Rakesh Jhunjhunwala: The Intuitive Investor

Billionaire market maverick Rakesh Jhunjhunwala on his life, wealth, philanthropy and, of course, investing

Rakesh Jhunjhunwala

Age: 54

Rank in the rich list: 51

Net Worth $1.86 billion: The big challenge faced in the last year Manoeuvreing volatile markets before the beginning of the current bull run

The way forward: Focus on philanthropy, particularly education and nutrition. Plans to put in Rs 1,000 crore in an educational institution. Considering setting up an institution to ensure more effective government spending

Rakesh Jhunjhunwala has set himself two important targets. By the end of the year, the man people like to call India’s Warren Buffett wants to be 20 kilos lighter than what he was at his peak weight. The second target is more serious: Jhunjhunwala plans to give away Rs 5,000 crore or 25 percent of his total wealth, whichever is lower, to philanthropy when he turns 60 on July 5, 2020. And Jhunjhunwala’s track record would validate the achievability of both targets.

Consider how investors hang on to every word the 54-year-old Jhunjhunwala says about the markets and the economy. Company managements often come to him and make presentations so that he invests in them. But he confesses that he is not as smart as people make him out to be. “My failures are far less known than my successes,” says the billionaire investor during a nearly hour-and-a-half long chat with Forbes India in his 15th floor, sea-facing office at Nariman Point, once Mumbai’s only business district.

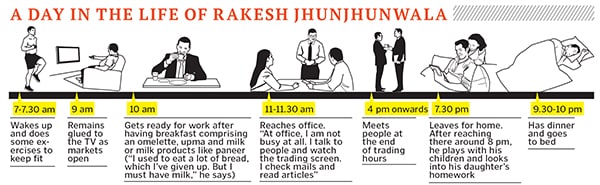

In his simple office, people pore over Excel sheets and trading charts, and, occasionally, some of them enter his cabin to show him a paper or two.

Inside, dressed in a plain white shirt (which costs Rs 800, he informs us), black trousers and a Titan watch, sits Jhunjhunwala, surrounded by some more trading terminals and a large collection of Ganesha statuettes adorning the shelves. On the walls hang two separate sets of “commandments”—for trading and investing—which he keeps distinct from each other.

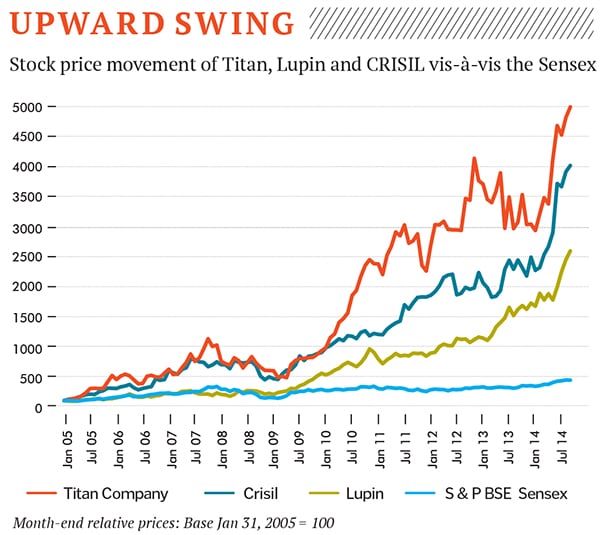

The past year, with a major bull run on the stock markets, has been great for Jhunjhunwala, whose wealth has grown by a hefty 62 percent during the period, positioning him at number 51 in the 2014 Forbes India Rich List (against 61 in 2013). His three key holdings—Titan Company, Lupin and CRISIL—have also seen handsome gains. Not surprising then that Jhunjhunwala had not made a single trade, either in the cash market or in futures, on August 7, the day Forbes India met him. For now, he can afford to rest easy and allow his investments to work for him. Changing Views

Changing Views

Jhunjhunwala’s love affair with the markets started early, when he was only 12 or 13 years old. His father, who was a civil servant, would discuss stocks with his friends and that got him interested in the markets. “I was a curious child and I would watch stock prices fluctuate,” he says. “I would ask my father why prices went up or down. He would point to news items and tell me that prices react to news. Those days, stocks like Century, Gujarat State Fertilizer and Grasim were the main ones.” As he began studying chartered accountancy (CA), his interest in the markets grew stronger. He would often go to the trading ring during lunchtime to get a feel of the place. Those were the days of open outcry trading and, for Jhunjhunwala, it was a world which had a romance and thrill of its own.

“My first investment was when I completed my CA in 1985,” he says, adding that initially, he would believe any company which had strong reserves and surpluses was good. “I have truly learnt by trial and error.”

Today, many years and several bull and bear phases later, he is much wiser and knows smart investing is far more than reading balance sheets. Ask him about his investment philosophy and he responds quickly that he is “too young” to have one. “Let’s not try to over-glorify things. I would say an understanding of the investment thought or process is required,” he says.

His journey as an investor has moved from the quantity of profits to the quality, and the recognition of what he calls ‘non-company factors’ on stock prices. “When you start, the quantum of profits is important, but then you realise that quality is more important,” he says. “So I would put it in a subtle and brief manner: Consistency, return on capital, corporate governance, payouts and such things are very important.”

Transitory Investor

For someone who has held on to his key investments for several years (he has remained invested in Lupin, for instance, for 11 years now), Jhunjhunwala is emphatic that he does not get emotional about particular stocks and buys every stock to sell.

“I have my love and emotions for my wife, my girlfriend, my mistress, my children, my brother, my sisters, my friends, not for stocks,” he jokes.

But if he feels it’s worth holding on to a stock for longer, he will do so. “I make an investment and I review it constantly. And I am not affected by a temporary loss in valuation,” he says. When he invests, he has an entry value and a perceived terminal value. He says he will sell either when he wants to bring leverage down or when he has a better opportunity, or when earnings have peaked and the price-earnings (PE) ratio is stretched.

Jhunjhunwala bought into Titan in 2002-03 at an average price of around Rs 5 the stock then rose to touch Rs 80 and later fell to Rs 30, but he did not sell a single share. “That Rs 30 is nearly Rs 375-400 today. And when it fell from Rs 80 to Rs 30, I lost Rs 300 crore of value in my portfolio. But I never sold as I thought that neither EPS [earnings per share] nor PE had peaked and there was a lot of growth still to come.”Similarly, he kept the faith in his second big holding, Lupin. “From 2006 to 2009, Lupin went nowhere. It was in the Rs 135-150 range, but that Rs 150 is Rs 1,350 today. I always thought Lupin had good potential.”

His reasoning is simple. The Indian market, he says, is still not deep enough and doesn’t have too many good quality companies to buy into. And those that exist aren’t cheap. “I would, therefore, not like to sell in a hurry. I am also not one to flip-flop such that if I feel Lupin is fully priced, I’ll sell it and buy Tata Motors, and when that goes up, I buy something else. I am not so smart,” he says. “Why would I not hold on to the investments that have given me good returns?”

But he has also sold parts of his holdings in Titan, Lupin and CRISIL. “I wish I had not sold CRISIL, but I have.” In 2005, he sold Rs 27 crore worth of CRISIL shares and bought a house in Mumbai. “That house may be worth Rs 50 crore today, but if I had held on to the shares, they would be worth Rs 700 crore now, and tax-free,” he admits. While he made his base investment in Lupin in just around a fortnight, his investments in Titan and CRISIL were made over a span of a year-and-a-half.

Forever Bullish on India

There is a common thread in Jhunjhunwala’s top three holdings, though. A large part of the businesses of the three companies is linked to the Indian economy, especially that of CRISIL and Titan. “As much as 70 percent of CRISIL’s business and 25 percent of Lupin’s is linked to the Indian economy,” he points out. “And 85 percent of Indians don’t wear watches, so there’s so much space for Titan to grow. Jewellery is a Rs 3 lakh crore market, so even if they are at Rs 10,000 crore now, that’s just three percent of the market.” Clearly, Jhunjhunwala is betting on the Indian growth story. He insists the Indian economy will grow by 9-10 percent, though that may need a transition of two to three years. “Then where will you get these companies from?” he asks.

Ask him whether, in the absence of any clear signs of growth having picked up just yet, the bull run in the markets is a sign of irrational exuberance, and the star investor admits that the market does have its excesses on both sides. He is not happy or unhappy that it happens, but he makes sure he doesn’t cause it in any manner.

“In 2007-08, I didn’t go at 6000 Nifty and tell people to buy stocks. I told them to sell. We should never try to fuel [the excesses] on either side. But it is our God-given birthright to take advantage of it. That it is going to happen is a reality,” he says. “As long as human nature remains what it is, excesses will happen. And I don’t think human nature is going to change.”

Jhunjhunwala isn’t taken in by the lofty analyses market-watchers put out. “When I hear people say it is a liquidity-driven market, I don’t understand all this English,” he points out. “Stocks go up as there is a paucity of sellers. Whether it is liquidity, whether it is fundamentals, what is fair value… has your grandfather given you the right to judge what fair value is? When people get left out, they say it’s a liquidity-driven market.”

Just as he analyses companies carefully, Jhunjhunwala also likes to assess the country’s potential. India, he points out, has the skills, the demography, a culture of acceptance and patience and natural resources. “We have all the ingredients of growth and you can’t take that away,” he says. A supporter of Prime Minister Narendra Modi, he adds: “We need someone who can act as a catalyst and simplify things so that we as a society can prosper. I am not an economist. I am just Rakesh Jhunjhunwala, investor and trader. But I don’t see why India can’t grow at 9-10 percent. My faith in this country is impeccable. When people ask me what has made you successful, I say one of the greatest reasons of whatever God has endowed upon me is my belief in India and the stock market.”

Jhunjhunwala’s thesis is that Indians will save $1 trillion a year, and even if 10 percent of that money—$100 billion —flows into the markets, there will be a tsunami on the bourses. “So I remain bullish that, for the next 20 years, we could see a bull run like the one Wall Street had from 1987.”

The Power of Mistakes

A chartered accountant by training, Jhunjhunwala has a natural bent for data and analysis. But instinct, he says, plays a large role in the way he makes his investments. “What is research? For me, it is 40 percent data, 20 percent analysis, 40 percent instinct.”

While his successes are celebrated and the subject of stock market folklore, Jhunjhunwala says he doesn’t want to write books or articles on investing. He also stays away from managing other people’s money because that would impinge on his freedom apart from being a huge responsibility.

“Managing money is a very responsible business. I get very scared of advising people to buy this or that. Because things could change and then my view will change and it becomes difficult for me to communicate that change to them,” he says. “If you don’t believe the markets are supreme, you will never admit that it was your mistake. If you don’t admit that it is your mistake, you will never learn. Eventually we invest out of informed ignorance. I invest in a bank, jewellery, watch, pharma, software or EPC company, but finally I am investing out of ignorance. I cannot be a master of all these businesses.”

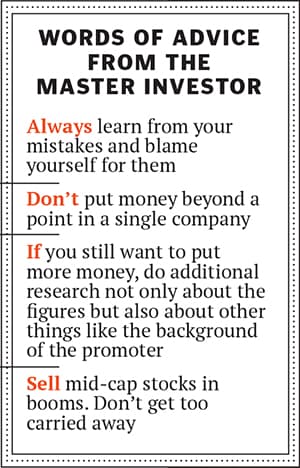

To succeed in the stock market, not only is the ability to learn from one’s mistakes vital, he says, but also to blame only oneself for it. “I don’t blame the promoters of companies. I blame myself. The promoter is what he is. I have to recognise that. He is not what I expect him to be.”

When an investment doesn’t work out and takes a beating on the bourses, how easy is it to get over the loss? “Over a cigarette,” he says. “There’s no point lamenting.”

Family, wealth and philanthropy

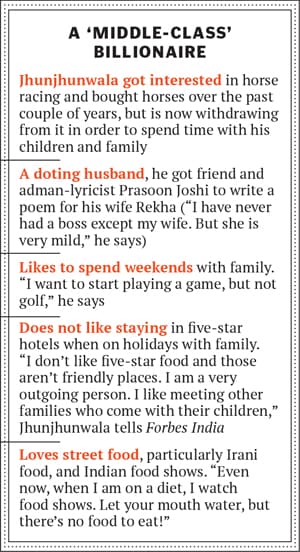

During the course of the interview, Jhunjhunwala talks repeatedly about his wife and family. His wife Rekha, (the first two alphabets of her name make up the second part of the name of his firm Rare Enterprises) and his three children—a 10-year-old daughter and twin sons who are five-and-a-half years old—are the people he spends his weekends with. A recent love, horses, is now in the process of being wound down since he finds it tough to spend weekends with his children if he has to be at the races.So what does wealth mean to a man who, despite his billions, remains at the root a self-confessed ‘middle-class’ person?

“I think it means we value what we spend. If I want to buy a Rs 5 crore car and I enjoy it, I will buy it because I want it, not because I want to show it off. Already, people think I have far more wealth than I have,” he says. To him, wealth means freedom, a sense of achievement and a thrill. The thrill of being right about the markets. “I’d be lying if I say I don’t like the money. But it is for the thrill and fun of it and the competitive intensity.”

And he has been on the ball as far as his views on the markets are concerned. In August 2013, when stocks were tanking, he gave an interview, saying the mother of all bull runs awaited the markets. “Today, when I read the interview, I feel happy,” he confesses.

Jhunjhunwala says the income he gets from dividends is enough to take care of his requirements. “It’s not that I have some great income every year. That takes care of my charity, my office expenses, my interest payments. July to September are the best months because dividends come in,” he laughs.

The nature of his work is such that even if his family and he went off for a three-month cruise, nothing, apart from his trading income, would be affected, he points out. “So, I like to think I don’t have that money [the trading income],” he says.

Not someone who judges people (he was a heavy drinker and smoker until January this year when he was diagnosed with a lung ailment since then he started leading a healthy life), Jhunjhunwala won’t make giving his wealth to his children conditional on how they lead their lives.

“I have no plans for them. I only want them to have my brains and their mother’s nature. And education, integrity and independence,” he says, pointing out that it was the freedom his father gave him that helped him shape his life and career. “But I will never use my wealth as leverage over them if I don’t like what they are doing.”

His children are Jhunjhunwala’s main priority but next on the list is philanthropy. “The giver of wealth is God and it is our duty that we share this wealth. To me the question also is, what will I do with all my money? I have no single asset to represent my wealth. I have no legacy of my company to leave, just two partners and ten employees,”

he says, adding that he thinks a lot about philanthropy these days, particularly after he turned 50.

He now gives away 25 percent of his dividend income. This year, he would have donated anywhere between Rs 20-25 crore to charity.

Influenced by American billionaires such as John D Rockefeller, Jhunjhunwala says he admires the passion of Melinda Gates and Azim Premji in the area of philanthropy. Two major causes—nutrition and education—are on the top of his agenda and he aims to set up a quality institution of learning over the next 10 years, where he plans to put in over Rs 1,000 crore.

“About 40-45 percent of the money will go to nutrition because I believe it’s the biggest problem facing India,” he says. “And I also want to set up a Ralph Nader-type organisation which can study government expenditure and pressure the government to spend funds better.”

These days, Jhunjhunwala is trying to get a well-known personality to take charge of his R Jhunjhunwala Foundation as chairman. Once he agrees, he plans to hand over the running of the foundation to him. “I will, of course, retain the lifelong right to nominate the trustees, but I don’t want to run the foundation. It involves too many people and administrative work. That’s not my cup of tea,” he says.

His openness about his philanthropy goals has invited questions. Many people have asked him why he went public with his plans to donate his wealth in 2020. To that, the maverick investor responds with trademark candour: “I tell them, I am saying this now so that you can come back to me on July 6, 2020 and if I haven’t given it away, say ‘shame, shame.’”

First Published: Oct 27, 2014, 06:11

Subscribe Now