Vishal Mega Mart's incredible comeback

The retailer scripted a turnaround built on a new management, fixing issues such as bad economics, under-utilisation of resources and poorly located stores

Vishal Mega Mart’s outlet in Khanpur, New Delhi, is one of its 322 stores in the country

Vishal Mega Mart’s outlet in Khanpur, New Delhi, is one of its 322 stores in the country

Image: Madhu Kapparath[br]It was a slump sale by founder Ram Chandra Agarwal. Debt-ridden Vishal Retail was sold for a paltry ₹70 crore to TPG and a Shriram Group firm in 2010. Eight years down the line, the company changed hands again. This time, it was bought by another private equity consortium—Partners Group and Kedaara Capital—for reportedly more than ₹5,000 crore. That’s the stunning turnaround story of Vishal Mega Mart, one of the earliest fashion-led hypermarket chains in India, founded in 2001.

For Puneet Bhatia, buying Vishal was a great investment. “It had a strong value proposition,” recalls Bhatia, co-managing partner and country head (India) for TPG Capital Asia.

At a time when organised retail was in its infancy in India, Bhatia spotted a gem. Firstly, the brand was not built on high streets: Its 200 stores were dotted across small towns. Secondly, the consumption story of the Indian middle-class had just started to take off, and the combination of rising aspirations and purchasing power was a right fit for any retailer. Thirdly, the product mix of the stores was interesting: While 50 percent consisted of apparel, the other half was merchandise and FMCG products. “It was a big opportunity for us,” he recounts.

With opportunity, though, come challenges. And in the case of Vishal Mega Mart, the odds were heavily stacked against the new owners in 2010. “It was on the verge of collapse,” says Bhatia. The biggest problem was the deep financial mess the company was in, thanks to aggressive expansion on the back of short-term debt. Poor execution and under-performance made matters worse. “We had to rebuild, reimagine, reorganise every aspect of the business,” Bhatia says.

The first major step in turning around the company was rationalising store count. A combination of poor location, bad economics and under-utilisation of resources had made most of the stores almost redundant. “From 200 stores, the number was shrunk to 100,” Bhatia says. The new owners had to get rid of the legacy business and its issues.

In the next few years, Vishal was back on its feet. Revenue grew at a healthy compound annual growth rate (CAGR) of 24 percent during the three years through FY18, according to a report by Crisil, which adds that cash accrual has increased steadily over the years. For FY17, the company had posted revenues of ₹1,341 crore, with estimated profits of more than ₹150 crore for FY18 against ₹33 crore in FY16. “Vishal operates in the value retail segment and is best positioned to benefit from the healthy business prospects of the organised retail segment,” says the report, released in August 2018.

The ratings agency is bullish on Vishal Mega Mart’s future as well. India’s growing middle-class with increasing disposable income and a burgeoning young population with increased brand consciousness are expected to help the organised retail industry, particularly the value retail format, register a healthy CAGR over the medium-term, Crisil says.

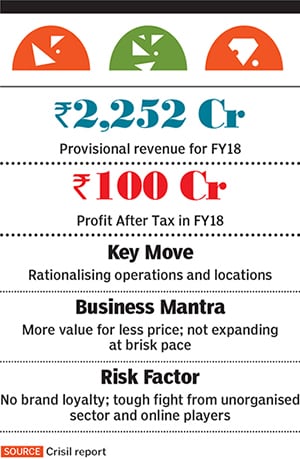

In another ratings release this February, Crisil put the provisional revenue of Vishal for 2018 at ₹2,252 crore. Adjusted profit after tax stood at ₹100 crore as against a loss of ₹44 crore for 2017.

In 2018, when Partners Group and Kedaara Capital bought the company, the turnaround stumped many, although the new owners were not surprised.

“Led by a strong execution-focussed team and supported by secular macro drivers, Vishal Mega Mart has developed a highly replicable and scalable model offering consumers an aspirational assortment at compelling value through its franchisee network,” said Nishant Sharma, co-founder and partner at Kedaara Capital, in a media statement last year.

Though the brand has had a dream run over the last eight years, the going ahead might be tough. The biggest challenge is Vishal’s exposure to risks related to a price-sensitive customer segment and intense competition. Although organised retail penetration was moderate at 7.8 percent in FY18—a major proportion of which took place in tier-1 cities—Vishal derives a substantial portion of its revenue from the lower middle-class segment, including through stores in tier-II cities. “Hence, the company primarily competes with retailers in the unorganised segment,” says Crisil.

Online retail, says analysts, is also going to pose a stiff challenge. Aggressive expansion and the penetration of Flipkart and Amazon in smaller towns and cities threatens to play spoilsport, says Saurabh Jindal, analyst at Bonanza Portfolio. Consumers in such places have become aspirational, and they uptrade. Huge discounts by online players have made a plethora of brands affordable. “Selling the story of being a value brand under such circumstances is a very tough task,” says Jindal, adding that offline expansion could also take a toll.

But the story of Vishal’s turnaround is one of meeting challenges head on. And it seems well-placed to do that.

First Published: Aug 19, 2019, 10:43

Subscribe Now