Suresh Narayanan, 57, chairman and managing director of Nestlé India, the local arm of the Swiss fast moving consumer goods (FMCG) major, is no stranger to crisis.

In 2011, Narayanan was stationed in Cairo, in charge of Nestlé’s operations in Egypt, Libya and Sudan, when the Arab Spring revolutions spread to the country, crippling normal life. Like several other economic installations in the country, Nestlé’s factory, too, had to be shut down over safety concerns.

Expatriate executives of multinational companies, and their families, were leaving the country amid mounting tension. But Narayanan and other senior executives at Nestlé Egypt decided to stay back. “Honestly, I didn’t feel unsafe. They had nothing against us,” Narayanan says, sitting in Nestlé India’s headquarters in Gurugram. “I told my technical director, let’s try and get to the factory and see if it can be reopened. We made an announcement to that effect.”

Narayanan admits that he expected just a handful of workers to show up. But he was pleasantly surprised to see the exact opposite. Most of the employees turned up for work at the appointed date and time. “One of them told me that the workers respected the fact that we, the senior management, didn’t desert them,” he says. “It’s symbolic. If, as the leader, you walk away during a crisis, I don’t think you have the moral ticket to come back and say you’re the leader.”

Narayanan, who has more than three decades of experience in the FMCG sector, believes that sometimes the best way out of a hurdle is through it, and not around it. It is this bent of mind, coupled with his sound understanding of the Indian context, that prompted Nestlé’s global leadership in Vevey, Switzerland, to entrust him with pulling its Indian subsidiary out of the rut in 2015.

*********

In May that year, a random test on a sample of Nestlé’s blockbuster product in India, instant noodles Maggi, by the Department of Food Safety and Drug Administration of Uttar Pradesh in Lucknow found lead content in excess of the permissible limit, as well as traces of monosodium glutamate, a flavour-enhancing additive, which wasn’t disclosed on the packaging.

The findings cascaded into a chain of events that saw Maggi being banned in several Indian states. Though always confident of Maggi’s quality and fitness for consumption, Nestlé decided to withdraw the product across the country till the issue was resolved.

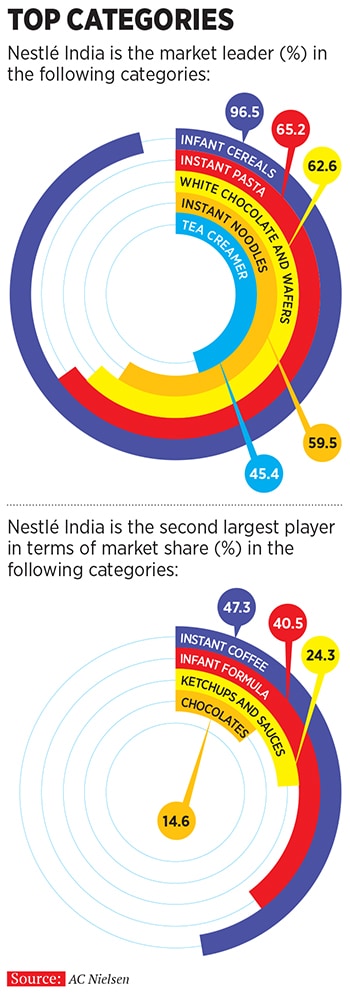

To put things in perspective, before this crisis, the instant noodles market in India was worth ₹3,400 crore, of which Maggi had a 77 percent share. After Maggi went off the shelves, the market fell by 42 percent to ₹2,000 crore.

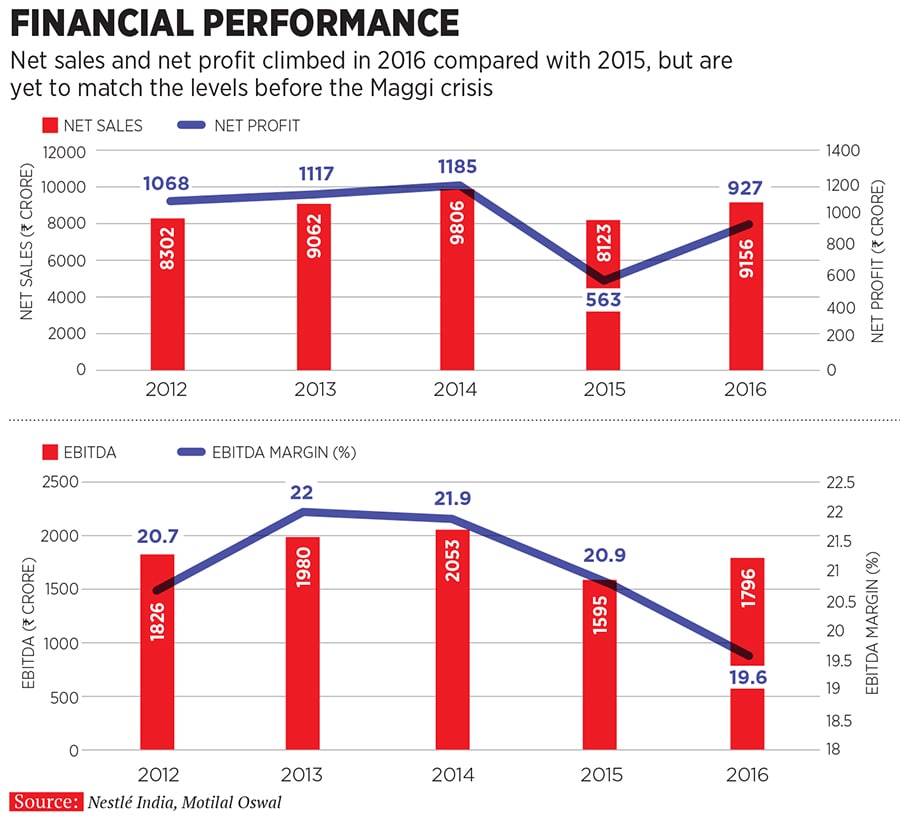

Nestlé India’s financials suffered due to loss of sales from Maggi, which accounted for 30 percent of the company’s topline. Net sales fell 17 percent year-on-year to ₹8,123 crore in 2015 (Nestlé India follows a January-December financial year) net profit halved in the same period to ₹563 crore (after a one-time hit of ₹500 crore on account of recalling Maggi).

There was reputational loss as well. For the company, which has been in India for 105 years, aspersions on the safety standards of one of its products led to people questioning the safety of its other products (like those in the milk and nutrition category, consumed by infants and children).

![g_101091_nestle_280x210.jpg g_101091_nestle_280x210.jpg]()

The company faced criticism over its initial handling of the imbroglio. The global headquarters, perhaps still grappling with the magnitude of the problem, responded only around the first week of June when its then global CEO (and now chairman) Paul Bulcke flew down to India.

This is the situation that Narayanan faced when the global leadership asked him to take over the reins of Nestlé India in October 2015. He wasn’t overly concerned about Maggi’s quality, since the company was confident of its product and knew that the tests would eventually prove that.

Subsequent laboratory tests—mandated by the courts, where Nestlé India faced off with the Food Safety and Standards Authority of India (FSSAI)—proved that Maggi was fit for consumption and, in a phased manner, the product returned to the stores from August 2015.

Maggi is once again the leader with more than 61 percent share of the instant noodles market, with the company gunning for pre-crisis levels.

“Suresh, and the team he leads, are doing a fantastic job,” says Bulcke. “He was sent to India to lead Nestlé’s operations here as he had done a very good job elsewhere and he understands the country very well.” Bulcke adds that Narayanan wasn’t sent to India only to deal with the immediate crisis, but to chart Nestlé India’s growth path. But pulling Nestlé India out of the crisis was an added responsibility that fell on his shoulders.

Through the turmoil, Narayanan kept a transparent channel of communication open with all stakeholders—customers (through brand messaging), employees, suppliers and distributors (through town hall meetings and one-on-one discussions), the media and even FSSAI. “Whatever I try to do or say, it is with dignity, calmness and maturity. I am not here to hurt anybody and say ‘you are the one who ruined me’. I am here to share my point of view transparently and reasonably and am willing to listen to your point of view as well,” Narayanan says.

Sanjay Khajuria, senior vice president of corporate affairs at Nestlé India, who worked closely with Narayanan during the Maggi crisis, says his boss genuinely likes to be with people and isn’t a “hierarchy conscious CEO” who deals only with his next line of leadership. “This gives him an edge since he can feel the pulse of the organisation,” says Khajuria.

Through these rules of engagement, Narayanan has been able to win over most of Nestlé India’s former critics, including the FSSAI, with which it is now collaborating to further the cause of food safety in India. This September, Nestlé SA set up a food safety institute (it has similar institutes in China and Switzerland) close to its R&D centre in Manesar, Haryana. The idea is to bring in Nestlé’s global best practices in food safety to stakeholders in the Indian food industry.

Begun under Narayanan’s leadership, another initiative empowers employees at the state level to interact with stakeholders like regulators and develop “environment sensing skills”. “Over the last year-and-a-half, we have empowered our more experienced people, who are well-versed with Nestlé, to serve as contact points with the local ecosystem,” says Narayanan. “Our people are constantly in touch with the local food regulators through training programmes and site visits. I am thereby sending a message that I have nothing to hide.”

“Suresh has immense experience dealing with varied markets across the global footprint of the company, and this manifests in the India operations as well,” says Prasoon Joshi, chairman of McCann Worldgroup Asia Pacific, and CEO and chief creative officer of McCann Worldgroup, India. Joshi worked closely with Narayanan when McCann was brought on board as the creative agency to design a messaging campaign during Maggi’s absence from the market and around its re-launch. “His calm and experienced approach is extremely valuable for stakeholders.”

*********

There is an opportunity in every adversity, and Narayanan utilised Nestlé India’s crisis to rework the company’s strategy for growth. From an earlier, disproportionate focus on maximising profits and rationalising the product portfolio, the mantra now is to aggressively grow volumes through new products.

![g_101093_nestle_mnc_280x210.jpg g_101093_nestle_mnc_280x210.jpg]()

Narayanan had told Forbes India in May 2016: “What we sell are packets or cases, not rupees. I always believe that market penetration and market share are driven by actual consumption of products, not just by increasing value through prices.”

Narayanan has stuck to his guns and has deepened Nestlé India’s penetration in product categories such as instant noodles, milk and nutrition, chocolates and beverages. In the last 18 months, the company has launched 42 new products (many from its global portfolio), and the Street is loving this new-found aggression.

“We like Nestlé India for its renewed focus on volume growth across categories driven by new product launches, which have started to yield results, as evident from a strong 9.5 percent year-on-year volume growth in H1 [January-June 2017],” write analysts Gauran Kakkad and Premal Kamdar in a research report by Haitong dated September 4.

“Based on the current management’s strategy of focusing on volume-led revenue growth aided by investment in advertising and promotional spending to maintain brand strength and new product innovation, we expect a revival in revenue growth rates in the medium term.”

The fruits of Narayanan’s labour are evident. After losing ground in 2015, Nestlé India’s sales are back to 2014 levels. The company reported a turnover of ₹9,159 crore in 2016, up almost 13 percent over 2015. But cost pressures and increased marketing spend have led to subdued growth in profits. (See Financial Performance)

The Haitong report says that Nestlé India’s product pipeline remains healthy and some of its recent launches have been successful, in turn aiding sales recovery from a 5 percent compound annual growth rate (CAGR) in 2011-2016 to an estimated 15.4 percent CAGR in FY2017-19. The brokerage expects Nestlé India to report an impressive CAGR of 22.8 percent in the same period.

Narayanan is aware that not all new products will be successful. But his logic is, if you don’t try new things, it is impossible to know what works. The message that he is trying to send across the organisation is that it is okay to fail. “As the leader of the company the buck stops at my door,” says Narayanan. “I am willing to take a rap if some of these new products don’t work. But it is in the larger interest of identifying new pillars of growth. If I am extremely risk averse, then I will just stifle the organisation.”

R Gopalakrishnan, a former director with Tata Sons and former managing director of Brooke Bond Lipton India, says Narayanan fits his “model of leadership to a T”. “He is accomplished, has delivered results, is affable, good at advocacy and authentic,” says Gopalakrishnan, who was Narayanan’s boss at Hindustan Unilever.

Gopalakrishnan recalls that during the merger of the tea brands Brooke Bond and Lipton, Narayanan played a stellar role in calming nerves among the field force. “There was a lot of anxiety as the field forces of two separate companies were merging. People like Suresh helped by putting their hands around the shoulders of colleagues and reassuring them that working together won’t be a problem.”

Narayanan is also conscious of the fact that while Nestlé India’s parentage is Swiss, it is inherently an Indian company, owing to its strong local connections. Nestlé India has around 7,500 employees and works with around 4 lakh wheat farmers, 15,000 spice farmers, 3,500 suppliers and 1,600 distributors in India.

One of the reasons why Maggi was able to quickly recover lost ground after being reintroduced was due to the strength of these connections. During the crisis, Narayanan had ensured that Nestlé India stands by these stakeholders, whose livelihoods had been impacted, by “nurturing them in terms of new business opportunities and training”.

Standing by his people is Narayanan’s old trait. Even when he was leading the company’s operations in Singapore in 2008, during the global economic slowdown when layoffs were common in many sectors, he ensured not a single job was lost at Nestlé.

It was no different in India during the Maggi crisis. As Narayanan knows well by now, when coming out of a crisis, it is all hands on deck, and the loyalty of his people is a leader’s biggest asset.

Image:Amit Verma

Image:Amit Verma