Medi Assist: Health Insurance Made Easy

This Bangalore-based third party administrator has gone digital to connect hospitals, insurers and patients with each other

There is a stark reality that India’s 1.2 billion citizens are beginning to grasp: Health care costs will continue to rise even as ‘miracle’ drugs ensure that people live longer. Exacerbated by low government expenditure, the private insurance premium market is expanding rapidly by about 30-35 percent every year, according to a 2014 healthcare report by PricewaterhouseCoopers.

It is in this backdrop that Medi Assist has emerged as one of the country’s biggest players in the more organised cashless insurance market, not as a policy provider, but a third party administrator (TPA). Its technology-driven, easy-to-use interface provides a platform where hospitals, patients and insurers can interact with each other and untangle the web of health-related claims.

Dr Vikram Chhatwal, director of Medi Assist, who previously worked with Reliance Health and Apollo Hospitals, says there is no escaping the need for specialised but affordable healthcare. “We spend half our lives off medication and half our lives on it.”

Medi Assist, which is licensed by India’s Insurance Regulatory and Development Authority, partners with insurance companies and through them reaches 4,000 corporate houses. It has the health of nine million people in its care, and charges an administrative fee for its service, paid either by the corporate or the insurance agency it works with.

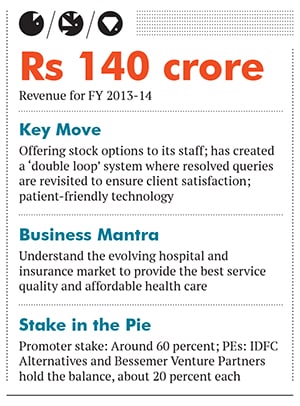

What sets it apart from other TPAs is the range of services it offers: Claims administration and settlement, cashless hospitalisation, reimbursement, identification cards, hospital networks, pre-authorisation, pre-policy medical checks and specialised value-added services for corporate clients. Its revenue for the financial year ended 2014 was Rs 140 crore, and Chhatwal estimates a 40 percent jump by FY 2015.

The Men behind it

Medi Assist was the brainchild of Infosys co-founder NS Raghavan, who provided the seed fund in 2002 through his private investment firm, Nadathur Investments. B Madhavan, now CEO of Medi Assist, was one of its earliest members.

In 2006, Reliance Health, which is part of the Anil Dhirubhai Ambani Group, acquired Medi Assist. In 2011, the Medi Assist management, along with private equity group Bessemer Venture Partners, bought out both Reliance and the Nadathur Group’s stake in the firm. When the deal was done, Chhatwal, who was CEO of Reliance Health, quit his job to head Medi Assist.

The 45-year-old doctor studied medicine in both India and Singapore. At Reliance Health, he had been involved in setting up the Kokilaben Dhirubhai Ambani Hospital and Medical Research Institute. Prior to that, he was the CEO of Apollo Health Street and had a concurrent position as the CIO for the Apollo Group.

In 2013, IDFC became the second private equity player to invest in the company, with a Rs 85 crore funding. “We were looking for a first-generation promoter, who had the passion, and understood the business he wanted to grow,” says Satish Mandhana, chief investment officer of IDFC Alternatives, which identifies private equity investment opportunities.

Why it is a Gem

Why it is a Gem

Of the 29 health care insurance TPAs in India, Medi Assist is one of the frontrunners. Apart from its services, it also provides prescribed medicines—sourced directly from drug makers and wholesale dealers—to corporate employees at a price which is 5-7 percent cheaper than retail outlets. (Drugs are released only after a doctor’s prescription.)

The services it provides help not just insurers but also patients. In a particular case, an employee of a Bangalore-based IT company identified a super-speciality hospital and sought information such as details of how much was payable through her policy and when she could get her claim (money) back from Medi Buddy, the company’s mobile application. She was also able to place orders for prescribed drugs for her baby, and vitamins for herself through the app. Her post-admission paper work was processed in two hours.

Medi Assist plans to buy out smaller regional players and is likely to act as a consolidator of the TPA business. Funds will be channeled towards technology enhancement, buyouts or alliances and new business lines such as pharmacy. It is the only TPA to offer stock options to its staff.

Why it was hidden

It’s only in recent years that TPAs have emerged as key players in the health care insurance space. PwC’s 2014 health care report shows that only 25 percent of Indians have some form of health care insurance, and that more than 70 percent of the health care costs are borne by patients.

Another reason for Medi Assist’s anonymity is that its direct clients are insurance firms, corporates and hospitals. The nature of its business cannot be easily certified or rated. Word-of-mouth is a critical factor.

Risks and challenges

Medi Assist operates in a competitive environment, where quality of service and affordability will be the key ifferentiators. There will be competition from the public sector too.

The Health Insurance TPA of India—a health insurance claims processing company set up by four public sector insurers—is expected to start by January 2015. But Chhatwal isn’t worried. “The fact that the insurers are setting up a benefits-administrator lends legitimacy to a business like ours,” he says, adding, “may the best man win.”

First Published: Jul 21, 2014, 07:19

Subscribe Now