Social Networking: The Corporate Value Proposition

This article takes a look at social media's value to C-Suite decision makers

Marketers habitually find it hard to quantify the value of what they do, and their use of social networks is the latest manifestation of this difficulty. Why is it so hard to determine the business value of social networks? This article explores the slippery slope of coming up with a useful ‘social media ROI’ and offers new ways to understand social networking’s value proposition.

Almost two years ago, in an article in the July-August issue of the Ivey Business Journal, “Social Networking: The View from the C-Suite,” we wrote that, “Many managers today are uncertain about what social networking really means, how it fits their business strategy, and most importantly how they can define its practical value to the business.” How little the world changes! Despite two years of increasing corporate social media activity, our research is telling us that the C-Suite is still finding it extremely hard to define their organization’s value proposition for social media.

eMarketer, a U.S.-based firm that provides research and analysis of digital media, recently reported that 175 chief marketing officers were asked to identify social media activities with the highest Return on Investment. Most did not know the return (“Dramatic Difference in Approach to Social Media Metrics”, Feb 8, 2011). Even ‘Facebook’ and ‘ratings and reviews’, the two features rated as having the greatest ROI, were only so rated by about 15 percent of respondents. Other researchers have recently told similar stories. We agree with eMarketer, that, “The ROI question is still not answered”.

This article takes a further look at social media’s value to C-Suite decision makers. How can executives quantify the benefits of fostering customer engagement and brand? How can they impute value to transforming influence? How should real-time, collaborative dialogue between the company and customers and vice versa best be expressed as a value proposition?

1. Rethinking how marketing views social media

Given marketing’s prominence as an expense category, the C-Suite has long wrestled with the question, “What is our return on marketing?”.

To test the question, we asked a number of practitioners how they measure the value of social media and what sort of results they were seeing from its use. We found the answer can all too easily default to marketing goals rather than specific metrics and results. Certainly, goals are a valid conceptual starting point, especially for social-media measurement beginners. Indeed, failure to identify goals before selecting metrics frequently leads to underperformance.

However, goals can only take us so far in defining and assessing the value of social media, and they will likely be insufficient when we have to make operational marketing decisions. If executives are to deliver on brand promises, they need a deep understanding of customers, one that can be gained from evaluating customer behavioural data at a granular level.

Finding actionable metrics

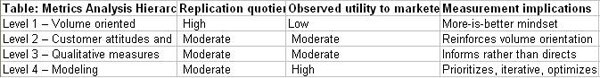

Analysis of customer data and other metrics has been evolving through a hierarchy of increasing sophistication (see the accompanying table): LEVEL 1 – Volume oriented

LEVEL 1 – Volume oriented

Traditionally, marketers wanting to address operational matters have taken a more quantifiable approach, using metrics that have tended to be volume-oriented. Typical examples are: number of followers, traffic driven to the website, community traffic hit rates, page openings, click-throughs, time spent on-line, responds vs. non-responds, postings and comments, conversions, and units sold. Volume-oriented metrics are undoubtedly useful, but relied on by themselves they can foster a ‘more is better’ mindset. They also tend to provide only a partial answer – flagging increases or decreases in customer activity without actually telling us what to do. Our view is that volume-oriented practices limit value for decision makers in the C-suite.

LEVEL 2 – Customer attitudes and needs

Limitations of volume metrics have led behavioural marketers to examine customer attitudes and needs more closely. Metrics include: customer satisfaction, cost-of-acquisition, brand awareness, brand competitiveness, and brand likeability. The ‘net promoter score’ is an indicator of customers’ attitudes derived from measuring the customer’s likelihood to recommend the firm or product to others. These metrics bring a more qualitative view of customers but they still can reinforce volume oriented thinking and thus inadequate as proxies for quantitative insights. Naturally, the more longitudinal the data become over time, the more relevant they will be to those who really want to know ‘what happened’. Our view is that a more holistic view of the customer, one provided by a social media microscope, offers considerable promise. But a lack of consistent data, historical bases, sharing standards, and transparency will keep it off many C-suite dashboards.

LEVEL 3 – Qualitative measures

Some marketers in this ‘advanced’ category optimize their operational practices and brand- execution value proposition the same way that they work to optimize their ad spend. This has led to use of qualitative measures to support operational questions like: What are our customers’ individual needs? How good are our insights into the way our customers regard and connect with our brand? How and when can we best engage our customers and enlist them as collaborators? How innovative, differentiated, and resilient will our brand continue to be in these commoditized and competitive times? Our 2009 article gave some examples of social media qualitative metrics that bear repeating: customer share of wallet, reasons for changes in composition of customer lifetime value and satisfaction, channel effectiveness related to customer needs, and effect of time to market, pricing power, and brand equity. The aim is to get dynamic insights into brand engagement, audience captivation, level of interest, and content curation – why people buy, what triggers a stretch-purchase, who the key influencers are, and what strengthens relationships? Until these questions can be answered adequately, these qualitative measures will inform a C-suite member’s decision but not direct it.

LEVEL 4 – Modeling

There is an emerging fourth level in the hierarchy, modeling planning-related data. This is so far a relatively underdeveloped (and under-automated) aspect of marketing practice. As discussed in the rest of this article, it involves creating social media analytical models that synthesize the complexities of both volume and qualitative data – with value projections, iterative ‘what if’ calculations, decision criteria, and prioritization of activities. The challenge for modellers is to eliminate the bias inherent in the mathematics underlying the business-as-usual mix optimization models that have been in use for over 30 years now. A message to econometricians: it is no longer business as usual so stop running those forecasts. More than any other decision makers, marketing planners tend to get this.

Empirical results from brand lifecycle activities example: Mark Daprato, VP, Marketing at Swiss Chalet, measures “the social media cost of acquiring a fan, the incremental benefit of unpaid content compared with paid clicks, and soft benefits like fan responses to an on-line customer complaint posting” that together provide social media value added. He adds that brand lifecycle only delivers a return when you reach the affinity stage with customers.

Level 4 (modeling) in our view is the most robust — and is essentially the platform on which the rest of this article is based.

Actual measurement practices in supporting specific brand planning can often be somewhat experimental. Examples related mainly to the first three levels are illustrated in the boxes containing comments from three of the leading marketers we spoke to. Their comments reinforce the understanding that a combination of quantitative and qualitative marketing measures helps the marketer improve interaction tone, quality, and benefit to the customer – not just in social media but across the full spectrum of the business.

2. Sales lift vs. customer relationship value lift

Modelling is not just for use in internal marketing. It can also to be used to answer questions posed by the other members of the C-Suite about those value-specific marketing activities that deliver value for the organization. Marketers should avoid overwhelming their colleagues with too much data, but they do need to provide a convincing justification for social media investments. They also need to distinguish the implications of sales lift from relationship lift.

Opportunity cost example: Frank Trivieri, GM Canada’s General Director, Marketing, says that social media is not just a mechanism that gets the message out but one that “enables us to listen closely to the customers.” He is mindful of the opportunity cost from not doing this – “If we don’t connect effectively in social media channels, we will miss out on key conversations and opportunities to engage people who may never have had GM on their radar before.” Trivieri uses a commercial measurement tool to track net positive/negative comments, to augment traditional audience activity metrics like increases in numbers of pages viewed, brand scores, etc. and has established a cross-functional social media council at GM Canada to ensure that the company remains relevant and accessible.

Sales Lift

Marketing analytics historically has tended to be more about product than customer, i.e. incremental units sold or, less helpfully, incremental ‘conversations’. Some in the leader category of brands claim to be able to map the connection from creating demand awareness to a conversion. But in social media it is hard to find anyone able to seamlessly replicate the process that got the consumer there the first time. Hard results from specific promotional activity are often easier to measure than soft benefits from improved relationships. We would like to see this reversed.

A typical product-planning model is based on the direct marketing deal – for example a coupon or a price cut, maybe backed by a print or TV advertising campaign. It is not surprising that many of these models originated in the advertising industry.

Several social marketers we spoke to have found it quite difficult to adapt traditional advertising interaction models to on-line interactions, even when deal-based. Perhaps, insufficient on-line history has yet been accumulated to refine their model assumptions.

The promotional approach to social media appears to have staying power. Our research indicates that companies posting deals on social media generally express satisfaction with results, claiming the direct marketing approach is generating incremental sales and customer receptiveness.

Tools to Support Product or Service Promotion

Promotional activities are also the foundation for many social media support tools, reflected for example by deal-based web sites like Groupon, or Facebook, Twitter and other popular sites whose facilities are used, among other things, for posting promotions.

New social media tools are constantly being introduced to support campaign management and advertising planning, a lot of it geared toward automating and standardizing the workflow and business processes supporting them. We spoke with two firms providing analytical services that include ROI calculations for their tools.

Value to the customer (rather than just to the organization) example: Uwe Steuckmann, Loblaws Senior VP of Marketing says, “Value to the customer is based on providing useful information to people who chose to interact.” Loblaws is focusing not so much on return on investment as return on attention (“is it important enough to interrupt someone in this world of ‘free’?”). Steuckmann notes how easier email results are to measure, with metrics like ‘was it opened?’, ‘was it clicked through?’, or ‘was it forwarded?’ and is still looking for a really good social media equivalent.

e10egency’s The Drum Platform is an Oakville, Ontario-based web service that combines direct marketing and social media sharing. Managing Partner Derek Lackey characterizes the approach as “stop pretending when what you really want is to sell”. His calculations are based on customer conversions, “driving traffic rather than just getting eyeballs.” He explains that “value computations are derived from marketing benefits like increased response rates and tracking campaign performance – but also from value imputed to marketing activities such as building opt-in email lists, identifying key brand influencers, collecting additional data about customers, and improving organic rankings.” His point is that, “You can expect direct measures as well. Indeed you SHOULD expect direct measures. In the mass marketing era, the owners of the media had a strong commitment to not being too measurable. In the Google Age no such commitment exists. Now we can be more accountable.”

Crowd Factory, a San Francisco-based customer acquisition web solution, also expresses value in terms of conversion. Sanjay Dholakia, Crowd Factory’s CEO, says that “benefits tend to come in two primary ways: amplifying the brand for existing customers and acquiring new customers.” The result is the ability to engage and retain customers in a more powerful way. “We seek revenue lift by having customers spread the word rather than having to spend marketing budget on paid clicks. The conversion rate on social traffic,” he adds, “tends to be at least three to five times higher than other traffic.”

Promotions and Relationships

Few of the companies we spoke to use social media exclusively for promotional deals. It seems that with social media, many companies that rely heavily on promotional deals are also active relationship builders, reflecting apparent widespread recognition that not using social media to build relationships is to miss the larger opportunity. As Crowd Factory’s Dholakia put it, “if companies are just using social media as another sales channel, then they are not taking full advantage of the powerful relationship benefits on offer.”

For example, an airline that has been using Twitter to pump out information on last-minute deals also uses Twitter extensively for one-to-one interactions. Its passengers say that last-minute deals are something they really want to have brought to their attention they also say that their ongoing personal connection with the airline is very important to them.

It should be noted that some companies do not post deals on social sites at all, such as Swiss Chalet. “Many product marketers are not deal-centric,” Mark Daprato of Swiss Chalet points out, citing Coke and Pepsi as well as Swiss Chalet. “Our brand would be diluted if we were thought of by the social media community as a discounter.”

Relationship Lift

Some social marketers have started value computations by measuring social media value in the aggregate, much as many promotional models do. An example of a simple aggregate relationship value model is an estimate of enterprise value before a given marketing activity compared with value computed afterwards.

Others adapt traditional one-to-one relationship engagement models to social media. A bank’s analytics manager told us he is doing this to evolve a longer term conversation and make ‘social’ the medium of customer choice.

Analysis has tended to become more granular over time, i.e. at a more detailed, transactional relationship level – such as for loyalty card responses, propensity, attrition, fraud, attribution, lifestyle segmentation, or event triggers – with calculations evolving from computations of groups of customers, down to individual customers’ current value, and then to individual customers’ net present value.

If product sales lift is the currency for the promotional use of social media, what then might be the equivalent for a relationship approach? For Ian Barr, Vice President of RocketXL, a unit of the EdC marketing agency network, the brand objective typically is the driving force. This often refers back to optimizing customer lifetime value, a concept many marketers have relied on over the years but in a social networks world have had little ability to re-create in any meaningful way. Customer lifetime value holds considerable promise to marketers who are trying to provide senior leadership with a long term driver of decision making.

Aaron Magness, Senior Director – Brand Marketing & Business Development of Zappos, the Las Vegas-based clothing and shoe distributor famous for uncompromising on-line service, told us that Zappos’ social media investments build relationships. “We think about future relationship value compounding just like the time value of money. We build customer value similar to the way others build cash net present value,” he told us. “Metrics designed just for same day, or even for same month, results will tend to produce a lower return over time. Short term effects do not matter as much as long term value creation.”

RocketXL’s Barr points out the importance of prioritization in sustaining a brand’s increase in value. “The old style was to grow the value of a customer through a huge investment in paid media,” he observed. “This leaves little budget for social media measurement especially since there is so much that can be measured. Today, web brands can be overwhelmed by the number of fans as well as the amount of data.” For Barr, measurement is an ongoing examination of which data points yield the significant findings that enable marketers to keep relationship and brand values moving forward.

This will take on increasing importance in the future, given Morgan Stanley’s recent estimate that global internet ad spending is growing at a 40 percent rate.

3. A Social Analytical Model for Smart System Planning

Advanced social analytical model examples

These are tools that aim to provide a more accessible and analytical picture of grass-roots opinion and future activity around a brand than traditional focus groups.

Smart System Planning

We believe that ‘smart system marketing planning’ will become a very new way for executives to take in the past, present and future of a company’s ability to plan, forecast and measure the effectiveness of their investment in marketing. It is ‘smart’ because it is self-actualizing and self-sustaining. It is a ‘system’ because it is technologically-borne and close-looped. It is ‘marketing’ because it addresses all aspects of marketing strategy and operations new and old. It is ‘planning’ because it reinvents the function and new role as the ultimate site of collaboration for all business planners – within a company and with all those in the marketing value chain.

At the heart of smart system planning is modeling the value proposition. This helps clarify the core rationale of social media, especially finding influencers, taking collaborative approaches, and fostering brand interaction – leading to relationship engagement and transformation – and then to building deeper relationships that sustain brand value.

As Susan Smith of the strategic communication firm, Livewire Communications, puts it, “the key is to identify the factors that will produce a shift in brand mindset”.

The Business Impact Model

We have used business impact models to create marketing business cases during more than two decades, translating specific measurements selected case by case. The models are essentially customized payback calculations that use assumptions about customer behavioural implications derived from previous experience.

The models typically provide quantified estimates of potential economic benefits, often revenue lift or cost reductions in spreadsheet format, and include forecasted ROI.

Successful business impact models generally include the following characteristics:

4. Getting from marketing planning to financial payback

Today, just as we wrote two years ago, “senior decision makers can no longer avoid facing the challenge of knowing how to use the data to judge the depth and characteristics of interactions and brand perceptions”. How this is done could have far reaching implications for the future direction of marketing.

Better analysis of the value of social media could help head off any incipient business tensions between chief marketing officers and the rest of the C-Suite.

We see risks of moving in the other direction if social media is widely used simply for posting deals on Facebook and Twitter. In other words, promotion-skewed business processes could dominate social media (and cross-platform) planning practices, sending social media eventually back to a traditional product/service push and a ‘compete on price’ mindset –messages sent to the mass market rather than conversations to build one-to-one relationships.

Marketing can lend a business model-building perspective to all of the chatter around what collaboration really is, thereby optimizing the value of customer relationships This would see social media firmly established as mainstream for Canadian executives seeking to discern the differences among alternative relationship planning options competing for restricted marketing resources.

As is the case with all of the practices we have reviewed in this article, the greatest obstacle to developing a smart systems view of social media is that change-resistant marketers will cause C-suite members to resist adopting it.

Reprint from Ivey Business Journal

First Published: Jan 04, 2013, 06:00

Subscribe Now