The time is ripe to buy affordable homes

What makes house purchase in the affordable segment particularly compelling is the narrowing gap between rental yields and effective housing loan interest rates

India ended 2015 as the fastest growing economy in the world, beating China by clocking a GDP growth of 7.3 percent. This is expected to be sustained, if not bettered, and India is likely to be the world’s top-performing economy for the next three years. This speed of growth has triggered a migration towards urban areas, chasing expanding job opportunities in the service and non-agriculture sectors. According to the 2011 census, 31.2 percent of Indians are urban dwellers, up from 27.8 percent in 2001. This pace of urbanisation is expected to pick up and, by 2026, nearly 40 percent of all Indians are expected to be living in urban areas.

The GDP growth will sustain wage inflation, which has averaged between 10.5 percent and 12 percent for the past four years. Growing income levels, increasing urbanisation and fragmentation of the traditional large family structures into smaller nuclear units, along with the already large housing shortfall, will converge to trigger an unprecedented boom in the housing market.

According to a recent report by real estate consultant JLL, residential unit sales in Mumbai have jumped by 28 percent year-on-year. Over the past five years, the housing finance market has compounded at a CAGR of 18 percent. Housing Finance Companies (HFCs), which are specialist non-bank financial companies exclusively focussed on housing and mortgage lending, have grown at a CAGR of 22 percent, expanding their market share to 39 percent, up from 33 percent five years ago.

EFFECTIVE INTEREST RATES ON HOME LOANS

Tax deductions, Effective Interest rate and Rental yields

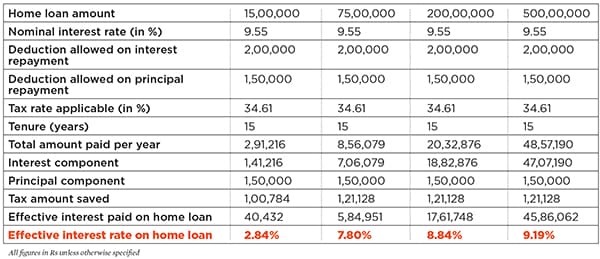

In the last two years, there has been an interesting divergence between the affordable housing segment and houses in the above-Rs 1 crore category. Tax deductions against principal and interest repayment of housing loans significantly cut the effective interest rate in the affordable housing segment of Rs 15-75 lakh. With the existing deductions against interest and principal repayments, a headline yield of 9.55 percent winds down to an effective yield of between 2.8 percent and 7.8 percent for a housing loan of Rs 15 lakh to 75 lakh.

This saving is less significant in the Rs 2 crore to Rs 5 crore housing loan segment as the effective interest rate goes down by about 0.7 percent to 0.4 percent from the headline yield. This means that the effective rate is 8.84 percent and 9.19 percent respectively (see table). Interest rates are expected to soften further and this will further push the effective rate of interest down, most tellingly in the Rs 15-75 lakh segment.

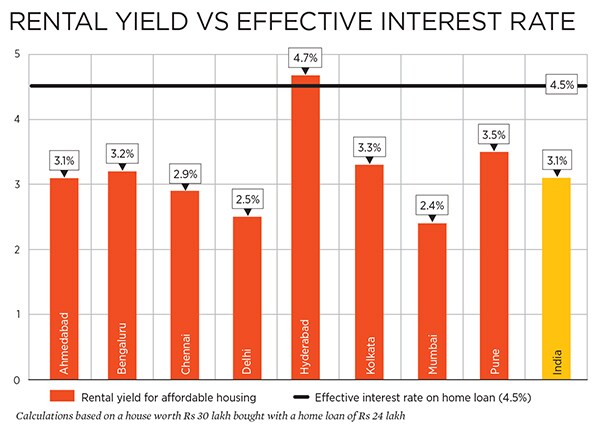

What makes house purchase in the affordable segment particularly compelling is the narrowing gap between rental yields and effective housing loan interest rates.Average rental yield for the top eight Indian cities works out to 3.1 percent. For a Rs 30 lakh house bought with a housing loan of Rs 24 lakh, the effective yield after tax deductions works out to only 4.51 percent. In absolute monetary terms, for only about Rs 2,762 per month more in interest expense in lieu of rent, a family can buy a house instead of renting one. This gap is significantly wider for houses in the Rs 2 crore and above category where rental yields hover at 2 percent and the effective yield after tax deductions are in the 8.8 percent to 9.2 percent range.

Prospects of capital appreciation

Residential price inflation has become considerably moderate over the past three years. Near-stagnant residential capital values, despite annual inflation of 5 to 8 percent, indicate a price correction of nearly 20 percent in real terms. This is against a background of input costs such as that of land and construction inching up, squeezing developer margins. Expectations of a further dip in residential prices from here on are unrealistic. Residential real estate prices are on a cusp and consumption-led demand in the Rs 15-75 lakh ticket-size range will result in a rise in capital values ensuring healthy returns.

A rally in financial securities since 2012 had triggered an exodus of investors from real assets such as real estate. But the world today is an increasingly uncertain place with many geographies on the verge of plunging into long drawn conflicts and uncertainties. Conflicts in the Middle East, their humanitarian fallout in Europe, the geo-political wranglings of Russia, plummeting commodity prices and the slump in Chinese markets can trigger a swift pullout of foreign capital from emerging economies such as India. Over the next few years, real estate will be an attractive investment proposition and will gain from money fleeing financial assets.

If you are looking to buy a house to live in or invest in, then there is no time like the present. Capital values will see healthy appreciation in the Rs 15-Rs 75 lakh ticket-size range sustained by a growing demand.

The office space connect

According to a recent report by the property advisory firm CBRE, office space leased in the top seven cities of India grew by 18 percent in 2015 over the previous year. The report attributed this growth to a strong macroeconomic climate and an overall positive market sentiment.

Further, this report pointed to acceleration in the leasing activity in the last quarter of 2015, clocking 26 percent growth over the earlier quarter. Combined with steady supply where delivery of office space peaked in 2015, this points to a sustained growth in leasing of office space.

A rule of thumb is that 100 sq ft of office space will require 1,000 sq ft of residential space. The uptick in commercial lending activity is a precursor to a spurt in residential sales. According to the report, the growth in leasing activity is mainly in the suburban and peripheral districts. There are also localities with the availability of affordable housing in the Rs 15-75 lakh ticket-size range, and the influx of professionals in the expanding commercial facilities will spur and sustain housing demand.

In conclusion, if you are thinking of buying a house then it is time to take the plunge.

Gagan Banga is vice chairman and managing director of Indiabulls Housing Finance

First Published: Jan 29, 2016, 07:22

Subscribe Now