Indian luxe chocolates are having a moment under the sun

As the demand for craft chocolates rises, entrepreneurs are working with cacao farmers to improve processes

In 2015, Karthikeyan Palaniswamy, a textile entrepreneur from Coimbatore, got chatting with his brother-in-law Harish Kumar Manoj over ramping up revenues for Regal Plantations, the farm Harish’s family owned in Tamil Nadu’s Pollachi. Housed over 160 acres, Regal grew coconut, nutmeg and cacao, and Harish was brainstorming to see if the cacao, the raw ingredient for chocolates, which they had planted since 2003, could fetch them a higher value. “He was wondering if he should export the beans, and through such conversations came up the idea why not make our own chocolate?" says Karthikeyan.

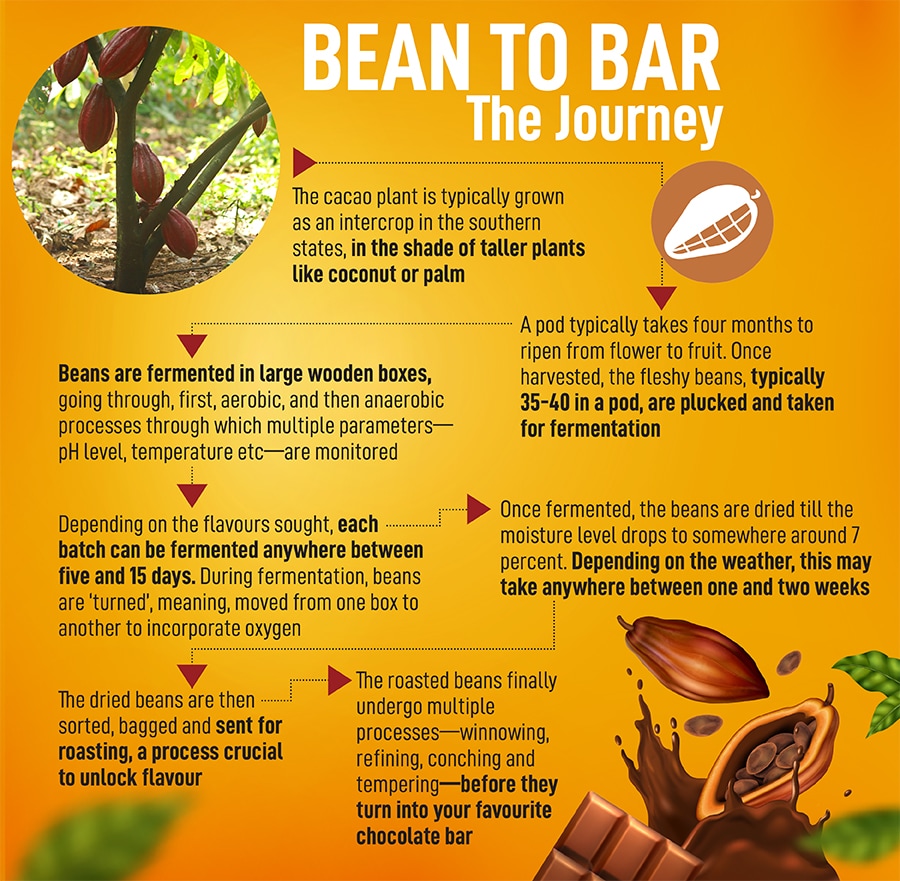

A bit of R&D and online tutoring later, they produced a bar, but the duo also realised the secret to good cocoa (the processed product) used in craft chocolates—small-scale, fine-flavoured chocolates—lies in the quality of cacao beans, and if they were to match global standards, they needed to benchmark themselves against top bean-to-bar makers around the world. Karthikeyan’s textile business often took him to the US and, on one such visit, he reached out to Dandelion Chocolate in San Francisco, which makes about $15 million a year by selling craft chocolates. “But they told us our beans were not good enough," says Karthikeyan. “That made us pull our socks up. We visited a lot of farms around the world—in Indonesia, Vietnam—to learn how they harvested beans and the processes they set up to ferment and dry beans post-harvest. It took us one whole year to get these rolling."

In 2017, at the Paris Salon du Chocolat, an annual trade fair for the industry, Regal was selected as one of the top cocoa producers in the world and received the International Cocoa Awards. Buoyed by the recognition, they launched their own brand, Soklet, in end-2017. From zero revenues that year, the company closed FY23 at ₹3 crore, and is hoping to cross ₹4 crore this year.

Regal also produces about 50 tonnes of beans a year, of which 35 to 40 tonnes are exported to Europe, the Middle East and Japan, among others. Bars made from these beans have received top awards at the International Chocolate Awards—French chocolatier 20°Nord 20°Sud’s dark chocolate bar with Regal’s Anamalai beans won the silver in the European region this year, while Japan’s Daito Cacao won the gold in the Asia-Pacific region blending Regal’s beans with those from Uganda.

“When they first came to us, they were under-fermenting the beans, which left woody and off flavours. But there were some good notes too, which told us we could work with them if they improved their processes," says Ron Sweetser, cocoa sourcing and quality manager, Dandelion. “Now we buy about 8,000 to 10,000 kg of beans a year from them, pretty much the same average that we buy from other producers around the world."

The rise of Regal and Soklet—from scratch but steadily upwards—mirrors the story of the craft chocolate industry in India, which has seen a surge of late in terms of players as well as consumer interest. While India has never been acknowledged as the home of fine cocoa, a sobriquet that has been reserved for equatorial Africa and Latin America, a group of small-scale chocolate-makers are working with cacao farmers to give the Indian cacao and chocolate their moment in the sun.

Given its nascent status, there are few credible market analyses on the craft chocolate industry, but data from research done by some of the companies is telling.

According to L Nitin Chordia, among the earliest certified chocolate tasters in the country, the Indian bean-to-bar market recorded sales of ₹35 crore in FY23 and is expected to rise 30 percent each year for the next five years. Chordia’s zero-waste, organic chocolate brand Kocoatrait started with selling 50 kg of chocolate every month during the pandemic in 2020, but has now gone up to 200 kg a month during season.

Manam, a brand that launched in Hyderabad this August, has pegged the bean-to-bar market to go from ₹50 crore in FY22 to ₹201 crore in 2028, at a CAGR of 26.1 percent. The number of producers, meanwhile, is expected to go up from 20 to 250 by 2026. The company, which wants to scale up beyond the bean-to-bar niche and foray into the larger premium chocolates segment, projects its revenue to cross ₹250 crore by 2027.

Manam’s study was vindicated in the aftermath of its launch when the police had to shut down its 10,000 sq ft chocolaterie-cafe in Hyderabad’s tony Banjara Hills for three days due to crowding and the ensuing traffic jam. “On the weekends, we were parking over a thousand cars. There are at least 500 people at the shop on a Saturday afternoon," says Chaitanya Muppala, founder of the brand. “But it’s a happy headache to have."

What changed for a country that thrived on a culture of commercial chocolates? To begin with, exposure, as people travelled abroad and refined palates, and a growing awareness of dark chocolate as healthy, as opposed to the high sugar content of industrial bars. As craft chocolate-makers caught on to the trend, they also plunged headlong into elevating the two levers that separate premium chocolate from chaff—beans and post-harvesting processes (fermenting, drying, roasting etc). But changing habits, especially of farmers who have been cultivating cacao for a few decades, wasn’t easy and couldn’t be achieved overnight.

(Clockwise from above) Vikas Temani, the founder of Paul And Mike the company’s dark chocolate with real sitaphal Paul And Mike’s award-winning dark chocolate with gin and candied ginger

(Clockwise from above) Vikas Temani, the founder of Paul And Mike the company’s dark chocolate with real sitaphal Paul And Mike’s award-winning dark chocolate with gin and candied ginger

Muppala’s family runs Almond House, a 30-year-old mithai brand in Hyderabad, and the 32-year-old had joined the business about 10 years ago trying to reinterpret mithai. Chocolates became a logical progression around 2018, when he realised their growing relevance, but also that “anybody who’s doing anything in chocolate, of size and scale, is buying chocolate from the same two or three sources, melting it, moulding it, putting their sea salt or their nuts etc, and packaging as their brand", and that didn’t work for him as sustainable differentiation.

Vikas Temani, who worked with Synthite, which is one of the largest exporters of spice extracts from India, faced a similar problem. Temani came across the cacao ecosystem during an acquisition opportunity for a cocoa processor, and realised that there is an opportunity to build a local premium brand. In 2017, he started planting cacao at Synthite’s farms in Kochi and Coimbatore, but it took him two years to establish the standard operating procedures and launch craft chocolate brand Paul And Mike (under the Synthite umbrella), since practices in India were skewed towards the large commercial chocolate-makers, the biggest buyers of beans.

Paul And Mike’s masala chai-flavoured vegan chocolate bar won gold at the International Chocolate Awards (Asia-Pacific) 2023, while 64 percent dark sichuan pepper and orange peel vegan chocolate bagged the silver in the 2021 world final.

Cacao plants were introduced to India in the 1960s, says Muppala, by commercial chocolate makers who brought varietals that were hybridised and enhanced merely for disease resistance, yield, consistency and scale etc, while craft chocolate needs to be optimised for flavour and complexity that comes from the beans. Same for fermentation, which happened as gunny bags full of beans were left in the open, or drying that didn’t often get the attention it deserved.

“Your chocolate is only as good as your beans and post-harvest protocols," Muppala figured, as he went around visiting cacao farms in Andhra Pradesh’s West Godavari district, the largest-cacao growing belt in the country. For a year, he ran pilot projects with the farmers before embarking on a full harvest. Subsequently, Muppala set up his own processing facility in Tadikalapudi, West Godavari district, under the brand name Distinct Origins, taking over an old, now-defunct, tobacco factory, where he procures beans from 110 farmers and processes them with proprietary technology that the company has developed.

(From left) Naviluna’s dark chocolate range David Belo, the founder of Naviluna chocolate-making in progressImage: Courtesy Naviluna

(From left) Naviluna’s dark chocolate range David Belo, the founder of Naviluna chocolate-making in progressImage: Courtesy Naviluna

Why do craft chocolate-makers harp on post-harvest protocols? Because, as David Belo, founder of Mysore-based Naviluna, says, quality in cacao doesn’t just come from genetics and terroir, but post-harvesting protocols. “Which was always an issue in India," says Belo, a London bartender-turned-chocolate-maker, who moved to India in 2011 and started Naviluna the next year with ₹18,000.

“Let me give you an example. Most farmers rely on wood fire dryers to dry cacao beans during monsoon harvests," adds Belo. “But the problem with that is the smoke leeches onto the cacao. With the beans having upwards of 50 percent fat content that absorb flavours from the environment, you end up getting very smokey cacao." Besides, temperatures aren’t accurate in wood fire dryers, so the moment they go over 70°C, the acetic acid in cacao beans gets baked in, making the cacao, and subsequently the chocolate, sour.

When Belo started working with cacao, even he couldn’t tell the good from the bad, and his only criterion of working with farmers was whether they were responsive enough over emails. But, over time, he saw the farmers were unwilling to evolve the processes adopted for commodity-grade cacao. “Around 2015, there was a general atmosphere of reluctance towards innovation," he says.

Cut test to ascertain the level of fermentation (top) fermented beans being dried at Lakshmana Rao Kolluri’s Beanzo fermentery

Cut test to ascertain the level of fermentation (top) fermented beans being dried at Lakshmana Rao Kolluri’s Beanzo fermentery

That began to change a few years later, as the coffee revolution seeped in. Like cacao, coffee beans, too, need delicate handling and post-harvest processes, and as farmers witnessed premium value being attributed to fine-flavoured coffee beans, they warmed up to the prospects of cacao. While cacao prices depend upon global benchmarks—the highest the commercial manufacturers have paid Indian farmers this year is ₹240/kg—as the farmers improved quality, craft chocolate-makers ascribed a premium by paying them ₹25-30 extra per kg, over and above what the commercial buyers pay them.

Lakshmana Rao Kolluri, a former IT professional, who quit his job in 2017 and settled down in a farm in Challapally village, near Vijaywada, was one such farmer who discovered the primacy of quality. A few of his friends in West Godavari district were farming cacao as an intercrop with coconut, and much of their produce was procured by a multinational buyer. “But we felt the farmers weren’t getting the right price since there was only one buyer. On the other hand, craft chocolate makers were importing beans because they weren’t getting properly fermented beans here," says Lakshmana. “We decided to bring in value and bridge the gap."

Along with a few friends, he set up a 50 sq m polyhouse in Tadikalapudi district, where he offered chocolate-makers fermentation and drying with proper know-how on one hand, and, on the other, trained the farmers to identify the right beans to pick (the ones that haven’t germinated), the right technique to cut them open (without the blade touching the pods) and how to collect wet beans in food-grade containers. In 2019, they reached out to Temani of Paul And Mike, who travelled to the facility, was convinced and has since been sourcing beans from them.

“By adopting different protocols, you can get different flavoured beans at the end of the fermentation. So, Vikas tells me if he wants two tonnes of five-day or seven-day fermentation beans or if he wants the beans that have been fermented for 15 days by rotating them in boxes twice in a day. And we follow the exact instructions," says Lakshamana, managing partner of Beanzo, the fermentation unit.

“We source a lot from Andhra, which has palm oil plantations where cacao grows as an intercrop," says Temani. “The lands there are fertile and flat, and cacao grows very well under those conditions. Plus commercial chocolate companies and even the state government have worked on the ground to encourage the cultivation of cacao. That has led to Andhra now becoming the number one state in cocoa production in India."

Outside of Andhra too, farmers have gone on a journey of learning. Thankachan Chempotty, a former corporate executive who moved to Mysuru in 2005 and took to horticulture farming, was, in the early days, selling commercial-grade cacao to industrial buyers. But he and his wife Jessy upped their game, learning from chocolate-makers and going through rigorous training with them. “Earlier we would do heap fermentation of beans, which means you heap the cacao beans on a banana leaf, cover them, and leave them to ferment," says Jessy. “Now we ferment in wooden boxes, which abets drainage. People who have bought chocolates from us four years ago won’t recognise the taste now, such has been the improvement in quality through the adoption of better methods."

The Chempottys now sell to craft chocolate-makers as well as use the cacao for a range of products—like dips, juice, nibs—they retail online. Thankachan, who is setting up a manufacturing facility on his plant itself to propel his bean-to-bar initiative, says: “The younger generation doesn’t know chocolate actually comes from the tree, they think it comes from factories. With better beans and processes, we can change that."

(Clockwise from top left) Cacao fruits being sorted at Chempotty Farms the cacao tea produced at Chempotty Farms Cacao farmer GVS Prasad, who was the first one to tie up with Manam Cocoatrait’s L Nitin Chordia at a Cocoashala workshop zero-waste, organic chocolate produced by Cocoatrait Image: Courtesy Chempotty Farms & Cocoatrait

(Clockwise from top left) Cacao fruits being sorted at Chempotty Farms the cacao tea produced at Chempotty Farms Cacao farmer GVS Prasad, who was the first one to tie up with Manam Cocoatrait’s L Nitin Chordia at a Cocoashala workshop zero-waste, organic chocolate produced by Cocoatrait Image: Courtesy Chempotty Farms & Cocoatrait

GVS Prasad, a former mechanical engineer who took to farming in 1995, and started cacao farming in 1999, was the first farmer to tie up with Manam not just for the added revenue, but also farming takeaways. “What helps us is that entrepreneurs like Chaitanya are educating us about the way cacao is farmed," says Prasad, who farms 13 to 14 acres of cacao on his 25 acres. Manam also returns the favour by acknowledging its farmers on its products—its tablet No 3 is the GVS Prasad collection, one that uses 68 percent dark chocolate made with beans from his farm.

Fostering a community is what Cocoatrait’s Chordia does, too, through his passion project Cocoashala, a business incubator-cum-acceleration unit he launched in 2017 to train farmers as well as aspiring craft chocolate entrepreneurs. “Since 2015, we have trained 141 entrepreneurs on bean-to-bar chocolate-making. Of them, 30 are from overseas, but the rest are from India. Nineteen among the Indians have gone on to start making chocolates," says Chordia.

Between 2017 and 2020, says Chordia, his students were mostly international, who would reach out to him through various market shows and exhibitions that he would attend internationally. “But something changed in 2020, and we began to get a lot more Indian students. We’ve been running full batches of five people almost every month for the last two years." Cocoashala has also sensitised nearly 1,000 farmers, some via the government, through audiovisual training. “The government is funding multiple farmer-producer organisations who are signing up with me for this season," he says.

As the community snowballs, so does consumer interest. In 2014, when Naviluna’s Belo started selling 75 gm bars at ₹270, he had to invest much in convincing the customer about the value proposition—why s/he should buy his bars instead of the ones available in the market at less than half the price. That’s when he focussed on building the brand messaging—that Naviliuna wasn’t trying to sell chocolate as a commodity, but as a lifestyle and luxury brand. “Let’s just say it was much harder to sell 75 gm at ₹270 in 2014 than it has been to sell 60 gm at ₹390 in 2023," says Belo. The company, which was earlier selling through only retail stores and online, has pared down its brick-and-mortar partners since Covid to just a few boutique stores, and is looking to launch its own chain—the one in Mysuru is operational already, Bengaluru will come up early next year, and Mumbai late-2024, says Belo, who projects he’ll close the current fiscal with ₹1.5 crore.

While the scale for craft chocolate will never match the multinational commercial players, the community of entrepreneurs is looking to achieve a scale beyond the niche that is typically ascribed to them. “The premium craft industry will remain a niche within the overall chocolates market share (by volume)," says Muppala of Manam. “While batch sizes have to be small so that you can control the variables like flavour and complexity, my attempt is to bring to it the economics of scale within that."

First Published: Nov 13, 2023, 17:07

Subscribe Now