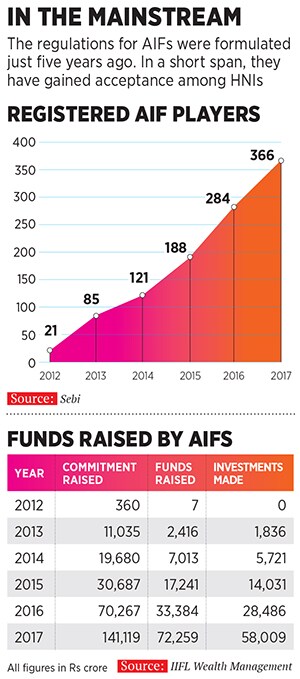

Compare this with mutual funds, equity derivative products and portfolio management schemes (PMS), which took longer to gain favour. Also, consider the fact that in half a decade, the number of players in the AIF space has risen to 366, an over-17-fold jump from 21 in 2012. This trend has been underpinned by the increasing tribe of billion-dollar fortunes in India—119, according to Forbes’s 2018 list of the World’s Billionaires.

undefinedNumber of players in the AIF space has jumped over-17-fold since 2012[/bq]

A range of AIFs has been launched by institutions ranging from Avendus Capital, IIFL Asset Management, Edelweiss and Reliance Capital to newcomers like Axis Mutual Fund, Lake Shore India Management and Old Bridge Capital Management. Mirae Asset Management has also indicated its keenness to enter the space.

India’s market regulator, the Securities and Exchange Board of India (Sebi), has identified three categories of AIFs. Category I AIFs include startup, early-stage venture funds or infrastructure funds category II includes real estate funds, private equity, debt funds or funds for distressed assets. The third includes funds with diverse trading strategies, hedge funds or ones with an eye on short-term returns.

Some fund houses in India and overseas only create an ‘alternatives’ division, within which their PMS or AIF schemes operate.

PMS requires a minimum investment of ₹25 lakh per investor, while it is ₹1 crore for AIFs, according to Sebi norms, making the latter a well-suited product for high networth individuals (HNIs).

In recent years, domestic investors have flocked to mutual funds emboldened by a buoyant equity market, but fund managers were always aware that there were ‘missing pieces’ in the investment pyramid, which had to be explored.

“The long-short position could not be structured in a mutual fund,” says Prashasta Seth, CEO at IIFL Asset Management. (The long position refers to investing in a security with the expectation that its asset value will appreciate, while in a short position, the investor anticipates a decline in asset value.) “Further, mutual funds operate in the listed space, while some AIF instruments invest in unlisted stocks,” says Seth, who has, earlier in his career, managed structured debt products for JP Morgan in London.

IIFL, which like most fund houses has a presence across all three categories, has raised nearly ₹16,500 crore through various AIFs (both active and matured schemes) since 2013. Seth explains the extent of innovation that went into structuring the various schemes. One of the earliest ones, in 2013, was the Asset Revival Fund, which was a long-only, category III scheme, investing in “beaten down” assets that were languishing at what IIFL felt was lower than their intrinsic value.

“That period was a very difficult one to bring people into the equity markets we felt that cyclical stocks will do well and also looked for some infrastructure and diversified companies such as L&T and Voltas,” Seth recounts. This was the phase where India’s GDP growth slowed to 4.5 percent in FY13. The Asset Revival Fund, now a matured scheme, raised over ₹245 crore and closed in the same year (2013), giving investors returns of around 23 percent.

IIFL has since made a mark by creating investment opportunities at the pre-IPO stage. It launched its IIFL Special Opportunities Fund in 2017, which has run into several series. “The idea was to invest before and during the IPOs of various private companies. This was an area that was untapped,” says Seth.

India’s IPO market witnessed a bumper year in 2017 with several insurance companies such as General Insurance Corporation (GIC) and ICICI Lombard listing on the bourses, besides exchanges such as the BSE and the Indian Energy Exchange (IEX) also going public. Earlier, fund managers would look to buy pre-IPO shares in the secondary market from private equity players, who were seeking an exit route.

But the IIFL Special Opportunities Fund invested primarily in companies at the pre-IPO stage or in the IPO as an anchor investor or as a qualified institutional buyer (QIB). The fund, across various series, has raised over `6,800 crore and invested in companies such as ICICI Lombard, IEX, mobile game developer Nazara Technologies, NSE and NSDL e-Governance infrastructure (NEGIL).![g_104379_prashastaseth_iifl_11copy_280x210.jpg g_104379_prashastaseth_iifl_11copy_280x210.jpg]() Prashasta Seth, CEO, IIFL Asset Management. The company's immensely successful Asset Revival Fund had bet on "beaten down" assetsIIFL is not alone in spotting the opportunities in the AIF space. Edelweiss Asset Management is a key player to reckon with, but with an investment philosophy of its own.

Prashasta Seth, CEO, IIFL Asset Management. The company's immensely successful Asset Revival Fund had bet on "beaten down" assetsIIFL is not alone in spotting the opportunities in the AIF space. Edelweiss Asset Management is a key player to reckon with, but with an investment philosophy of its own.

“We are clear there is no separate AIF strategy. What we have is an asset management strategy, using an AIF platform,” says Nitin Jain, CEO, global asset and wealth management at Edelweiss Financial Services, which now has over ₹6,500 crore as assets under management (AUM) in AIFs through various schemes. A further ₹12,000 crore would have been raised as “other alternative assets” through offshore vehicles.

Jain says Edelweiss in January 2018 launched an Infrastructure Yield Plus fund, which aims to raise ₹2,000 crore with an offshore greenshoe option of a further ₹4,500 crore.

The fund, though focussed on infrastructure, will buy into high-quality operating assets like highways, transmission and renewables (mainly solar), where the National Highways Authority of India, NTPC and Solar Energy Corporation of India are counter parties. Jain sees potential in quality operating assets instead of trying to invest in under-construction assets with high risk.

“This is probably the first-of-a-kind product in India,” he says, as this fund hopes to generate mid-teen returns for investors. Edelweiss in the AIF space uses a mix of debt, credit and long-short products, Jain says.

In the alternatives space, Edelweiss has been working on different strategies. In late 2016, it acquired the Alpha Fund, from Ambit. The objective of the Alpha Fund, a category III AIF, is to produce absolute returns through both long and short strategies in equities.

“Irrespective of market conditions, we try and deliver 12-15 percent returns to investors. For the last 15 months, we have not had a negative month, even in February when the indices fell about 6 percent the fund’s NAV was up one percent. So while one may not see a sharp 30 percent return, we ensure that even in the worst case, there will not be a dip,” Jain says. The fund now has ₹1,300 crore AUM.

Edelweiss also runs a long-bias fund called the Edelweiss Active Equities fund. With a concentrated portfolio, it identifies investment opportunities in “special situations” such as buybacks, de-listings, open offers, rights issues and hedging. “This is done to create an extra alpha [a measure of how a fund performs compared to its benchmark],” says Jain, so that on the downside, investors do not lose more than the market and on the upside, returns should be matched or outperformed.

Edelweiss, in its asset management strategy, continues to identify bluechip companies which generate earnings growth, whose leverage levels are low and have a moat (companies that have a competitive advantage over rivals and whose business models cannot be copied). “We are market agnostic, so our funds will mostly be invested in large-caps and mid-caps,” says Jain.

![g_104381_riseofaif_280x210.jpg g_104381_riseofaif_280x210.jpg]()

As with all businesses, smaller and newer players cannot be ignored. There is a strong new challenger to larger players in the AIF space. Kenneth Andrade, a former IDFC AMC veteran, who set up his own asset management company, Old Bridge Capital Management in 2016, is tapping into the AIF space.His company’s fund, Vantage Equity Fund, a three-year, close-ended, category III AIF, is in its second tranche and invests in companies with previously depressed valuations in the manufacturing, agriculture and engineering businesses.

“I play to my domain expertise,” Kenneth tells Forbes India. The fund, which already has 700 investors, has collected over ₹750 crore and is likely to raise another ₹300 crore. Andrade, true to his well-known investment strategy, will focus on mid-caps and stay away from investing in companies that are highly leveraged. “Once this trance of investment is complete, we will come back to the drawing board and look at newer strategies,” he says.

Another new player in the AIF space is Axis Mutual Fund. Seeking to offer its HNI investors a new set of products to invest in, it has launched the Axis New Opportunities fund, a close-ended category II AIF, which plans to raise ₹750 crore and an additional similar amount through a greenshoe option. HNIs will seek to invest in diversified listed equities, which could be in the space of financials, consumer, select IT and technology companies.

Axis has another new fund planned, a real estate, yield-oriented fund, expected to be launched in the April-June quarter of 2018. “Our strategy is to be a full services player, where we will continue to differentiate offerings,” says Ashwin Patni, head of products at Axis Mutual Fund.

Several other fund houses such as KKR-controlled Avendus Capital, led by former Ambit Investment advisory head Andrew Holland, are focussed on several hedge fund products. Holland and his team through various schemes are learnt to have raised close to $1.4 billion in India through equity-based alternative funds.

Fund managers will be expected to continue to curate newer products for wealthy investors. “AIF is nothing but a bespoke product created for a set of people who believe in a certain macro theme,” says Rakesh Singh, who heads private and institutional banking and the capital markets divisions at HDFC Bank. Singh feels that AIFs would be better products for ultra HNIs, rather than HNIs. “For an HNI, these products make little sense, they should play with products which have a lower risk spectrum, such as PMS/ conservative or direct equity,” he says.

Most of the experts Forbes India spoke to continue to be bullish on India’s economic growth story. From an HNI perspective, with all the demographical advantages that India offers, there are few other investment destinations to choose from, barring China. “Most of the institutional and wealth investors and family offices take a broader 10-15-year view on a country. India is getting its due under the sun. You cannot bet against India,” says Jain of Edelweiss.

So even as newer products emerge in the AIF space, the entry of more players will only make products diverse and concentrated at the same time. “India is at the start of the bell curve for wealth management opportunities,” sums up Singh from HDFC Bank.

Nitin Jain, CEO, global asset and wealth management at Edelweiss Financial Services. The AMC manages around ₹6,500 crore in AIFsWhen Finance Minister Arun Jaitley in his 2018 Union Budget speech spoke about measures to improve and strengthen investments into Alternative Investment Funds (AIFs)—particularly venture capital funds and angel investors—it sent out a signal. AIFs, whose regulations were formulated just over five years ago, have evidently gained acceptance among India’s ultra-rich as strong investible platforms.

Nitin Jain, CEO, global asset and wealth management at Edelweiss Financial Services. The AMC manages around ₹6,500 crore in AIFsWhen Finance Minister Arun Jaitley in his 2018 Union Budget speech spoke about measures to improve and strengthen investments into Alternative Investment Funds (AIFs)—particularly venture capital funds and angel investors—it sent out a signal. AIFs, whose regulations were formulated just over five years ago, have evidently gained acceptance among India’s ultra-rich as strong investible platforms. Prashasta Seth, CEO, IIFL Asset Management. The company's immensely successful Asset Revival Fund had bet on "beaten down" assetsIIFL is not alone in spotting the opportunities in the AIF space. Edelweiss Asset Management is a key player to reckon with, but with an investment philosophy of its own.

Prashasta Seth, CEO, IIFL Asset Management. The company's immensely successful Asset Revival Fund had bet on "beaten down" assetsIIFL is not alone in spotting the opportunities in the AIF space. Edelweiss Asset Management is a key player to reckon with, but with an investment philosophy of its own.