Mudra: New name for old loans

Mudra loans were offered previously too, and if they are creating jobs now, they must have done so in the past as well

Image: Shutterstock

Loans categorised as Mudra loans have been one of the big talking points of the Narendra Modi government. It has repeatedly said that loans under the Pradhan Mantri Mudra Yojana have led to large scale job creation, but no data has been provided to substantiate the claim.

A recent answer to a question raised in the Lok Sabha, along with the reading of the annual reports of the Micro Units Development & Refinance Agency (Mudra) Ltd, punches holes in the claim of Mudra loans creating jobs. These loans are basically a classification: Loans of up to ₹10 lakh, given by banks (public and private sectors), small finance banks, regional rural banks, cooperative banks, microfinance institutions and non-banking finance companies to non-corporate, non-farm, small and micro enterprises, are categorised as Mudra loans.

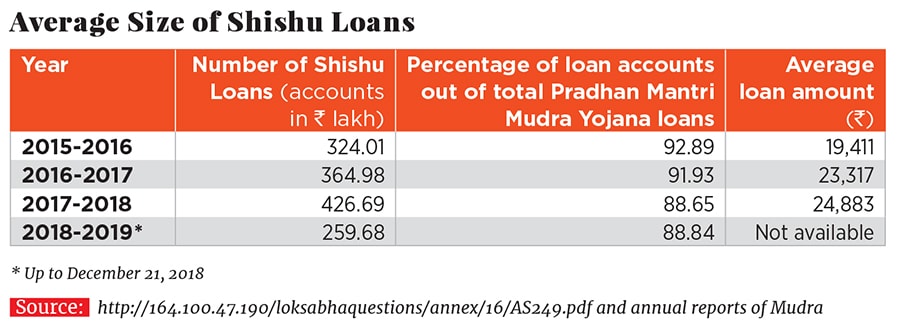

There are three further sub categorisations: Shishu (up to ₹50,000), Kishore (above ₹50,000 and up to ₹5 lakh) and Tarun (above ₹5 lakh and up to ₹10 lakh).

The accompanying table shows:

1. In the current financial year, Shishu loans formed around 89 percent of the loans categorised as Mudra loans. Between 2015-2016 and now, Shishu loans have formed 89 to 93 percent of Mudra loans.  2. In 2017-2018, the average size of a Mudra loan was ₹52,739. But this does not show the true picture because a bulk of the loans are Shishu ones. An average Shishu loan in 2017-2018 was ₹24,883.

2. In 2017-2018, the average size of a Mudra loan was ₹52,739. But this does not show the true picture because a bulk of the loans are Shishu ones. An average Shishu loan in 2017-2018 was ₹24,883.

Looking at the past growth, it is fair to say that the average Shishu loan in 2018-2019 would be in the range of ₹26,000-27,000.

3. Given this, it is worth asking: Does it just take an average loan of ₹26,000-27,000 to create jobs? And if that is true, why does India have all the unemployment and underemployment that it does?

4. Mudra loans are a classification, launched in April 2015. Even prior to them, financial institutions were giving out Mudra loans but they weren’t classified as Mudra loans.

The larger point is that if these loans are creating a lot of jobs now, they must have been doing the same then too.

5. As the Micro Units Development & Refinance Agency puts it on its website: “Mudra is a refinancing institution. Mudra do [sic] not lend directly to the micro entrepreneurs/individuals.”

In 2017-2018, loans worth ₹253,677 crore were categorised as Mudra loans. Of these, loans worth only ₹7,501 crore (2.96 percent) were refinanced at a lower rate of interest. Although that’s an improvement from previous years, the figure is very low. What this means is that even the basic idea behind loans being categorised as Mudra loans is not being fulfilled.

These loans were always given out, just that they have a new name now.

(Vivek Kaul is the author of the Easy Money trilogy)

First Published: Jan 14, 2019, 15:06

Subscribe Now