Jewel in the crown: TCS still leads for Tata

Image: Shutterstock

Image: Shutterstock

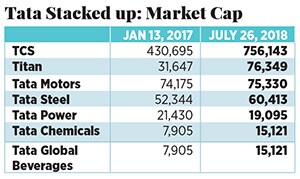

A year-and-a-half after N Chandrasekaran took over as chairman of Tata Sons, the group continues to be dependent on IT major Tata Consultancy Services (TCS), which has almost doubled in market cap and increased its dividend payout to the group. Titan has been another gainer.

An upswing in the steel cycle and the inking of a joint venture with Thyssenkrupp resulted in a re-rating of Tata Steel before debt concerns due to the buyout of Bhushan Steel saw it give up a fifth of those gains.

Tata Motors is at its lowest market cap in five years as domestic passenger car volumes fail to impress and the company continues to wait for the announcement of the Brexit terms.

One bright spot has been the sale of the loss-making telecoms business to Bharti Airtel marking its exit from the consumer telecom space.

First Published: Jul 30, 2018, 14:07

Subscribe Now