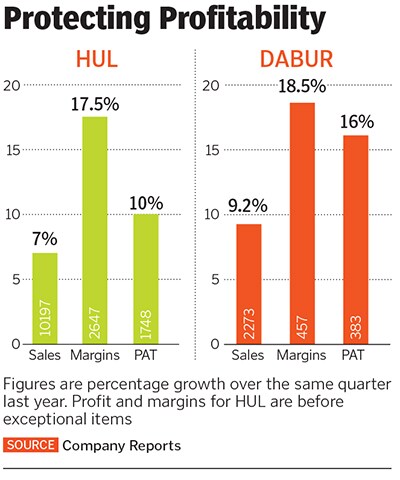

Consumer goods companies show steady gains

Even as sales have slowed, benign commodity prices have allowed companies to protect margins

Image: Shutterstock [br]A slowing market for consumer goods companies has entered its third quarter and, for now, there is no end in sight. As quarterly results came in, it’s clear that rural markets continue to decelerate, some urban consumers are shifting to lower value packs and companies are going slow on increasing advertising spends. Volume growth at Hindustan Unilever was the slowest in seven quarters. “We haven’t seen any pick-up in demand in the first three weeks of July,” said Sanjiv Mehta, chairman and managing director at Hindustan Unilever.

Image: Shutterstock [br]A slowing market for consumer goods companies has entered its third quarter and, for now, there is no end in sight. As quarterly results came in, it’s clear that rural markets continue to decelerate, some urban consumers are shifting to lower value packs and companies are going slow on increasing advertising spends. Volume growth at Hindustan Unilever was the slowest in seven quarters. “We haven’t seen any pick-up in demand in the first three weeks of July,” said Sanjiv Mehta, chairman and managing director at Hindustan Unilever.  While demand has been muted, benign commodity prices have allowed companies to protect margins. Both food and crude prices have stayed low keeping product as well as packaging costs in check.

While demand has been muted, benign commodity prices have allowed companies to protect margins. Both food and crude prices have stayed low keeping product as well as packaging costs in check.

With strong brands in place, companies have chosen to protect margins: For the last five years they have risen faster than sales. At Hindustan Unilever, margins have risen from 16 percent in the year ended March 2014 to 23 percent in the year ended March 2019, a CAGR of 13.1 percent. At Dabur and Marico, they are up by 9.4 percent and 11.3 percent respectively.

First Published: Jul 31, 2019, 11:56

Subscribe Now