Banks go stress-free

Most report higher profits and lower NPAs, but experts say concerns like Mudra-linked bank loans remain

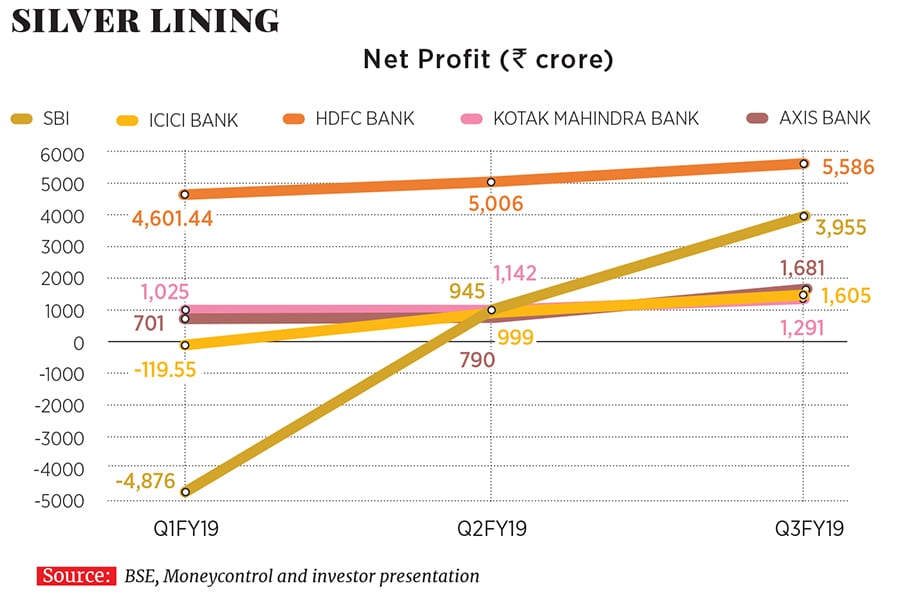

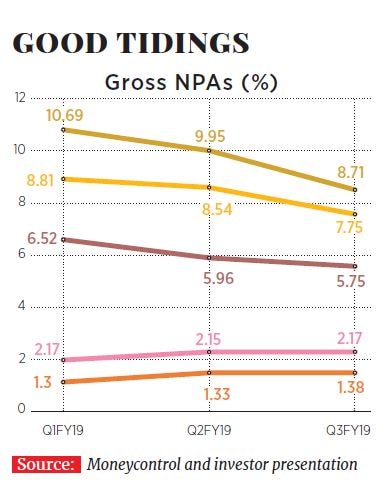

For the first time in months, data on bad loans and profitability is starting to prove bankers who had said “the worst is over” right. Most of the leading private sector banks, including Axis, Kotak Mahindra, HDFC Bank and ICICI Bank, and state-owned heavyweights such as State Bank of India (SBI) and Bank of Baroda have reported higher profits and lower bad loans for the quarter ended December 31, 2018.

“This is the end of the stress cycle,” says Yuvraj Choudhary, research analyst at Anand Rathi Securities, a financial services firm. “The bad loans are coming down and slippages are at multi-quarter lows.”

The SBI said total slippages for the quarter were at ₹4,523 crore against ₹10,725 crore in the corresponding previous quarter. ICICI Bank’s fresh slippages are at a 14-quarter low at ₹2,091 crore in Q3FY19 compared to ₹3,117 crore in Q2FY19.This shows that unlike the period between 2009 and 2014 when banks lent aggressively and did not do the necessary due-diligence, they have been far more prudent in lending.

Another factor for lower non-performing assets (NPAs) is that for banks, their already recognised slippage ratios are starting to come down. Credit growth, too, has improved which has helped lower the percentage of gross NPAs (to gross loans). Gross bank credit was at ₹82.4 lakh crore on December 21, 2018, compared to ₹73.05 lakh crore a year earlier, according to Reserve Bank of India (RBI) data, indicating a 12.8 percent jump.“Credit growth, lower fresh slippages and resolution of some bad assets are bringing down the bad loans percentage,” says Dhananjay Sinha, head (institutional research), Emkay Global Financial Services. “The intensity of the pressure of NPAs is definitely easing.”

Three banks—Bank of India, Bank of Maharashtra and Oriental Bank of Commerce—are out of the Prompt Corrective Action (FCA) framework, which means various curbs to lending and expansion of business have been lifted. Finance Minister Piyush Goyal said more banks—in the list of 11—will be out of the PCA. Choudhary believes this could happen in six to 12 months.

That doesn’t mean everything is hunky-dory. Choudhary and Sinha believe stress in the form of NPAs will be seen under the Pradhan Mantri Mudra Yojana (PMMY) and other agriculture loans. The RBI has cautioned that the bad loans under PMMY have risen to ₹11,000 crore from ₹3,790 crore in FY17.

SBI and HDFC Bank continue to face stress on this front.

First Published: Feb 11, 2019, 14:41

Subscribe Now