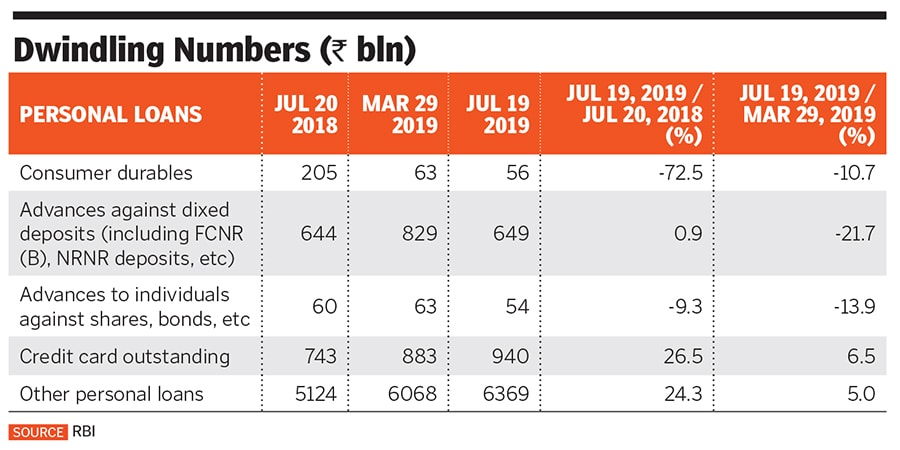

Leverage to finance consumption sees a sharp fall in growth

Growth in consumption-led loans saw a decline this fiscal year, according to recent data from an RBI report, and loans for consumer durables and automobiles registered negative growth

Image: Shutterstock[br] Over the past five years, Indian consumers have rarely shied away from setting aside a slice of their future income to buy a car, washing machine or a mobile phone. After all they had several lenders vying for their business. Now, as news of slower growth and job losses filters through the headlines, they’re holding back on loosening their purse strings.

Image: Shutterstock[br] Over the past five years, Indian consumers have rarely shied away from setting aside a slice of their future income to buy a car, washing machine or a mobile phone. After all they had several lenders vying for their business. Now, as news of slower growth and job losses filters through the headlines, they’re holding back on loosening their purse strings.

Growth in consumption-led loans—consumer durable loans, vehicle loans, personal loans—has registered a steep fall this financial year, according to recent data from the Reserve Bank of India (RBI). While all categories saw a decline in growth this fiscal year when compared to a year ago, loans for consumer durables and automobiles registered negative growth. Home loans, which were earlier growing at half the pace of personal loans, have now caught up.

Don’t expect a revival in consumer spending any time soon. The latest RBI Consumer Confidence Survey points to decelerating consumer confidence. It fell by 4 points in the latest readings released in August.

First Published: Sep 10, 2019, 08:15

Subscribe Now