IndiGo's Rahul Bhatia Has Redefined A Budget Airline

The man behind InterGlobe and its flagship airline is all about enjoying every efficiency

Rahul Bhatia

Founder and MD, IndiGo

Age: 54

Rank in the Rich List: 5

Net Worth: $1.9 billion

The Big Challenge Faced in the Last Year: Rising cost of aviation fuel and weaker rupee were big challenges for the aviation sector, but IndiGo has stayed on course

The Way Forward: Rahul is unperturbed about competition from AirAsia and Vistara. He is keen on making a name in the hotels business

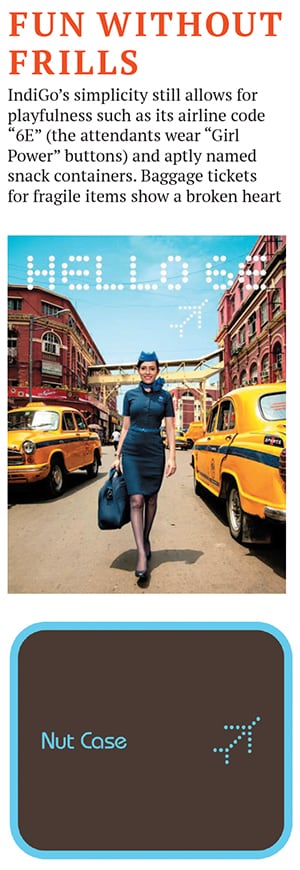

In early October, InterGlobe Enterprises, a $2.6 billion (revenues) travel and hospitality group, best known for its efficient budget airline IndiGo, will have completed 25 years. No huge celebrations are in store to mark the milestone. Group managing director Rahul Bhatia will address an all-staff meeting broadcast from InterGlobe’s headquarters in Gurgaon, near Delhi, and then it will be business as usual. “Why spend all that money?” shrugs Rahul.

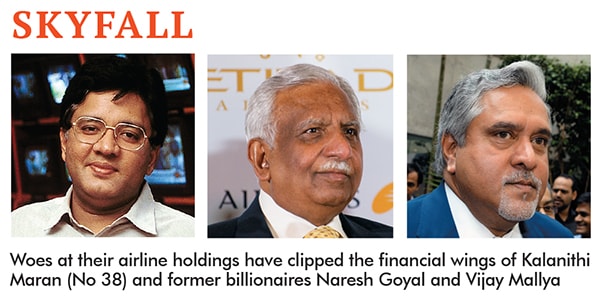

Fanatical cost-consciousness has lifted IndiGo, a rank newcomer eight years ago, to the top of India’s airline market. As per August data tracked by India’s airline regulator, the privately held carrier that has carried 84 million passengers to date has a third of all domestic passengers (Rahul and dad Kapil Bhatia, InterGlobe’s executive chairman, own 51 percent). Media baron Kalanithi Maran’s SpiceJet, lately a discount warrior, is a distant No 2 with close to one-fifth share. Airline tycoon Naresh Goyal’s 21-year-old Jet Airways, co-owned by Etihad Airways, trails in the third spot. While SpiceJet and Jet have been racking up losses, IndiGo makes money and has been doing so since 2009. In the fiscal year till March 2013, the latest for which official numbers are available, it reported net profits of $130 million on revenues of $1.6 billion.

Though airlines in India were battered last year by the rising cost of aviation fuel and the weaker rupee, IndiGo is believed to have stayed on course with net earnings in the year till March 2014 estimated at $100 million.

“IndiGo has completely changed the concept of what a budget airline should be. Low cost need not mean low quality. I’m a huge fan,” says Deep Kalra, founder of online travel agency MakeMyTrip.com, which is a big seller of IndiGo tickets. IndiGo’s formula is to offer economy-plus service at economy rates and on-time performance that’s the envy of rivals. This fetish for punctuality has made it, despite its single-class offering, the airline of choice for the business crowd. “Being on time is a wonderful thing. In my experience IndiGo has been late only once—for 10 minutes,” says Manmohan Tiwana, founder of Wodehouse Capital Advisory, a Mumbai family office advisory firm. Tiwana travels on business every week and ditched Jet for IndiGo five years ago. He appreciates the “squeaky cleanliness” of IndiGo’s planes (average age: Under three years) and is happy to cooperate with the onboard crew as they collect all the trash from passengers before the aircraft lands.

Baby Steps to Perfection

A note in the onboard magazine asks passengers to pull the window shades down and rearrange their seat belts to the original position before leaving the plane. These small touches help the airline achieve quick turnarounds of less than 30 minutes between flights. “Operating a budget airline successfully is all about execution. IndiGo has delivered on that count flight after flight, day in and day out,” says Kapil Kaul, who heads the South Asian arm of airline consultancy Centre for Aviation.

That record is a feat in India, where the state-controlled aviation infrastructure has notoriously lagged rising air travel. While the situation has eased somewhat with the government handing over the running and rebuilding of key airports to private companies, capacity constraints are yet to be overcome.

For example, Mumbai airport has two runways and when one is shut down for maintenance, flight delays are inevitable. Lufthansa and Emirates are currently battling over time slots for the sole parking bay available in Mumbai for their A380 jets. “I often marvel at what we achieve despite all odds. But we want to deliver the India experience differently,” explains Rahul over lunch at L’Angoor, one of the four restaurants that this avowed foodie owns. For him, there’s no fussing over a menu or even much of a walk. The restaurant, whose name is a pun on the Hindi words for grape (angoor) and an Asian breed of monkey (langur), is in the same building as IndiGo’s office. While I sample a chilled melon soup—it’s a hot and muggy day in Gurgaon—Rahul restricts himself to a bowl of lentils. He has just returned from a five-week stay at an ayurvedic clinic in South India 22 pounds lighter, sporting a beard and a cropped haircut.

Low-profile tycoon

Low-profile tycoon

The airline business doesn’t lack tycoons who are flamboyant and outspoken, but Rahul, who prefers casual shirts to business suits, has an understated approach and shies away from the spotlight. Flying below the radar and avoiding external distractions to keep focussed on business is his mantra, he explains. Father Kapil, who still comes to office, is equally low profile. That will probably have to change as the Bhatias, who have kept all their businesses private so far, are reportedly preparing to list IndiGo next year and subject themselves to more public scrutiny.

Valuations for the airline range from $1.5 billion to $3 billion though Rahul won’t speak about those estimates. Nor will he confirm that an IPO is imminent, despite the market buzz, except for saying, “There’s no urgency as we’ve tied up financing for our current needs.”

Recently, IndiGo secured a $2.6 billion loan from the Industrial and Commercial Bank of China for 30 planes. IndiGo needs to quickly augment its all-Airbus fleet of 81 aircraft as the final deliveries of the 100 planes it ordered in 2005 before it started operations will finish in November.

IndiGo is the launch customer of Airbus’ fuel-efficient A320neo, having placed an eye-popping $16 billion order for 180 planes in 2011, but deliveries of the Neo will begin only by the end of 2015, confirms Kiran Rao, executive vice president of strategy and marketing for Airbus. There is speculation that an aircraft deal is imminent. Meanwhile, competition is heating up. The Tata Group’s budget airline with AirAsia’s Tony Fernandes has taken off, albeit with only one plane. Tata has a second venture with Singapore Airlines for a full-service carrier called Vistara. The government has approved a handful of other entrants as well. Rahul says the arrival of the new airlines will push the industry deeper into the red. As per CAPA estimates, the combined losses of the Indian industry were $1.8 billion in the sluggish fiscal year to March 2014. Jitendra Bhargava, former director of the state-owned Air India and author of The Descent of Air India, agrees that those losses could mount, even in a brisker economy. “New airlines will compete aggressively with legacy carriers that are weighed down by debt and accumulated losses,” he maintains.

An industry group lobbied Delhi not to grant AirAsia permission to fly and also took the matter to court. That prompted Fernandes to lash out in a tweet that “Whatever IndiGo tries to do to stop us, it just makes us smarter and stronger.” Rahul insists he’s not afraid of AirAsia, and his objection is grounded in current rules permitting foreign investment in existing airlines, not new ones. I ask Rahul what he makes of mutterings by rivals that IndiGo’s profits are a mirage having to do with the lucrative sale-and-leaseback agreements for its planes, which are estimated to net $5 million for each aircraft. He counters that if sale-and-leaseback were such a sure-shot formula then every airline in the world would be profitable: “That’s a loose statement for the birds. Our profits are real.” So far, IndiGo has stayed financially aloft, Rahul insists, by “keeping costs structurally low.” For example, the airline stocks no hot food on board and has no loyalty programme (only adds to costs, he insists). Every expense has to be justified: Will it bring more customers? Says Rahul: “We keep asking ourselves: What other cost can we remove without losing a single customer? This is our religion and it serves us well.”

Travel wasn’t Rahul’s first career choice. His father was in the trade with Delhi Express, an airline agency he co-founded with nine partners in 1964. More than two decades later, the partners fell out and he started over with the equivalent of $37,000 as seed capital. Rahul, who had completed his electrical engineering degree from the University of Waterloo in Canada, came back to India in 1984 with a plan to set up a telecom venture with Nortel to make digital telephone exchanges.

But that went nowhere as the government of the time did not favour foreign technology. He was drawn to a teaching career, but had to reconsider it when dad, then ailing, enlisted his help. “I wasn’t really prepared to carry the baton. It was an emotional decision,” he recalls. In 1988, he joined the family business, naming it InterGlobe. The early days were rough—“We had a cash crunch every two weeks”—but the young Bhatia sought new opportunities.

In 1994, InterGlobe snatched the franchise for what is now Galileo International, an airline reservation system once owned by United Airlines, which InterGlobe went on to represent in India. In 1999, they formed a joint venture with Galileo to provide back-office services. That venture is now a separate unit called InterGlobe Technologies with 6,000 people and overseas offices in China, the Philippines, Singapore, Dubai, the US and the UK. These businesses and a growing friendship with Rakesh Gangwal, a seasoned airline executive who worked at United before he went on to head US Airways, prepared the ground for Rahul’s next leap. Old associates say Rahul often spoke of his dream of starting an airline that he wanted to name IndiGo. But he waited until Gangwal agreed to partner with him. “Gangwal was hesitant because of the high mortality rate in the business. But I’m a persistent guy,” says Rahul, who credits Gangwal equally for IndiGo’s success. (US-based Gangwal, who owns an estimated 48 percent of the airline and is more reclusive than Rahul, declined to comment for this story.) IndiGo got its airline licence in 2004, but didn’t take off until 2006.“People said we were crazy not to launch with old, leased planes. But we didn’t want to cut any corners on quality,” recalls Aditya Ghosh, IndiGo’s president. Rahul picked Ghosh, then 33, to run IndiGo after Bruce Ashby, the airline’s first chief executive, left in 2008 and went on to head airline travel alliance OneWorld. A trained lawyer, Ghosh had no aviation experience though he had worked as InterGlobe’s general counsel. He admits that it was a trial by fire, but today, “I’ve got two owners who let me do my job.” Ghosh emphasises that having crews with the right attitude in all areas of operation has been crucial to IndiGo’s success. He personally interviews new hires, including drivers and mechanics. “I try to judge if there’s a desire to chase the dream. People can’t get motivated by a manual.”

Budget-conscious travellers used to cheap seats and shoddy service by India’s no-frills carriers started flocking to IndiGo as word got around. Saroj Datta, a former director at Jet Airways, recalls that as the entrenched market leader, Jet didn’t take the upstart seriously. “But in six months, it became evident that we were losing traffic to IndiGo.” In response, Jet lowered prices, then focussed on its budget offerings, JetLite and JetKonnect. Jet is now retracing its full-service roots. IndiGo has had its own air pockets to navigate along the way. Rahul highlights a bout it had with the government in 2012 when approval to bring in new planes was suddenly withdrawn. He had to lobby hard to get the decision reversed. With a full fleet and the grounding of Kingfisher Airlines owned by liquor tycoon Vijay Mallya, IndiGo soon flew past rivals to claim the top spot.

While IndiGo covers some close foreign destinations, it hasn’t succumbed to the lure of long haul— that will involve a new type of aircraft— so it remains largely a domestic carrier. “It might be sexy to see the IndiGo tail in Los Angeles, but we’re doing well right here,” maintains Rahul, who sees the bigger challenge in delivering superior service even as the airline expands. India is back on an upswing, but other dips can be expected. Rahul believes that an “economy plus” business targeting its rising middle-class can survive the cycles.

“When people start tightening their belts, you benefit.” He’s replicated the IndiGo model in hotels in a joint venture with Accor. InterGlobe Hotels’ Chief Executive JB Singh says that Rahul won’t let him cut quality corners, and the fittings and furniture are all imported. There are currently 10 Ibis hotels across the country with nine more to be added by 2017.

India’s airlines carried 60 million domestic passengers in 2013, and that could triple in the next decade. Consultant Kaul says that with new rivals now in the fray, “IndiGo needs to shake the tree and figure out a new strategy.” Rahul disagrees : “If you keep driving costs down and improving efficiency, the runway is long.”

First Published: Oct 14, 2014, 06:53

Subscribe Now