Sensex and its budget moves

Knee-jerk reactions give way to fundamentals

16% is the rate at which the Sensex has compounded since 1979, when the index was introduced

16% is the rate at which the Sensex has compounded since 1979, when the index was introduced

Image: Punit Paranjape / Reuters

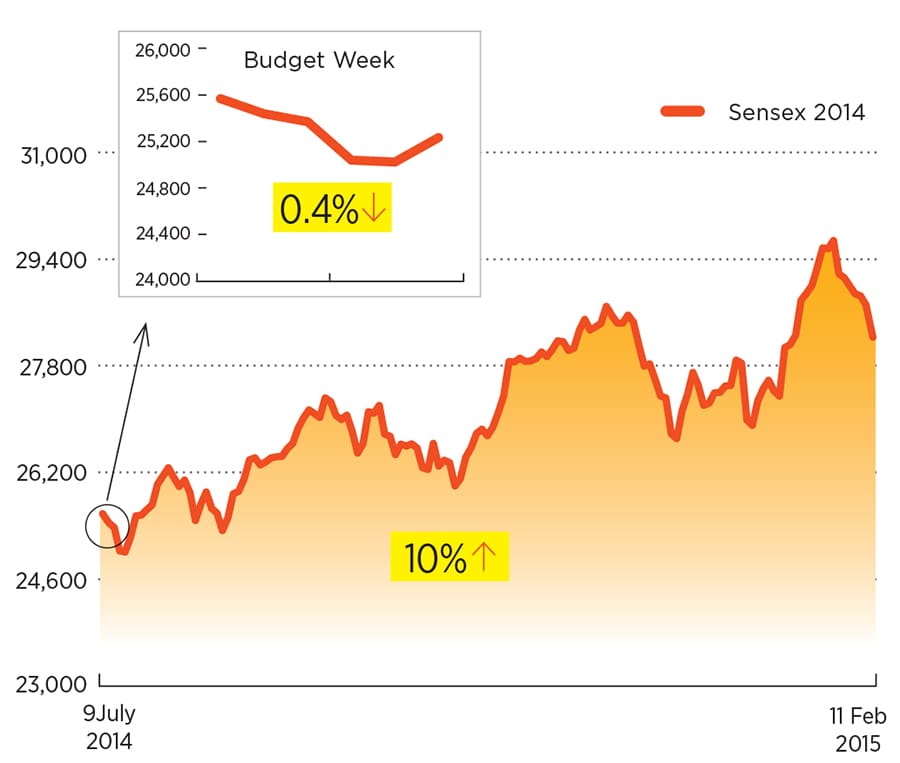

2014

One week later: The Sensex had an almost non-stop rally from about 17,000 when Narendra Modi was announced as PM candidate. The budget rally was tempered when Arun Jaitley failed to announce any significant policy changes. Over six months: While awaiting the NDA government's first full budget, the market continued to rally primarily due to the steep decline in oil prices. By hiking excise duties the government was able to sharply reduce the fiscal deficit.

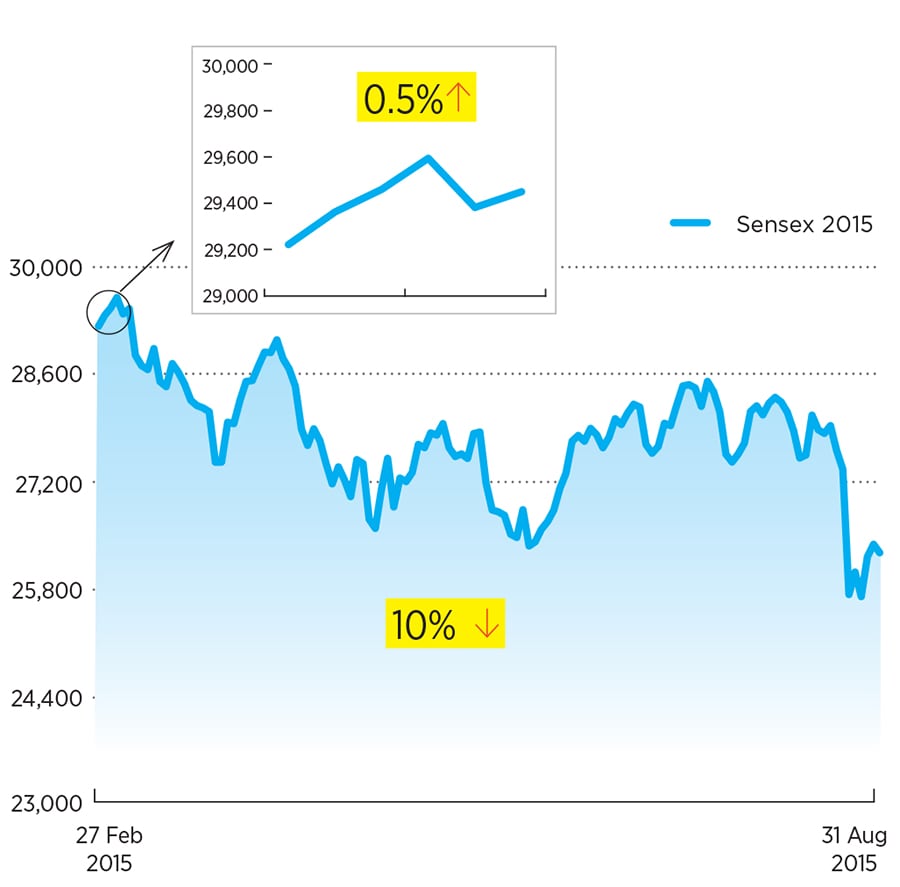

2015

One week: By 2015, the government, confident of a better fiscal position, was able to budget for increased spending. The NDA’s 2015 budget got a thumbs up due to the road map for the reduction in corporate taxes, a ‘housing for all’ push as well as a significant bump in the allocation for infrastructure spending.

Six months: While India’s macro position had improved significantly, corporate performance and the lack of earnings growth drove the Sensex down.

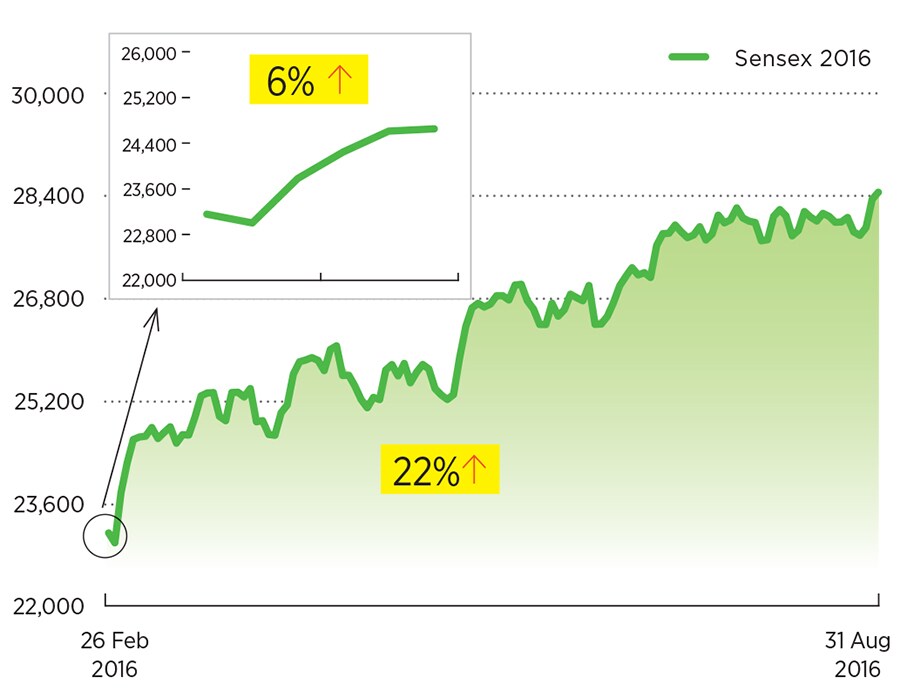

2016

One week: The period leading up to the budget had seen a brutal correction in the Sensex, which had fallen by 12 percent from the start of 2016. While the budget brought little cheer, the Sensex began rallying along with global markets as the US Federal Reserve indicated it would go slow on tightening.

Six months: The six months after the budget saw India enter a Goldilocks period of low oil prices, low inflation and low interest rates. Valuations expanded and the markets rallied even in the absence of earnings growth.  2017

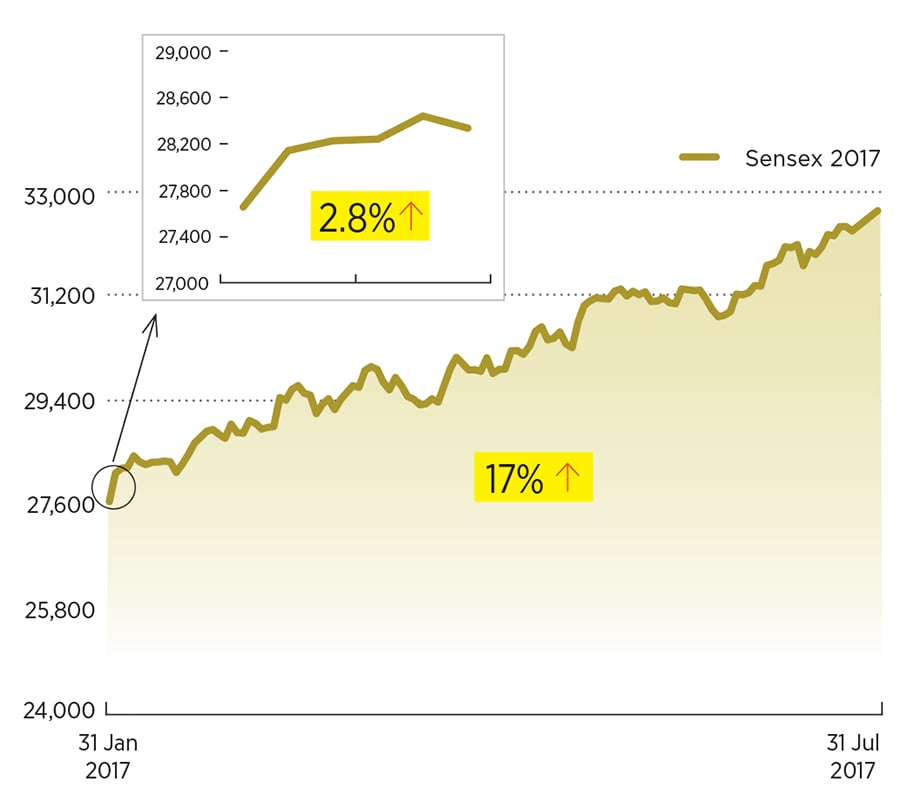

2017

One week: The Budget did little to pause the post demonetisation rally, which began in January 2017 after a steep fall the previous two months. Housing incentives were expanded and education and social sector spends were up while the subsidy bill came down—all of which the market liked.

Six months: Sensex valuations continued to expand as the market priced in a revival in earnings. Rising commodity prices aided earnings of oil and metal companies even as India’s macro position worsened. The selling by FIIs was made up by buying from domestic investors.

First Published: Jan 31, 2018, 06:58

Subscribe Now