S Chand: India's Fastest-Growing Educational Publisher

A strategy to acquire and grow is set to elevate the 76-year-old educational publishing veteran to domestic market leader

The beginnings of the S Chand Group were steeped in nationalism. Started by Shyam Lal Gupta in 1937, its mission was to publish Indian authors unable to find a voice in colonial times. S Chand has evolved into one of the biggest domestic publishers and exporters of textbooks. It publishes all types of educational books: Higher education, technical and management education, school books (they account for 60 percent of its revenues).

The education market in India is roughly pegged at $20 billion, growing at over 30 percent. The industry’s attractiveness is obvious and, among all its segments, the publishing space has the lowest entry barrier. Reason: It is the least infrastructure-intensive.

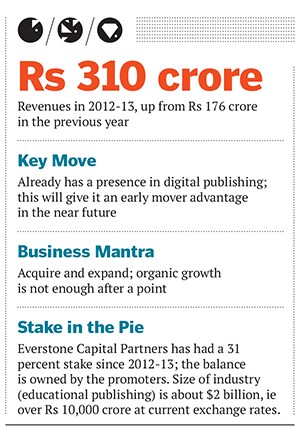

But the educational publishing market, worth about $2 billion, while promising, is very fragmented. There are over 8,000 publishers but not more than 20 have a turnover of over Rs 100 crore. It is a high margin, high growth, direct-to-consumer business. Also, it is dominated by MNCs like Oxford University Press India, Pearson Education and McGraw-Hill. But in the domestic category, S Chand is the second largest player by revenue after Navneet Publications. It has grown from Rs 100 crore in 2005-06 to Rs 310 crore in 2012-13. Its target is to become the largest player in the Asian publishing market over the next five years.

THE PEOPLE BEHIND IT

S Chand is the first in the Indian publishing industry to be funded by a private equity firm. What stood out for Everstone Capital, which took a 31 percent stake in S Chand in 2012-13, was its entrepreneurial leadership. MBA drop-out Himanshu Gupta, a third generation entrepreneur, as joint managing director showcases the ambitious and aggressive side, while brother-in-law Dinesh Jhunjhunwala, vice chairman, is the more seasoned face. “They have the perfect combination of aggression and realism,” says Dhanpal Jhaveri, partner and CEO at Everstone Capital. “Both have shown commitment not just to growth, but to growth with profitability.” S Chand is the industry leader in operating margins.

The team has had experience in acquiring companies—in growth by aggregating. This is a crucial aspect of strategy for anyone who wants to grow in the Indian market. Thanks to Everstone’s funding, S Chand last year bought out Vikas Publishers along with its imprint Madhuban. It was the largest acquisition in the Indian publishing industry and cost between $25 and $30 million. “We understand that, organically, we can only grow at 20-25 percent. So we want to be in the business of acquisitions. And we are looking at both the publishing as well as the digital space,” says Gupta. WHY IT IS A GEM

WHY IT IS A GEM

Apart from S Chand’s high growth since 2005-06, it is respected for being professionally-managed despite being family-owned. “Apart from the MNCs, this was the one company where the CEO, CFO, the head of distribution, etc, are professionals,” says Deep Mishra, managing director at Everstone Capital.

It is the sector’s fastest-growing company and likely shortly be the largest player in the (domestic) category. It scores over the current market leader in that a large chunk of Navneet’s revenues comes from stationery.

The other aspect that makes it a safe bet is that it already has a foot in the door of digital education: Its product Destination Success is being rolled out in schools. Lastly, it is among the best consolidators in the market—experts believe that is the way forward in this industry.

WHY IT WAS HIDDEN

It remains a 76-year-old company working out of Old Delhi bylanes. But the bigger reason why S Chand had operated quietly is because it did not need external funds to make the big acquisitions. Earlier, it was making money and staying debt-free because of the high margins. It did not have to go to the capital markets.

RISKS AND CHALLENGES

S Chand’s focus on acquiring industry leaders is a reasonable strategy because it takes a long time, between 10 and 15 years, to build content and establish a dependable brand. But there is a flip side: Not every company can be absorbed easily. Also, it is crucial to assess that it truly adds value to the existing portfolio.

The other potential challenge in the long-term is the advent of digital media in education. The publishing business accounts for 95 percent of S Chand’s revenues, digital 5 percent. But the good news is that even in advanced overseas markets, digital education is just 20 percent of the market. Moreover, S Chand has already started its journey in the digital space.

Gupta points out operational challenges that S Chand faces as it grows faster. “It is not about making a book, which is becoming easier. It is about selling it,” he says. A publisher makes money when a title sells in big numbers, so hitting a benchmark like 25,000 copies is crucial. A large and efficient sales network is critical.

First Published: Aug 29, 2013, 06:38

Subscribe Now