How to Make The Most of Your Investments

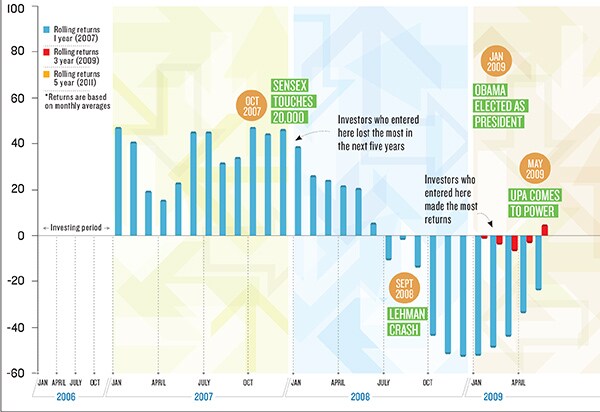

You may not make money just by being a long-term investor. This chart shows you why

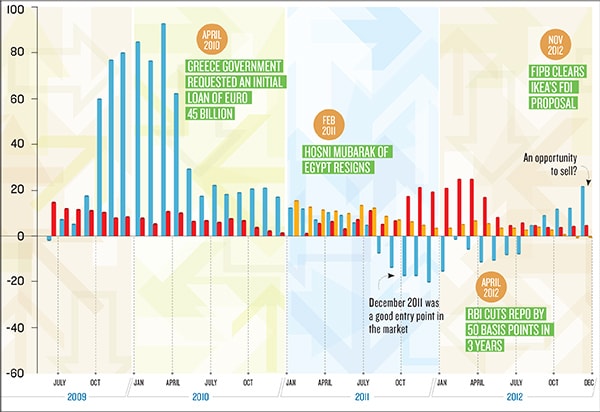

Investors have made maximum returns by catching the market at its lows and booking profi ts when it rises. A graphical guide to the stock market rollercoaster over the past five years

Many stock market investors have seen their wealth remain static, and some have even lost money over the last five years. So, what ought to have been the market mantra?

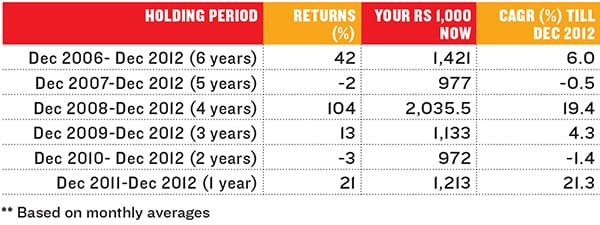

Many stock market investors have seen their wealth remain static, and some have even lost money over the last five years. So, what ought to have been the market mantra?  If we take the Sensex as a barometer, the returns for an investor who stayed put over five years were down by 0.5 percent in December 2012. But, an investor who entered the markets in December 2011 would have got 21 percent return. It proves that you don’t make hay just by being a long-term investor.

If we take the Sensex as a barometer, the returns for an investor who stayed put over five years were down by 0.5 percent in December 2012. But, an investor who entered the markets in December 2011 would have got 21 percent return. It proves that you don’t make hay just by being a long-term investor.

Instead, you can get the best returns if you catch the markets at their lowest, book your profits when they are hot, and re-enter when markets fall again. For instance, if one had invested in March 2009, when the markets hovered around 8,900, their wealth would have shot up by 92 percent. That means, Rs 1,000 would have become Rs 1,920.

Investors still got into the market in Dec 2007 when it was overvalued

First Published: Jan 22, 2013, 00:10

Subscribe Now