IFMR Capital: The money conductors

With its unique risk-mitigating financial products, the NBFC has handheld MFIs into the world of big finance. In the process, it has helped breadline businesses find their passports to growth—credit

Paramesan Gowda, 48, has been running a makeshift sandwich stall outside the BSE for many years. Given his humble business, he is not the typical customer to whom traditional bankers feel inclined to lend. With its overemphasis on paper work and address proofs, India’s banking and financial services system is not primed to give him credit. Hence, despite being in the heart of India’s financial nerve centre, Dalal Street, Gowda for long lingered beyond the fringes of the financial system, deprived of any formal channels of credit to grow his sales.

Until, that is, Mumbai-based Essel Finance Business Loans—a non-banking financial company (NBFC) that specialises in small business loans—sanctioned a Rs 30 lakh loan to Gowda in June 2014. Essel Finance Business Loans studied his business closely for two days and realised he had steady cash flows. Gowda repaid his loan in 13 months.

Essel Finance Business Loans may be the face of the help Gowda was getting, but there is another force that has enabled this support: IFMR Capital, a Chennai-based NBFC, which helps Essel Finance Business Loans meet its cash requirements.

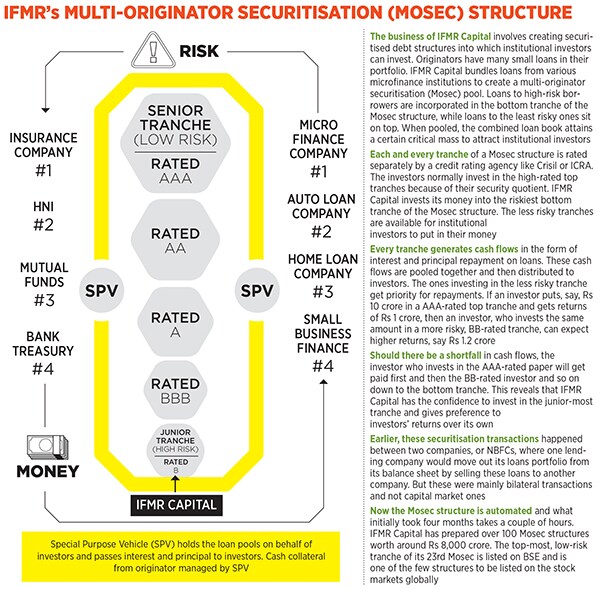

IFMR’s relevance cannot be overstated. Even the NBFCs and microfinance institutions (MFIs) that lend directly to people like Gowda—they are called originators—find themselves stonewalled when trying to access capital from traditional banking channels. Enter IFMR Capital, which either lends directly to originators or connects them to cash-rich institutional investors like mutual funds and insurance companies. It has devised one-of-its-kind securitised debt products, or securitisation structures (see box ), through which investors can put their money in originators.

“After understanding our business, they lend us the required capital or get a financial institution to do that. IFMR Capital audits our books on a regular basis. They have their ears close to the ground, which helps understand the end customers,” explains Sandeep Wirkhare, CEO, Essel Finance Business Loans.

IFMR Capital is thus taking the challenge of financial inclusion head on.

“It is our mission to reach out to Indians who find it difficult to get a housing loan or a business loan because they are not part of the formal system. Banks and financial institutions that have the capital do not understand these segments. Our job is to bring in capital to originators who provide finance to informal sectors,” says Kshama Fernandes, 47, managing director and CEO, IFMR Capital.

Over the last eight years, IFMR Capital has facilitated capital to the tune of around Rs 30,000 crore to 100-odd originators, serving 25 million end borrowers. IFMR Capital estimates that the size of the market it deals with is Rs 14 lakh crore.

The company started in 2008 focusing on the microfinance sector. Today, its originators span several asset classes like small business finance, vehicle finance, commodity finance and affordable housing finance.

Over the years, the company has pioneered many innovative structures like its flagship multi-originator securitisation (Mosec) as well as pooled bond issuances and has become a market leader in these areas. IFMR Capital’s Mosec structure offers institutional investors with different risk appetites a simple avenue to invest in originators.

The main source of income for IFMR Capital is the fees and interest it garners by connecting institutional investors and originators. For the year ended March 2016, IFMR Capital had revenues of Rs 246 crore and clocked a net profit of Rs 60 crore.

The People Behind It

In 2007, when Bindu Ananth quit her job—as the head of the new product development team within the Rural and Inclusive Banking Group at ICICI Bank—to build a startup in the field of financial inclusion, she had the support of Nachiket Mor, who was then heading the ICICI Foundation for Inclusive Growth.

Armed with a seed funding of Rs 150 crore—a long-term loan from ICICI Bank—Ananth set up IFMR Trust in 2007 as an affiliate of the Institute for Financial Management and Research (IFMR), Chennai. The idea was to collaborate on action-research Mor was appointed the chairperson of the governing council of the IFMR Trust, which had its office in the campus of IFMR.

In the same year, the IFMR Trust tied up with Nobel laureate Muhammad Yunus’s Grameen Bank, known for its principles of helping the poor through financial inclusion. Together, they created Grameen Capital India, a social investment bank that facilitated capital flow to MFIs. (In 2012, IFMR Trust sold its stake in Grameen Capital to the Patni brothers of Patni Computer Systems.)In 2008, the IFMR Trust wanted to expand its role beyond that of a mere facilitator and that’s when IFMR Capital was set up. The initial brief was to build a financial institution that would serve as an intermediary and bring capital to MFIs. These MFIs had a good business model but needed capital to grow their business. Mor and Ananth were interested in creating a model that would link MFIs to big financial institutions. Mor started to brainstorm with the founding team of the IFMR Trust, which included his ICICI colleagues Anil Kumar SG and Puneet Gupta apart from Ananth.

“We were among the few people who had moved out of ICICI Bank with some idea about what we wanted to do. But the vision became sharper when we started to meet more people who wanted to work with us. Two of them, Sucharita Mukherjee and Kshama Fernandes, joined us immediately and helped us build this organisation,” recalls Ananth, 37, who is now the chair of the IFMR Trust.

Mukherjee had worked with Morgan Stanley in London, where her job was to create asset-backed financing structures in intellectual property. Fernandes, on the other hand, was a professor heading the finance division at the Goa Institute of Management. Her deep understanding of risk impressed Mor and Ananth. “Kshama brought in the academic capability. She had no experience in running an institution at that time but we needed her to manage the core functions. Hiring her worked,” says Mor, 56.

In 2008, the IFMR Trust put in Rs 60 crore to start IFMR Capital. Two more companies, IFMR Rural Finance and IFMR Rural Channels and Services, were set up subsequently. All three are now held by IFMR Holdings set up in 2014 Mukherjee is the CEO of IFMR Holdings and was the founding CEO and managing director of IFMR Capital from 2008 until 2012, when Fernandes took over. Till then, Fernandes was chief risk officer of the company. Mor, who set up the core team of IFMR Capital, moved out in 2011 to pursue work in the area of health care and is currently the director of the Bill & Melinda Gates Foundation in India.

In the founding years, IFMR Capital had six employees. They created their first structure for Equitas Micro Finance—of Rs 15.7 crore—for offering microcredit and later sold it to investors in 2009. “It was crazy. I remember the time we found the first investor in the structure we created. It was a mutual fund which put a person in our office to understand our company. From then on, we just moved forward,” says Ananth.

Equitas provided a ‘first-loss’ facility, which meant that in the event of a default on the loans it had sanctioned to its customers, the company would be liable for it. Equitas gave cash collateral to the tune of 11.7 percent of the principal amount to cover any shortfall in loan repayment. IFMR Capital, too, invested Rs 3.13 crore in the structure.

The company has come a long way since creating its first structure. When Fernandes took over as the CEO and MD in 2012, the annual volume of financing done by the company was Rs 975 crore. It has risen to Rs 13,244 crore in 2016. In 2012, almost 90 percent of the business was associated with the microfinance sector. Fernandes took the challenge of bringing on originators from newer sectors, like affordable housing companies Aptus Value Housing Finance India Limited and India Shelter Finance. She also got in companies like Janalakshmi Financial Services and Ujjivan Financial Services. Over a period of four years, she has more than tripled the number of originators from 30 to 100.Fernandes also started to grow the number of products that she was offering the investing community. Initially, IFMR Capital had a securitisation product and a term-loan product. But with the increasing number of clients, she helped create guarantee products, pooled bond issuance (where a large number of originators come together to issue loans) and non-convertible debenture products backed by guarantee. “While business grew 13 times [since 2012] in terms of volumes, none of our stakeholders has lost a single rupee,” says Fernandes.

There was also a need to increase capital. In 2014, IFMR Holdings approached LeapFrog Investments for equity capital and sold a 40 percent stake for Rs 175 crore.

“IFMR Capital is an example of a world-changing financial institution, improving the lives of millions through innovative, structured finance solutions. They’ve built a successful business to serve the underserved. We see them as true pioneers of the new growth frontier,” says Michael Fernandes, partner at LeapFrog Investments.

Fernandes and Mukherjee have a database of all the underwritten loans, which run into millions. The repayment track record of these loans is available across sectors and companies. This database was built to create IFMR Capital’s own proprietary risk model to assess risk and do risk-based pricing.

However, the real monitoring of risk had to be done at the originators’ side. Fernandes hired people with expertise in automobile loans, home loans and microfinance. These experts monitor the originators 24x7. “These risk experts attend meetings with the originators. They don’t dress up in ties and suits. The originators and their customers need to feel that these guys speak in their language,” says Fernandes.

Why it is a Gem

What differentiates IFMR Capital from other NBFCs is the fact that it brings buyers (originators) and sellers of capital (investors) on the same platform. IFMR Capital also leads by example as it is an investor in the very financial structure it creates.

IFMR Capital’s model ensures that all stakeholders in a transaction have reason to make a deal work. The originator puts cash collateral to defend against defaults by the end borrower.

Hinduja Leyland Finance is one such investor that has benefited from its three-year-old association with the company.

“IFMR Capital has helped several institutions raise debt in a timely and efficient manner and by connecting investors like us to such players, they have helped diversify our own asset base. All this is done through efficient structuring, rigorous monitoring and seamless execution,” says Sachin Pillai, managing director, Hinduja Leyland Finance.

The effort is also ongoing in terms of product innovation to bring down the cost of capital for the originators, which can later be passed on to the borrowers. The company has only worked with domestic investors and is in the process of launching a significant international investor coverage strategy.

The IFMR Capital team, with over 100 members, is divided into two sub-teams—origination and risk. The origination team’s job is to identify new originators and maintain relationships with existing ones. The latter does online monitoring and surveillance.

Risks and Challenges

The 2008 global financial crisis was fundamentally related to securitisation structures. Investors who invested in securitised products did not understand the risks involved. These risks emerged because the investors thought they were putting money in perfectly safe assets.

But the reality was that the underlying loans that were used in these structures were not risk-free and investors were not aware about the quality of the borrowers. When cash flows from these products became erratic, investors panicked, precipitating a crisis and bringing down the financial system.

IFMR Capital deals with similar products and has to pay constant heed to the risks the originators of the loans take on. If the originators end up taking risky loans, and their end customers are not able to repay, it would weaken not just IFMR Capital but also its investor clients. This is where the fact that IFMR Capital puts it own money where its faith is comes into play.

First Published: Sep 12, 2016, 06:42

Subscribe Now