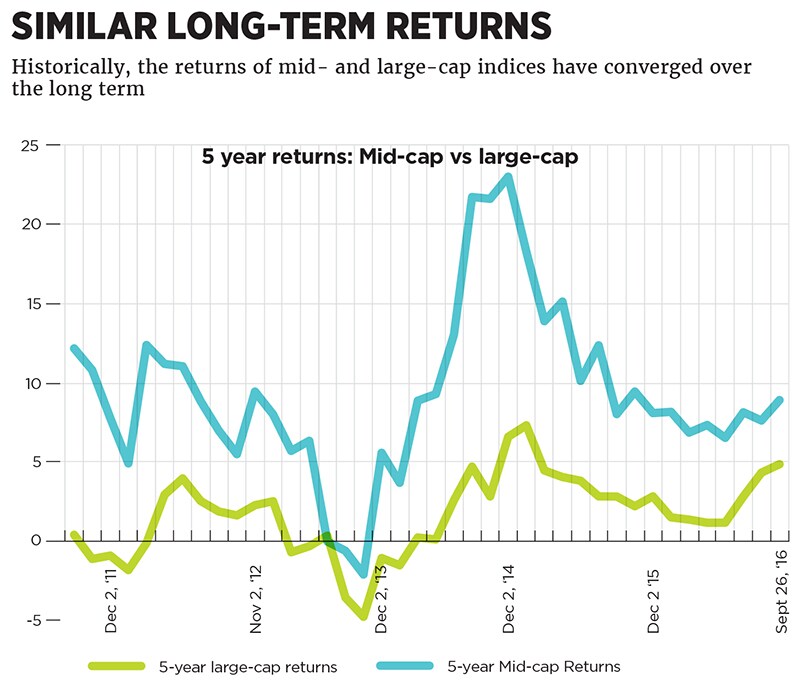

Historically, the returns of mid- and large-cap indices have converged over the long term. For instance, over the last ten years, the Free Float Midcap 100 index has given annualised returns of 13 percent, which is close to the Nifty’s 10 percent.

“In the large-cap space, we are taking concentrated bets. We have less number of stocks in the portfolio of our funds. We prefer to go with total conviction and concentration,” says Badshah.

Apprehensions apart, if investors still want to be in equities, then mid-caps are still the best choice for those who understand that this segment is risky but has the ability to deliver higher returns.

“In the large-cap space, I am better off buying a passive, low-cost index fund. But that is not the case with mid-caps. The opportunities are many and looking for quality becomes a problem. So you are better off buying an active, mid-cap fund,” says Vikaas Sachdeva, CEO, Edelweiss Mutual Fund. (A fund that tries to deliver the exact returns as a benchmark index is called an index fund or a passive fund. An active fund tries to beat the benchmark index.)

Consider this thought experiment. If an investor had put Rs 100 each, everyday into the NSE Free Float Midcap 100 index and the Nifty between September 2006 and September 2013, just before mid-caps became fashionable, what would the returns be? In this timeframe, the midcaps gave a return of 1.64 percent, compared with 17 percent for the large-cap index. However, if the investor had continued to invest till September 2016, the mid-cap index would have delivered higher annualised returns of 14.53 percent for the 10-year period and the large-cap index 2.35 percent.

Moral of the story: Mid-caps always tend to go through long periods of lull which becomes an accumulation stage for long-term investors.

So what does the investor do given that the mid-cap index is at an all-time high currently? Sachdeva feels that it is just a matter of time before the midcap space becomes efficient. “Investors should always do SIP investments into midcap funds,” he says.

Given that the mid-cap index undergoes long periods of zero growth, it makes sense to start a fresh SIP. Most fund houses understand this. They have already stopped bulk investments and are encouraging investors to go in for SIPs.

“That will lead you into an accumulation stage and will again work for the extreme long-term investor. Mid-cap investments are risky but will work well for this kind of investor even from here on,” says Sachdeva.

First Published: Oct 24, 2016, 09:18

Subscribe Now