India loses out on innovation quotient: Kiran Mazumdar-Shaw

The Biocon founder on the need for an ecosystem where VCs invest in life tech enterprises and why some Indian startups prefer a presence in the mature US market

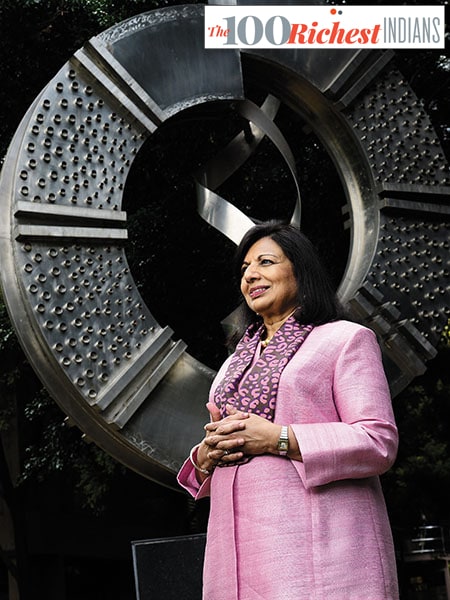

Kiran Mazumdar-Shaw, Founder, Biocon

Image: Nilotpal BaruahQ. Through the many decades of building Biocon, what has held you in good stead?

I would attribute our success to a laser sharp focus on being a differentiated biopharmaceutical company and enduring the long gestational process of getting to the end points. It has also involved a high regulatory and investment risk profile which has enabled us to build a growing risk-management capability. We have seen several competitors dropping out given the gruelling obstacles of regulatory and investment risks. We have also displayed resilience in addressing setbacks. And we have had the courage of our conviction to withstand criticism and scepticism.

Additionally, we have invested significantly in research infrastructure and building high-end scientific talent. Quality and compliance have also been a strong focus, driving a culture of continual improvement. We have also pursued a model of striking strategic partnerships to manage risks and bridge near-term experience gaps.

Q. Would you say that the next stage is to see the company irrevocably commit to novel drug discovery?

Well, Biocon’s biologics journey started with novels. We were the first company in India to develop a new biologic and take it from lab to market. BIOMab EGFR/Nimotuzumab was our first novel monoclonal antibody for cancer, which was launched in India in 2006.

This was followed by a second novel antibody, ALZUMAb&trade, the world’s first novel anti-CD6 monoclonal antibody, Itolizumab, in India, for psoriasis in 2013. This antibody has been licensed to a US biotech company, Equillium, which recently listed itself on Nasdaq to pursue several orphan indications in immune mediated diseases.

It is this approach that has enabled us to acquire deep insights into immunology and antibody technology. We had forayed into novel biologics ahead of our entry into the biosimilars segment. We have leveraged this knowledge to develop a wide portfolio of biosimilar drugs to address a large and evolving worldwide demand. Today, we have created a rich pipeline of novel and biosimilar assets aimed at addressing large unmet medical needs globally.

Our basket of novel assets under development represents an interesting combination of early and advanced stage programmes. These include an oral insulin molecule monoclonal antibodies against targets like CD6, CD20 and EGFR a pipeline of bispecific fusion antibodies that exploit the recent understanding of the role of checkpoint inhibitors and a partnered siRNA-based molecule. We have generated encouraging and exciting data, garnering a great deal of licensing and partnering interest.

Q. Last year saw a strong upside for Biocon, which also made you the top gainer in percentage terms on Forbes India’s list of Indian billionaires…

I am extremely proud of the business we have built with a singular focus on delivering biologics that address affordability and access. The string of regulatory approvals we have received from the USFDA [Food and Drug Administration] and EMA [European Medicines Agency] has endorsed our business leadership in biosimilars. We were the first company globally to get our biosimilars for Trastuzumab and Pegfilgrastim, co-developed with Mylan, approved by the USFDA. We were also among the first few to receive insulin glargine approval from the European Commission and Australia.

These achievements have infused investor and market confidence which have led to a huge surge in our market cap and thereby my personal wealth.

Q. Which achievement has given you the most satisfaction and the confidence that you’ll can make much bigger plays in the global pharma/bio-pharma markets?

The USFDA approval of biosimilar Trastuzumab in 2017 was a big credibility endorsement for Biocon and personally a big confidence boost. This was significant given that several credible competitors were unable to cross the finish line. It was followed by a second approval of biosimilar Pegfilgrastim, where we were laggards in development, but eventually beat the front runners. This endorsed our ability to develop high quality biologics and get it right the first time. These two events have catapulted us into the leadership league of biosimilar companies.

Today Biocon is well-poised to enter the developed markets of US and Europe at a time of increasing acceptance of biosimilars.

Q. How do you view the fact that you’re a multibillionaire?

Having grown up in a middle-class family in India, I was brought up by my parents to believe that wealth creation is about making a difference to society. As a first-generation entrepreneur, I built Biocon with these guiding principles. My success has given me the ability to pursue my commitment to social inclusiveness that goes beyond running a business aimed at developing drugs with a potential to treat a billion patients.

As part of my philanthropic efforts, I also support the pursuit of science to target cancer. The Mazumdar Shaw Medical Centre, my philanthropic initiative in partnership with Dr Devi Shetty, aims to create a sustainable affordable cancer care model that leverages advanced technologies, state-of-the-art diagnostics and best-in-class talent to address the challenges associated with this disease. Our unique model enables the poor to access treatment at costs subsidised by those who can afford it. The Mazumdar Shaw Centre for Translational Research, which is an integral part of the hospital, has developed a number of advanced-yet-affordable genomics-based cancer diagnostics, including liquid biopsies. This enables early diagnosis and better treatment outcomes based on personalised medicine.

Through Biocon Foundation’s corporate social responsibility initiatives we are ensuring that marginalised communities can enjoy the ‘right to health, education and sanitation’.

Q. Most successful people tend to see the ‘greater-than-the-sum-of-the-parts’ aspect of their work with more clarity than others. How does one develop that ability… with perseverance or is it inherent?

I believe it’s a combination of both. I started out with the ambition to be a doctor, but life took me on another path. I was an accidental entrepreneur who started her journey in an unknown sector of biotechnology without any family linkages to the business world. Today, I am extremely proud of what we are doing. I have been able to touch many more lives through the drugs developed by Biocon. As a first-generation entrepreneur, I have challenged the Western pharmaceutical model of creating monopolistic markets that deliver high margins at low volumes. This is because I have been driven by the belief that the pharmaceutical industry has a humanitarian responsibility to provide affordable access to essential drugs for patients who are in need and to do so with the power of innovation. My vision for our research programmes for treating diabetes and cancer is to bring transformative change in treatment paradigms. Affordable blockbuster drugs with a ‘Made in India’ label that can change the lives of billions of patients around the world will stand testimony to our foresight.

Q. Can India become a powerhouse of novel drug discovery? Will its pharma/bio-pharma industry move towards high-end R&D-based business opportunities?

We have the potential to deliver innovation at scale but the biggest challenge is to fund startups to scale up. For example, Bengaluru has almost 700 life science startups with a few outstanding incubators and innovation hubs, both at academic institutions as well as independent standalone ones. One of the most successful of these is C-CAMP. The lack of venture funding and access to capital markets is preventing these companies from scaling. In fact, there is a growing trend to establish a presence in the US to be able to raise funds from the highly networked and mature US market. Consequently, India loses out on its innovation quotient even though early stage research for many of these takes place in India.

While the government is doing its bit by giving the seed capital for startups, for the long-term risk capital, we are yet to see the emergence of an ecosystem in India where the VCs [venture capitalists] start investing in innovation-driven enterprises. I believe this will happen gradually when a few success stories start emerging. VCs in India today prefer information technology-led startups, which are of much lower risk and more predictable rather than a gestational business like life tech.

Another challenge is the poor clinical and translational research culture in India. Clinicians prefer practice to research and publication. Unless this changes, India will not be able to compete effectively in life sciences.

I think the sooner India understands the power of innovation, the greater the chances for a ‘Made in India’ novel molecular entity to make an impact globally.

Q. What gives you that confidence? And what are the implications if most remain in the generics business?

The Indian pharmaceuticals sector built global scale and leadership by reverse engineering expensive, chemically synthesised, small molecule drugs to produce cost-effective generic alternatives. In doing so, it earned the label of being the ‘Pharmacy of the World’. After dominating the traditional generic drugs industry for decades, many Indian companies are now in the race to create generic versions of biologic drugs, or biosimilars, which are far more complex to make but offer a large global opportunity. As patents expire on novel biologics, the biosimilars market is expected to grow rapidly, exceeding $28 billion by 2020 from the present $5 billion. The Indian biosimilars industry is evolving fast and promises to transform health care in the years to come.

First Published: Nov 09, 2018, 10:16

Subscribe Now