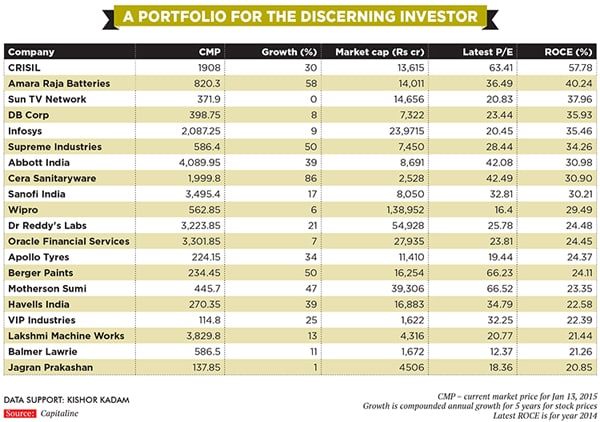

20 Quality stocks to invest in 2015

A new government, a new sentiment, a different approach: This year, Forbes India crafts its portfolio keeping in view the prevalent bull market

The theory is counterintuitive but, when you think about it, it is one that is hard to argue with. S Naren of ICICI Prudential says, “In a bull market, you are better off going with known names rather than unknown names.”

One would assume that picking stocks in a bull market is like playing darts—every stock will eventually rise. But as the positive run continues, the market gets more discerning about quality. Sectors that are heavily in debt or companies that have shaky business models have seen their stocks rise and then correct to the levels before the start of a bull run.

In compiling this portfolio, Forbes India took a combination of high returns on capital employed (RoCE) with a relatively low price-earnings (P/E) multiple. In a growing market, this seems to be the surest way to make money. As Nemish Shah, the co-founder of Enam, explains: “A company should be able to consistently make more than its cost of capital. Else, it has no reason to be in business.”

There will be times when the P/E multiple might appear expensive but if a company has a sustainable growth path, our experts advise you to keep buying.

In the last five years, Berger Paints’s profits have compounded by 15 percent. This, coupled with a RoCE of 24 percent, has seen the stock compound at 49 percent a year for the last five years. The story repeats itself with Havells India, another outperformer.

What becomes clear is that stable businesses can have consistent RoCE.

The message seems to be clear: Stick to quality in this market and the move will eventually pay off.

First Published: Feb 05, 2015, 06:01

Subscribe Now