Vivek Chaand Sehgal: Man of many parts

Over the past two decades, he has used strategy and innovation to create a global auto ancillary behemoth. Now, as headwinds mount for the car industry, he is well prepared to battle future challenges

Vivek Chaand Sehgal, Chairman, Samvardhana Motherson Group

Image: Amit Verma

Forbes India Leadership Awards 2018: Entrepreneur For The Year

A section of the top management of Motherson Sumi, India’s largest auto ancillary firm—including Chairman and Co-founder Vivek Chaand Sehgal—has proactively been visiting the manufacturing plants of Netherlands-based auto parts maker Reydel in Argentina.

The company, acquired by a subsidiary of the listed Motherson Sumi Systems in August, is the latest to join the large family of companies—now 21—that form the Samvardhana Motherson Group, to which Motherson Sumi Systems Ltd (MSSL) belongs.Renamed Samvardhana Motherson Reydel Companies after being acquired, the acquisition will provide Motherson Sumi the ability to expand its presence in Argentina, Croatia, Morocco and the Philippines at one go.

But despite the string of exciting developments and acquisitions, it’s not all smooth sailing for the auto ancillary firm. In fact, Motherson Sumi could well be on the cusp of one of the most critical phases of its 43-year-old corporate history. This is because the demand for passenger cars across key markets is starting to slow.

China, the world’s largest car market in terms of demand, in November reported an 11.7 percent drop in car sales to 2.38 million units for the month of October, the fourth consecutive month of year-on-year decline, according to the China Association of Automobile Manufacturers. This is due to slowing growth in China and the impact of a frosty trade relationship between China and the United States.

Ford, Toyota, Nissan and Honda have all reported a bumpy trend in monthly car sales in the US. In the UK, Volkswagen—whose group accounts for 35 to 40 percent revenues of Motherson Sumi—reported lower September sales in five of its key markets in Europe, as tighter emission testing rules take force. Jaguar Land Rover and BMW have warned of closing some of their factories in the UK for around a month in April 2019, due to uncertainties over Brexit.

All of these are clients of Motherson Sumi, which has Japan’s Sumitomo Wiring Systems as its partner, and 271 factories across 41 countries. Motherson Sumi drew 87 percent of its revenues from outside India, as of March 31, 2018.

The headwinds facing the global auto manufacturers should be cause for concern for the 62-year-old Sehgal, India’s 21st richest billionaire according to Forbes, with a net worth of $5.5 billion in 2018. But Sehgal is least perturbed when you throw these numbers at him.

“Historically, Motherson has always over-delivered when the conditions have been tough. When conditions are good, things are fine. And when things are bad, it means there are that many more opportunities where stressed companies are available cheaper, so it works as a positive for us,” Sehgal tells Forbes India.

This is not just talk. Motherson has pulled through some of the toughest economic periods and has been quick to spot opportunities to grow. For instance, in the backdrop of the tough economic conditions of 2008, the company acquired the ailing UK-based firm Visiocorp (later renamed Samvardhana Motherson Reflectec, or SMR), which makes rear-view mirrors for cars, in March 2009. SMR’s then losses of ₹22.3 crore in the quarter ended June 2009 plunged MSSL into a loss of ₹12.88 crore (before considering minority interests) in that period.

But Sehgal’s son, Laksh Vaaman, who had trained in MSSL’s partner firms Woco Group in Germany and on the shop floors in Thailand, took charge and turned around the SMR business in less than a year. Laksh’s strategy was to break down businesses into small units, so that each one operated like a separate company and devised its own route to profitability.

Motherson Sumi has no plans to alter its strategy of growing inorganically. “We are happy to be in the space where, through an acquisition, we give a company a second chance, so that it can be brought back into power. I do not see our acquisitions spree dying down over the next five to 10 years,” Sehgal says.

The group is currently eyeing 32 potential acquisitions across five continents. “Feelers have been coming in, in some cases there are family companies that might want to sell off,” he says. The Group has a track record of 5 percent success in acquiring companies it targets.

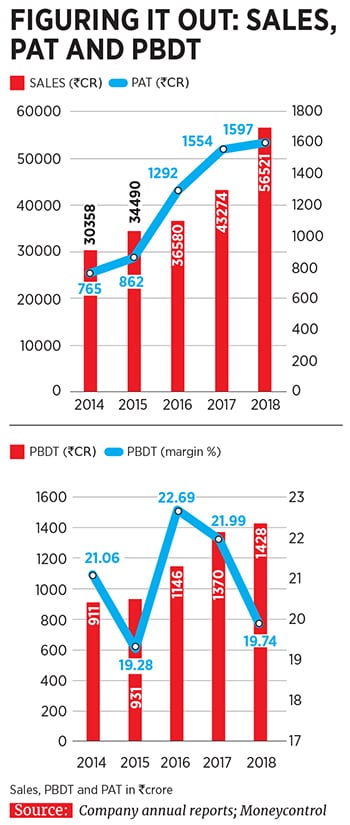

Sehgal also points to the fact that Motherson has consistently grown faster than the industry rate. “In 1993 when we listed we were a $2.2 million company, now we are at $12.5 billion [grown about 6,000 times], the global car industry has not grown at the same rate,” Sehgal says. It has also rewarded investors well over this period: ₹2,500 invested in the MSSL IPO is worth ₹89.7 lakh (including cumulative dividend) today.

Laksh Vaaman Sehgal took charge and turned around the SMR business in less than a year

Image: Amit Verma

In mid-November, Motherson Sumi reported weaker consolidated Q2FY19 earnings, with a 15 percent drop in net profit at ₹371 crore, hurt by a rise in start-up costs for new plants being set up. Group firm SMRPBV had incurred startup costs amounting to ₹469.3 crore (&euro62 million) during FY 2017-18.

Reviewing the latest earnings, Jinesh Gandhi, equity research analyst at Motilal Oswal Securities said that new plants will take four quarters to ramp-up (in line with OEMs’ ramp-up). Gandhi expects a $1 billion revenue potential of three new plants of group company Samvardhana Motherson Peguform (SMP) to reflect from H2FY20.

“Motherson is primed for a recovery, based on execution of the strong order book of SMRPBV and continued traction in the wiring harness business,” he says.

The group has disclosed that its order book through a group subsidiary is ₹164,315 crore (&euro19.53 billion).

“[From an auto perspective] a lot of the countries in the West are looking to reset goals. We will take it in our stride and carry on. The key thing for the group is not to have a strategy, we need to stay nimble-footed, constantly change and adapt. Having a long-term thought process is a waste,” Sehgal adds.

With acquisitions across the globe Motherson Sumi has been able to achieve its target of 3Cx15 (no country, customer, component to contribute more than 15 percent to revenues). In the next five-year plan, which is likely to be disclosed in July/August 2020, Sehgal is expected to tighten this norm to 3Cx10.

Looking Beyond Auto

Much as Sehgal is confident that his acquisition-led strategy will continue to work, the Samvardhana Motherson Group has nevertheless started to look beyond the automobile sector, to grow rapidly. “I see synergies in the defence and aeronautics space. We are also looking at medical components in devices [stem cell printer pens],” Sehgal says.

Sehgal declined to disclose details of the kind of orders being garnered at this stage. “We are looking at orders from DRDO currently these are in just tens of lakhs,” he says. “I would not call this diversification, I would call it seeding.”

[qt]Motherson is primed for a recovery, based on execution of the strong order book of SMRPBV.”

Jinesh Gandhi, equity research analyst, Motilal Oswal Securities[/qt]

Motherson Sumi is the 23rd largest auto ancillary company in the world. If it meets its five-year targets announced earlier—of $18 billion in revenues and a consolidated return on capital employed (ROCE) of 40 percent—it would be among the top 15 auto parts company by 2020. “That is a good place to be in, but we want to get into a bigger space,” he adds.

“And then as a group, we will go from 99 percent auto to 75 percent, so 25 percent will come from the non-automobile segment, but the target group will be that much bigger,” he says.

One of the other areas Motherson has already forayed into is railways, where its presence has been strengthened with the 2017 acquisition of Finland-based auto component major PKC, through the manufacture of rolling stock (powered and unpowered locomotives, railroad cars and wagons) in India and China. PKC designs and manufactures tailored electric wiring harnesses for trucks and buses, and now contributes about &euro1 billion to the group’s revenues.

An Eye On The Future

Motherson Sumi, and Sehgal, have an eye on the developments of the future, particularly electric vehicles (EVs) and how carmakers are coping with the change in technologies inside a car. India’s largest passenger car maker Maruti Suzuki plans to start testing EVs on roads soon and aims to launch a WagonR EV in 2020.  An EV is expected to have 80 percent fewer moving parts than an internal combustion engine. Fewer components in an engine will be a reality that Motherson Sumi will have to deal with, but he says there is little to worry about. “When you get into a car, will you be standing?” he asks, pointing out that customers will continue to seek basic details and accessories even in EVs.

An EV is expected to have 80 percent fewer moving parts than an internal combustion engine. Fewer components in an engine will be a reality that Motherson Sumi will have to deal with, but he says there is little to worry about. “When you get into a car, will you be standing?” he asks, pointing out that customers will continue to seek basic details and accessories even in EVs.

The concerns over EVs have been overplayed, Sehgal says. “Globally, there are 1.3 billion cars on the road, 100 million cars are made every year and less than 700,000 of these have electric engines. So, for all cars to be moved onto an EV platform it will take at least 20 more years. I don’t know what everyone is worrying about.” Sehgal says.

Motherson does have an effective weapon in its arsenal—its company Motherson Innovations (MI)—to deal with rapidly changing designs and technologies in passenger cars. Headed by Laksh, MI provides solutions to car makers on how dashboards can be designed better and how the driver can get better front and rear views. MI is in talks with Google for Camera 360 on how to improve safety and security features that individual car makers might find difficult to incorporate independently.

While Sehgal has been able to ride through the business cycles for cars across different continents, he will need to tackle one challenge very quickly: That of the rising presence of India and China, as car markets. Without including Reydel, the group gets 13 percent of its revenues from India and just 7 percent from China.

“These are two markets where global auto makers with historically strong linkages with Motherson Sumi have a presence but have not been able to create a dent where local manufacturing units have emerged as stronger players,” says an analyst with an equity research firm, declining to be named.

It will be interesting to see what Motherson’s strategy for growth will be in China, where several of their clients do not have a strong presence.

Sehgal believes in his India strategy, where his company is a little more insulated due to the strong association with client Maruti Suzuki. With over 90 plants in India, and the cost of learning and innovation being one of the cheapest, Motherson Sumi is confident it will continue to grow and these learnings “from jugaad” can be implemented across other countries.

Meanwhile, in two years’ time, Sehgal will, in consultation with the board, start to disclose to the company and investors how the succession planning at the company will take shape.

He does not agree with the usual strategy often followed by several family-run houses, where the vision comes from the family and execution by the professionals.

“The entrepreneur must allow the professional to work better, there cannot be over checking or overcontrol,” Sehgal says. “Our plan is in the works. I have another seven years to make it happen, we have to see the way the group evolves. It could follow the German way where companies create supervisory boards, so that senior officials will be on the supervisory side and are also held accountable, while professionals continue to run the business.”

Until then Sehgal, and the group, are well prepared to deal with the challenges the industry throws up. It is after all something he has been doing well for over two decades.

“Keep breathing with the market. Always. This mantra never fails.”

First Published: Nov 22, 2018, 17:00

Subscribe Now