India's tryst with taxes

While the rich pay a bulk of the income tax paid by individuals in India, many wealthy people do not pay their share of taxes

Image: Shutterstock

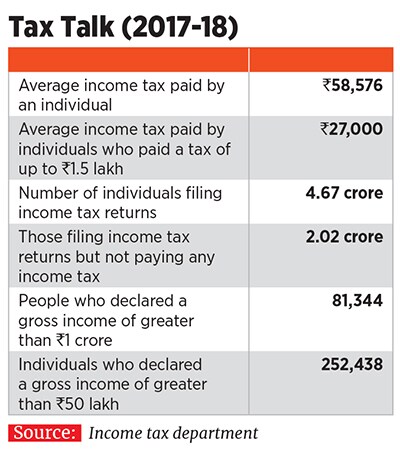

The income tax (IT) department recently published detailed data on individual Indian taxpayers for the assessment year 2017-2018 (financial year 2016-2017). The statistics reveal interesting points. Here are some:

1. Around 4.67 crore returns were filed by individuals during the assessment year and personal

income tax collected stood at ₹273,405 crore. The average tax paid by an individual was ₹58,576. In comparison, 3.65 crore returns were filed during assessment year 2014-15 (financial year 2013-14) whereas the personal income tax collected was ₹169,338 crore. The average tax paid by a person was ₹46,377. Even after adjusting for inflation, there has been some improvement in the income tax collected per individual over the years.

2. Of the total 4.67 crore returns filed by individuals, around 2.02 crore or 43.4 percent paid zero tax. In 2014-15, it was around 1.74 crore or 47.7 percent. So, more individual tax filers are paying tax, which is good news.

3. A bulk of individual tax filers (2.34 crore) paid tax of up to ₹1.5 lakh. The total tax paid in this bracket amounted to ₹62,823 crore or around 23 percent of the total tax collected. The average income tax paid in this bracket amounted to ₹27,000. Around 1.72 crore individuals paid a tax of up to ₹1.5 lakh in 2014-15. The total tax paid in this bracket amounted to ₹43,964 crore or 26 percent of the total tax collected. The average income tax paid was ₹26,000. There has been an increase in the total amount of tax paid in this bracket. It is a clear case of the government finding fortune at the bottom of the pyramid. 4. A bulk of India’s taxes in 2017-2018 were paid by individuals paying an income tax of higher than ₹1.5 lakh per year. The total number of such taxpayers was 30.72 lakh. So, only 30.72 lakh individuals paid 77 percent of the income tax paid by individuals (given that those who paid an income tax of up to ₹1.5 lakh, paid 23 percent of the total).

4. A bulk of India’s taxes in 2017-2018 were paid by individuals paying an income tax of higher than ₹1.5 lakh per year. The total number of such taxpayers was 30.72 lakh. So, only 30.72 lakh individuals paid 77 percent of the income tax paid by individuals (given that those who paid an income tax of up to ₹1.5 lakh, paid 23 percent of the total).

Data from the World Bank suggests that in 2016, India’s population was at 132.4 crore. This means 0.23 percent of the population paid 77 percent of the income tax paid by individuals in 2017-2018.

Contrast this with 2014-2015: 19.18 lakh individuals paid around 74 percent of the total tax paid by individuals. The population in 2014 was 129.4 crore, so 0.15 percent of India’s population paid 74 percent of income tax paid by individuals. Basically, the rich pay a bulk of India’s individual income tax.

5. But do enough people rich pay taxes? Only 81,344 individuals declared a gross total income of greater than ₹1 crore while filing their tax returns. This number is too low. The number of individuals who declared an income of ₹50 lakh or more stood at 252,438. The figure for the former was 48,416 in 2014-15, a jump of 68 percent, over three years. The number of individuals who declared an income of ₹50 lakh or more stood at 147,231.

Vivek Kaul is the author of the Easy Money trilogy

First Published: Nov 21, 2018, 10:27

Subscribe Now