Chanda Kochhar: Rewiring a Behemoth

Having taken over at a turbulent time, Chanda Kochhar employed a back-to-basics strategy to bring ICICI Bank back to the path of sustainable growth and profitability

Award: Best CEO - Private Sector

Chanda Kochhar

MD & CEO, ICICI Bank

Age: 51

Interests outside of work:

It is inevitable. The head of the country’s largest private sector commercial bank, Chanda Kochhar, MD and CEO of ICICI Bank, will have a punishing work schedule. But the 51-year-old is particular about not letting it get to her. “I don’t allow the stress to overtake me,” says Kochhar with a smile, settling down to chat with Forbes India in her office in Mumbai’s Churchgate. “I am conscious of the challenge the environment brings and concentrate on managing it.”

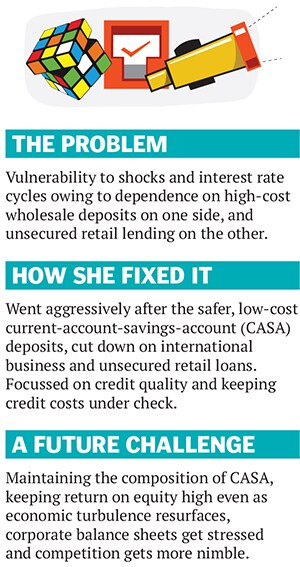

When she took charge in 2009, the Lehman Brothers-driven financial crisis had enveloped the world it threatened to impact ICICI Bank as well. It was stuck with some exposure to Lehman Brothers which, despite its miniscule share of just one percentage point of the bank’s total assets at the time, did create tremors. Further, the bank was overly dependent on wholesale deposits as opposed to lower cost retail deposits and was under pressure owing to its risky unsecured retail lending portfolio. As the environment worsened, investors and analysts began questioning the bank’s strategy of relying on these areas and its much-vaunted aggressive growth strategy was seen as a problem.

Cut to 2013. Things have changed quite dramatically for ICICI Bank, which today has an asset size of Rs 5.36 lakh crore, up from Rs 3.79 lakh crore in 2008-09, when Kochhar took charge. The proportion of low-cost current-account-savings-account (CASA) deposits has grown substantially, from 28.7 percent of the total in 2008-09 to 41.9 percent in 2012-13, adding stability to the balance sheet. Unsecured retail loans have reduced sharply, and the cost-to-income ratio is down from 43.4 percent to 40.5 percent over the same period. The focus on better management of risks has led to a dramatic improvement in credit quality, with the net non-performing assets (NPA) ratio dropping from 1.96 percent to 0.64 percent. Credit costs—or the cost of the provisions the bank makes against bad loans—declined from 2.2 percent of total assets to just 0.8 percent.

“The consolidation phase is over,” says Kochhar. “The things we did during that phase have given us the strength to get back to growth.” The investors too aren’t complaining, since return on equity on a consolidated basis has nearly doubled from 7.8 percent to 14.7 percent. On a standalone basis, the bank’s return on assets has also grown from 0.98 percent to 1.66 percent.

However, Kochhar knows that while stability has returned, the growth agenda will now need investment. “The way we benchmark ourselves is by adopting a three-pronged approach to business. We have to take the parameters of growth, profitability and risk management and try to be the best in these.”

Back to Basics

For a seasoned ICICI-Banker like Kochhar, moving away from the growth mindset of several years to one of capital conservation with profitability wasn’t going to be easy. But the business environment was getting turbulent. “The task was to preserve the legacy and strengths of the past and reorient to a different environment,” says Kochhar. “The need was to bring in change with continuity. We had to reorient the thinking in the minds of our people. How do we look at growth and profits in the new environment?” What she did was to strengthen the balance sheet by taking some immediate steps. “The intermediate steps were painful and it was important to understand...that the long-term plan was of growth and profits. The couple of years of pain were only in preparation for that,” she says.

Fundamental to Kochhar’s strategy was getting the hygiene factors right, moving to CASA-based banking for instance. “We decided that the funding strategy should move in tandem with the asset strategy. So we paid back a lot of wholesale deposits even as we were growing CASA. In fact, there was a time where the paying back of wholesale deposits was higher than the growth in CASA, so the overall balance sheet was shrinking,” Kochhar says, admitting to feeling embarrassed during bankers’ meetings at the time. “It wasn’t the most pleasant experience to sit there when others were growing at 15-20 percent and I had to say that my balance sheet has come down.”

It was a mixed strategy. On the one hand, costs were being cut and high-cost deposits were being shed. On the other, the branch network was being expanded. Internally, from a products-centric model where segmentation was done on the basis of deposits, home loans, car loans and the like, the bank moved to customer segmentation. Branch banking—seen as mundane—became the bedrock of the new ICICI Bank strategy. “Earlier, we focussed more on the large deals and were more centralised. The big change was to move transactions to the branches and empower them,” Kochhar says. Boring banking was fashionable again. For a bank which took pride in being futuristic and at the forefront of technology and innovation, this was as big a change as you could get.

By reducing dependence on wholesale funds, the bank also cushioned the impact of interest rate cycles. “At one time, retail deposits as a proportion of total deposits used to be less than 50 percent now they are over 70 percent,” points out Kochhar. “Further, within wholesale deposits, dependence on 10 large depositors is lesser than earlier. So we have granularised our deposits and focussed on CASA, which is more stable.”

ICICI Bank also began to prune its international portfolio as the global business environment turned hostile. It wound down its investment portfolio in the UK. The bank also took its feet off the accelerator as far as growth rates of overseas subsidiaries were concerned. The business environment apart, Kochhar also attributes this change to the regulators’ changing perceptions, where tightening controls meant greater focus on domestic rather than global business. “We decided instead to focus on the global companies which were doing business domestically,” she says.

Some analysts, though, feel the bank is still vulnerable on the international side. A report by HDFC Securities says: “Overseas business is a large chunk of the total business of the bank. Forex fluctuations, economic turbulences in areas of presence, etc, could hurt the bank’s overall profitability.”

Driving the Transformation

For someone who joined the bank as a management trainee in 1984, when ICICI was a development financial institution undertaking project finance, Kochhar was, perhaps, best placed to drive the transformation during testing times. Having been a part of the organisation’s top tier when it was aggressively pushing for growth under former MD and CEO Kundapur Vaman Kamath, Kochhar now had to think differently. Also, she had to communicate the new philosophy clearly to everyone so that the mindset percolated to the lowest levels.

“It was tough because while we were actually growing some parts of the business, we were cutting some others. But, net-net, the balance sheet was indeed getting smaller. The home loans, the secured working capital parts of the business, were growing,” she says. “We had to work that much harder to grow those sections of the business since the other parts were going down. But even with that much of effort, the balance sheet did shrink.” Consequently, while the bank’s outstanding advances in 2008-09 stood at Rs 2.18 lakh crore, the figure had dipped to Rs 1.81 lakh crore by 2009-10, before climbing back again from 2010-11 onwards. The bank now seems to be on comfortable terrain, ending FY13 with outstanding advances of Rs 2.9 lakh crore.

But while the changes were being put in place, the broader family of employees had to be convinced that things were fine that changes were being made to ensure that the bank was back on the path to sustainable profitability and growth. “I spent a lot of time communicating with people. I didn’t leave it to the next level and wait for it to flow down,” says Kochhar, who also helmed the merger of Bank of Rajasthan with ICICI Bank in 2010.

Mentored right

During this process, Kochhar drew on the lessons learnt from ICICI’s iconic chairman Narayanan Vaghul, as well as Kamath, both of whom have deeply influenced her career. Starting at ICICI around the same time Vaghul came to the institution, Kochhar made her mark early, being confirmed in her job three months ahead of schedule. Vaghul identified Kochhar’s talent quickly, and included her in a select team to drive the computerisation of ICICI. Several years later, Kochhar was instrumental in establishing the new banking entity in 1993, which later became the giant it is today.

But, in between, she had taken on several roles at the institution, heading the infrastructure finance and corporate banking business in ICICI, and building the retail business in 2000 as universal banking became the mantra driving the institution. By 2006-07, Kochhar was leading ICICI Bank’s corporate and international banking businesses at a time when Indian companies were aggressively making a mark on the global mergers and acquisitions landscape.

Between 2007 and 2009, she had consolidated her position as its joint MD and CFO. “Mr Vaghul had a vision for the institution. He could take transformational steps. He picked me to lead the banking initiative and told me this was the first time in 50 years that people were getting an opportunity to build a bank from scratch rather than setting up branches,” says Kochhar. “Mr Kamath, on the other hand, had the ability to spot trends ahead of others. He saw the retail trend and that of the globalisation of Indian businesses.”Kochhar’s peers hold her in high esteem. Says Vishwavir Ahuja, former India head of Bank of America, and now MD & CEO of Ratnakar Bank: “Chanda is a very bright, capable leader with admirable grit and determination. She is very focussed, and always has been so. Her personality traits are responsible for the success she has achieved.”

Recalling the bank’s earlier aggressive growth strategy when the economic environment was ‘secularly positive’, Ahuja, who has known Kochhar for about 17 years, says she has been responsible for recalibrating ICICI Bank towards greater cost consciousness, with a focus on asset quality. “Though she has grown in the earlier economic environment, she has realised the imperatives of today. I am strongly of the view that ICICI Bank’s prospects are very bright. She has changed the quality of the bank. She is the right person to lead the bank in these times.”

Back to the Future

While ICICI Bank is back on the path to sustainable profitability, Kochhar knows only too well that it is work in progress. Once again, the economic environment is witnessing serious headwinds and the bank will have to continue to do the right things to stay ahead of competition. While the bank’s profit after tax has grown from Rs 3,758 crore in 2008-09 to a much higher Rs 8,325 crore in FY13, with net interest margins (NIM) up from 2.43 percent to 3.11 percent now, it has to ensure it stays on the profits path.

But some analysts do warn about the prospect of competition from peers like Axis Bank, HDFC Bank and Yes Bank in the private sector. Public sector banks such as State Bank of India, Bank of Baroda and Punjab National Bank are also embracing technology and ramping up on the service front. ICICI also has to sustain its healthy CASA percentage over the long term, else there could be an increase in the cost of deposits, shrinking the overall NIMs.

Kochhar is aware of these. “As we grow, the task is to ensure that the basic principles of sustainability remain. We don’t want CASA to come down. We also don’t want credit costs jumping to beyond one percent,” she says. The growth strategy from here on would be built on profitability and risk management. But universal banking, which ICICI made fashionable ahead of most others, will still define it. “We are a universal bank and we will grow the businesses appropriate to the given environment. Today, housing, vehicle loans and working capital finance are good businesses which are growing. As and when the investment pipeline returns, we will get back to growing the project finance side as well,” she says.

For now, as the economy slows down, Kochhar hopes the bank, with its distribution network, funding profile, knowledge and skills base, will continue growing at 2-3 percent higher than the industry average. “If the industry in these times is growing at 14-15 percent, we are at 18 percent,” she points out.

The analysts are buying the strategy. “The bank’s substantial branch expansion in the past 24 months is expected to result in a more favourable deposit mix going forward. It expects the growth in advances for FY14 to be 2-3 percent above industry growth which at this time looks achievable,” HDFC Securities says. “Stable margins, tight cost control and contained credit costs will help sustain return ratios,” broking firm Edelweiss adds.

The hardest part of Kochhar’s job seems to be done. What does she have to look forward to as a leader? “There’s much that we have to do as a country and as an organisation. It is India’s growth that can give the momentum to banks to grow. The country should get back to the deserving levels of 8-9 percent growth and the banking sector to 24-25 percent levels. That’s what I look forward to.”

First Published: Oct 22, 2013, 06:21

Subscribe Now